Adrian Orr

British evaluation of central bank quantitative easing says it's now a core part of monetary policy, meaning public trust in and understanding of QE is important

21st Jan 21, 5:00am

56

British evaluation of central bank quantitative easing says it's now a core part of monetary policy, meaning public trust in and understanding of QE is important

Attack on system banks use to share data with the Reserve Bank puts routine statistical releases on hold

18th Jan 21, 4:53pm

9

Attack on system banks use to share data with the Reserve Bank puts routine statistical releases on hold

Roger J Kerr says market conditions and incentives have shifted in favour of the American currency

18th Jan 21, 8:20am

1

Roger J Kerr says market conditions and incentives have shifted in favour of the American currency

Jenée Tibshraeny on the billion dollars a bank has just borrowed from the RBNZ, the Chris Liddell saga, banks writing riskier mortgages and cafés closing during peak season

12th Jan 21, 11:29am

46

Jenée Tibshraeny on the billion dollars a bank has just borrowed from the RBNZ, the Chris Liddell saga, banks writing riskier mortgages and cafés closing during peak season

The Reserve Bank updates the situation regarding the illegal breach of its data system

11th Jan 21, 6:04pm

1

The Reserve Bank updates the situation regarding the illegal breach of its data system

Roger J Kerr says positives fuelling equity markets ruled out any downward NZD correction so far, other financial market signals are mixed, and the local economic outlook is dimming

11th Jan 21, 8:21am

7

Roger J Kerr says positives fuelling equity markets ruled out any downward NZD correction so far, other financial market signals are mixed, and the local economic outlook is dimming

Reserve Bank responding to illegal breach of data system

Jenée Tibshraeny considers what would happen if house prices fell by nearly 20% - to where they were one year ago

23rd Dec 20, 9:00am

227

Jenée Tibshraeny considers what would happen if house prices fell by nearly 20% - to where they were one year ago

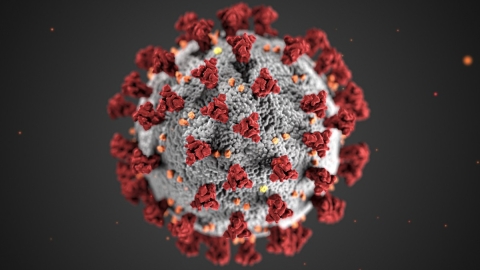

The 2020 Interesties featuring the National Party, Adrian Orr, Jacinda Ardern, Donald Trump, David Seymour, NZX, Ashley Bloomfield, David Clark, Daniel Andrews, COVID-19, Judith Collins & more

20th Dec 20, 6:02am

28

The 2020 Interesties featuring the National Party, Adrian Orr, Jacinda Ardern, Donald Trump, David Seymour, NZX, Ashley Bloomfield, David Clark, Daniel Andrews, COVID-19, Judith Collins & more

Jenée Tibshraeny has spent the year scrutinising the seismic government and central bank interventions made to keep the economy (and house prices) afloat. She shares her observations on the NZ Everyday Investor podcast

18th Dec 20, 1:51pm

47

Jenée Tibshraeny has spent the year scrutinising the seismic government and central bank interventions made to keep the economy (and house prices) afloat. She shares her observations on the NZ Everyday Investor podcast

With a debt-to-income ratio tool back on the table, Gareth Vaughan looks at the political and other challenges the RBNZ needs to overcome to be granted the financial stability tool

15th Dec 20, 11:47am

21

With a debt-to-income ratio tool back on the table, Gareth Vaughan looks at the political and other challenges the RBNZ needs to overcome to be granted the financial stability tool

Roger J Kerr looks at some of the candidates that might cause a downward correction for the NZ dollar

14th Dec 20, 8:08am

1

Roger J Kerr looks at some of the candidates that might cause a downward correction for the NZ dollar

Brendon Harre offers part two of his analysis of New Zealand’s rack-rent housing crisis focusing on the economic opportunities. He offers solutions in the fight against the evils of housing inflation

12th Dec 20, 11:55am

79

Brendon Harre offers part two of his analysis of New Zealand’s rack-rent housing crisis focusing on the economic opportunities. He offers solutions in the fight against the evils of housing inflation

Reserve Bank open to having more regard for house prices through the way it regulates banks, not through the way it conducts monetary policy; Asks for debt-to-income tools

11th Dec 20, 11:38am

83

Reserve Bank open to having more regard for house prices through the way it regulates banks, not through the way it conducts monetary policy; Asks for debt-to-income tools

Adrian Orr provides reminder the RBNZ might not have to loosen the monetary policy tap by as much as it has said it could

9th Dec 20, 2:13pm

103

Adrian Orr provides reminder the RBNZ might not have to loosen the monetary policy tap by as much as it has said it could

Gareth Vaughan on QE vs monetary financing, COVID-19 housing opportunities, crowdsourcing low interest rate advice, how a computer language controls the financial life of the world, strangled by conservative credentialism & Project Helvetia

7th Dec 20, 10:19am

17

Gareth Vaughan on QE vs monetary financing, COVID-19 housing opportunities, crowdsourcing low interest rate advice, how a computer language controls the financial life of the world, strangled by conservative credentialism & Project Helvetia

Long time Kiwi dollar bull Roger J Kerr concludes that our currency has now overcooked itself at current levels

7th Dec 20, 8:30am

5

Long time Kiwi dollar bull Roger J Kerr concludes that our currency has now overcooked itself at current levels

Social Credit leader Chris Leitch argues the clock should be wound back for the future so the Reserve Bank acts in support of government policy rather than against it

3rd Dec 20, 9:14am

19

Social Credit leader Chris Leitch argues the clock should be wound back for the future so the Reserve Bank acts in support of government policy rather than against it

RBNZ Governor Adrian Orr says the impact of monetary policy decisions on wealth & income equality is an important topic for considering economic wellbeing, but it's not clear if lower interest rates increase or decrease income & wealth inequality

3rd Dec 20, 6:34am

97

RBNZ Governor Adrian Orr says the impact of monetary policy decisions on wealth & income equality is an important topic for considering economic wellbeing, but it's not clear if lower interest rates increase or decrease income & wealth inequality

Roger J Kerr reflects on the positives and negatives for New Zealand during a most tumultuous year

30th Nov 20, 8:54am

3

Roger J Kerr reflects on the positives and negatives for New Zealand during a most tumultuous year

Robertson says Labour wouldn't be breaking its pre-election promises on tax if it extended the bright-line test; Orr clarifies the RBNZ would like debt-to-income ratios to be added to its toolkit but this hasn't been a priority

26th Nov 20, 4:31pm

94

Robertson says Labour wouldn't be breaking its pre-election promises on tax if it extended the bright-line test; Orr clarifies the RBNZ would like debt-to-income ratios to be added to its toolkit but this hasn't been a priority

Adrian Orr indicates he might put the onus back on Grant Robertson to do more on housing affordability, including by looking at tax

26th Nov 20, 8:00am

107

Adrian Orr indicates he might put the onus back on Grant Robertson to do more on housing affordability, including by looking at tax

Live-streamed video from the November 2020 RBNZ Financial Stability Review press conference with Governor Adrian Orr

25th Nov 20, 10:46am

6

Live-streamed video from the November 2020 RBNZ Financial Stability Review press conference with Governor Adrian Orr

RBNZ notes the financial stability risks associated with sky-rocketing house prices, but doesn't ask for a debt-to-income ratio tool to be added to its macro-prudential toolkit

25th Nov 20, 10:12am

120

RBNZ notes the financial stability risks associated with sky-rocketing house prices, but doesn't ask for a debt-to-income ratio tool to be added to its macro-prudential toolkit

Economists expect the RBNZ to respond to government pressure over house prices by restricting bank lending; Financial markets now see lower odds of a negative OCR in 2021

25th Nov 20, 6:58am

16

Economists expect the RBNZ to respond to government pressure over house prices by restricting bank lending; Financial markets now see lower odds of a negative OCR in 2021