TWI

US jobs growth modest, prior months revised down; equity markets tumble; China to retaliate over US tariffs; Japan & Korea dispute escalates; regulator defects; UST 10yr 1.84%; oil down and gold up; NZ$1 = 65.3 USc; TWI-5 = 70.7

3rd Aug 19, 8:33am

43

US jobs growth modest, prior months revised down; equity markets tumble; China to retaliate over US tariffs; Japan & Korea dispute escalates; regulator defects; UST 10yr 1.84%; oil down and gold up; NZ$1 = 65.3 USc; TWI-5 = 70.7

A review of things you need to know before you go home on Friday; a floating rate drop, consumer confidence sags, Barfoot sales volumes up on lower prices, swaps dive, NZD holds, & more

2nd Aug 19, 3:59pm

29

A review of things you need to know before you go home on Friday; a floating rate drop, consumer confidence sags, Barfoot sales volumes up on lower prices, swaps dive, NZD holds, & more

Trump hits US importers of Chinese goods with new tariffs; Wall Street recoils in horror; US economy data weakens; China PMIs stable; BofE lowers growth forecasts; UST 10yr yield at 1.89%; oil slumps, gold leaps; NZ$1 = 65.6 USc; TWI-5 = 71.1

2nd Aug 19, 7:10am

26

Trump hits US importers of Chinese goods with new tariffs; Wall Street recoils in horror; US economy data weakens; China PMIs stable; BofE lowers growth forecasts; UST 10yr yield at 1.89%; oil slumps, gold leaps; NZ$1 = 65.6 USc; TWI-5 = 71.1

A review of things you need to know before you go home on Thursday; no rate changes, retail sluggish, millennials as saver/investors, real estate activity slumps, dairy season starts well, swaps firm, NZD soft, & more

1st Aug 19, 3:59pm

8

A review of things you need to know before you go home on Thursday; no rate changes, retail sluggish, millennials as saver/investors, real estate activity slumps, dairy season starts well, swaps firm, NZD soft, & more

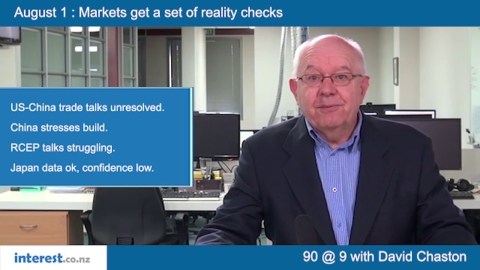

Fed cuts as expected, ends bond sales early; US jobs expand modestly; Chicago PMI slumps; trade talks fizzle; China stresses grow, RCEP struggling, TPP stars; UST 10yr yield at 2.01%; oil unchanged, gold down; NZ$1 = 65.6 USc; TWI-5 = 71.2

1st Aug 19, 7:26am

44

Fed cuts as expected, ends bond sales early; US jobs expand modestly; Chicago PMI slumps; trade talks fizzle; China stresses grow, RCEP struggling, TPP stars; UST 10yr yield at 2.01%; oil unchanged, gold down; NZ$1 = 65.6 USc; TWI-5 = 71.2

A review of things you need to know before you go home on Wednesday: Rabobank cuts some rates, 'grim' business confidence, banks pull back on consumer loans, swaps down, NZD down, & more

31st Jul 19, 3:59pm

22

A review of things you need to know before you go home on Wednesday: Rabobank cuts some rates, 'grim' business confidence, banks pull back on consumer loans, swaps down, NZD down, & more

The Opening Bell: Where currencies start on Wednesday, January 31, 2019

31st Jul 19, 8:38am

The Opening Bell: Where currencies start on Wednesday, January 31, 2019

All eyes on the Fed; US consumer spending modest; US home sales falter; Trump lashes out at China; Japan factories slow; Aussie building consents slump; UST 10yr yield at 2.07%; oil & gold up; NZ$1 = 66.1 USc; TWI-5 = 71.4

31st Jul 19, 7:16am

36

All eyes on the Fed; US consumer spending modest; US home sales falter; Trump lashes out at China; Japan factories slow; Aussie building consents slump; UST 10yr yield at 2.07%; oil & gold up; NZ$1 = 66.1 USc; TWI-5 = 71.4

A review of things you need to know before you go home on Tuesday; Co-op Bank cuts rates, soft building consent growth, weak auction markets, swaps stable, NZD stable, & more

30th Jul 19, 3:59pm

15

A review of things you need to know before you go home on Tuesday; Co-op Bank cuts rates, soft building consent growth, weak auction markets, swaps stable, NZD stable, & more

The Opening Bell: Where currencies start on Tuesday, January 30, 2019

30th Jul 19, 8:48am

The Opening Bell: Where currencies start on Tuesday, January 30, 2019

Wholesale interest rates slide further; official rate cuts imminent; US data soft; US Fed also tackles climate change risk; UK faces EU lockout; Aussie new house sales rise; UST 10yr yield at 2.05%; oil & gold up; NZ$1 = 66.3 USc; TWI-5 = 71.6

30th Jul 19, 7:16am

18

Wholesale interest rates slide further; official rate cuts imminent; US data soft; US Fed also tackles climate change risk; UK faces EU lockout; Aussie new house sales rise; UST 10yr yield at 2.05%; oil & gold up; NZ$1 = 66.3 USc; TWI-5 = 71.6

A review of things you need to know before you go home on Monday; no retail rate changes, NZ arm pressures ANZ Group, DIA issues AML warning, swaps plumb new lows, NZGB yields sink, NZD soft, & more

29th Jul 19, 3:59pm

39

A review of things you need to know before you go home on Monday; no retail rate changes, NZ arm pressures ANZ Group, DIA issues AML warning, swaps plumb new lows, NZGB yields sink, NZD soft, & more

The Opening Bell: Where currencies start on Monday, January 29, 2019

29th Jul 19, 9:04am

The Opening Bell: Where currencies start on Monday, January 29, 2019

US growth slows quickly, especially business investment; Chinese profits fall, investment under pressure; big rise in household debt; Aussie houses selling faster; UST 10yr yield at 2.07%; oil unchanged & gold up; NZ$1 = 66.4 USc; TWI-5 = 71.6

29th Jul 19, 7:16am

37

US growth slows quickly, especially business investment; Chinese profits fall, investment under pressure; big rise in household debt; Aussie houses selling faster; UST 10yr yield at 2.07%; oil unchanged & gold up; NZ$1 = 66.4 USc; TWI-5 = 71.6

US Q2 growth lower but beats forecasts; US policies resisted; Nissan to cut thousands of jobs; iron ore price stays high; UST 10yr 2.07%; oil flat and gold up; NZ$1 = 66.4 USc; TWI-5 = 71.6

27th Jul 19, 9:35am

4

US Q2 growth lower but beats forecasts; US policies resisted; Nissan to cut thousands of jobs; iron ore price stays high; UST 10yr 2.07%; oil flat and gold up; NZ$1 = 66.4 USc; TWI-5 = 71.6

A review of things you need to know before you go home on Friday; market-leading mortgage rate cut, overseas buyers scarce, property yields rise, swaps fall further, NZD stable, & more

26th Jul 19, 3:59pm

12

A review of things you need to know before you go home on Friday; market-leading mortgage rate cut, overseas buyers scarce, property yields rise, swaps fall further, NZD stable, & more

US durable goods orders show zero yearly growth; US GDPNow estimate cut; German factories suffering; ECB prepares more QE; RBA defends inflation targeting; UST 10yr yield at 2.08%; oil up & gold down; NZ$1 = 66.6 USc; TWI-5 = 71.8

26th Jul 19, 7:16am

21

US durable goods orders show zero yearly growth; US GDPNow estimate cut; German factories suffering; ECB prepares more QE; RBA defends inflation targeting; UST 10yr yield at 2.08%; oil up & gold down; NZ$1 = 66.6 USc; TWI-5 = 71.8

A review of things you need to know before you go home on Thursday; no rate changes, record low NZGB yield, living costs impacts regressive, swaps lower again, NZD stable, & more

25th Jul 19, 3:59pm

6

A review of things you need to know before you go home on Thursday; no rate changes, record low NZGB yield, living costs impacts regressive, swaps lower again, NZD stable, & more

The Opening Bell: Where currencies start on Thursday, July 24, 2019

25th Jul 19, 10:03am

The Opening Bell: Where currencies start on Thursday, July 24, 2019

US factory expansion ends; new house sales rise; China property developers squeezed, Japan and Europe factories suffer; equities show gains; APRA pay rules flawed; UST 10yr yield at 2.05%; oil down & gold up; NZ$1 = 67.1 USc; TWI-5 = 72.2

25th Jul 19, 7:18am

24

US factory expansion ends; new house sales rise; China property developers squeezed, Japan and Europe factories suffer; equities show gains; APRA pay rules flawed; UST 10yr yield at 2.05%; oil down & gold up; NZ$1 = 67.1 USc; TWI-5 = 72.2

A review of things you need to know before you go home on Wednesday; more rate cuts, Westpac grinning, another working group, better trade data, FHBs holding back, swaps lower, NZD soft, & more

24th Jul 19, 3:59pm

10

A review of things you need to know before you go home on Wednesday; more rate cuts, Westpac grinning, another working group, better trade data, FHBs holding back, swaps lower, NZD soft, & more

US house sales fall; Richmond Fed data weak; debt ceiling deal done; China bond woes deepen; China rushes to import beef; IMF downgrades global growth again; UST 10yr yield at 2.07%; oil up & gold down; NZ$1 = 67.1 USc; TWI-5 = 72.1

24th Jul 19, 7:23am

12

US house sales fall; Richmond Fed data weak; debt ceiling deal done; China bond woes deepen; China rushes to import beef; IMF downgrades global growth again; UST 10yr yield at 2.07%; oil up & gold down; NZ$1 = 67.1 USc; TWI-5 = 72.1

A review of things you need to know before you go home on Tuesday; many TD rate cuts, dairy farmers levied for MPB, A2 Milk zooms higher; FMA issues warning, SFO files charges, swaps lower, NZD lower, & more

23rd Jul 19, 3:59pm

12

A review of things you need to know before you go home on Tuesday; many TD rate cuts, dairy farmers levied for MPB, A2 Milk zooms higher; FMA issues warning, SFO files charges, swaps lower, NZD lower, & more

The Opening Bell: Where currencies start on Tuesday, July 23, 2019

23rd Jul 19, 9:01am

The Opening Bell: Where currencies start on Tuesday, July 23, 2019

US can't break trend growth; US debt ceiling talks progress well; Canada wholesale trade dips; China has eyes on home loans; Hayne piles pressure on APRA; UST 10yr yield at 2.05%; oil & gold up; NZ$1 = 67.7 USc; TWI-5 = 72.6

23rd Jul 19, 7:25am

2

US can't break trend growth; US debt ceiling talks progress well; Canada wholesale trade dips; China has eyes on home loans; Hayne piles pressure on APRA; UST 10yr yield at 2.05%; oil & gold up; NZ$1 = 67.7 USc; TWI-5 = 72.6