By Paul Morris*

Last week the Reserve Bank of New Zealand (“RBNZ”) cut its Official Cash Rate (“OCR”) from 1.75% to a record low of 1.50%. It noted there is now a “more balanced outlook for interest rates”, albeit details in its accompanying Monetary Policy Statement suggest the door remains ajar to another cut.

This is good news for borrowers, notably residential mortgage borrowers as banks cut mortgage lending rates. There are however two sides to every interest rate and savers using bank term deposits have also seen their rates cut.

Given even lower interest rates it is likely some savers will have noted suggestions from the RBNZ governor at his post Monetary Policy Statement press conference that they should think about alternatives to term deposits.

Many savers use term deposits as a simple and accessible investment. The most natural progression away from term deposits in terms of risk and complexity are bonds or fixed interest.

Why bonds over term deposits

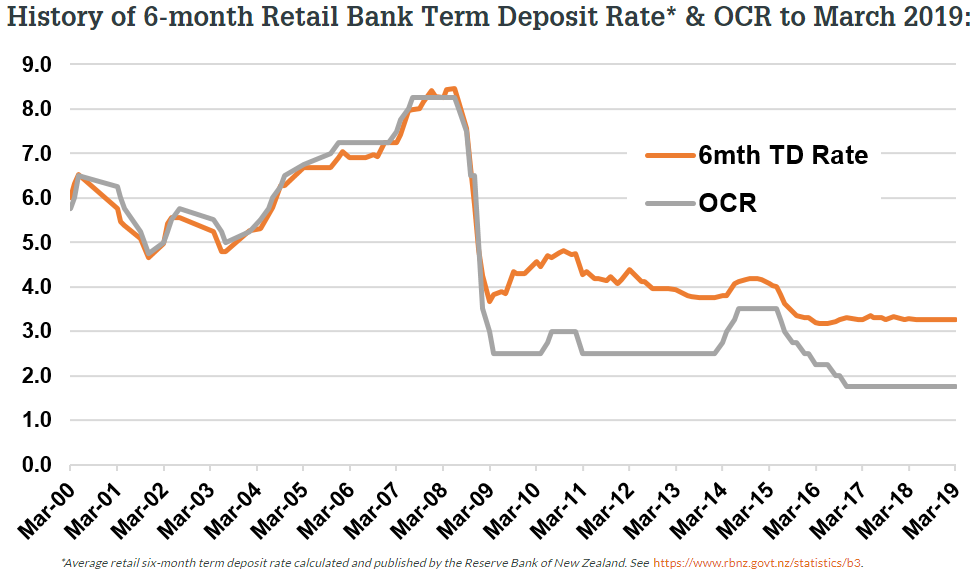

As illustrated in the chart below, competition among banks to attract term deposits to meet regulatory requirements (see here) has meant term deposit rates have fallen less than the OCR. This has held term deposit rates elevated relative to New Zealand bond interest rates, even on many corporate bonds, which has made some investors reticent to invest in bonds.

That would however have been to their detriment. For example, since 10th November 2016 when the OCR was cut to 1.75% the New Zealand investment grade corporate bond market has returned over 5.0% per annum compared to an average 6-month bank term deposit rate of about 3.25% per annum over the same period.

Savers can be put off by the appearance that bonds are more complex than term deposits. While true, the difference is exacerbated by a general lack of understanding of the risks associated with bank deposits (see here). Nevertheless, we suggest any added complexity can be navigated through good financial advice and/ or the use of a bond fund manager.

Some investors have been, and remain, wary of the interest rate exposure inherent in bonds. Diversified portfolios of bonds and shares should instead note the need to retain some interest rate exposure, to benefit from the fact bond interest rates typically fall (meaning their prices rise) when share markets fall or market volatility increases.

Furthermore, a glance to the negative interest rates in many offshore economies should act as a warning that another fall in bond and term deposit interest rates remains a possibility. Rolling/ reinvesting of short dated term deposits therefore has reinvestment risk (i.e. reinvesting at lower rates), compounded by the possibility that post the RBNZ bank capital review banks may look to protect their returns by cutting term deposit rates, irrespective of the OCR (see here).

As alluded to here, banking regulation changes meant deposits are generally no longer able to be broken by depositors, except for financial hardship. That means savers should be wary of their tenor. This compares to bonds and most bond funds which can be bought and sold daily.

Finally, a portfolio of bonds held directly or via a bond fund provides improved diversification away from the risk of failures in the banking system. Potential increases to bank capital levels should reduce the chance of a bank failure and a bank’s deposits falling foul of Open Bank Resolution (see here).

Nevertheless, we agree with the RBNZ governor that savers should look to diversify, at least in part, away from term deposits. Bonds/ fixed interest funds are a natural progression. Those investors wary of market interest rates going higher, can mitigate the risk by using bond funds which explicitly target an absolute return. Remember also that while some bond interest rates may be lower than term deposit rates, through active management, and of course the possibility bond interest rates fall further, bond funds may realise higher returns than term deposits, as we have seen in recent years.

Disclaimer: This is intended to provide general information only. It does not take into account your investment needs or personal circumstances. It is not intended to be viewed as investment or financial advice. Should you require financial advice you should always speak to an Authorised Financial Adviser. Please note past performance is not a guarantee of future performance.

*Paul Morris is a portfolio manager with Milford Asset Management. This article was originally published here and is reproduced with permission.

5 Comments

Biggest issue with trading bonds in NZ is the dual cost problem. First a market maker at a bank is providing a two way price with a nice juicy retail margin for the bank. Then your broker is charging 0.2% for a phone call, usually to a single bank to get you that price. Net effect is the average Joe pays twice.

Over all to get in and out of the trade you will be paying North of 75bps ~ at least that is my experience trading govt bonds through my bank.

If you have any ideas on how to avoid the double charging or disagree would be really interested in hearing your views.

I, too, would like to know how to own NZ treasury bonds without ridiculously high bid-ask spreads. Is 75bps really the best that's available to small fish?

It's noteworthy perhaps that, in other countries such as the US with its 'Treasury Direct' program, individuals can purchase treasury debt through 'noncompetitive tenders' purchasing at the average bond auction price without paying any dealer fees. Why has Treasury not provided New Zealanders this option?

In the other market I have traded (Hong Kong) the bank makes a market and quotes a retail price but does not charge brokerage. If you negotiate, because they are making a spread (similar to FX) you end up paying about 20bps in price terms from the interbank market.

To be honest I'm surprised clients here haven't reported the banks for gouging.

The above comments suggest a fairly high degree of caution, distrust and concern at high fees charged by money managers.

Many baby boomers who are now retired and with funds to invest are highly cautious as many experienced the 1987 share market crash, the finance company crashes with the onset of the GFC, and poor practices of "insurance salesmen/financial advisers". As such they have tended to invest in those things they know and perceive to have a high degree of control over and safe - housing and bank term deposits.

Many retirees are facing tough decisions when that $500,000 nest egg which they invested safely in term deposits with a planned return $30,000pa is only currently returning $15,000.

To persuade baby boomers in any alternative investment there is a great need to address their fears associated with skepticism and trust. I don't think that this article does it.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.