ANZ

ANZ's analysts note that the gold price has started the year 'with a bang'. They say both investment and physical demand are supportive for 2023, supported by China’s reopening

17th Jan 23, 2:03pm

30

ANZ's analysts note that the gold price has started the year 'with a bang'. They say both investment and physical demand are supportive for 2023, supported by China’s reopening

[updated]

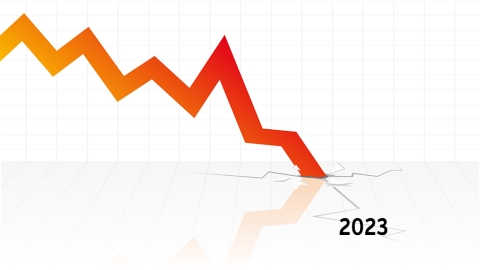

National's finance spokesperson scalds Government after long-running NZIER business survey records the weakest result in its history; ASB economists say economy has 'run into a brick wall'; BNZ economists see 'stagflation on steroids'

17th Jan 23, 10:23am

188

National's finance spokesperson scalds Government after long-running NZIER business survey records the weakest result in its history; ASB economists say economy has 'run into a brick wall'; BNZ economists see 'stagflation on steroids'

Firms are looking ahead with trepidation for the general economy, and they are looking at their own prospects much more negatively now too. It's a widespread malaise

20th Dec 22, 1:43pm

26

Firms are looking ahead with trepidation for the general economy, and they are looking at their own prospects much more negatively now too. It's a widespread malaise

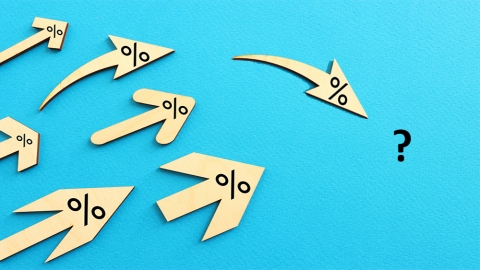

Kiwibank raises fixed home loan rates, adding impetus to key mortgage rates rising to 11-year highs. But no bank has yet followed wholesale rates into an inversion

9th Dec 22, 12:21pm

12

Kiwibank raises fixed home loan rates, adding impetus to key mortgage rates rising to 11-year highs. But no bank has yet followed wholesale rates into an inversion

BNZ chooses a lower rate track for its floating and fixed rate offers following last week's 75 basis points RBNZ OCR hike

6th Dec 22, 9:38am

8

BNZ chooses a lower rate track for its floating and fixed rate offers following last week's 75 basis points RBNZ OCR hike

[updated]

Curtain falling on Reserve Bank's Funding for Lending Programme which has continued providing economic stimulus as the OCR has been hiked 400 basis points

6th Dec 22, 7:00am

59

Curtain falling on Reserve Bank's Funding for Lending Programme which has continued providing economic stimulus as the OCR has been hiked 400 basis points

ANZ chief economist Sharon Zollner says 'good on' the Reserve Bank for recognising the scale of the inflation problem 'and fronting up to the fact that hoping inflation just goes away is likely to lead to worse outcomes in the end'

30th Nov 22, 2:56pm

13

ANZ chief economist Sharon Zollner says 'good on' the Reserve Bank for recognising the scale of the inflation problem 'and fronting up to the fact that hoping inflation just goes away is likely to lead to worse outcomes in the end'

Latest ANZ Business Outlook Survey shows a sharp drop in confidence and own activity readings, while sentiment in the residential construction sector has 'tanked' and 'could hardly be lower'

30th Nov 22, 1:27pm

26

Latest ANZ Business Outlook Survey shows a sharp drop in confidence and own activity readings, while sentiment in the residential construction sector has 'tanked' and 'could hardly be lower'

[updated]

Mixed in with ANZ's floating mortgage rate & term deposit rate hikes, are chunky fixed mortgage rate hikes too. But wholesale rates influential for fixed home loan rates are falling. Opportunities for borrowers are opening up

30th Nov 22, 12:13pm

90

Mixed in with ANZ's floating mortgage rate & term deposit rate hikes, are chunky fixed mortgage rate hikes too. But wholesale rates influential for fixed home loan rates are falling. Opportunities for borrowers are opening up

[updated]

Term deposit rates have jumped this week following the big OCR rise last week, and most banks are still yet to move up. But we suggest these recent rises lag what has been 'normal'. There is room for 'more' - but only if the general economy allows it

30th Nov 22, 7:29am

27

Term deposit rates have jumped this week following the big OCR rise last week, and most banks are still yet to move up. But we suggest these recent rises lag what has been 'normal'. There is room for 'more' - but only if the general economy allows it

The Aussie parents of NZ's big four banks have billions of reasons to cheer the removal of RBNZ dividend restrictions

30th Nov 22, 5:00am

16

The Aussie parents of NZ's big four banks have billions of reasons to cheer the removal of RBNZ dividend restrictions

[updated]

ANZ the first bank to raise floating mortgage rates following last week's OCR hike. They are passing through less than the full +75 bps to floating rate borrowers, but all of it to their bonus saver account. Term deposit savers get less

29th Nov 22, 2:34pm

145

ANZ the first bank to raise floating mortgage rates following last week's OCR hike. They are passing through less than the full +75 bps to floating rate borrowers, but all of it to their bonus saver account. Term deposit savers get less

ANZ's economists now believe house prices will decline by 22% from last year's peak before bottoming out in the third quarter next year

29th Nov 22, 11:19am

64

ANZ's economists now believe house prices will decline by 22% from last year's peak before bottoming out in the third quarter next year

ANZ's commodity strategists expect the gold price to resume its downtrend and fall below US$1700/oz 'in the short term'

23rd Nov 22, 11:28am

ANZ's commodity strategists expect the gold price to resume its downtrend and fall below US$1700/oz 'in the short term'

Citi analysts argue Australasia's big 4 banks have significantly more loan provisioning than required

22nd Nov 22, 9:32am

4

Citi analysts argue Australasia's big 4 banks have significantly more loan provisioning than required

In the last of a series of articles on bank fees, Matt Skinner looks at personal borrowing fees the major banks charge

17th Nov 22, 3:31pm

1

In the last of a series of articles on bank fees, Matt Skinner looks at personal borrowing fees the major banks charge

In the fourth of a series of articles on bank fees, Matt Skinner looks at the mortgage fees the major banks charge

16th Nov 22, 10:12am

8

In the fourth of a series of articles on bank fees, Matt Skinner looks at the mortgage fees the major banks charge

ANZ NZ awaiting outcome of RBNZ probe into 'material breach' of anti-money laundering laws

15th Nov 22, 11:54am

7

ANZ NZ awaiting outcome of RBNZ probe into 'material breach' of anti-money laundering laws

In the third of a series of articles on bank fees, Matt Skinner looks at international service fees the major banks charge

14th Nov 22, 3:33pm

1

In the third of a series of articles on bank fees, Matt Skinner looks at international service fees the major banks charge

It will take a 'concerted effort' to squash wage-price spiral dynamics 'that are becoming ever more established' in New Zealand, ANZ economists say

14th Nov 22, 10:31am

28

It will take a 'concerted effort' to squash wage-price spiral dynamics 'that are becoming ever more established' in New Zealand, ANZ economists say

Do banks really make too much profit? And what would we gain if they made less? What would we lose?

12th Nov 22, 8:53am

26

Do banks really make too much profit? And what would we gain if they made less? What would we lose?

In their quarterly economic outlook ANZ economists say the Reserve Bank 'should be worried' about how developed the wage price spiral has become

9th Nov 22, 2:13pm

24

In their quarterly economic outlook ANZ economists say the Reserve Bank 'should be worried' about how developed the wage price spiral has become

In the second of a series of articles on bank fees, Matt Skinner looks at credit card fees the major banks charge

8th Nov 22, 10:12am

1

In the second of a series of articles on bank fees, Matt Skinner looks at credit card fees the major banks charge

PM says banks not demonstrating 'social license' by repeatedly making very high profits, but does not have policy options; instead says banks 'should take a long hard look at themselves'

7th Nov 22, 6:11pm

74

PM says banks not demonstrating 'social license' by repeatedly making very high profits, but does not have policy options; instead says banks 'should take a long hard look at themselves'

In the first of a series of articles on bank fees, Matt Skinner looks at the business borrowing fees the major banks charge

4th Nov 22, 11:38am

1

In the first of a series of articles on bank fees, Matt Skinner looks at the business borrowing fees the major banks charge