First home buyers

Forsyth Barr research analysts see 'elevated' downside risks to the housing market and more generally see continuation of supply chain woes and inflation and they will be watching out for a few stretched company balance sheets

16th Dec 21, 3:05pm

56

Forsyth Barr research analysts see 'elevated' downside risks to the housing market and more generally see continuation of supply chain woes and inflation and they will be watching out for a few stretched company balance sheets

ASB trims its two year fixed home loan rate by 20 basis points to 4.15% as wholesale swap rates make a similar move down. And the CCCFA rules start to bite at loan demand

7th Dec 21, 9:12am

39

ASB trims its two year fixed home loan rate by 20 basis points to 4.15% as wholesale swap rates make a similar move down. And the CCCFA rules start to bite at loan demand

Economists at three of the four largest banks now see house prices dropping in 2022

1st Dec 21, 1:49pm

26

Economists at three of the four largest banks now see house prices dropping in 2022

More information will need to be gathered from borrowers by lenders about the reasons why they need the loan, their income, and expenses. Lenders need to assess that the borrower can afford the repayments without getting into financial difficulty

1st Dec 21, 9:47am

13

More information will need to be gathered from borrowers by lenders about the reasons why they need the loan, their income, and expenses. Lenders need to assess that the borrower can afford the repayments without getting into financial difficulty

Suddenly, the rise and rise of fixed mortgage rates looks less certain as financial markets recoil at Omicron. Maybe that opens up an opportunity for borrowers to seek discounts off the new higher carded rates

29th Nov 21, 9:33am

21

Suddenly, the rise and rise of fixed mortgage rates looks less certain as financial markets recoil at Omicron. Maybe that opens up an opportunity for borrowers to seek discounts off the new higher carded rates

Sharply higher house prices, rising interest rates and tightening credit criteria are creating a perfect storm for first home buyers

25th Nov 21, 10:48am

65

Sharply higher house prices, rising interest rates and tightening credit criteria are creating a perfect storm for first home buyers

The housing market remains amazingly buoyant even as interest rates are getting cranked up

24th Nov 21, 3:20pm

18

The housing market remains amazingly buoyant even as interest rates are getting cranked up

ASB the first bank to increase floating home loan rates following the 25 basis points OCR rise, but only by 15 basis points, ANZ adds 20 basis points, Kiwibank, Westpac and BNZ add 25 bps

24th Nov 21, 2:14pm

12

ASB the first bank to increase floating home loan rates following the 25 basis points OCR rise, but only by 15 basis points, ANZ adds 20 basis points, Kiwibank, Westpac and BNZ add 25 bps

Reserve Bank plays down the likely impact of restricting house buyers' borrowing capacity on first home buyers

23rd Nov 21, 3:34pm

24

Reserve Bank plays down the likely impact of restricting house buyers' borrowing capacity on first home buyers

David Hargreaves crunches some facts and numbers and worries about what might be ahead in 2022

23rd Nov 21, 2:29pm

72

David Hargreaves crunches some facts and numbers and worries about what might be ahead in 2022

Reserve Bank launches consultation on potential debt serviceability restrictions that could be used if it believes financial stability risks warrant them

23rd Nov 21, 10:49am

99

Reserve Bank launches consultation on potential debt serviceability restrictions that could be used if it believes financial stability risks warrant them

Market conditions for Mum & Dad residential housing investors have changed and the future looks tough for them as a series of regulatory changes take an increasing toll on their cash flows

22nd Nov 21, 1:52pm

96

Market conditions for Mum & Dad residential housing investors have changed and the future looks tough for them as a series of regulatory changes take an increasing toll on their cash flows

Following ASB and Westpac, ANZ as the largest home loan lender raises its carded offers, pushing some rates to new higher territory. One year rates now have a 70 bps advantage

22nd Nov 21, 8:37am

86

Following ASB and Westpac, ANZ as the largest home loan lender raises its carded offers, pushing some rates to new higher territory. One year rates now have a 70 bps advantage

Westpac joins ASB in pushing through higher fixed mortgage rates, as rising inflation expectations push up wholesale rates, and all eyes turn to how the RBNZ will react

18th Nov 21, 4:06pm

85

Westpac joins ASB in pushing through higher fixed mortgage rates, as rising inflation expectations push up wholesale rates, and all eyes turn to how the RBNZ will react

ANZ economists see 'a relatively middle of the road outlook' for a period of weaker-than-average house price growth over 2022, but a gradual return to average over 2023

17th Nov 21, 3:01pm

18

ANZ economists see 'a relatively middle of the road outlook' for a period of weaker-than-average house price growth over 2022, but a gradual return to average over 2023

Kiwibank pulling plug on pre-approvals for low deposit home loans as banks strive to meet new RBNZ LVR restrictions

17th Nov 21, 7:44am

38

Kiwibank pulling plug on pre-approvals for low deposit home loans as banks strive to meet new RBNZ LVR restrictions

New Reserve Bank debt to income figures show the extent to which housing investors filled their boots during the low-interest, LVR-free days of last year and into this year

16th Nov 21, 3:25pm

79

New Reserve Bank debt to income figures show the extent to which housing investors filled their boots during the low-interest, LVR-free days of last year and into this year

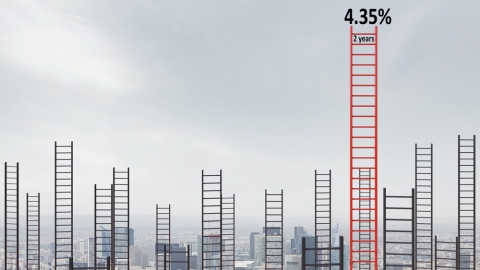

ASB raises all its fixed home loan rates giving it the highest rates on offer for most fixed terms. Options under 4% are shrinking fast, especially at the main banks

16th Nov 21, 9:02am

98

ASB raises all its fixed home loan rates giving it the highest rates on offer for most fixed terms. Options under 4% are shrinking fast, especially at the main banks

New figures show house buyers are still stretching themselves ever more as the RBNZ prepares to consult on possible DTI limits

15th Nov 21, 3:51pm

48

New figures show house buyers are still stretching themselves ever more as the RBNZ prepares to consult on possible DTI limits

ANZ raises its mortgage rates but only to take up the space beneath its main rivals. It also raised its term deposit rates a minor amount

10th Nov 21, 7:17pm

11

ANZ raises its mortgage rates but only to take up the space beneath its main rivals. It also raised its term deposit rates a minor amount

Westpac raises mortgage rates again, unafraid of having the highest 1, 2 and 3 year fixed rates of any bank, probably confident others will follow

4th Nov 21, 8:23pm

22

Westpac raises mortgage rates again, unafraid of having the highest 1, 2 and 3 year fixed rates of any bank, probably confident others will follow

The direction and speed from here of higher mortgage rates now depends on a set of official data and statistics being released over the rest of November

3rd Nov 21, 10:21am

5

The direction and speed from here of higher mortgage rates now depends on a set of official data and statistics being released over the rest of November

Reserve Bank analysis suggests that as interest rates 'normalise' and supply continues to enter the market over the coming years, house prices are likely come under pressure to realign with fundamental values

2nd Nov 21, 12:08pm

50

Reserve Bank analysis suggests that as interest rates 'normalise' and supply continues to enter the market over the coming years, house prices are likely come under pressure to realign with fundamental values

Ahead of some major public policy set pieces, New Zealand's largest mortgage lender follows its rivals with higher rates, pushing its 3 year fixed rate to the highest of any bank for that term. ASB goes even higher

1st Nov 21, 7:16pm

67

Ahead of some major public policy set pieces, New Zealand's largest mortgage lender follows its rivals with higher rates, pushing its 3 year fixed rate to the highest of any bank for that term. ASB goes even higher

A whiff of instability and broken deal making stalks wholesale money markets, suddenly raising the stakes for indebted homeowners, especially those who need to roll over soon

28th Oct 21, 8:54pm

42

A whiff of instability and broken deal making stalks wholesale money markets, suddenly raising the stakes for indebted homeowners, especially those who need to roll over soon