By David Hargreaves

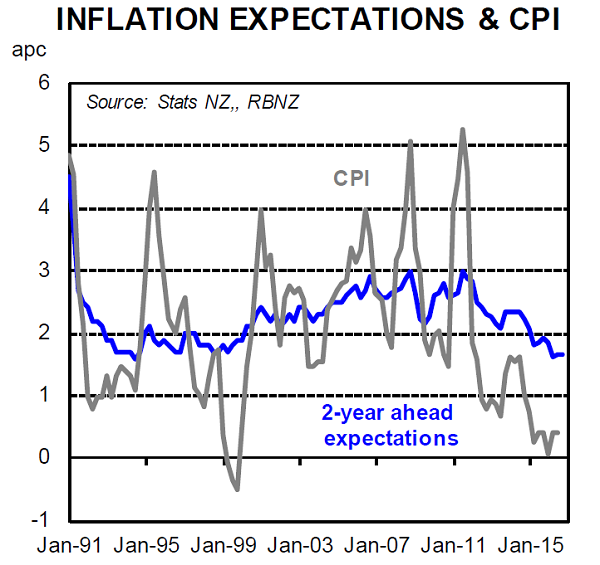

The latest quarterly Reserve Bank Survey of Expectations, shows that inflation is anticipated to be just 1.65% in two years time - still well under the RBNZ's explicit inflation target of 2%.

However, the latest result, which is a slight rise from a pick of 1.64% in the last survey, will nevertheless come as something of a relief to the central bank and will not place any more pressure on it regarding interest rate cuts.

Having said that, the decision by the RBNZ's counterpart the Reserve Bank of Australia to drop its key rate to 1.5% will keep tension on, particularly when it comes to the New Zealand dollar.

The survey of expectations is watched very closely by the RBNZ. After the February survey showed a sharp fall in inflation expectations, with the two-year-out figure dropping to 1.63% from 1.85%, the central bank followed up within a month with a cut to the Official Cash Rate.

This was a cut that had clearly not been planned or intended prior to the result of the survey coming out.

Therefore any sharp fall in the latest survey would have put more pressure on. As it is, expectations appear to have settled, albeit at low levels.

The RBNZ gets very uncomfortable when it sees falling inflation expectations, because clearly such expectations feed into businesses' future pricing plans. Expectation of falling inflation makes for weak future pricing intentions.

In terms of one-year-out inflation, the latest survey outcome is a pick of 1.26%, up from 1.22% in the last survey and a low point of 1.09% in February.

ASB economist Kim Mundy said the 2-year-ahead measure remained near record lows in the survey and was well below the 2% considered as consistent with the RBNZ meeting its inflation target.

"As a result, the RBNZ will be hoping to see inflation expectations pick up in the near future in order to avoid longer-term expectations becoming unanchored from the inflation target," she said.

"For some time now our central view has been that the outlook for inflation remains subdued, with the risks tilted to the downside. If anything, a number of downside risks have grown recently.

"The ongoing strength in the NZD and recent falls in oil prices are key risks to the near-term inflation outlook. The high NZD and low oil prices, on top of global growth concerns, global spare capacity and capacity in the NZ labour market all reinforce our view the RBNZ will need to provide further stimulus to ensure inflation returns comfortably within the target band.

"While the RBNZ is unlikely to be too concerned about the level of 2-year-ahead inflation expectations in Q3, it will be hoping to see a more convincing lift sooner rather than later. The RBNZ will no doubt be keeping an eye on a range of other inflation expectation surveys in order to assess whether or not inflation expectations are likely to remain anchored around 2%. We continue to expect the RBNZ will cut the OCR again in August and November," Mundy said.

It is already pretty much a given that the RBNZ will drop the Official Cash Rate next week from the current record low of 2.25%, in all likelihood to a new low of 2%.

In a recent unscheduled economic update that was put out partly because of the current long gap between OCR reviews (from June 9 to August 11), but also principally because of the strong Kiwi dollar, the RBNZ signalled further OCR cuts and warned that the then 6% rise in the New Zealand dollar since its last OCR decision was making it hard to meet the 1-3% inflation target.

Having fallen in the wake of that announcement, the Kiwi dollar has subsequently surged again and is currently about 7% higher than the RBNZ has forecast for the September quarter.

A strong Kiwi dollar of course helps to push down prices and pushes back the time at which the RBNZ might get anywhere near its inflation targets.

Inflation in this country has now been below the 1%-3% target for nearly two years and nowhere near the 2% that is the explicit target-within-the-target for the RBNZ.

6 Comments

It depends on why things are getting cheaper. If it is because of productivity improvements then it seems very strange to view it as a bad thing. The reason for wanting inflation is people will reduce consumption if they think the prices will be cheaper later unless they need the goods/services urgently. This is not ideal as it would result in a recession.

The productivity improvements are negligible. The EU and US are flooding the world with cheap currency to try to deal with their, rather serious, economic issues.

"The enormity of that decay is almost incomprehensible, especially when factoring population. The BLS in its other estimates tells us that the civilian non-institutional population, the aggregate pool of all potential laborers, expanded by nearly 41 million in those fifteen years. That means the raw count of potential workers grew by 19% while total labor output added just 2%."

http://www.realclearmarkets.com/articles/2016/07/29/to_be_clear_the_hel…

It's pretty clear that productivity isn't improving in the US or here.

In addition consider my original post the method for measuring inflation is bullshit and is intended to deceive people into believing that everything is fine. We are in a deflationary phase, and given your post I would assume you understand that this is bad.

The more people have to spend on a roof over their heads, the less they have for all the other stuff that seems to make up "inflation". In the current housing market is it any surprise at all that less and less is being spent otherwise, thus driving prices down in order to sell anything at all. Sort that and you might see a bit of "healthy" inflation, although I reckon that is an oxymoron, but hey, that is just me.

Wheeler should be made to write 100 times; low inflation is structural, not merely cyclical. Inflation has been on a downwards trend in NZ since 1990 and for longer in the US, UK and Australia. Long-term graphs make the picture very clear. Dictator is quite right; we are in a deflationary era and NZ's labour productivity growth rate is dismal.

Globalisation, technology, loss of employee bargaining power, central banks success in inflation targeting; all have played their part in getting us to where we are now. Globally, some $11trillion of assets have negative interest rates. I think the RB's chance of getting inflation back to 2% is about NIL.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.