Treasury

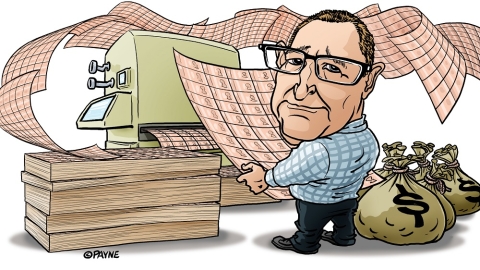

ANALYSIS: How can Grant Robertson prepare a budget if he doesn't know how much of the $62 billion ring-fenced for COVID-19 has been spent?

4th May 21, 6:30pm

15

ANALYSIS: How can Grant Robertson prepare a budget if he doesn't know how much of the $62 billion ring-fenced for COVID-19 has been spent?

Robertson to oversee 'Implementation Unit' to be set-up to ensure the Government delivers on its major policy initiatives

4th May 21, 8:27am

79

Robertson to oversee 'Implementation Unit' to be set-up to ensure the Government delivers on its major policy initiatives

Treasury expected to issue less debt than planned, as NZ weathers the COVID-19 storm better than expected and the Government doesn't spend all it borrows

4th May 21, 6:00am

74

Treasury expected to issue less debt than planned, as NZ weathers the COVID-19 storm better than expected and the Government doesn't spend all it borrows

David Hargreaves doesn't see anything to be too fearful of in the moves by Finance Minister Grant Robertson to get more hands-on with the Reserve Bank's lending restrictions

29th Apr 21, 8:08am

36

David Hargreaves doesn't see anything to be too fearful of in the moves by Finance Minister Grant Robertson to get more hands-on with the Reserve Bank's lending restrictions

RBNZ to provide Govt with advice on debt-to-income and interest-only mortgage restrictions weeks after it releases its Financial Stability Report on May 5

28th Apr 21, 8:24am

92

RBNZ to provide Govt with advice on debt-to-income and interest-only mortgage restrictions weeks after it releases its Financial Stability Report on May 5

BNZ economists describe Govt plans to influence bank lending as a "surprise" but say judgement will have to wait until further details are revealed

27th Apr 21, 2:55pm

8

BNZ economists describe Govt plans to influence bank lending as a "surprise" but say judgement will have to wait until further details are revealed

Gareth Vaughan delves into the detail of sweeping new powers proposed for the Reserve Bank, and explains why the Government wants to move regulation of deposit takers in this direction

27th Apr 21, 5:00am

29

Gareth Vaughan delves into the detail of sweeping new powers proposed for the Reserve Bank, and explains why the Government wants to move regulation of deposit takers in this direction

Government eyes personal insurance requirement for directors of banks and other deposit takers with the entity they represent not allowed to insure or indemnify directors

25th Apr 21, 6:01am

14

Government eyes personal insurance requirement for directors of banks and other deposit takers with the entity they represent not allowed to insure or indemnify directors

Beefed up RBNZ bank failure powers under the incoming Deposit Takers Act to include statutory bail-in and statutory management

23rd Apr 21, 2:33pm

32

Beefed up RBNZ bank failure powers under the incoming Deposit Takers Act to include statutory bail-in and statutory management

Finance Minister Grant Robertson unveils a a new process for setting lending restrictions, which introduces what appears to be a more active role for the Minister of Finance

22nd Apr 21, 12:37pm

46

Finance Minister Grant Robertson unveils a a new process for setting lending restrictions, which introduces what appears to be a more active role for the Minister of Finance

Government takes feedback on board and doubles coverage of proposed deposit insurance scheme to $100k per depositor, per institution

22nd Apr 21, 10:00am

47

Government takes feedback on board and doubles coverage of proposed deposit insurance scheme to $100k per depositor, per institution

A look at what government officials, deposit-takers and the public want from a deposit insurance scheme, ahead of a government update expected on Thursday

21st Apr 21, 9:00am

16

A look at what government officials, deposit-takers and the public want from a deposit insurance scheme, ahead of a government update expected on Thursday

RBNZ expected to put the property investor crackdown, trans-Tasman bubble, slowing growth and higher inflation expectations aside, and take a breather before changing monetary policy

11th Apr 21, 6:00am

110

RBNZ expected to put the property investor crackdown, trans-Tasman bubble, slowing growth and higher inflation expectations aside, and take a breather before changing monetary policy

Air New Zealand defers capital raise plans until later in the year, as the Crown increases a loan facility for the airline by $600 million to $1.5 billion

9th Apr 21, 10:10am

18

Air New Zealand defers capital raise plans until later in the year, as the Crown increases a loan facility for the airline by $600 million to $1.5 billion

Does the removal of interest deductibility for investors reduce the likelihood of the RBNZ further restricting bank lending? Quite possibly, Jenée Tibshraeny argues

2nd Apr 21, 7:01am

150

Does the removal of interest deductibility for investors reduce the likelihood of the RBNZ further restricting bank lending? Quite possibly, Jenée Tibshraeny argues

Tax only paid on 3,698 property transactions in 2018/19 due to the bright-line test; No prosecutions made; Question marks remain over whether compliance will improve with an extension to the test

25th Mar 21, 12:20pm

72

Tax only paid on 3,698 property transactions in 2018/19 due to the bright-line test; No prosecutions made; Question marks remain over whether compliance will improve with an extension to the test

Budget 2021 to be delivered on May 20; Finance Minister recommits to striking a 'balance' between investing in public services and housing, while keeping a lid on debt

24th Mar 21, 9:04am

18

Budget 2021 to be delivered on May 20; Finance Minister recommits to striking a 'balance' between investing in public services and housing, while keeping a lid on debt

Govt advised against changing interest deductibility rules; Meanwhile Treasury wanted a 20-year bright-line test and Inland Revenue didn't want a change to the status quo

23rd Mar 21, 3:46pm

131

Govt advised against changing interest deductibility rules; Meanwhile Treasury wanted a 20-year bright-line test and Inland Revenue didn't want a change to the status quo

Secretary to The Treasury Caralee McLiesh says current debt levels are manageable and the Government has options when it comes to deciding who should bear the burden of repaying the debt

22nd Mar 21, 12:34pm

18

Secretary to The Treasury Caralee McLiesh says current debt levels are manageable and the Government has options when it comes to deciding who should bear the burden of repaying the debt

Treasury says the Government's targeted fiscal response to COVID-19 complemented the RBNZ's monetary response; Says the impact of low interest rates on inequality is unknown

21st Mar 21, 6:31am

214

Treasury says the Government's targeted fiscal response to COVID-19 complemented the RBNZ's monetary response; Says the impact of low interest rates on inequality is unknown

Bill English takes aim at central banks for overcooking their responses to COVID-19 in fear of repeating mistakes made during the Global Financial Crisis

10th Mar 21, 10:00am

75

Bill English takes aim at central banks for overcooking their responses to COVID-19 in fear of repeating mistakes made during the Global Financial Crisis

Inland Revenue estimates the average 'high wealth individual' in New Zealand pays 12% tax on all their income, including non-taxable capital gains

25th Feb 21, 6:54am

88

Inland Revenue estimates the average 'high wealth individual' in New Zealand pays 12% tax on all their income, including non-taxable capital gains

NZ will have to wait a couple more weeks to find out how the Govt plans to address the housing crisis, as the latest COVID-19 outbreak moves housing down the priority list

22nd Feb 21, 2:11pm

106

NZ will have to wait a couple more weeks to find out how the Govt plans to address the housing crisis, as the latest COVID-19 outbreak moves housing down the priority list

Document reveals Treasury - like National - wanted the RBNZ to put conditions on its Funding for Lending Programme to direct cheap funding to businesses

22nd Feb 21, 9:00am

18

Document reveals Treasury - like National - wanted the RBNZ to put conditions on its Funding for Lending Programme to direct cheap funding to businesses

Government tweaks eligibility criteria of new COVID-19 Resurgence Support Payment and provides a refresher of other support available to businesses

16th Feb 21, 11:42am

14

Government tweaks eligibility criteria of new COVID-19 Resurgence Support Payment and provides a refresher of other support available to businesses