home loans

RBNZ January new residential mortgage figures show overall lending levels back close to where they were in January 2020

28th Feb 22, 10:53am

RBNZ January new residential mortgage figures show overall lending levels back close to where they were in January 2020

Kiwibank raises its floating mortgage rate 25 basis points, and ups its home loan fixed rates too, some to higher than its Aussie bank rivals

28th Feb 22, 10:26am

11

Kiwibank raises its floating mortgage rate 25 basis points, and ups its home loan fixed rates too, some to higher than its Aussie bank rivals

Kiwibank CEO Steve Jurkovich says Credit Contracts and Consumer Finance Act changes appear to be catalyst for slowing housing market

25th Feb 22, 10:44am

44

Kiwibank CEO Steve Jurkovich says Credit Contracts and Consumer Finance Act changes appear to be catalyst for slowing housing market

Reserve Bank highlights higher mortgage rates faced by borrowers refixing mortgages for more than one year

24th Feb 22, 7:31pm

Reserve Bank highlights higher mortgage rates faced by borrowers refixing mortgages for more than one year

Heartland Group's car loan decline rate trebles, mortgage acquisition cost rises following December's CCCFA changes

23rd Feb 22, 9:35am

Heartland Group's car loan decline rate trebles, mortgage acquisition cost rises following December's CCCFA changes

Heartland Group Holdings posts 8% interim profit rise, eyes growth in home loan market

22nd Feb 22, 10:23am

Heartland Group Holdings posts 8% interim profit rise, eyes growth in home loan market

ANZ loosens high LVR home lending criteria after November clamp-down, but borrowers need more uncommitted monthly income than before

21st Feb 22, 3:39pm

20

ANZ loosens high LVR home lending criteria after November clamp-down, but borrowers need more uncommitted monthly income than before

David Chaston assesses the current round of mortgage rate increases in the perspective of how rates have changed over the past five years, and suggests there's serious upside ahead

18th Feb 22, 10:07am

52

David Chaston assesses the current round of mortgage rate increases in the perspective of how rates have changed over the past five years, and suggests there's serious upside ahead

The Credit Contracts & Consumer Finance Act - the case for a more 'principles-based' approach to affordability requirements

18th Feb 22, 9:34am

9

The Credit Contracts & Consumer Finance Act - the case for a more 'principles-based' approach to affordability requirements

BNZ has raised some home loan rates too following ANZ, but somewhat surprisingly, it has lowered a key one as well. Meanwhile many swap rates move up to four to six year highs

16th Feb 22, 5:59pm

42

BNZ has raised some home loan rates too following ANZ, but somewhat surprisingly, it has lowered a key one as well. Meanwhile many swap rates move up to four to six year highs

The nation's largest home loan lender takes a chance and pulls up some key home loan rates, with most of its fixed term offers now higher than all, probably hoping its main rivals will follow soon

14th Feb 22, 8:13pm

33

The nation's largest home loan lender takes a chance and pulls up some key home loan rates, with most of its fixed term offers now higher than all, probably hoping its main rivals will follow soon

Challenger banks make changes to some key home loan rates, some up as expected, others down unexpectedly

14th Feb 22, 10:37am

6

Challenger banks make changes to some key home loan rates, some up as expected, others down unexpectedly

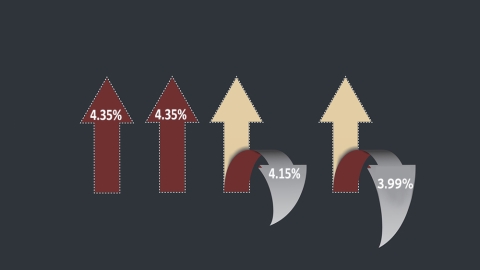

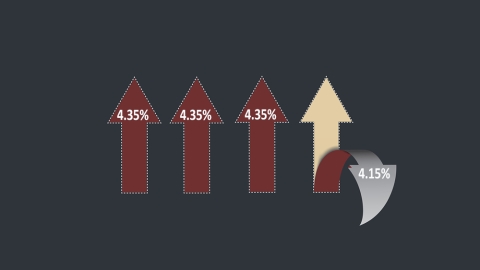

The flat-lining of the two year wholesale swap rate has allowed a few banks to trim a mortgage rate for a competitive advantage in the meantime. TSB is the latest

3rd Feb 22, 10:43am

27

The flat-lining of the two year wholesale swap rate has allowed a few banks to trim a mortgage rate for a competitive advantage in the meantime. TSB is the latest

Centrix questions if we are facing the next great credit crunch, as borrowers face more hoops to jump through

2nd Feb 22, 1:20pm

8

Centrix questions if we are facing the next great credit crunch, as borrowers face more hoops to jump through

Despite recent interest rate rises, Kiwi home loan borrowers are still getting a good deal compared to those offered to Australians. We update our trans-Tasman comparison and find we are batting on even terms still

30th Dec 21, 11:53am

12

Despite recent interest rate rises, Kiwi home loan borrowers are still getting a good deal compared to those offered to Australians. We update our trans-Tasman comparison and find we are batting on even terms still

ASB trims its two year fixed home loan rate by 20 basis points to 4.15% as wholesale swap rates make a similar move down. And the CCCFA rules start to bite at loan demand

7th Dec 21, 9:12am

39

ASB trims its two year fixed home loan rate by 20 basis points to 4.15% as wholesale swap rates make a similar move down. And the CCCFA rules start to bite at loan demand

Suddenly, the rise and rise of fixed mortgage rates looks less certain as financial markets recoil at Omicron. Maybe that opens up an opportunity for borrowers to seek discounts off the new higher carded rates

29th Nov 21, 9:33am

21

Suddenly, the rise and rise of fixed mortgage rates looks less certain as financial markets recoil at Omicron. Maybe that opens up an opportunity for borrowers to seek discounts off the new higher carded rates

ASB the first bank to increase floating home loan rates following the 25 basis points OCR rise, but only by 15 basis points, ANZ adds 20 basis points, Kiwibank, Westpac and BNZ add 25 bps

24th Nov 21, 2:14pm

12

ASB the first bank to increase floating home loan rates following the 25 basis points OCR rise, but only by 15 basis points, ANZ adds 20 basis points, Kiwibank, Westpac and BNZ add 25 bps

Reserve Bank launches consultation on potential debt serviceability restrictions that could be used if it believes financial stability risks warrant them

23rd Nov 21, 10:49am

99

Reserve Bank launches consultation on potential debt serviceability restrictions that could be used if it believes financial stability risks warrant them

Country's largest bank joins growing number of banks declining mortgage applications for loans with less than a 20% deposit

23rd Nov 21, 9:41am

27

Country's largest bank joins growing number of banks declining mortgage applications for loans with less than a 20% deposit

Following ASB and Westpac, ANZ as the largest home loan lender raises its carded offers, pushing some rates to new higher territory. One year rates now have a 70 bps advantage

22nd Nov 21, 8:37am

86

Following ASB and Westpac, ANZ as the largest home loan lender raises its carded offers, pushing some rates to new higher territory. One year rates now have a 70 bps advantage

BNZ clamps down on low equity home lending to meet new RBNZ speed limit

Cost for the financial sector of companies delaying climate action tallied, NAB's potential mortgage discounts for borrowers reducing their reliance on fossil fuels & guidance on managing climate-related financial risks

19th Nov 21, 9:47am

7

Cost for the financial sector of companies delaying climate action tallied, NAB's potential mortgage discounts for borrowers reducing their reliance on fossil fuels & guidance on managing climate-related financial risks

Westpac joins ASB in pushing through higher fixed mortgage rates, as rising inflation expectations push up wholesale rates, and all eyes turn to how the RBNZ will react

18th Nov 21, 4:06pm

85

Westpac joins ASB in pushing through higher fixed mortgage rates, as rising inflation expectations push up wholesale rates, and all eyes turn to how the RBNZ will react

Kiwibank pulling plug on pre-approvals for low deposit home loans as banks strive to meet new RBNZ LVR restrictions

17th Nov 21, 7:44am

38

Kiwibank pulling plug on pre-approvals for low deposit home loans as banks strive to meet new RBNZ LVR restrictions