lower for longer

Frank Jasper of Fisher Funds says the COVID-19 pandemic has shown investors need to be prepared to put money into businesses to bolster their robustness

29th Apr 20, 4:41pm

20

Frank Jasper of Fisher Funds says the COVID-19 pandemic has shown investors need to be prepared to put money into businesses to bolster their robustness

COVID-19 set to rear its head for an early impact assessment as three of Australasia's big four banking groups report their interim financial results

24th Apr 20, 9:05am

3

COVID-19 set to rear its head for an early impact assessment as three of Australasia's big four banking groups report their interim financial results

Gareth Vaughan on the long-run economic consequences of pandemics, how the South Koreans & Germans are dealing with COVID-19, picking the bottom & don't try this at home

31st Mar 20, 11:41am

13

Gareth Vaughan on the long-run economic consequences of pandemics, how the South Koreans & Germans are dealing with COVID-19, picking the bottom & don't try this at home

ASB tests the low end of term deposit offer ranges with a range of cuts up to -20 bps. Other banks sure to follow and loan demand is expected to dive and mortgage rates fall

27th Mar 20, 9:55am

34

ASB tests the low end of term deposit offer ranges with a range of cuts up to -20 bps. Other banks sure to follow and loan demand is expected to dive and mortgage rates fall

Fixed mortgage rate offers below 3% arrive with HSBC's Premier new one year and eighteen month rates. They cut all other fixed rates too

26th Mar 20, 8:57am

3

Fixed mortgage rate offers below 3% arrive with HSBC's Premier new one year and eighteen month rates. They cut all other fixed rates too

More banks make fixed home loan rate cuts and match them with steep term deposit rate cuts and the overall level of interest rates sink lower

25th Mar 20, 10:42am

28

More banks make fixed home loan rate cuts and match them with steep term deposit rate cuts and the overall level of interest rates sink lower

Interest rate changes are now fast-moving and volatile, at both the wholesale and retail levels. We update what that means for term deposit investors

21st Mar 20, 4:24pm

38

Interest rate changes are now fast-moving and volatile, at both the wholesale and retail levels. We update what that means for term deposit investors

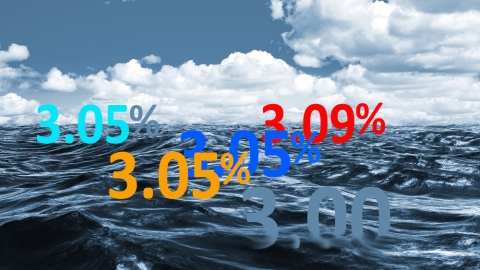

Bank of New Zealand launches a market leading 18 month fixed mortgage rate offer at just 3.05%, the lowest rate for this term by any bank. They also change term deposit rates

20th Mar 20, 6:17pm

17

Bank of New Zealand launches a market leading 18 month fixed mortgage rate offer at just 3.05%, the lowest rate for this term by any bank. They also change term deposit rates

Kiwibank is cutting 1-year fixed mortgage rate 'special' by -36 bps from Monday to 3.09%, and cutting savings rates by between -10 and -50 bps

19th Mar 20, 1:23pm

29

Kiwibank is cutting 1-year fixed mortgage rate 'special' by -36 bps from Monday to 3.09%, and cutting savings rates by between -10 and -50 bps

ANZ sets a record low one year fixed home loan rate and slices -25 bps off of almost all term deposit offers. Other banks expected to follow soon

18th Mar 20, 4:49pm

44

ANZ sets a record low one year fixed home loan rate and slices -25 bps off of almost all term deposit offers. Other banks expected to follow soon

BNZ, Westpac, ANZ, ASB and Kiwibank cut floating mortgage rates to match RBNZ's 75 basis points OCR cut, some savings rates lowered too

16th Mar 20, 8:52am

51

BNZ, Westpac, ANZ, ASB and Kiwibank cut floating mortgage rates to match RBNZ's 75 basis points OCR cut, some savings rates lowered too

The RBNZ cuts the OCR by 75 bps in an emergency announcement, next step is a Large Scale Asset Purchase program if more support needed

16th Mar 20, 8:04am

237

The RBNZ cuts the OCR by 75 bps in an emergency announcement, next step is a Large Scale Asset Purchase program if more support needed

Kiwibank make the next home loan rate reductions, and its new three year rate stands out as the lowest among their main rivals. ANZ slips further behind the pace

14th Mar 20, 10:21am

13

Kiwibank make the next home loan rate reductions, and its new three year rate stands out as the lowest among their main rivals. ANZ slips further behind the pace

ASB becomes the first bank to offer all fixed rates below 4%, and now offers the lowest two year fixed rate 'special' of any major bank. These reductions come after TD rate cuts

12th Mar 20, 12:46pm

10

ASB becomes the first bank to offer all fixed rates below 4%, and now offers the lowest two year fixed rate 'special' of any major bank. These reductions come after TD rate cuts

A downbeat economic outlook is seeing more banks cut their term deposit offers and the trend is probably only just starting

12th Mar 20, 10:46am

33

A downbeat economic outlook is seeing more banks cut their term deposit offers and the trend is probably only just starting

Four key profit measures all weakened for New Zealand's big five banks in the December quarter

6th Mar 20, 9:39am

3

Four key profit measures all weakened for New Zealand's big five banks in the December quarter

David Hargreaves ponders the mediocre returns available on 'safe' investments and wonders whether technology might lead us to a new path of investment types

23rd Feb 20, 6:02am

53

David Hargreaves ponders the mediocre returns available on 'safe' investments and wonders whether technology might lead us to a new path of investment types

Heartland Bank says enquiries about reverse mortgages are the highest it has experienced to date, helped by the ongoing low interest rate environment

20th Feb 20, 2:18pm

3

Heartland Bank says enquiries about reverse mortgages are the highest it has experienced to date, helped by the ongoing low interest rate environment

ANZ economists see trouble ahead for the economy from the declining rate in growth of bank deposits at a time of strong demand for credit

17th Feb 20, 2:26pm

30

ANZ economists see trouble ahead for the economy from the declining rate in growth of bank deposits at a time of strong demand for credit

ASB CEO Vittoria Shortt says in a low interest rate world where the bank's feeling a deposit margin squeeze, 'people need to be really careful about where they're putting their money and what returns are available and the risk profile attached to it'

16th Feb 20, 6:02am

55

ASB CEO Vittoria Shortt says in a low interest rate world where the bank's feeling a deposit margin squeeze, 'people need to be really careful about where they're putting their money and what returns are available and the risk profile attached to it'

ASB interim profit drops 5% from last year's record high after bank books loss on sale of funds administration business Aegis

12th Feb 20, 10:20am

13

ASB interim profit drops 5% from last year's record high after bank books loss on sale of funds administration business Aegis

RBNZ data shows household deposits recorded their lowest annual percentage growth since October 2010 in the year to December as housing loan growth hits highest point since July 2017

3rd Feb 20, 1:56pm

17

RBNZ data shows household deposits recorded their lowest annual percentage growth since October 2010 in the year to December as housing loan growth hits highest point since July 2017

Banks have reduced the interest rates they use to test mortgage borrowers' ability to repay loans this year, but are increasingly interested in borrowers' expenses as they calculate their ability to service loans

20th Dec 19, 5:00am

25

Banks have reduced the interest rates they use to test mortgage borrowers' ability to repay loans this year, but are increasingly interested in borrowers' expenses as they calculate their ability to service loans

Reserve Bank wants insurers' solvency buffers hiked by a yet-to-be-determined amount; Voices concern over 'material' impact low interest rates are having on life insurers in particular

28th Nov 19, 1:59pm

6

Reserve Bank wants insurers' solvency buffers hiked by a yet-to-be-determined amount; Voices concern over 'material' impact low interest rates are having on life insurers in particular

Against the backdrop of its record low OCR, the RBNZ suggests the impact on bank profitability of very low interest rates will be neutral and notes countries with negative interest rates have not experienced significant falls in bank profits

28th Nov 19, 7:37am

2

Against the backdrop of its record low OCR, the RBNZ suggests the impact on bank profitability of very low interest rates will be neutral and notes countries with negative interest rates have not experienced significant falls in bank profits