home loans

Kiwibank increases six-month & one-year mortgage rates, plus term deposit rates, other banks expected to follow

30th May 22, 10:36am

107

Kiwibank increases six-month & one-year mortgage rates, plus term deposit rates, other banks expected to follow

TSB follows up a cut to its one year home loan rate with a new cut to its two year rate

19th May 22, 9:32am

4

TSB follows up a cut to its one year home loan rate with a new cut to its two year rate

TSB surprises the home loan market cutting its one-year fixed rate 'special' as term deposit rates continue to trend up

13th May 22, 9:33am

5

TSB surprises the home loan market cutting its one-year fixed rate 'special' as term deposit rates continue to trend up

BNZ the latest bank to increase the interest rate it uses to stress test mortgage applicants' ability to service their loans

12th May 22, 10:35am

13

BNZ the latest bank to increase the interest rate it uses to stress test mortgage applicants' ability to service their loans

Westpac NZ CEO Catherine McGrath 'pretty happy' with how bank staff are assessing how borrowers can afford their debt

11th May 22, 5:00am

10

Westpac NZ CEO Catherine McGrath 'pretty happy' with how bank staff are assessing how borrowers can afford their debt

CEO Dan Huggins says despite the weaker housing market, BNZ retains the appetite to grow lending; - responsibly

6th May 22, 10:35am

9

CEO Dan Huggins says despite the weaker housing market, BNZ retains the appetite to grow lending; - responsibly

ANZ New Zealand lifts its Servicing Sensitivity Rate, which it uses to stress test mortgage applicants, by 45 basis points

2nd May 22, 10:53am

71

ANZ New Zealand lifts its Servicing Sensitivity Rate, which it uses to stress test mortgage applicants, by 45 basis points

[updated]

Consumer NZ says the Bank of Mum and Dad is the fifth biggest owner-occupier lender in New Zealand

28th Apr 22, 8:26am

117

Consumer NZ says the Bank of Mum and Dad is the fifth biggest owner-occupier lender in New Zealand

Westpac pushes through its third interest rate rise for home loans in April, but ends up with the most competitive card for key terms among the main banks. It raised its term deposit rates at the same time

26th Apr 22, 4:32pm

18

Westpac pushes through its third interest rate rise for home loans in April, but ends up with the most competitive card for key terms among the main banks. It raised its term deposit rates at the same time

[updated]

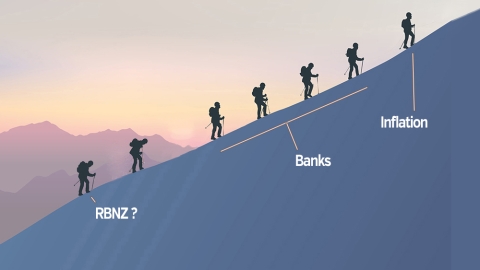

The scale of home loan rate rises is now at a level that will crimp consumer spending for those who roll over the fixed rate mortgages. The impact will spread relentlessly over the next few months

22nd Apr 22, 9:19am

92

The scale of home loan rate rises is now at a level that will crimp consumer spending for those who roll over the fixed rate mortgages. The impact will spread relentlessly over the next few months

ASB raises its fixed home loan rates just ahead of the imminent release of the March quarter inflation data. Banks are now in two separate rate-level camps

21st Apr 22, 9:14am

27

ASB raises its fixed home loan rates just ahead of the imminent release of the March quarter inflation data. Banks are now in two separate rate-level camps

[updated]

BNZ joins ANZ pushing fixed home loan rates higher as the relentless rise in wholesale rates compresses bank margins faster than some of them are responding. Westpac raises rates too but by less

20th Apr 22, 8:57am

81

BNZ joins ANZ pushing fixed home loan rates higher as the relentless rise in wholesale rates compresses bank margins faster than some of them are responding. Westpac raises rates too but by less

ANZ raises its fixed home loan rates sharply, after passing on the full +50 bps rise in their floating rate. Their fixed rates rose between +20 bps and +40 bps too. Their rivals are sure to follow soon

13th Apr 22, 5:48pm

13

ANZ raises its fixed home loan rates sharply, after passing on the full +50 bps rise in their floating rate. Their fixed rates rose between +20 bps and +40 bps too. Their rivals are sure to follow soon

Westpac is the last to the rate-hike party, and since ANZ started this round of rises, the 2year swap rate has risen +40 bps. But Westpac is another main bank with a sub-4% rate still

7th Apr 22, 4:47pm

42

Westpac is the last to the rate-hike party, and since ANZ started this round of rises, the 2year swap rate has risen +40 bps. But Westpac is another main bank with a sub-4% rate still

Sensing an opportunity, BNZ holds back on part of their home loan rate increases, opening up a gap between them and ANZ/ASB. The pace of swap rate increases may however close that opportunity soon

5th Apr 22, 9:06am

18

Sensing an opportunity, BNZ holds back on part of their home loan rate increases, opening up a gap between them and ANZ/ASB. The pace of swap rate increases may however close that opportunity soon

Kiwibank the third major to raise home loan interest rates, although a sub 4% rate is still hanging in there from them. Expect the other two majors to announce chunky rises soon too

4th Apr 22, 9:45am

116

Kiwibank the third major to raise home loan interest rates, although a sub 4% rate is still hanging in there from them. Expect the other two majors to announce chunky rises soon too

ASB follows ANZ with new home loan rate increases, and goes even higher for most key fixed terms. 5% rates for a two year fixed deal looks imminent now, but the variation still allows for much lower fixing

1st Apr 22, 9:17am

62

ASB follows ANZ with new home loan rate increases, and goes even higher for most key fixed terms. 5% rates for a two year fixed deal looks imminent now, but the variation still allows for much lower fixing

With wholesale swap rates at seven year highs, home loan rates push on up higher with ANZ the latest to raise fixed rates up to the next level

28th Mar 22, 5:54pm

106

With wholesale swap rates at seven year highs, home loan rates push on up higher with ANZ the latest to raise fixed rates up to the next level

ASB ending its low interest lending campaign to borrowers who are building new houses

18th Mar 22, 11:00am

ASB ending its low interest lending campaign to borrowers who are building new houses

Two more major mortgage lenders raise rates, but take different approaches. BNZ matches ANZ, but ASB goes further with some sharp extra hikes

17th Mar 22, 8:40am

82

Two more major mortgage lenders raise rates, but take different approaches. BNZ matches ANZ, but ASB goes further with some sharp extra hikes

As bond and swap rates rise inexorably, only Kiwibank has moved to match ANZ with higher mortgage rates so far. But the margin pressure on the other majors is building fast

15th Mar 22, 8:53am

42

As bond and swap rates rise inexorably, only Kiwibank has moved to match ANZ with higher mortgage rates so far. But the margin pressure on the other majors is building fast

NZ Bankers' Association argues there'd be 'real risk of adverse customer impact' if the RBNZ introduces a debt-to-income ratio cap for home loan borrowers

11th Mar 22, 12:23pm

31

NZ Bankers' Association argues there'd be 'real risk of adverse customer impact' if the RBNZ introduces a debt-to-income ratio cap for home loan borrowers

ANZ kicks off next round of mortgage rate hikes with some mid-range increases

Non-bank lenders growing their slice of new housing lending as headwinds strengthen against banks

4th Mar 22, 9:28am

Non-bank lenders growing their slice of new housing lending as headwinds strengthen against banks

Westpac is the next major to raise fixed mortgage rates, taking them to mid-pack. They also raised most term deposit rates by about the same amount. But wholesale echoes grow louder from eastern Europe

1st Mar 22, 5:00pm

Westpac is the next major to raise fixed mortgage rates, taking them to mid-pack. They also raised most term deposit rates by about the same amount. But wholesale echoes grow louder from eastern Europe