As we know, the Government this week outlined that to date it has paid out a massive $6.6 billion in wage subsidies for over 1 million Kiwis representing over 40% of the workforce.

That's a lot of money to a lot of people.

If like me you struggle to get the grey matter around such mind-boggling large numbers, you might find it informative to have a look at how such numbers are reflected within one business - albeit a fairly large one.

On Thursday The Warehouse Group provided a business update to the NZX.

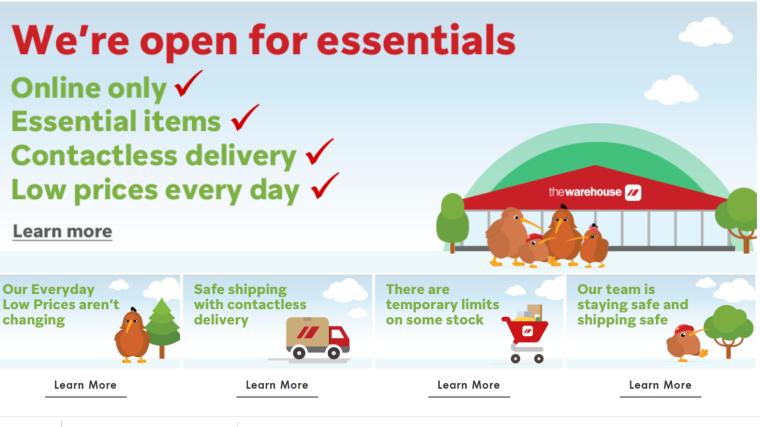

The company's retail outlets are closed but the group’s brands are now operational in a limited capacity for essential items only (both online and available to be contacted over the phone) after agreement from the Ministry of Business, Innovation and Employment (“MBIE”).

The company stated early on that it was intending to pay its 11,000 staff full wages during the four-week period of the lockdown.

Since then it has applied for the Government’s wage subsidy scheme.

And the company says it has received $67.7 million in total to support its employees over a 12-week period.

"The split by brands is $52 million to the The Warehouse Limited (including Warehouse Stationery), $12.1 million to Noel Leeming, $3.2 million to Torpedo7 and $0.4 million to the TheMarket.com.

"The receipt of this funding is crucial to the Group maintaining its workforce while stores remain shut and the Group thanks the government for this support," the company said.

The company has been working with its existing banking institutions and said it has secured $150 million of additional banking facilities, extending the total debt facilities available to $330 million.

"These additional bank facilities are currently undrawn and would allow for the refinancing of the Group’s NZX listed bond of $125 million that matures in June 2020."

11 Comments

Part time workers subsidy is $350.

How many of theses did they apply for and how are they allocating it amongst their part time workers?

How much of this is not getting paid out as their part timers earn less?

Multiply this around all the part timers in NZ.

Few answers required me thinks

It did occur to me, hearing about the endless trouble that Health Department seems to have matching Demand for everything from PPE to swabs, with Supply, in a DIFOTIS (Delivered in full, on time, in spec) fashion, that they might just have been better to leave the whole Inventorying thing to the logistics experts, which include the Red Sheds amongst many, many other private sector operators......

Heck, if Zuru, source of those execrable little balloons I pick up from the beach most every day, can charter a private jet for PPE and have it out there where it matters, then it does rather show up the public sector plodders, no?

Terrible idea. Chinese-owned enterprises in Australia have bought up huge amounts of PPE in the last 8 weeks and sent it back to China at the direction of the CCP. Now the Australians have a shortage and have had to pass legislation banning the export of PPE, customs are seizing it at the border. I'd side with the Government looking at the whole supply and demand chain over companies acting in their own interest with a limited view in this case.

I hope worldwide nations started to realise for certain basic important necessities, they should not be all sourced to lower wages economy, build each countries resilience..globalisation is just an excuse to shifted into 'cheaper wages, cheaper regulatory control' - But on different stories, this is just a start, to stamp out future unknown outbreak:

https://www.stuff.co.nz/world/asia/120952627/china-moves-toward-ban-on-…

Here's an idea ........The NZ BUSINESS COMMUNITY could start by bringing all those callcentres back onshore to create jobs , that will take up a few tens of thousands of workers post Covid

All those jobs that have gone to Asia and so on could be done by Kiwis instead

I am suggesting all the 0800 numbers ......... the Banks , Oil Companies , Spark , Vodafone , Xero etc bring customer support jobs back home

The majority 'immediate main recipients' for all those payment subsidy? (borrowed loan to be re-paid by all future tax payers) surely will be the 'private & commercial landlords and Banks' - As we all knew the past 10-20yrs this country has geared up heavily towards the Finance, Insurance, Real Estate productivity economy. If not mistaken almost around 65-75% of any previous incomes goes to pay for the rent, commercial leasing & banks mortgages - so 'contractually' in proportions to what those subsidy recipients received? Yip, same % ratio above goes to.. that 'contractual obligation'.. here? the Landlords & Banks, can claim they too 'bleed as part of their contribution' - May be? it's a time for those essential renters workers troop (eg. rubbish collectors, doctors, nurses etc.) to demands more, off course the answer will be: 'another future tax payers subsidy' - This is the Very Essence what most of the property/RE bull promoted on this website: Whichever you look at it? RE will always came out as the 'winner' in FIRE economy - Every governance level, economist, think tank, banks, central bank, local councils, already/would be/should be part of the participant in this Wealth ponzi scheme, 'you'll be an outsiders until you decided to join in the club' - Therefore, you started to realise those magnitude of 'collective sub-conscious' in decision making process. It's all about 'self preservation mode', and in grand scheme of 'too big to fail' they all label it as 'for greater good of all/nation'.. Nice..nice.. - for PR purposes, in the near future, only 'minor losses' from RE industries nationwide.. but the report would be 'dramatised' in order to gain public sympathy.

I think the subsidy was available to any enterprise that showed a drop in turner of more than 30 percent or a forecast drop in turnover of more than 30 percent due to the Corona Virus. So in this scenario the staff may be working at home full time, the company has been hit badly by the virus and this supports them just like it supports businesses that have had to fully close for the lock down.

Here's the first start of positive spin-up news, for Kiwis - future NZ productive, essential & resilience industry,

the social caring of FIRE economy, NZ neo-liberal light-house signal beacon example to the world:

https://www.stuff.co.nz/business/120934302/coronavirus-no-big-rise-in-r…

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.