By Carol Cheng*

A UK friend commented to me this week that nowadays China cannot be ignored as it is an important part of the global financial market. I couldn't agree more. The term "Circuit breaker" became a key word within days and people have quickly learnt this financial terminology in China.

January is the time for new resolutions for both ourselves and planning for our business. Often we realise we are making the same resolutions each year. “Diet” is a popular word for people. “Growth” is one of the key words for businesses. Being a business advisor, I wonder how many people will choose "China" as one of the key words for their business planning this year.

China is often linked with the word “growth”. China has demonstrated 20 years of double-digit growth which is uninterrupted and unprecedented. Although China's economy is slowing, it has become the second largest in the world. Some people may worry - even panic - about the current volatility of share markets. Some may be too pessimistic at the beginning of the year and start to think it’s not a good time to put China in their business planning. Well, let me share a story with you.

I was working in a consulting firm in Beijing during the GFC. All of our clients and potential clients were foreign investors who were doing business in China or planning to enter the China market. In fact, some of my clients’ downsized or closed operations in China during this period, which was sad. It was the most difficult time to make investment decisions. However, at the same time there were foreign companies starting to enter China in this period. On a cold windy winter day in Beijing in 2008, I met a CEO of a medium sized software company from the US. He said, “Carol, I am very surprised I do not feel the GFC in Beijing. I have become very positive this week after meeting people and have had good meals in the restaurants. People are positive here. ” It wasn’t the banquets that cheered him up, it was the opportunities he saw and positive attitude he experienced. After this trip, his company increased their investment in China and has performed well since.

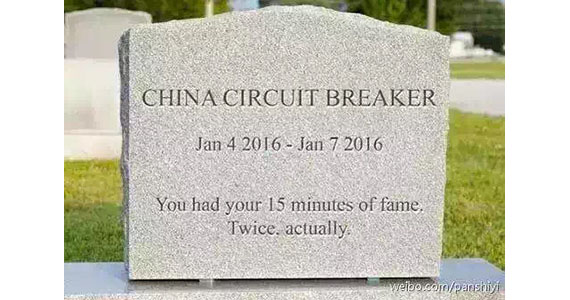

When it comes to the smog in Beijing and China's share markets, I admire the positive attitude of the Chinese and their talents to create so many jokes, funny cartoon pictures and short videos on line to express their mixed feelings these days. All in all, they are humorous positive expressions with some frustrations. (See example below.)

Another two key words connected with China are “change” and “complexity”. I often remind my clients that China is a much more complex and expensive place to do business today compared with 10 years ago. But it is still full of potential and opportunity. The circuit breaker suspension is a typical example of “change”. Change is good. Another example; the recent change to one child policy is very positive. Different languages, cultures, laws and regulations and the size of the market itself have add lots of complexities.

There are more keys words to be considered for your business planning. My advice is that if China is one of your 2016 key words, you will need to form the best-fit China strategy to find growth, while coping with the rapid changes and complexity of the Chinese market for your business. Forming a China strategy is not about a fancy document prepared by external consultants or internal management team. It’s a thought process, a road-map for your growth, aligned to the realities of that market.

I would like to share a picture of fireworks of my home city Changsha, the provincial capital of Hunan province to wish everyone a healthy and prosperous New Year. (above)

Carol Cheng is an Auckland-based independent business consultant who specialises in advising New Zealand companies who invest in China and Chinese companies who invest in New Zealand.

4 Comments

Divide 70 by the annual percentage growth rate to get the doubling time. 7% annual growth gives a doubling time of 10 years. Two consecutive doubling periods (of 7% annual growth) results in quadrupling. And therein lies the problem for China because the resources -especially easily extracted oil- required for another period of doubling growth do not exist on this planet. And pollution levels are already beyond intolerable.

The collision between the reality of resources being finite and the economic ideology of perpetual growth, which has been in vogue for decades, will be very difficult for many people -especially mainstream economists- to cope with.

Perpetual growth? "It is a common belief that China’s CO2 emissions will continue to grow throughout this century and will dominate global emissions. The findings from this research suggest that this will not necessarily be the case because saturation in ownership of appliances, construction of residential and commercial floor area, roadways, railways, fertilizer use, and urbanization will peak around 2030 with slowing population growth."

http://china.lbl.gov/sites/all/files/lbl-4472e-energy-2050april-2011.pdf

http://www.economist.com/news/china/21570750-first-two-articles-about-im...

Bull in a China shop by the sounds of it. The Chinese are running for the exits and key indexs are being propped/floated up by government buying . The true underlying picture is far more sinister regarding the current route. I'll pass and rethink China on a rainy day in 2017.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.