This is the second part of Deloitte Access Economic's "Regions of Growth" series. It is here with permission.

----

What role should regions play in supporting overall economic success? How can our regions build a pathway to prosperity, and what role do exports play in this picture?

To address these questions, our analysis focuses on:

• The industries that would provide New Zealand with the best chance to successfully turn local advantage into global competitiveness (industries of opportunity).

• The economic impact of increasing exports, within each industry of opportunity, on our regions and the New Zealand economy as a whole (economic impact).

Industries of opportunity

This report focuses on four of New Zealand’s five industries of opportunity:6

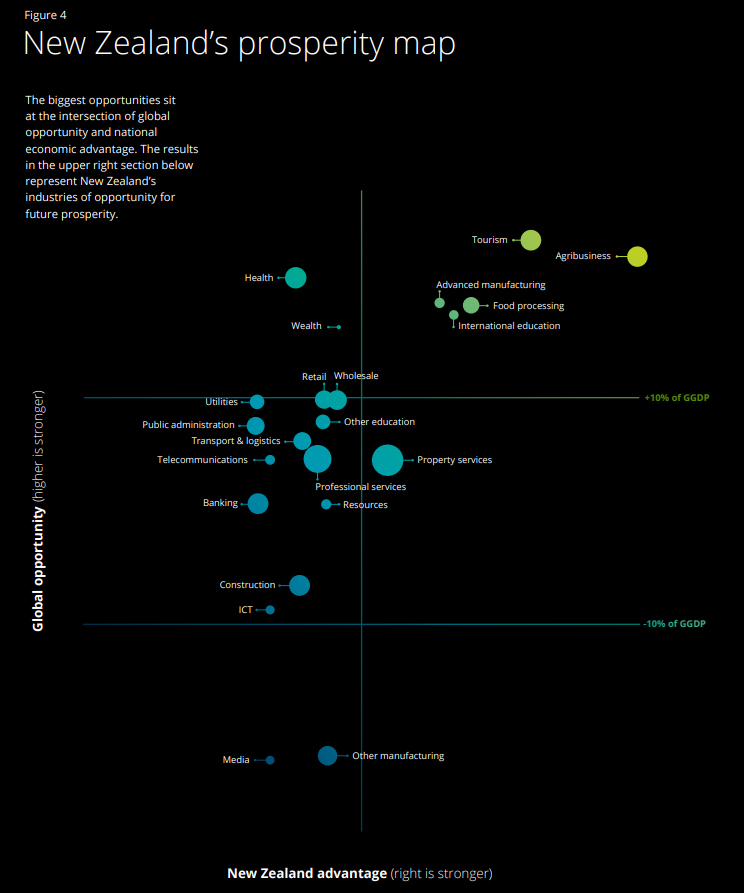

These are the industries identified in Shaping our slice of heaven: Industries of opportunity, as having both above average global economic growth over the next 20 years, as well as industries in which New Zealand has a strong comparative advantage on the global stage. Our prosperity map outlines where these sit relative to other industries, as seen in Figure 3.

We are not attempting to “pick winners”. We recognise that there are other industries contributing to New Zealand’s prosperity, and these industries – or ones that haven’t been identified yet – may end up also being key to future economic prosperity. We also recognise that there are other types of prosperity, such as social prosperity, that this report doesn’t cover.

However, based on these selected industries, we wanted to know how our regions of focus could benefit from increased export growth. To do so, we measured the economic impact of scenarios in which each industry of opportunity’s exports grow at the highgrowth profile necessary to reach certain industry or government targets.

Assessment of the economic impact of increasing exports on our focus regions

We used our in-house regional general equilibrium model (DAE-RGEM) to estimate the economic impact of growing exports in our industries of opportunity. The model simulates how the economy will respond and adjust to increased export growth over the period of 2019 to 2040. We assume that this growth stems from change within New Zealand, in particular from an increase in productivity in each relevant industry, rather than from an increase in demand from international markets. Since productivity improvements do not differentiate between production for domestic consumption and export, these improvements benefit the entire industry’s production regardless of the final consumer.

Based on the assumed increase in exports, DAE-RGEM models the behavioural response of consumers, firms, governments and overseas markets. At the same time, it observes resource constraints and takes into account the optimal distribution of resources. The model has the ability to incorporate the flow-on impacts to any region of New Zealand and the rest of the world.

We modelled four independent ‘counterfactual’ scenarios – one for each industry of opportunity. In each ‘counterfactual’ scenario, high-growth profiles are applied to our focus regions.

This provides a ‘what if’ style analysis, based on a hypothetical scenario where the five focus regions achieve the export growth necessary to reach national targets. Appendix B details our approach, our in-house DAE-RGEM tool, and the inputs used in the model.

Scenarios and key inputs

To determine the economic impact of the increased export growth, we compare the national and regional economies under two distinct scenarios:

• The ‘base case’ scenario grows exports at the same rate as the average annual growth rate over the past ten years for each industry.

• The ‘counterfactual’ scenario grows exports at a higher rate than the base-case scenario.

We have used the growth rate required to achieve national export targets set for each industry of opportunity.7 This creates a ‘high-growth profile’. We modelled four independent ‘counterfactual’ scenarios – one for each industry of opportunity. In each ‘counterfactual’ scenario, high-growth profiles are applied to our focus regions.8 We recognise that how each region responds to export growth will differ due to differences in, for example, access to capital and resources, available products and services, level of competition, and employment opportunities.

However, our focus regions follow a higher-growth path, while all other regions grow at their ‘base case’ growth rates.

Appendix A outlines our methodology to create export growth profiles for both scenarios.

Export targets are what our country aspires to in order to maximise prosperity. They are set to help government achieve their priorities and hold industry leaders accountable. We used the following export targets to inform our ‘counterfactual’ scenario for each industry of opportunity:

• Tourism: MBIE forecasts international tourist spending in New Zealand to reach $14.8 billion in 2024, up 40 percent from 2017.9 To meet this forecast, international tourist spending would have to grow on average by 5.4 percent annually up to 2024. We think, given increasing tourist spend and the current economic conditions, achieving this target is feasible.

• Agribusiness: In 2014, the Primary Industries Minister announced an ambitious goal to double the value of primary sector exports from its 2012 level to $64 billion by 2025.10 This would require an annual growth rate of 6.2 percent from now until 2025 for agribusiness. With current exports in agribusiness not keeping up with the growth required, we think this target is a stretch. However, the agribusinesses industry is looking positive over the long-term, and we expect the industry to respond to the key challenges it faces to continue to be prosperous.

• Food processing: The export target for food processing is included in the primary sector target just mentioned. Further to that, Fonterra – New Zealand’s largest dairy exporter – has an aggressive growth target to reach $35 billion in total revenue by 2025.11 These targets in aggregate suggest that an annual growth rate of 7.5 percent is required to achieve the export targets set for food processing exports. We feel this target is optimistic, despite the historic average annual growth rate of 5.1 percent. However, the food processing sector in New Zealand has experienced a boom over the past few years, and the constant growth rate needed to achieve the export target is still possible.

• Advanced manufacturing: The Government is determined to increase research and development (R&D) and productivity, announcing in the 2018 Budget their commitment to increase national investment in R&D to 2.0 percent of GDP.12 R&D expenditure has a significant impact on advanced manufacturing exports.13 Using the findings from a 2014 study,14 we estimated what the growth in advanced manufacturing exports would be if R&D expenditure reached the desired 2.0 percent of GDP by 2040.15 This shows that exports would grow at 6.0 percent per annum to 2040. Assuming the relationship between R&D expenditure and growth in advanced manufacturing exports is similar in New Zealand, we think this growth rate is achievable, given the right incentives are created by the implementation of R&D tax credits and the growing demand for advanced manufacturing exports.

Economic impact on New Zealand

Our analysis reveals that the economy would enjoy considerable benefits as a direct result of increasing exports in our industries of opportunity from our regions of focus. Specifically, we estimate that:16

As sectors are interrelated and affected by changes in other industries, related industries also benefit from an increase in exports (and therefore increased production) by our industries of opportunity. For example, the economic impact of the agribusiness ‘counterfactual’ scenario is $4.0 billion to New Zealand over the period 2019 to 2040. This does not mean that the GDP growth is limited to the agribusiness industry, but rather the economic benefit is spread across a number of industries.

$1.9 billion in GDP growth out of the total $4.0 billion economic benefit comes through GDP growth within agribusiness, $1.3 billion comes through growth in ‘other business services’ and a further $500 million from both ‘trade’ and ‘other government services’.18 This explains why we will observe in the following sections of the report that regions that are not relatively strong in an industry of opportunity may still see considerable GDP growth occurring from exports in that particular industry.

Economic shocks rarely occur in isolation, therefore the modelling should be interpreted as an indication of the potential magnitude of the impact of increasing exports in each industry and each region, but not as a prediction of the future.

Regional economic impact on our focus regions

Which of the industries are likely to provide the largest benefit to each region from strong export growth?

The estimated economic impact varies significantly across our focus regions. This variability is driven by differences in the relative size of the industry, the economic composition within the region and the extent to which each region is export-driven.

The next five chapters (which will follow in separate postings) provide a detailed narrative on each region, discussing:

• An overview of the current economic conditions. The economic impact results, in terms of regional GDP and employment for each industry of opportunity.

• A consideration of how the region could amplify the economic opportunity identified in our economic impact results.

This is the second section of Deloitte's report: "Shaping our slice of heaven: Regions of opportunity". The full report is here. This article is reproduced with permission.

3 Comments

Er, but what about profitability and the higher pay this allows? Increased sales are not an end in themselves. I suspect Tourism is subsidised by shareholder dilution. An example is it now takes me 20 minutes to get to the beach in summer, 5 minutes in winter. Tourism provides entry level low skilled jobs, so good for soaking up unemployment, but very vulnerable to the price of oil.

Advanced manufacturing sounds much more exciting as it suggests profitability and high pay. Profitability and high pay is good for everyone. It encourages capital investment and upskilling of the whole society, as each industry poaches workers from the less profitable industries in the region and trains them up and people study independently to get the skills too.

Of course, changing the country's business model from one based on 2% inflation, housing speculation and immigration and government dependency, to one based on productivity, profitably, 0% inflation and rising wages will be violently resisted by everyone, as we are all conditioned to the current set up.

Tourism to grow at 5.4%? So 40% increase by 2024. That may be feasible but to then suggest the same increase until 2040 means a growth of 224% over current figures. Many of our tourist highlights are already overcrowded. OK lets invent a few new ones but what about the Carbon Emission cost of all those extra international flights?

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.