LVRs

Westpac is the last to the rate-hike party, and since ANZ started this round of rises, the 2year swap rate has risen +40 bps. But Westpac is another main bank with a sub-4% rate still

7th Apr 22, 4:47pm

42

Westpac is the last to the rate-hike party, and since ANZ started this round of rises, the 2year swap rate has risen +40 bps. But Westpac is another main bank with a sub-4% rate still

Sensing an opportunity, BNZ holds back on part of their home loan rate increases, opening up a gap between them and ANZ/ASB. The pace of swap rate increases may however close that opportunity soon

5th Apr 22, 9:06am

18

Sensing an opportunity, BNZ holds back on part of their home loan rate increases, opening up a gap between them and ANZ/ASB. The pace of swap rate increases may however close that opportunity soon

Kiwibank the third major to raise home loan interest rates, although a sub 4% rate is still hanging in there from them. Expect the other two majors to announce chunky rises soon too

4th Apr 22, 9:45am

116

Kiwibank the third major to raise home loan interest rates, although a sub 4% rate is still hanging in there from them. Expect the other two majors to announce chunky rises soon too

ASB follows ANZ with new home loan rate increases, and goes even higher for most key fixed terms. 5% rates for a two year fixed deal looks imminent now, but the variation still allows for much lower fixing

1st Apr 22, 9:17am

62

ASB follows ANZ with new home loan rate increases, and goes even higher for most key fixed terms. 5% rates for a two year fixed deal looks imminent now, but the variation still allows for much lower fixing

Latest Reserve Bank figures show slowing mortgage growth, but business lending is growing at its fastest rate since before the pandemic

31st Mar 22, 4:00pm

15

Latest Reserve Bank figures show slowing mortgage growth, but business lending is growing at its fastest rate since before the pandemic

With wholesale swap rates at seven year highs, home loan rates push on up higher with ANZ the latest to raise fixed rates up to the next level

28th Mar 22, 5:54pm

106

With wholesale swap rates at seven year highs, home loan rates push on up higher with ANZ the latest to raise fixed rates up to the next level

Reserve Bank figures show February mortgage borrowing rose strongly from January's figures, but first home buyers are getting a smaller share of the lending

24th Mar 22, 3:57pm

66

Reserve Bank figures show February mortgage borrowing rose strongly from January's figures, but first home buyers are getting a smaller share of the lending

Two more major mortgage lenders raise rates, but take different approaches. BNZ matches ANZ, but ASB goes further with some sharp extra hikes

17th Mar 22, 8:40am

82

Two more major mortgage lenders raise rates, but take different approaches. BNZ matches ANZ, but ASB goes further with some sharp extra hikes

As bond and swap rates rise inexorably, only Kiwibank has moved to match ANZ with higher mortgage rates so far. But the margin pressure on the other majors is building fast

15th Mar 22, 8:53am

42

As bond and swap rates rise inexorably, only Kiwibank has moved to match ANZ with higher mortgage rates so far. But the margin pressure on the other majors is building fast

ANZ kicks off next round of mortgage rate hikes with some mid-range increases

Non-bank lenders growing their slice of new housing lending as headwinds strengthen against banks

4th Mar 22, 9:28am

Non-bank lenders growing their slice of new housing lending as headwinds strengthen against banks

Westpac is the next major to raise fixed mortgage rates, taking them to mid-pack. They also raised most term deposit rates by about the same amount. But wholesale echoes grow louder from eastern Europe

1st Mar 22, 5:00pm

Westpac is the next major to raise fixed mortgage rates, taking them to mid-pack. They also raised most term deposit rates by about the same amount. But wholesale echoes grow louder from eastern Europe

Kiwibank raises its floating mortgage rate 25 basis points, and ups its home loan fixed rates too, some to higher than its Aussie bank rivals

28th Feb 22, 10:26am

11

Kiwibank raises its floating mortgage rate 25 basis points, and ups its home loan fixed rates too, some to higher than its Aussie bank rivals

ANZ loosens high LVR home lending criteria after November clamp-down, but borrowers need more uncommitted monthly income than before

21st Feb 22, 3:39pm

20

ANZ loosens high LVR home lending criteria after November clamp-down, but borrowers need more uncommitted monthly income than before

David Chaston assesses the current round of mortgage rate increases in the perspective of how rates have changed over the past five years, and suggests there's serious upside ahead

18th Feb 22, 10:07am

52

David Chaston assesses the current round of mortgage rate increases in the perspective of how rates have changed over the past five years, and suggests there's serious upside ahead

BNZ has raised some home loan rates too following ANZ, but somewhat surprisingly, it has lowered a key one as well. Meanwhile many swap rates move up to four to six year highs

16th Feb 22, 5:59pm

42

BNZ has raised some home loan rates too following ANZ, but somewhat surprisingly, it has lowered a key one as well. Meanwhile many swap rates move up to four to six year highs

The nation's largest home loan lender takes a chance and pulls up some key home loan rates, with most of its fixed term offers now higher than all, probably hoping its main rivals will follow soon

14th Feb 22, 8:13pm

33

The nation's largest home loan lender takes a chance and pulls up some key home loan rates, with most of its fixed term offers now higher than all, probably hoping its main rivals will follow soon

Challenger banks make changes to some key home loan rates, some up as expected, others down unexpectedly

14th Feb 22, 10:37am

6

Challenger banks make changes to some key home loan rates, some up as expected, others down unexpectedly

Early criticism of the effect credit contracts law changes are having on first home buyers may be misplaced

8th Feb 22, 1:21pm

155

Early criticism of the effect credit contracts law changes are having on first home buyers may be misplaced

The flat-lining of the two year wholesale swap rate has allowed a few banks to trim a mortgage rate for a competitive advantage in the meantime. TSB is the latest

3rd Feb 22, 10:43am

27

The flat-lining of the two year wholesale swap rate has allowed a few banks to trim a mortgage rate for a competitive advantage in the meantime. TSB is the latest

Mortgage lending growth slows, but first-home buyers manage to cobble together deposits big enough for them to remain key players in the market

31st Jan 22, 6:03pm

29

Mortgage lending growth slows, but first-home buyers manage to cobble together deposits big enough for them to remain key players in the market

Financial consultant Geof Mortlock calls for independent reviews of the CCCFA and LVR changes that are tightening credit conditions

30th Jan 22, 6:00am

116

Financial consultant Geof Mortlock calls for independent reviews of the CCCFA and LVR changes that are tightening credit conditions

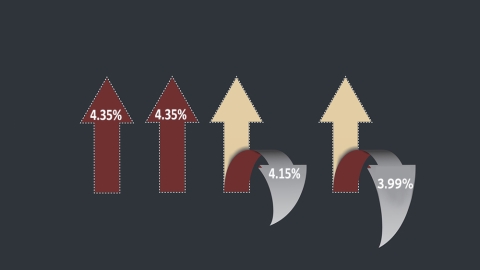

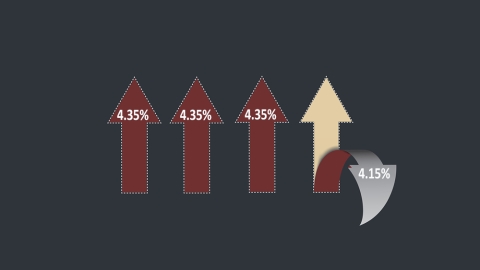

ASB trims its two year fixed home loan rate by 20 basis points to 4.15% as wholesale swap rates make a similar move down. And the CCCFA rules start to bite at loan demand

7th Dec 21, 9:12am

39

ASB trims its two year fixed home loan rate by 20 basis points to 4.15% as wholesale swap rates make a similar move down. And the CCCFA rules start to bite at loan demand

Economists at three of the four largest banks now see house prices dropping in 2022

1st Dec 21, 1:49pm

26

Economists at three of the four largest banks now see house prices dropping in 2022

Suddenly, the rise and rise of fixed mortgage rates looks less certain as financial markets recoil at Omicron. Maybe that opens up an opportunity for borrowers to seek discounts off the new higher carded rates

29th Nov 21, 9:33am

21

Suddenly, the rise and rise of fixed mortgage rates looks less certain as financial markets recoil at Omicron. Maybe that opens up an opportunity for borrowers to seek discounts off the new higher carded rates