Banking and financial services group Heartland Group Holdings has announced a 6.5% increase in half-year after-tax profit for the period to December 31, but has trimmed its pick for full year earnings by potentially as much as $4 million.

The company said on Tuesday that underlying balance sheet growth supported a result "in line" with the original forecast in the range of $75 million to $77 million.

"However, the one-off costs incurred in relation to the corporate restructure and ASX listing, and the higher than anticipated impact of IFRS9 [new accounting treatment] as a result of receivables growth, have caused some pressure on earnings.

"Whilst Heartland considers that it could still achieve a result at the bottom end of guidance, it would come at a cost to further investment in growth.

"Accordingly, an updated guidance range of $73 million to $75 million is now considered prudent. The midpoint of that range would see the delivery of approximately 10% NPAT growth for FY19 compared to FY18," the company said.

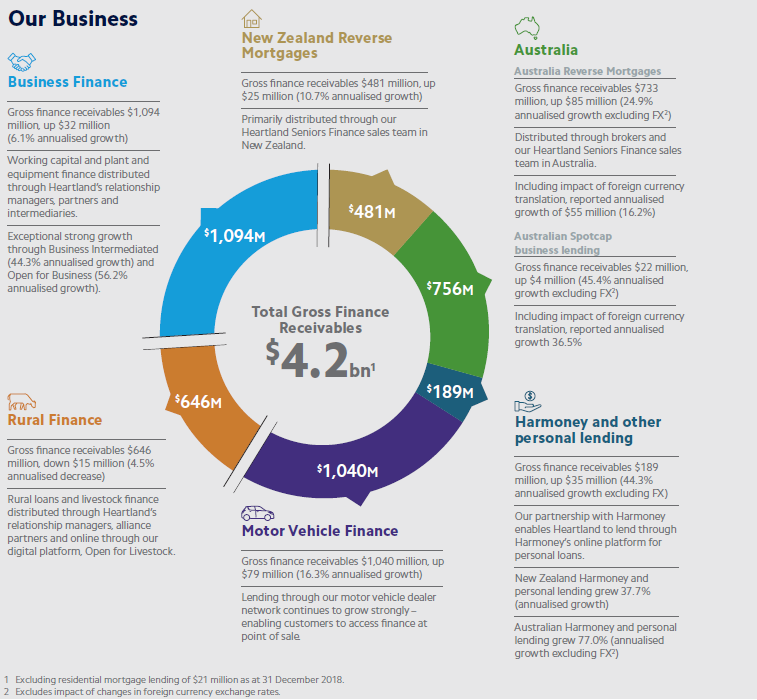

In the first half of the year Heartland said gross finance receivables grew $240.7 million, an annualised growth rate of 11.9%, excluding the impact of changes in foreign currency exchange rates.

Net Operating Income (NOI) was $102.1 million, an increase of $8.2 million (8.7%) compared with the previous corresponding reporting period.

Heartland Group’s Net Interest Margin (NIM) for the six months ended 31 December 2018 was 4.36% compared to 4.44% for the six months ended 31 December 2017.

"NIM was impacted by $1.1m of break costs incurred due to the early repayment of the Tier 2 Australian dollar subordinated bond, and was 4.41% excluding those break costs.

"The Tier 2 bond has been replaced by lower cost funding, which is expected to result in lower interest expense in the second half of the financial year."

Return on Equity (ROE) for Heartland Group reduced from 10.8% (annualised) for the six months ended 31 December 2017 to 10.3% (annualised) for the six months ended 31 December 2018. The reduced ROE is a result of higher average equity for the current period. Earnings per share for Heartland Group for the six months ended 31 December 2018 was 5.9 cents per share, compared to 6.0 cents per share for the six months ended 31 December 2017.

The company is paying an interim dividend of 3.5c a share.

The new accounting standard relating to impairments, IFRS9, came into effect on 1 July 2018.

"This new standard requires impairments to be provided for on an expected loss basis at the date of loan origination. For the period ending 31 December 2018, whilst receivables have performed largely in line with expectations, there has been an increase in impairment expense due to how changes in product mix and growth are provided for under new IFRS9 methodology.

"Impaired asset expense increased $2.9 million (27.6%) to $13.3 million for the six months ended 31 December 2018. $2.2 million of that increase is a result of the new IFRS9 methodology, which is greater than anticipated due to the timing and mix of our loan portfolio growth.

"As a result, impaired asset expense as a percentage of average gross finance receivables increased from 0.58% as at 30 June 2018 to 0.64% as at 31 December 2018. Despite the increase, underlying receivables performance is stable."

Net operating income from Australian operations (comprising Australian Reverse Mortgages and business lending to Spotcap) was $11.8 million, an increase of $2.2 million or 23.3% from the previous corresponding reporting period. Australian Reverse Mortgages gross receivables grew by $85.1 million (24.9% annualised growth) in the six months to 31 December 2018. This growth was offset by an adverse movement in foreign currency translation of $29.8 million, resulting in a reported growth of $55.3 million (16.2% annualised growth) to gross receivables of $733.3 million as at 31 December 2018. Australian business lending to Spotcap increased $4.3 million (45.4% annualised growth), also offset by a small adverse movement in foreign currency translation of $0.8 million to $22.2 million as at 31 December 2018.

New Zealand Reverse Mortgages net operating income was $10.0 million, an increase of $1.2 million or 13.5% from the previous corresponding reporting period. New Zealand Reverse Mortgages gross receivables increased $24.6 million (10.7% annualised growth) during the period to $481.5 million as at 31 December 2018.

Following the corporate restructure, Heartland Group’s activity comprises three areas of strategic focus: Australia Reverse Mortgages, Digital Platform Services (including O4B, the mobile app and new markets) and New Zealand Banking (including the five core lending areas: New Zealand Reverse Mortgages, Motor, SME, Livestock and Harmoney).

As part of the restructure, Chris Flood (previously Deputy CEO) has been appointed as dedicated CEO for Heartland Bank Limited, subject to Reserve Bank of New Zealand non-objection. Jeff Greenslade will remain CEO for Heartland Group Holdings, providing oversight of all Heartland Group activities, including banking, and will take direct responsibility for Australia and Digital as well as managing the Group’s strategy, capital and corporate finance.

The company listed the following highlights:

- Net profit after tax $33.1 million, up 6.5%

- Gross finance receivables $4.2 billion, up 11.9% (annualised growth excluding the impact of changes in foreign currency exchange rates)

- Return on equity (ROE) 10.3%

- NIM 4.36%

- Cost to income ratio 42.5%, down from 42.9% in the previous corresponding reporting period

- 2019 Interim Dividend 3.5cps

- Corporate restructure successfully completed – removing the funding constraints on growth in Australia previously arising from Reserve Bank of New Zealand regulations, and providing greater flexibility to take advantage of growth opportunities and capital raising options in New Zealand and Australia

- ASX foreign exempt listing successfully completed

5 Comments

Heartland is a well run operation , and they have grown their lending book very quickly over the past few years.

One has to only hope that the quality of the loan book , especially to small businesses is as robust as it was when the loans were granted . Small business loans can be a nightmare for bankers

Secondly, reverse mortgages are a messy form of lending for any Bank and it involves "money out" with no actual "money in " until the borrower falls off the perch or moves into frail-care, and the property is sold .

Heartland has been very active on this type of lending

In spite of the nature of the loan , its reflected as an asset , and as a 'receivable" in the accounts , so the balance sheet looks robust, and receivables look good , but interest still has to be paid ( to depositors ) , and this can be quite constraining , and requires good management

By the time the old biddy moves out to shady -pines or the shady cemetery the home is often in a run -down state , poorly maintained , and if this coincides with a house price slump ( think Sydney or Melbourne ) then it opens a whole new set of cans of worms .

That apart , the Bank seems to be going great guns

(Comment from this site in 2010, when "Heartland" was being formed - to bail out the property loans gone bad of Geroge Kerr/Marac?)

"Why are the CBS shareholders agreeing to this merger?

They are the strongest component of the three parties merging. Without CBS they have no banking license. Both Marac and SCBS have had huge losses and write-offs and are desperate for the merger.

Even the new Chair of Heartland Bank, Bruce Irvine, has recently admitted that Marac only survived because of a $250M capital raising that also decimated the value of the original loyal shareholders. Many old Canterbury families lost millions of legacy dollars. These people were very loyal to PGC and Marac over many years and they bore the brunt of the losses.

So the track record of these organisations with the exception of CBS is not flash. The CBS shareholders should vote against this deal before it's too late and they become the next victims.

Up until very recently, Heartland Bank had George Kerr well entrenched in the organisation. If it wasn't for his well-publicised indiscretions with SCF, he would still be being supported by Bruce Irvine and his band of merry men."

https://www.interest.co.nz/news/51125/proposed-heartland-bank-eyes-nz50…

Funny. My wife had a car loan with Marac, we tried settling early (a little over $1000) which they had no issue with. Took us 3 attempts to pay the lump sum. Each time we’d get confirmation that the balance has been settled, security released and then 2 days later the money is back in my account. I gave up on the third try and kept the money. Could be one reason they were losing money?

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.