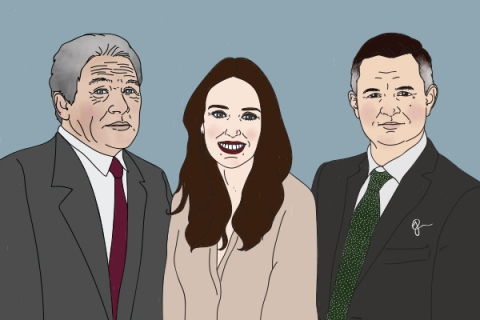

Stuart Nash

Revenue and Small Business Minister Stuart Nash seeking advice on extending the one month timeframe for loan applications to the Small Business Cashflow Loan Scheme

27th May 20, 5:00am

7

Revenue and Small Business Minister Stuart Nash seeking advice on extending the one month timeframe for loan applications to the Small Business Cashflow Loan Scheme

Govt to write "viable" small businesses loans of up to $100k depending on how many employees they have

1st May 20, 12:36pm

151

Govt to write "viable" small businesses loans of up to $100k depending on how many employees they have

New law enables Crown to write COVID-19-affected SMEs loans; IRD to administer the scheme; Details to be unveiled on Friday

30th Apr 20, 4:34pm

71

New law enables Crown to write COVID-19-affected SMEs loans; IRD to administer the scheme; Details to be unveiled on Friday

New temporary loss carry-back scheme to put cash in struggling firms' pockets; Changes to tax loss continuity rules to help firms raise capital

15th Apr 20, 7:06am

7

New temporary loss carry-back scheme to put cash in struggling firms' pockets; Changes to tax loss continuity rules to help firms raise capital

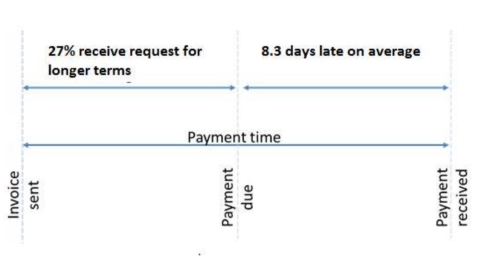

Minister for Small Business Stuart Nash 'prepared to legislate if necessary' to speed up late payments from large organisations to smaller suppliers

26th Feb 20, 10:11am

1

Minister for Small Business Stuart Nash 'prepared to legislate if necessary' to speed up late payments from large organisations to smaller suppliers

Government releases its Economic Plan, which includes measures to make business feasibility studies tax deductible and makes it easier for new ventures to carry forward deductions for tax losses

23rd Sep 19, 8:30am

20

Government releases its Economic Plan, which includes measures to make business feasibility studies tax deductible and makes it easier for new ventures to carry forward deductions for tax losses

Government maintains introducing a vacant land tax in the short term is unfeasible; says it's open to reviewing the scope of the bright-line test and the ring-fencing of rental losses

11th Aug 19, 6:42am

64

Government maintains introducing a vacant land tax in the short term is unfeasible; says it's open to reviewing the scope of the bright-line test and the ring-fencing of rental losses

Will a new digital services tax backfire? Is it an 'ugly tax' that will bite some local companies hard, despite being aimed at tax-avoiding FAANGS? Should we worry about potential US retaliation? LawNews investigates

29th Jul 19, 11:56am

1

Will a new digital services tax backfire? Is it an 'ugly tax' that will bite some local companies hard, despite being aimed at tax-avoiding FAANGS? Should we worry about potential US retaliation? LawNews investigates

Government announces plans to introduce a gun register, tighten rules for gun owners, and licence shooting clubs as part of second tranche of gun law reform; National unsupportive

22nd Jul 19, 6:38pm

Government announces plans to introduce a gun register, tighten rules for gun owners, and licence shooting clubs as part of second tranche of gun law reform; National unsupportive

IRD now says over half a million kiwis in schemes such as Kiwisaver were on the wrong tax rate and will collectively be billed a total of between $45-50 million

19th Jun 19, 12:54pm

8

IRD now says over half a million kiwis in schemes such as Kiwisaver were on the wrong tax rate and will collectively be billed a total of between $45-50 million

Almost everyone buying or selling residential property will now be required to provide their IRD number on land transfer documents

18th Jun 19, 3:55pm

25

Almost everyone buying or selling residential property will now be required to provide their IRD number on land transfer documents

Terry Baucher explains how not to end up in court defending a $4m tax evasion charge, reviews the Welfare Expert Advisory Group report, and the problems with overseas mortgages

14th May 19, 9:39am

3

Terry Baucher explains how not to end up in court defending a $4m tax evasion charge, reviews the Welfare Expert Advisory Group report, and the problems with overseas mortgages

In the shadow of the Tax Working Group, Terry Baucher looks at other changes including the tax pressure on NZ Super, issues with 'simplification', the digital services tax, and issues with automated refunds

6th May 19, 10:38am

1

In the shadow of the Tax Working Group, Terry Baucher looks at other changes including the tax pressure on NZ Super, issues with 'simplification', the digital services tax, and issues with automated refunds

Government tasks Productivity Commission with exploring options for taxing vacant land, to prioritise work on ways to encourage investment in significant infrastructure projects

17th Apr 19, 2:52pm

17

Government tasks Productivity Commission with exploring options for taxing vacant land, to prioritise work on ways to encourage investment in significant infrastructure projects

Prime Minister says Govt unable to find 'consensus' and is ruling out a Capital Gains Tax under her leadership

17th Apr 19, 2:09pm

107

Prime Minister says Govt unable to find 'consensus' and is ruling out a Capital Gains Tax under her leadership

Tax experts: Govt should hold fire introducing rules to ring-fence rental losses until it knows if it'll introduce a capital gains tax, as we don't need both

10th Apr 19, 9:19am

37

Tax experts: Govt should hold fire introducing rules to ring-fence rental losses until it knows if it'll introduce a capital gains tax, as we don't need both

Veiled threats by eBay and Alibaba that they could be forced to go offline if the Government doesn't give them more time to get ready to start paying GST met with scepticism by MPs

4th Apr 19, 1:21pm

8

Veiled threats by eBay and Alibaba that they could be forced to go offline if the Government doesn't give them more time to get ready to start paying GST met with scepticism by MPs

PM's visit to China sees 7th round of negotiations on updated NZ-China FTA to happen 'soon', a double tax agreement between NZ and China refreshed and other MoUs signed

1st Apr 19, 8:30pm

4

PM's visit to China sees 7th round of negotiations on updated NZ-China FTA to happen 'soon', a double tax agreement between NZ and China refreshed and other MoUs signed

Government to pass law under urgency to ban military style semi-automatics and assault rifles; buyback scheme to cost $100m+; National and Federated Farmers supportive

21st Mar 19, 3:06pm

87

Government to pass law under urgency to ban military style semi-automatics and assault rifles; buyback scheme to cost $100m+; National and Federated Farmers supportive

The New Zealand government plans to push on with its own digital services tax despite EU ructions

14th Mar 19, 4:15pm

3

The New Zealand government plans to push on with its own digital services tax despite EU ructions

Peter Dunne argues the Wellington bureaucracy will be a good gauge of whether the Government is likely to be re-elected next year

10th Mar 19, 6:02am

50

Peter Dunne argues the Wellington bureaucracy will be a good gauge of whether the Government is likely to be re-elected next year

IRD to share information with larger pool of jurisdictions to help crack down on tax evaders; More data not expected to bring in more tax revenue until IRD ups its capabilities

5th Mar 19, 5:48pm

3

IRD to share information with larger pool of jurisdictions to help crack down on tax evaders; More data not expected to bring in more tax revenue until IRD ups its capabilities

Revenue Minister Stuart Nash says any Tax Working Group recommendations the government adopts will be made by legislation meaning a full select committee process

1st Mar 19, 12:09pm

10

Revenue Minister Stuart Nash says any Tax Working Group recommendations the government adopts will be made by legislation meaning a full select committee process

Government taking 'measured' approach as coalition partners seek consensus on Tax Working Group's findings; Winston Peters sticks to the script

21st Feb 19, 1:48pm

36

Government taking 'measured' approach as coalition partners seek consensus on Tax Working Group's findings; Winston Peters sticks to the script

Government expects to earn up to $80 million a year by taxing multinationals that provide digital services in NZ but don't pay income tax here

18th Feb 19, 5:42pm

44

Government expects to earn up to $80 million a year by taxing multinationals that provide digital services in NZ but don't pay income tax here