Interest rates

Girol Karacaoglu suggests we need to move away from a price (interest-rate) centred monetary policy implementation regime and we need to control the growth of the aggregate balance sheet of the banking system

27th Feb 24, 8:35am

18

Girol Karacaoglu suggests we need to move away from a price (interest-rate) centred monetary policy implementation regime and we need to control the growth of the aggregate balance sheet of the banking system

ASB cuts 18 month fixed home loan rate by 26 basis points, ahead of the Reserve Bank's OCR decision, and in the face of a stuttering real estate market

27th Feb 24, 7:56am

23

ASB cuts 18 month fixed home loan rate by 26 basis points, ahead of the Reserve Bank's OCR decision, and in the face of a stuttering real estate market

The Reserve Bank could easily hike the Official Cash Rate again in the coming week. But should it?

25th Feb 24, 6:00am

155

The Reserve Bank could easily hike the Official Cash Rate again in the coming week. But should it?

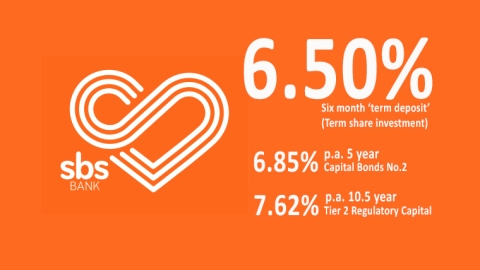

The term deposit rate benefit from a challenger bank just got a sharp boost from a new offer from SBS Bank, part of a recent set of fundraising offers

24th Feb 24, 9:35am

4

The term deposit rate benefit from a challenger bank just got a sharp boost from a new offer from SBS Bank, part of a recent set of fundraising offers

Another major bank tweaks its mortgage rate card lower as doubts spread about an OCR hike next week. Competition is rising as the real estate market hasn't really fired yet in its crucial selling season

22nd Feb 24, 8:06am

72

Another major bank tweaks its mortgage rate card lower as doubts spread about an OCR hike next week. Competition is rising as the real estate market hasn't really fired yet in its crucial selling season

Reserve Bank policymakers will be weighing up various measures of inflation as they begin committee deliberations

18th Feb 24, 6:00am

53

Reserve Bank policymakers will be weighing up various measures of inflation as they begin committee deliberations

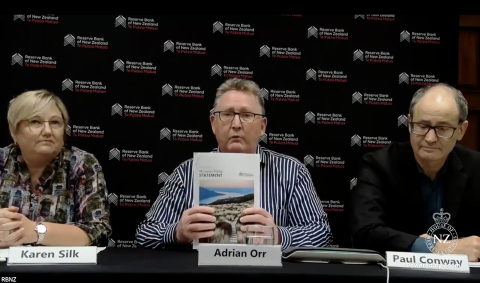

Governor Adrian Orr says the Reserve Bank is focused on core inflation and is not willing to tolerate even temporary inflation pressure

16th Feb 24, 9:32am

120

Governor Adrian Orr says the Reserve Bank is focused on core inflation and is not willing to tolerate even temporary inflation pressure

[updated]

Influential RBNZ survey shows a decisive drop in the expectation of future levels of inflation in a result that will give the RBNZ comfort ahead of its next Official Cash Rate decision

13th Feb 24, 3:35pm

20

Influential RBNZ survey shows a decisive drop in the expectation of future levels of inflation in a result that will give the RBNZ comfort ahead of its next Official Cash Rate decision

With some economists expecting a higher OCR soon, and financial markets responding with higher wholesale rates, savers might be expecting higher term deposit offers as one consequence

12th Feb 24, 11:08am

31

With some economists expecting a higher OCR soon, and financial markets responding with higher wholesale rates, savers might be expecting higher term deposit offers as one consequence

ANZ's Sharon Zollner says the Reserve Bank could shock New Zealand by lifting the Official Cash Rate 50 basis points to 6%

9th Feb 24, 1:32pm

80

ANZ's Sharon Zollner says the Reserve Bank could shock New Zealand by lifting the Official Cash Rate 50 basis points to 6%

Traders and economists are losing hope that interest rate cuts could occur in the first half of 2024 after discouraging data updates

9th Feb 24, 12:33pm

12

Traders and economists are losing hope that interest rate cuts could occur in the first half of 2024 after discouraging data updates

The Red Bank becomes the first major to break out of the tight range of mortgage rates being offered by the majors, cutting both fixed home loan rates modestly (and term deposit rates by more) even as wholesale rates rise

9th Feb 24, 6:04am

30

The Red Bank becomes the first major to break out of the tight range of mortgage rates being offered by the majors, cutting both fixed home loan rates modestly (and term deposit rates by more) even as wholesale rates rise

Heartland Bank slices its fixed home loan rates with big cuts to all terms, opening up a big differences to main bank rates

8th Feb 24, 8:46am

21

Heartland Bank slices its fixed home loan rates with big cuts to all terms, opening up a big differences to main bank rates

Stronger employment data could spook the Reserve Bank into raising the Official Cash Rate above 5.50%, economists say

7th Feb 24, 2:04pm

58

Stronger employment data could spook the Reserve Bank into raising the Official Cash Rate above 5.50%, economists say

Australian mortgage and inflation pain to ease, but only slowly: How 31 top economists see 2024

5th Feb 24, 3:48pm

3

Australian mortgage and inflation pain to ease, but only slowly: How 31 top economists see 2024

Kenneth Rogoff explains why the celebratory mood of CEOs and political leaders is premature - and probably misplaced

4th Feb 24, 3:06pm

8

Kenneth Rogoff explains why the celebratory mood of CEOs and political leaders is premature - and probably misplaced

Squirrel's David Cunningham says it's 'pretty realistic' to expect 1-year fixed home loan rates below 6% by the end of 2024, and below 5% by the end of 2025

3rd Feb 24, 9:00am

60

Squirrel's David Cunningham says it's 'pretty realistic' to expect 1-year fixed home loan rates below 6% by the end of 2024, and below 5% by the end of 2025

Reserve Bank chief economist Paul Conway suggests softer GDP and CPI data doesn't mean the central bank will cut interest rates

30th Jan 24, 10:55am

50

Reserve Bank chief economist Paul Conway suggests softer GDP and CPI data doesn't mean the central bank will cut interest rates

First home buyers neither better nor worse off in 2023 as the housing market remained as flat as a pancake

29th Jan 24, 6:00am

101

First home buyers neither better nor worse off in 2023 as the housing market remained as flat as a pancake

Kiwibank's Jarrod Kerr on the war on inflation including how much the RBNZ can influence non-tradeable inflation, and whether its mandate may need changing

26th Jan 24, 10:01am

69

Kiwibank's Jarrod Kerr on the war on inflation including how much the RBNZ can influence non-tradeable inflation, and whether its mandate may need changing

ASB moves both home loan and term deposit rates lower but only for the less popular longer terms. Still, they can claim a competitive three year home loan rate. But they can't claim unique term deposit offers

25th Jan 24, 9:48am

18

ASB moves both home loan and term deposit rates lower but only for the less popular longer terms. Still, they can claim a competitive three year home loan rate. But they can't claim unique term deposit offers

CPI inflation falls to a two year low of 4.7% as food prices decline, albeit domestic inflation tops RBNZ expectations

24th Jan 24, 10:56am

161

CPI inflation falls to a two year low of 4.7% as food prices decline, albeit domestic inflation tops RBNZ expectations

The next bank to trim home loan rates is Westpac. Their adjustments take them into line with their main rivals. But they did make a +10 bps rise to their six month term deposit rate to a somewhat unique level

18th Jan 24, 6:17pm

5

The next bank to trim home loan rates is Westpac. Their adjustments take them into line with their main rivals. But they did make a +10 bps rise to their six month term deposit rate to a somewhat unique level

Both Kiwibank and TSB trim home loan rates to match the big Aussie banks. They also reduce some longer term deposit rates

15th Jan 24, 9:47am

23

Both Kiwibank and TSB trim home loan rates to match the big Aussie banks. They also reduce some longer term deposit rates

The Co-operative Bank becomes the first mover on home loan and term deposit rates in 2024, even if most of its changes mirror those made by the majors at the end of last year

10th Jan 24, 2:49pm

2

The Co-operative Bank becomes the first mover on home loan and term deposit rates in 2024, even if most of its changes mirror those made by the majors at the end of last year