TSB

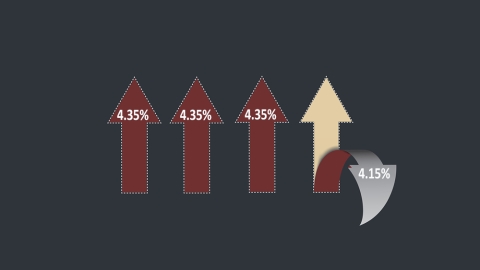

ASB trims its two year fixed home loan rate by 20 basis points to 4.15% as wholesale swap rates make a similar move down. And the CCCFA rules start to bite at loan demand

7th Dec 21, 9:12am

39

ASB trims its two year fixed home loan rate by 20 basis points to 4.15% as wholesale swap rates make a similar move down. And the CCCFA rules start to bite at loan demand

Suddenly, the rise and rise of fixed mortgage rates looks less certain as financial markets recoil at Omicron. Maybe that opens up an opportunity for borrowers to seek discounts off the new higher carded rates

29th Nov 21, 9:33am

21

Suddenly, the rise and rise of fixed mortgage rates looks less certain as financial markets recoil at Omicron. Maybe that opens up an opportunity for borrowers to seek discounts off the new higher carded rates

ASB the first bank to increase floating home loan rates following the 25 basis points OCR rise, but only by 15 basis points, ANZ adds 20 basis points, Kiwibank, Westpac and BNZ add 25 bps

24th Nov 21, 2:14pm

12

ASB the first bank to increase floating home loan rates following the 25 basis points OCR rise, but only by 15 basis points, ANZ adds 20 basis points, Kiwibank, Westpac and BNZ add 25 bps

Following ASB and Westpac, ANZ as the largest home loan lender raises its carded offers, pushing some rates to new higher territory. One year rates now have a 70 bps advantage

22nd Nov 21, 8:37am

86

Following ASB and Westpac, ANZ as the largest home loan lender raises its carded offers, pushing some rates to new higher territory. One year rates now have a 70 bps advantage

Westpac joins ASB in pushing through higher fixed mortgage rates, as rising inflation expectations push up wholesale rates, and all eyes turn to how the RBNZ will react

18th Nov 21, 4:06pm

85

Westpac joins ASB in pushing through higher fixed mortgage rates, as rising inflation expectations push up wholesale rates, and all eyes turn to how the RBNZ will react

ASB raises all its fixed home loan rates giving it the highest rates on offer for most fixed terms. Options under 4% are shrinking fast, especially at the main banks

16th Nov 21, 9:02am

98

ASB raises all its fixed home loan rates giving it the highest rates on offer for most fixed terms. Options under 4% are shrinking fast, especially at the main banks

ANZ raises its mortgage rates but only to take up the space beneath its main rivals. It also raised its term deposit rates a minor amount

10th Nov 21, 7:17pm

11

ANZ raises its mortgage rates but only to take up the space beneath its main rivals. It also raised its term deposit rates a minor amount

Westpac raises mortgage rates again, unafraid of having the highest 1, 2 and 3 year fixed rates of any bank, probably confident others will follow

4th Nov 21, 8:23pm

22

Westpac raises mortgage rates again, unafraid of having the highest 1, 2 and 3 year fixed rates of any bank, probably confident others will follow

The direction and speed from here of higher mortgage rates now depends on a set of official data and statistics being released over the rest of November

3rd Nov 21, 10:21am

5

The direction and speed from here of higher mortgage rates now depends on a set of official data and statistics being released over the rest of November

Ahead of some major public policy set pieces, New Zealand's largest mortgage lender follows its rivals with higher rates, pushing its 3 year fixed rate to the highest of any bank for that term. ASB goes even higher

1st Nov 21, 7:16pm

67

Ahead of some major public policy set pieces, New Zealand's largest mortgage lender follows its rivals with higher rates, pushing its 3 year fixed rate to the highest of any bank for that term. ASB goes even higher

A whiff of instability and broken deal making stalks wholesale money markets, suddenly raising the stakes for indebted homeowners, especially those who need to roll over soon

28th Oct 21, 8:54pm

42

A whiff of instability and broken deal making stalks wholesale money markets, suddenly raising the stakes for indebted homeowners, especially those who need to roll over soon

All the main banks have now moved fixed mortgage rates up so we can assess where they settled, who has the lowest, and note the non-rate inducements being offered by som

26th Oct 21, 9:21am

29

All the main banks have now moved fixed mortgage rates up so we can assess where they settled, who has the lowest, and note the non-rate inducements being offered by som

More banks jump on the fixed mortgage rate rise bandwagon as background wholesale rates push up both locally and internationally

22nd Oct 21, 9:08am

37

More banks jump on the fixed mortgage rate rise bandwagon as background wholesale rates push up both locally and internationally

TSB's penalty for breaching anti-money laundering laws reduced by $355k to $3.5 million

31st Aug 21, 10:13am

1

TSB's penalty for breaching anti-money laundering laws reduced by $355k to $3.5 million

TSB and the RBNZ reach agreement in precedent-setting court case, proposing TSB pays $3.85 million for breaching anti-money laundering law

22nd Jul 21, 1:52pm

6

TSB and the RBNZ reach agreement in precedent-setting court case, proposing TSB pays $3.85 million for breaching anti-money laundering law

RBNZ and TSB in the High Court seeking confirmation TSB has breached the AML/CFT Act, and thus how much it should cough up in penalties

22nd Jul 21, 10:29am

1

RBNZ and TSB in the High Court seeking confirmation TSB has breached the AML/CFT Act, and thus how much it should cough up in penalties

TSB lending more money in Auckland than Taranaki as annual profit and housing lending surges. Bank sells its Harmoney loan portfolio

30th Jun 21, 5:23pm

5

TSB lending more money in Auckland than Taranaki as annual profit and housing lending surges. Bank sells its Harmoney loan portfolio

RBNZ files High Court statement of claim against TSB for 'acknowledged breaches' of the Anti-Money Laundering and Countering Financing of Terrorism Act

27th May 21, 1:22pm

29

RBNZ files High Court statement of claim against TSB for 'acknowledged breaches' of the Anti-Money Laundering and Countering Financing of Terrorism Act

The country's key home lenders detail where they're at with COVID-19 related mortgage deferrals as the year long scheme comes to an end

8th Apr 21, 10:14am

14

The country's key home lenders detail where they're at with COVID-19 related mortgage deferrals as the year long scheme comes to an end

Encouraged by the RBNZ, one major bank offers a 2.29% one year fixed home loan rate. It is almost certain to signal a new round of mortgage rate cuts that will juice up the already-hot housing market

11th Jan 21, 8:18am

159

Encouraged by the RBNZ, one major bank offers a 2.29% one year fixed home loan rate. It is almost certain to signal a new round of mortgage rate cuts that will juice up the already-hot housing market

Mortgage brokers say most banks have had their struggles keeping up with demand in a red hot housing market

16th Dec 20, 10:51am

3

Mortgage brokers say most banks have had their struggles keeping up with demand in a red hot housing market

The RBNZ delaying moves to level capital playing field with Aussie owned banks disappoints NZ owned banks, and exclusion from the Funding for Lending Programme disappoints building societies and credit unions

12th Nov 20, 9:40am

3

The RBNZ delaying moves to level capital playing field with Aussie owned banks disappoints NZ owned banks, and exclusion from the Funding for Lending Programme disappoints building societies and credit unions

HSBC pushed fixed home loan rate offers lower yet again, with some market-leading low levels for their Premier product. They have cut TD rates as well. Meanwhile other banks are offering cashbacks more liberally

6th Nov 20, 10:27am

30

HSBC pushed fixed home loan rate offers lower yet again, with some market-leading low levels for their Premier product. They have cut TD rates as well. Meanwhile other banks are offering cashbacks more liberally

Discussion paper from Payments NZ details the 'building blocks' for a real-time payments system for the future

4th Nov 20, 9:34am

Discussion paper from Payments NZ details the 'building blocks' for a real-time payments system for the future

New Zealand's big five banks felt the icy blast of COVID-19 during the June quarter, with profits and net interest margins down, and cost-to-income ratios and non-performing loans up

26th Aug 20, 9:49am

New Zealand's big five banks felt the icy blast of COVID-19 during the June quarter, with profits and net interest margins down, and cost-to-income ratios and non-performing loans up