HSBC

Not only are wholesale rates rising, but banks are coming out of a period where their mortgage margins have been suppressed. Expect the new round of rate hikes to do some catch-up

15th Oct 21, 4:23pm

5

Not only are wholesale rates rising, but banks are coming out of a period where their mortgage margins have been suppressed. Expect the new round of rate hikes to do some catch-up

Wholesale rate pressure has pushed one of our largest home loan lenders to raise some key fixed rates and setting their market offerings as the highest available

14th Oct 21, 12:29pm

21

Wholesale rate pressure has pushed one of our largest home loan lenders to raise some key fixed rates and setting their market offerings as the highest available

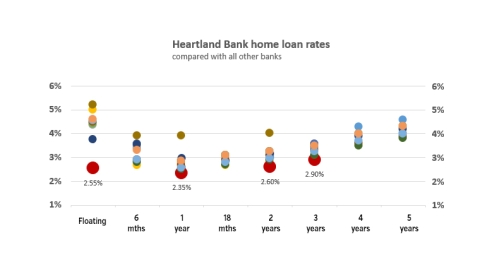

Heartland Bank raises all its home loan interest rates but still retains the claim to the lowest rates available from any bank. Home loan market awaits the RBNZ's signals next Wednesday

1st Oct 21, 10:38am

16

Heartland Bank raises all its home loan interest rates but still retains the claim to the lowest rates available from any bank. Home loan market awaits the RBNZ's signals next Wednesday

ANZ moves to raise rates back up to levels first adopted by rival ASB, taking some longer term rates back closer to 5%

28th Sep 21, 6:40pm

26

ANZ moves to raise rates back up to levels first adopted by rival ASB, taking some longer term rates back closer to 5%

Rising wholesale money costs are pressing banks to raise rates, but the pace of the rises vary among institutions. That means exploitable advantages are available for borrowers who need to fix now

28th Sep 21, 1:30pm

1

Rising wholesale money costs are pressing banks to raise rates, but the pace of the rises vary among institutions. That means exploitable advantages are available for borrowers who need to fix now

ASB sets a new tone in the mortgage market with 30 basis points rate hikes for the most popular fixed home loan terms, takes 18 month and two year rates above 3%. Westpac has matched them

16th Sep 21, 9:30am

31

ASB sets a new tone in the mortgage market with 30 basis points rate hikes for the most popular fixed home loan terms, takes 18 month and two year rates above 3%. Westpac has matched them

Are we about to go back to the future fast with as much as a sudden 100 basis points rise in fixed mortgage rate offers? The wholesale cost of money suggests that is a live possibility

15th Sep 21, 6:51pm

5

Are we about to go back to the future fast with as much as a sudden 100 basis points rise in fixed mortgage rate offers? The wholesale cost of money suggests that is a live possibility

Hobbled by the pandemic and rising rates, banks respond to the Spring real estate selling season with restrained rises rather than outright rate cuts

13th Sep 21, 8:58am

10

Hobbled by the pandemic and rising rates, banks respond to the Spring real estate selling season with restrained rises rather than outright rate cuts

HSBC trims its three year fixed home loan rate as it raises term deposit rates. This new 3yr rate gives it a substantial advantage over all the main banks

8th Sep 21, 11:08am

3

HSBC trims its three year fixed home loan rate as it raises term deposit rates. This new 3yr rate gives it a substantial advantage over all the main banks

HSBC announces some substantial home loan rate reductions but these come amidst sharp wholesale market movements and just 14 days after they hiked rates sharply

6th Aug 21, 11:45am

5

HSBC announces some substantial home loan rate reductions but these come amidst sharp wholesale market movements and just 14 days after they hiked rates sharply

SBS Bank launches a comprehensive home loan offer for first home buyers featuring a 1.99% rate fixed for one year, boosted by four other incentives

6th Aug 21, 10:31am

17

SBS Bank launches a comprehensive home loan offer for first home buyers featuring a 1.99% rate fixed for one year, boosted by four other incentives

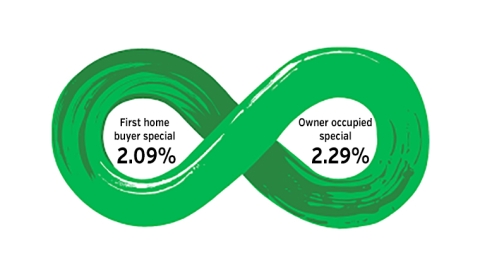

HSBC trims its one year home loan rate to just 2.09% even as wholesale swap rates start moving up at the short end. It raised all rates for two years and longer

1st Jul 21, 10:59am

29

HSBC trims its one year home loan rate to just 2.09% even as wholesale swap rates start moving up at the short end. It raised all rates for two years and longer

HSBC ends its 1.99% fixed home loan offers, raising them to 2.25% after a two month run at the unusually low level. All eyes are on how the RBNZ will react to rising international benchmark rates

6th Apr 21, 3:55pm

6

HSBC ends its 1.99% fixed home loan offers, raising them to 2.25% after a two month run at the unusually low level. All eyes are on how the RBNZ will react to rising international benchmark rates

Burcu Senel, who has worked for HSBC for 15 years, is named as the bank's new New Zealand CEO

8th Mar 21, 9:59am

Burcu Senel, who has worked for HSBC for 15 years, is named as the bank's new New Zealand CEO

Another challenger bank goes below 2% for mortgages, as the 2021 home loan market swells on sharply rising demand. These challenger banks have opened up a 30 bps rate advantage over the main banks

10th Feb 21, 10:10am

5

Another challenger bank goes below 2% for mortgages, as the 2021 home loan market swells on sharply rising demand. These challenger banks have opened up a 30 bps rate advantage over the main banks

A challenger bank offers first home buyers a one year fixed rate well below the main banks, raises two term deposit rates to well above the main banks as well

27th Jan 21, 3:30pm

6

A challenger bank offers first home buyers a one year fixed rate well below the main banks, raises two term deposit rates to well above the main banks as well

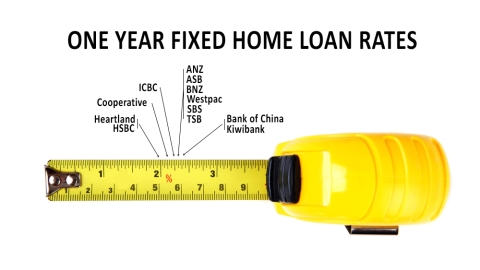

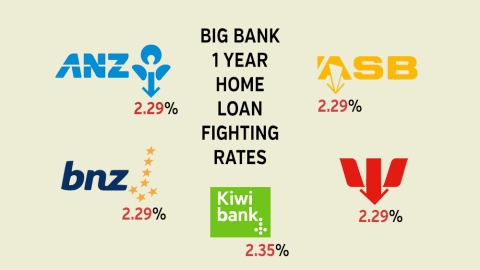

More big banks slip into line with lower one year fixed rate home loan offers. BNZ is the latest, then ASB. But challenger banks still have lower rates on the table

22nd Jan 21, 8:37am

42

More big banks slip into line with lower one year fixed rate home loan offers. BNZ is the latest, then ASB. But challenger banks still have lower rates on the table

Another big bank has cut a key home loan rate, signaling that a new round of mortgage rate cuts are on their way. The RBNZ's FLP gives them the low cost funds to do this if they apply

19th Jan 21, 6:22pm

26

Another big bank has cut a key home loan rate, signaling that a new round of mortgage rate cuts are on their way. The RBNZ's FLP gives them the low cost funds to do this if they apply

Encouraged by the RBNZ, one major bank offers a 2.29% one year fixed home loan rate. It is almost certain to signal a new round of mortgage rate cuts that will juice up the already-hot housing market

11th Jan 21, 8:18am

159

Encouraged by the RBNZ, one major bank offers a 2.29% one year fixed home loan rate. It is almost certain to signal a new round of mortgage rate cuts that will juice up the already-hot housing market

HSBC pushed fixed home loan rate offers lower yet again, with some market-leading low levels for their Premier product. They have cut TD rates as well. Meanwhile other banks are offering cashbacks more liberally

6th Nov 20, 10:27am

30

HSBC pushed fixed home loan rate offers lower yet again, with some market-leading low levels for their Premier product. They have cut TD rates as well. Meanwhile other banks are offering cashbacks more liberally

Discussion paper from Payments NZ details the 'building blocks' for a real-time payments system for the future

4th Nov 20, 9:34am

Discussion paper from Payments NZ details the 'building blocks' for a real-time payments system for the future

A large challenger bank trims home loan rates to near market-leading levels, the first to do so after the RBNZ MPS and the first to line up for the Spring real estate selling season race

17th Aug 20, 5:20pm

8

A large challenger bank trims home loan rates to near market-leading levels, the first to do so after the RBNZ MPS and the first to line up for the Spring real estate selling season race

A new low mortgage rate launched at 2.45% for one year fixed, by HSBC. And every fixed rate offered for their Premier customers is now market-leading

20th Jul 20, 10:40am

9

A new low mortgage rate launched at 2.45% for one year fixed, by HSBC. And every fixed rate offered for their Premier customers is now market-leading

HSBC economist Paul Bloxham suggests the New Zealand economy is heading for a 'V-shaped bounce back' while Australia faces a 'U-shaped economic recovery'

30th Jun 20, 10:20am

41

HSBC economist Paul Bloxham suggests the New Zealand economy is heading for a 'V-shaped bounce back' while Australia faces a 'U-shaped economic recovery'

ASB cuts most home loan rates again, and matches them with even sharper term deposit rate cuts

19th Jun 20, 9:59am

51

ASB cuts most home loan rates again, and matches them with even sharper term deposit rate cuts