SBS Bank

A new low mortgage rate launched at 2.45% for one year fixed, by HSBC. And every fixed rate offered for their Premier customers is now market-leading

20th Jul 20, 10:40am

9

A new low mortgage rate launched at 2.45% for one year fixed, by HSBC. And every fixed rate offered for their Premier customers is now market-leading

Reserve Bank data shows just how significant the initial impact of the COVID-19 crisis has been on New Zealand banks, with smaller NZ owned banks hit hardest

2nd Jun 20, 9:53am

2

Reserve Bank data shows just how significant the initial impact of the COVID-19 crisis has been on New Zealand banks, with smaller NZ owned banks hit hardest

ASB tests the low end of term deposit offer ranges with a range of cuts up to -20 bps. Other banks sure to follow and loan demand is expected to dive and mortgage rates fall

27th Mar 20, 9:55am

34

ASB tests the low end of term deposit offer ranges with a range of cuts up to -20 bps. Other banks sure to follow and loan demand is expected to dive and mortgage rates fall

Interest rate changes are now fast-moving and volatile, at both the wholesale and retail levels. We update what that means for term deposit investors

21st Mar 20, 4:24pm

38

Interest rate changes are now fast-moving and volatile, at both the wholesale and retail levels. We update what that means for term deposit investors

Annual advertising spending by New Zealand banks increased by more than a quarter in 2019 with all four major banks recording increases

7th Feb 20, 9:16am

Annual advertising spending by New Zealand banks increased by more than a quarter in 2019 with all four major banks recording increases

TSB acts to fix areas of its AML/CFT programme 'requiring improvement' and increases minimum capital requirement after regulatory capital errors came to light

5th Dec 19, 4:47pm

TSB acts to fix areas of its AML/CFT programme 'requiring improvement' and increases minimum capital requirement after regulatory capital errors came to light

Gareth Vaughan details six key changes proposed by the RBNZ in its bank capital review ahead of the release of the final decisions in its broadest ever review of bank regulatory capital requirements on Thursday

3rd Dec 19, 5:00am

10

Gareth Vaughan details six key changes proposed by the RBNZ in its bank capital review ahead of the release of the final decisions in its broadest ever review of bank regulatory capital requirements on Thursday

Kiwibank economists say one 'perverse' impact of the RBNZ's forthcoming capital proposals could be that banks focus on residential mortgages at the expense of business lending

2nd Dec 19, 12:10pm

8

Kiwibank economists say one 'perverse' impact of the RBNZ's forthcoming capital proposals could be that banks focus on residential mortgages at the expense of business lending

While mortgage bankers assess the wholesale money moves and await RBNZ rate and policy signals, at least one more bank is rolling out a cash incentive to get borrowers to switch

8th Nov 19, 4:37pm

2

While mortgage bankers assess the wholesale money moves and await RBNZ rate and policy signals, at least one more bank is rolling out a cash incentive to get borrowers to switch

The next move lower for home loan rates is a minor tweak, this time by Kiwibank, and the main features are that it just matches rate levels of its main rivals

24th Oct 19, 4:33pm

6

The next move lower for home loan rates is a minor tweak, this time by Kiwibank, and the main features are that it just matches rate levels of its main rivals

Another major bank adds momentum to the drift lower for term deposit rates, comfortable to be sitting lower than some key rivals. Now most of the OCR cuts have hit savers

24th Oct 19, 9:46am

51

Another major bank adds momentum to the drift lower for term deposit rates, comfortable to be sitting lower than some key rivals. Now most of the OCR cuts have hit savers

The re-emergence of cash-back home loan incentives in public mortgage advertising heralds an elevated drive for business by a number of banks

21st Oct 19, 1:49pm

6

The re-emergence of cash-back home loan incentives in public mortgage advertising heralds an elevated drive for business by a number of banks

A NZ-owned challenger bank bursts into contention with a 3.39% two year fixed home loan rate, plus a cash-back incentive. Other banks eye cashbacks too

21st Oct 19, 5:02am

19

A NZ-owned challenger bank bursts into contention with a 3.39% two year fixed home loan rate, plus a cash-back incentive. Other banks eye cashbacks too

This week BNZ, Kiwibank and Rabobank have cut term deposit rates and a 3% offer is only available from SBS Bank now. We update where term deposit rates are being pitched in this ever-declining space

17th Oct 19, 12:37pm

21

This week BNZ, Kiwibank and Rabobank have cut term deposit rates and a 3% offer is only available from SBS Bank now. We update where term deposit rates are being pitched in this ever-declining space

ANZ follows rivals with reductions to some credit card purchase interest rates, however most banks still have cash advance rates above 20%

4th Sep 19, 10:17am

13

ANZ follows rivals with reductions to some credit card purchase interest rates, however most banks still have cash advance rates above 20%

TSB CEO Donna Cooper 'feeling positive' about talks with the RBNZ seeking changes to the regulator's proposals for tougher bank regulatory capital requirements

29th Aug 19, 7:48am

TSB CEO Donna Cooper 'feeling positive' about talks with the RBNZ seeking changes to the regulator's proposals for tougher bank regulatory capital requirements

The country's key smaller banks deliver a weaker collective financial performance in the June quarter this year compared to the 2018 June quarter

28th Aug 19, 9:36am

The country's key smaller banks deliver a weaker collective financial performance in the June quarter this year compared to the 2018 June quarter

Challenger bank SBS trims its key home loan rates to current levels to stay in touch with a falling market, with more evidence that most banks will match the lowest rate on offer, provided your financials are good

24th Aug 19, 11:12am

3

Challenger bank SBS trims its key home loan rates to current levels to stay in touch with a falling market, with more evidence that most banks will match the lowest rate on offer, provided your financials are good

SBS Bank makes a small trim to its key mortgage rate offers, taking two of them down to market-leading levels. However, the whole home loan market is awaiting an RBNZ rate cut and assessing the impact of sharp swap rate drops

3rd Aug 19, 10:21am

8

SBS Bank makes a small trim to its key mortgage rate offers, taking two of them down to market-leading levels. However, the whole home loan market is awaiting an RBNZ rate cut and assessing the impact of sharp swap rate drops

The Cooperative Bank cuts home loan rates to remain a good option in the fiercely competitive mortgage market. But they also have trimmed term deposit and savings rates to allow that

30th Jul 19, 4:51pm

1

The Cooperative Bank cuts home loan rates to remain a good option in the fiercely competitive mortgage market. But they also have trimmed term deposit and savings rates to allow that

Although wholesale rates have bounced up after reaching record lows recently, banks continue to adjust their mortgage rates down. This time the cuts came with a matching term deposit rate cut

15th Jul 19, 10:23am

13

Although wholesale rates have bounced up after reaching record lows recently, banks continue to adjust their mortgage rates down. This time the cuts came with a matching term deposit rate cut

CEO Shaun Drylie says SBS Bank's looking to assist with a gap in the market for reverse mortgages, which he expects there to be a growing need for in New Zealand

7th Jun 19, 5:00am

9

CEO Shaun Drylie says SBS Bank's looking to assist with a gap in the market for reverse mortgages, which he expects there to be a growing need for in New Zealand

SBS Bank CEO Shaun Drylie hopeful the mutually owned building society will gain RBNZ approval for a Tier 1 capital instrument to help it meet the regulator's bank capital proposals

6th Jun 19, 5:00am

5

SBS Bank CEO Shaun Drylie hopeful the mutually owned building society will gain RBNZ approval for a Tier 1 capital instrument to help it meet the regulator's bank capital proposals

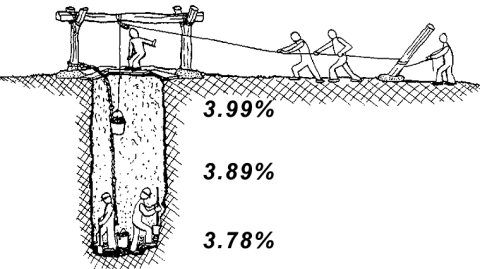

The latest offer from state-owned Kiwibank pushes the one year fixed rate down to 3.85% - and is accompanied by matching term deposit rates cuts

27th May 19, 5:02am

12

The latest offer from state-owned Kiwibank pushes the one year fixed rate down to 3.85% - and is accompanied by matching term deposit rates cuts

Seven of the eleven banks in the home loan business are offering a 3.89% fixed rate contract as both deposit rates and wholesale rates slide inexorably lower

25th May 19, 7:23am

31

Seven of the eleven banks in the home loan business are offering a 3.89% fixed rate contract as both deposit rates and wholesale rates slide inexorably lower