Economic growth

Latest 'consensus' economists' forecasts released by the NZIER show a substantial deterioration in the past three months of how the economists view prospects - particularly in three years' time

12th Dec 22, 1:26pm

43

Latest 'consensus' economists' forecasts released by the NZIER show a substantial deterioration in the past three months of how the economists view prospects - particularly in three years' time

Figures to be released in the coming week will show the economy has continued to grow quite strongly. The Reserve Bank's attempts to 'engineer' a recession are still very much in the future yet

12th Dec 22, 9:00am

54

Figures to be released in the coming week will show the economy has continued to grow quite strongly. The Reserve Bank's attempts to 'engineer' a recession are still very much in the future yet

Economist Brian Easton tackles Matthew Hooton's ideological alarmism, saying the cliché, ‘never waste a good crisis’, is not an excuse for trying to manufacture one

24th Oct 22, 9:00am

27

Economist Brian Easton tackles Matthew Hooton's ideological alarmism, saying the cliché, ‘never waste a good crisis’, is not an excuse for trying to manufacture one

The super hot labour market is the biggest threat to the Reserve Bank's efforts to get inflation back under control. David Hargreaves has a crunch of some numbers

22nd Sep 22, 10:00am

89

The super hot labour market is the biggest threat to the Reserve Bank's efforts to get inflation back under control. David Hargreaves has a crunch of some numbers

David Hargreaves thinks the Reserve Bank will actually be very comfortable with the latest GDP data - even if economists are not

20th Sep 22, 12:11pm

27

David Hargreaves thinks the Reserve Bank will actually be very comfortable with the latest GDP data - even if economists are not

Surging demand in the country's service industries after Covid restrictions saw the country easily avoid recession in the June quarter

15th Sep 22, 11:01am

156

Surging demand in the country's service industries after Covid restrictions saw the country easily avoid recession in the June quarter

BNZ economists say a very wide range of forecasts for the outcome of GDP figures this week likely reflects the 'noise' in the component parts

12th Sep 22, 3:10pm

6

BNZ economists say a very wide range of forecasts for the outcome of GDP figures this week likely reflects the 'noise' in the component parts

Figures to be released in the coming week will likely show the country stayed well clear of recession in the June quarter - but the outlook for the economy is looking, as the Reserve Bank has indicated, pretty anaemic

11th Sep 22, 6:00am

81

Figures to be released in the coming week will likely show the country stayed well clear of recession in the June quarter - but the outlook for the economy is looking, as the Reserve Bank has indicated, pretty anaemic

David Hargreaves attempts to caution us against talking ourselves into a lingering economic downturn

12th Jul 22, 12:42pm

78

David Hargreaves attempts to caution us against talking ourselves into a lingering economic downturn

[updated]

The economy shrank in the three months to March, contrary to the expectations of the Reserve Bank, which had forecast 0.7% growth

16th Jun 22, 10:54am

203

The economy shrank in the three months to March, contrary to the expectations of the Reserve Bank, which had forecast 0.7% growth

NZIER's latest consensus forecasts show GDP growth in future years of only about 2%, while inflation's expected to now be more persistent

13th Jun 22, 2:33pm

8

NZIER's latest consensus forecasts show GDP growth in future years of only about 2%, while inflation's expected to now be more persistent

This week's release of March quarter GDP figures is likely to reflect the impact of the surge of Omicron - but the immediate prospects are for a future slowdown in any case

13th Jun 22, 10:16am

15

This week's release of March quarter GDP figures is likely to reflect the impact of the surge of Omicron - but the immediate prospects are for a future slowdown in any case

David Malpass urges policymakers to focus on five areas in order to avert a prolonged period of high inflation and low growth

8th Jun 22, 9:55am

8

David Malpass urges policymakers to focus on five areas in order to avert a prolonged period of high inflation and low growth

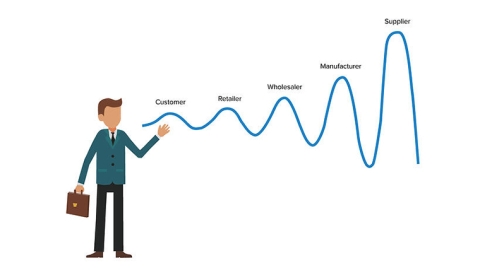

Alison Brook is wondering if we about to get a bullwhip sting, where an amplified demand surge is followed by an amplified plummeting of demand - and a global recession

18th May 22, 12:50pm

28

Alison Brook is wondering if we about to get a bullwhip sting, where an amplified demand surge is followed by an amplified plummeting of demand - and a global recession

Alison Brook isn't dismissing the stagflation fears. Our debt is skewed towards housing, so fast-rising interest rates could slam consumer demand and set the foundations in place for stagflation

16th Apr 22, 9:39am

71

Alison Brook isn't dismissing the stagflation fears. Our debt is skewed towards housing, so fast-rising interest rates could slam consumer demand and set the foundations in place for stagflation

The economy bounced back in the last quarter of 2021 from the lockdown blues - but the bounce was nowhere near as strong as economists thought it would be

17th Mar 22, 10:58am

33

The economy bounced back in the last quarter of 2021 from the lockdown blues - but the bounce was nowhere near as strong as economists thought it would be

This week's December quarter GDP figures will show a recovery from the sharp fall in September but all eyes will be on what the figures point to in the more problematic months ahead

14th Mar 22, 8:55am

4

This week's December quarter GDP figures will show a recovery from the sharp fall in September but all eyes will be on what the figures point to in the more problematic months ahead

Nouriel Roubini warns that the invasion of Ukraine will have steep stagflationary effects, even in otherwise strong economies

26th Feb 22, 10:12am

24

Nouriel Roubini warns that the invasion of Ukraine will have steep stagflationary effects, even in otherwise strong economies

Nouriel Roubini lists the policy, geopolitical, and systemic risks that investors will need to consider this year

9th Jan 22, 12:13pm

26

Nouriel Roubini lists the policy, geopolitical, and systemic risks that investors will need to consider this year

Country sees second largest ever quarterly fall in GDP - but the result shows increasing resilience in the face of lockdown restraints

16th Dec 21, 11:00am

25

Country sees second largest ever quarterly fall in GDP - but the result shows increasing resilience in the face of lockdown restraints

This week's GDP figures expected to show a drop - but by nothing like the sort of drop economists earlier expected

13th Dec 21, 10:18am

14

This week's GDP figures expected to show a drop - but by nothing like the sort of drop economists earlier expected

Reserve Bank wary of households' sensitivity to interest rate changes in a tightening environment

25th Nov 21, 7:37am

100

Reserve Bank wary of households' sensitivity to interest rate changes in a tightening environment

Alison Brook wonders if public policy makers have the patience to deleverage through a mix of cutting spending, reducing debt, transferring wealth and printing money to avoid a disastrous end to the debt supercycle

25th Oct 21, 10:00am

70

Alison Brook wonders if public policy makers have the patience to deleverage through a mix of cutting spending, reducing debt, transferring wealth and printing money to avoid a disastrous end to the debt supercycle

Yu Yongding considers the likely impact of the energy crisis and the Evergrande debacle on China's growth prospects

23rd Oct 21, 10:45am

15

Yu Yongding considers the likely impact of the energy crisis and the Evergrande debacle on China's growth prospects

Alison Brook wonders if persistently low interest rates may be doing more harm than good. They lead to debt accumulation, increasing asset prices, and ultimately limit the economy's ability to grow

2nd Oct 21, 9:55am

51

Alison Brook wonders if persistently low interest rates may be doing more harm than good. They lead to debt accumulation, increasing asset prices, and ultimately limit the economy's ability to grow