SBS Bank

Kiwibank, Co-op Bank, SBS & TSB welcome proposed RBNZ changes to level the capital playing field, but want access to a wide range of capital sources warning as currently proposed the RBNZ plans are unworkable for small banks

23rd May 19, 5:00am

11

Kiwibank, Co-op Bank, SBS & TSB welcome proposed RBNZ changes to level the capital playing field, but want access to a wide range of capital sources warning as currently proposed the RBNZ plans are unworkable for small banks

With headline mortgage rates from every bank for every fixed term now below 5% and most key rates below 4%, this is a very competitive home loan market. Cash incentives are also available as well

11th May 19, 3:09pm

5

With headline mortgage rates from every bank for every fixed term now below 5% and most key rates below 4%, this is a very competitive home loan market. Cash incentives are also available as well

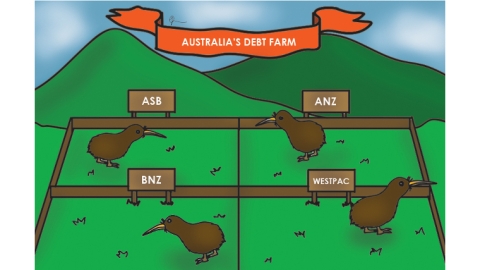

Business lobby group BusinessNZ is dismissive of the RBNZ's bank capital proposals yet NZ owned banks argue they would bolster their competitive position vs their big Aussie owned rivals. So why the disconnect?

11th May 19, 9:46am

13

Business lobby group BusinessNZ is dismissive of the RBNZ's bank capital proposals yet NZ owned banks argue they would bolster their competitive position vs their big Aussie owned rivals. So why the disconnect?

The range of term deposit offer rates tightens as yet more banks cut rates. With loan demand tepid, there is little sign of competition for customer funds

7th May 19, 11:59am

1

The range of term deposit offer rates tightens as yet more banks cut rates. With loan demand tepid, there is little sign of competition for customer funds

In a slowing housing market, banks chase carded home loan rate offers lower. Weighted average offers at challenger banks are lower than for the main banks

4th May 19, 9:31am

6

In a slowing housing market, banks chase carded home loan rate offers lower. Weighted average offers at challenger banks are lower than for the main banks

Another major bank has adopted ASB's market-leading three year mortgage rate. TSB's price-match offer applies

4th Apr 19, 2:58pm

8

Another major bank has adopted ASB's market-leading three year mortgage rate. TSB's price-match offer applies

ASB goes long. It raises its one year 'special' but cuts its 3 year rate to 3.95%, and reduces its 4 and 5 years rates too. And TSB's price-match offer applies

4th Apr 19, 12:30am

7

ASB goes long. It raises its one year 'special' but cuts its 3 year rate to 3.95%, and reduces its 4 and 5 years rates too. And TSB's price-match offer applies

Both SBS Bank and the Co-op Bank cut home loan rates in interesting ways, with one of them setting new market-leading levels

3rd Apr 19, 8:56am

12

Both SBS Bank and the Co-op Bank cut home loan rates in interesting ways, with one of them setting new market-leading levels

The Co-operative Bank takes a knife to most fixed mortgage rates, ending up with market leading positions at 6 months and for those three years and longer

6th Feb 19, 8:01am

5

The Co-operative Bank takes a knife to most fixed mortgage rates, ending up with market leading positions at 6 months and for those three years and longer

David Chaston suggests that if you want to know where mortgage rates are headed next, watch what the big banks do with term deposit rates rather than where swap rates go

2nd Feb 19, 9:49am

18

David Chaston suggests that if you want to know where mortgage rates are headed next, watch what the big banks do with term deposit rates rather than where swap rates go

Another bank raises its key term deposit rates, even in the face of sharply falling wholesale swap rates. A finance company raised a key rate too

1st Feb 19, 8:54am

Another bank raises its key term deposit rates, even in the face of sharply falling wholesale swap rates. A finance company raised a key rate too

Competitive pressure in the face of languishing house sales is driving mortgage rates lower. Kiwibank's latest cut brings sub-4% rates to fixed terms of two years

26th Jan 19, 12:02am

64

Competitive pressure in the face of languishing house sales is driving mortgage rates lower. Kiwibank's latest cut brings sub-4% rates to fixed terms of two years

The bank that led fixed mortgage rates lower ends its 'specials', reverting some key rates back to 3.99%. Almost all banks have now raised fixed rates in the past month

18th Dec 18, 8:40am

The bank that led fixed mortgage rates lower ends its 'specials', reverting some key rates back to 3.99%. Almost all banks have now raised fixed rates in the past month

Gareth Vaughan details how the RBNZ's proposals for NZ banks to hold more capital are a victory for the smaller NZ owned banks over their much bigger Aussie owned rivals

17th Dec 18, 5:14pm

34

Gareth Vaughan details how the RBNZ's proposals for NZ banks to hold more capital are a victory for the smaller NZ owned banks over their much bigger Aussie owned rivals

The end of the road approaches for sub-4% home loan rates as another two banks withdraw, leaving just one challenger bank with such offers

17th Dec 18, 8:37am

The end of the road approaches for sub-4% home loan rates as another two banks withdraw, leaving just one challenger bank with such offers

The last of the main banks retreats from a sub-4% home loan offer rate, just as wholesale rates tumble on the darkening international mood. But two smaller rivals still offer sub-4%

6th Dec 18, 8:39am

1

The last of the main banks retreats from a sub-4% home loan offer rate, just as wholesale rates tumble on the darkening international mood. But two smaller rivals still offer sub-4%

Co-op Bank, SBS, TSB, Heartland and Rabobank all deliver lending and deposit growth in the September quarter

4th Dec 18, 3:30pm

Co-op Bank, SBS, TSB, Heartland and Rabobank all deliver lending and deposit growth in the September quarter

ASB cuts one rate to 3.95% but raises two others as the sub 4% rate level embeds in the current home loan market; only three stragglers to go now

13th Nov 18, 1:59pm

27

ASB cuts one rate to 3.95% but raises two others as the sub 4% rate level embeds in the current home loan market; only three stragglers to go now

Another major bank reduces one mortgage rate below 4%, leaving only ASB and Kiwibank as majors with no offers at this new level

12th Nov 18, 5:05pm

20

Another major bank reduces one mortgage rate below 4%, leaving only ASB and Kiwibank as majors with no offers at this new level

ANZ follows up its new lower one year rate with a $3000 cash back incentive, with conditions that include promising to stay with them for three years

12th Nov 18, 9:05am

71

ANZ follows up its new lower one year rate with a $3000 cash back incentive, with conditions that include promising to stay with them for three years

We examine the margin shifts as wholesale money rates rise just as one large mortgage bank cuts a key rate, looking at the pressures and motivations for the move

10th Nov 18, 9:43am

34

We examine the margin shifts as wholesale money rates rise just as one large mortgage bank cuts a key rate, looking at the pressures and motivations for the move

New Zealand's largest home loan lender challenges its main rivals with a sub-4% one year fixed mortgage rate - just as wholesale swap rates turn up

10th Nov 18, 9:00am

41

New Zealand's largest home loan lender challenges its main rivals with a sub-4% one year fixed mortgage rate - just as wholesale swap rates turn up

Kiwibank is the next one to chop a key home loan rate, reducing its one year fixed rate to 4.05% as the main banks follow the challenger banks lower

5th Nov 18, 9:49am

33

Kiwibank is the next one to chop a key home loan rate, reducing its one year fixed rate to 4.05% as the main banks follow the challenger banks lower

Three cuts from a rising challenger bank tighten the rate competition for home loans. While none of these reductions are market-leading, they reinforce the downward trend in mortgage rate offers

3rd Nov 18, 11:17am

3

Three cuts from a rising challenger bank tighten the rate competition for home loans. While none of these reductions are market-leading, they reinforce the downward trend in mortgage rate offers

As mortgage lenders pull back from lending to property investors, offers to owner-occupiers are getting sharper as overall mortgage market growth slows

29th Oct 18, 8:36am

25

As mortgage lenders pull back from lending to property investors, offers to owner-occupiers are getting sharper as overall mortgage market growth slows