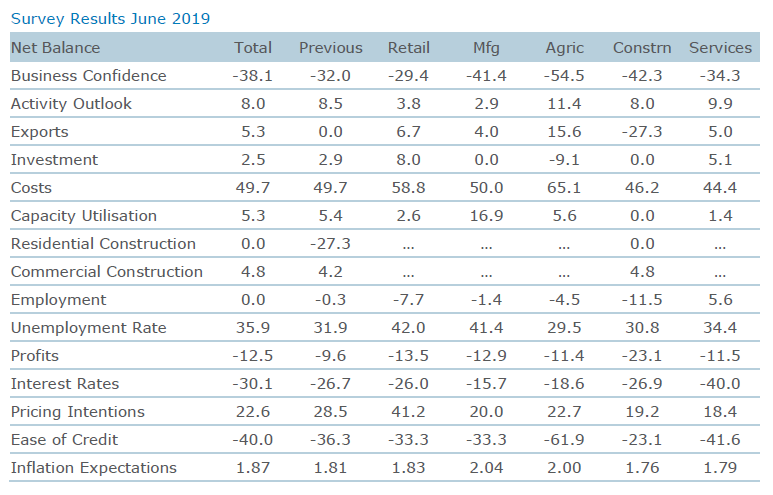

The latest ANZ Business Outlook Survey has shown a considerable bounceback in sentiment in the residential construction sector although the overall mood in the construction sector remains grim.

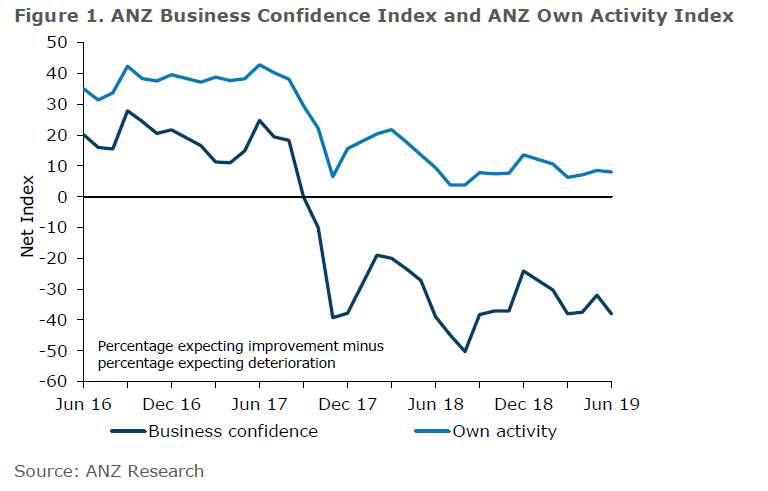

And in terms of general sentiment, the latest survey has shown another overall drop in overall business confidence - reversing a slight lift that occurred in May following the Government's April decision to torpedo any capital gains tax.

In commenting on the overall survey results, ASB senior economist Jane Turner said the ANZ monthly business confidence survey continued to paint a picture of subdued growth in investment, employment and economic activity, as well as declining firm profitability and muted inflation pressure.

"Weak sentiment maintains the case for additional policy support and we expect the RBNZ to cut the OCR by a further 25bps in August, with growing risk of further cuts beyond this."

Turner said the risk was that weak economic activity flowed through to the labour market, further entrenching the economic slowdown.

"Concerning for the RBNZ, business confidence did not react to the RBNZ’s 25 basis point OCR cut in May. This suggests the RBNZ may have to take more aggressive action to revive economic confidence help stimulate economic demand.

"At yesterday’s OCR review, the RBNZ indicated that further stimulus was likely to be needed and we expect the RBNZ to follow through with another 25bp rate cut in August, bringing the OCR to 1.25%. However, continued weak business confidence suggests a growing risk that the RBNZ will have to cut the OCR below 1.25%."

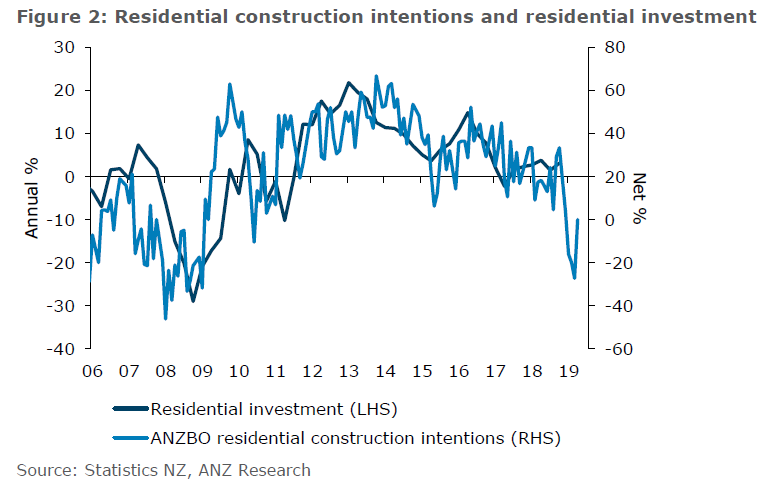

Back to the survey, the detail in the construction sector shows a big bounce from the net -27% of residential construction respondents expecting deteriorating conditions in May to a net zero in the latest month.

However, ANZ economists point out that employment intentions in the overall construction sector are gloomy, with a net 11.5% of respondents expecting to reduce staff. However, this is an improvement from the net 22% expecting reduction in May.

In commenting on residential building intentions, the ANZ economists note the rebound to zero, but say, looking through the volatility associated with the small sample size, the figures continue to suggest a marked fall in building activity.

They note the number of firms in the construction sector intending to cut jobs, "and the sector has the weakest profitability expectations across the economy too".

"The outlook for the economy is murky," ANZ chief economist Sharon Zollner says.

"As things stand, there is no reason for the economy to fall into a deep hole. Commodity prices are good, interest rates are at record lows, and the labour market is tight.

"But the economy is facing credit and cost headwinds and the global outlook is deteriorating.

"On the latter, for all that our commodity prices have been resilient, the risks are looking decidedly one-sided.

"Upside risks to growth appear few and far between and with the inflation outlook not consistent with the target midpoint we expect two more [Official Cash Rate] cuts this year.

4 Comments

They note the number of firms in the construction sector intending to cut jobs, "and the sector has the weakest profitability expectations across the economy too"

Policy makers could could do more to stabilize these rapidly alternating periods of boom and bust in the construction sector that have impacted economic sentiments over the last couple of decades. We cry about skill and capital shortages in the industry when most workers and investors are right to keep away from it given the short life of such construction booms.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.