Interest rates

Inflation will be extended if Kiwi's can't accept they are worse off, Reserve Bank’s Chief Economist Paul Conway says

23rd Mar 23, 2:20pm

92

Inflation will be extended if Kiwi's can't accept they are worse off, Reserve Bank’s Chief Economist Paul Conway says

Worst bank turmoil since 2008 means Federal Reserve is damned if it does and damned if it doesn’t in decision over interest rates

21st Mar 23, 4:03pm

34

Worst bank turmoil since 2008 means Federal Reserve is damned if it does and damned if it doesn’t in decision over interest rates

ASB follows rivals with mortgage rate cuts in a home loan market walking on eggshells, one that hasn't fired any shots in a season dominated by low real estate sales transaction levels

20th Mar 23, 9:18am

42

ASB follows rivals with mortgage rate cuts in a home loan market walking on eggshells, one that hasn't fired any shots in a season dominated by low real estate sales transaction levels

Westpac economist suggests weak local economy and overseas banking turbulence mean RBNZ may end OCR hiking cycle in April

17th Mar 23, 2:57pm

68

Westpac economist suggests weak local economy and overseas banking turbulence mean RBNZ may end OCR hiking cycle in April

Rising bank profits highlight tensions between competition watchdogs and central banks

17th Mar 23, 9:16am

31

Rising bank profits highlight tensions between competition watchdogs and central banks

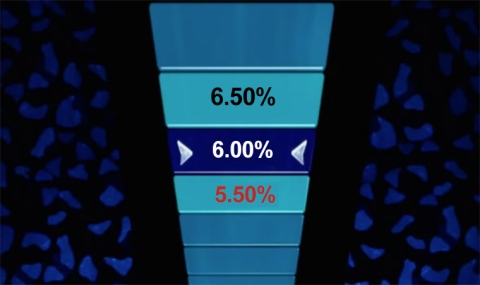

Bank term deposit rate offers have shrunk from the start of 2022 in relation to the OCR and the latest increases don't restore those premiums

16th Mar 23, 12:17pm

54

Bank term deposit rate offers have shrunk from the start of 2022 in relation to the OCR and the latest increases don't restore those premiums

BNZ chief economist Mike Jones says significant mortgage rate relief is unlikely this year and he's 'not confident' the housing market can 'right itself' till it is clear mortgage rates have stopped rising

6th Mar 23, 10:05am

16

BNZ chief economist Mike Jones says significant mortgage rate relief is unlikely this year and he's 'not confident' the housing market can 'right itself' till it is clear mortgage rates have stopped rising

Reserve Bank still has 'expectations' the country's banks will increase their term deposit rates - despite no moves from any of the major banks to date since last week's Official Cash Rate hike

3rd Mar 23, 9:26am

29

Reserve Bank still has 'expectations' the country's banks will increase their term deposit rates - despite no moves from any of the major banks to date since last week's Official Cash Rate hike

Latest RBNZ lending figures show the total stock of mortgage borrowing grew by just 4.1% in the 12 months to January, the slowest annual rate of growth in exactly 10 years

28th Feb 23, 4:11pm

11

Latest RBNZ lending figures show the total stock of mortgage borrowing grew by just 4.1% in the 12 months to January, the slowest annual rate of growth in exactly 10 years

Days have passed since the last +50 bps RBNZ rate hike, but no banks have changed retail rates yet, for either home loans or term deposits. And this is despite Adrian Orr calling out the banks over low rates for savers

25th Feb 23, 9:04am

17

Days have passed since the last +50 bps RBNZ rate hike, but no banks have changed retail rates yet, for either home loans or term deposits. And this is despite Adrian Orr calling out the banks over low rates for savers

Russia's war in Ukraine rumbles on, Robertson says monetary response to extreme weather independent decision for RBNZ

21st Feb 23, 7:07am

81

Russia's war in Ukraine rumbles on, Robertson says monetary response to extreme weather independent decision for RBNZ

US treasuries turnaround, Fed sees more work to do to contain inflation pressures as RBNZ moves into the spotlight

20th Feb 23, 7:24am

36

US treasuries turnaround, Fed sees more work to do to contain inflation pressures as RBNZ moves into the spotlight

Influential RBNZ survey shows substantial drop in expectations of inflation in two years time - albeit that at 3.3% the survey respondents still see inflation outside the targeted band in 2025

14th Feb 23, 3:25pm

48

Influential RBNZ survey shows substantial drop in expectations of inflation in two years time - albeit that at 3.3% the survey respondents still see inflation outside the targeted band in 2025

Keynes warned us that practical men and women are but slaves of defunct economists. Economist Brian Easton says the comment is particularly relevant as we try to understand the prospects for inflation

13th Feb 23, 9:23am

8

Keynes warned us that practical men and women are but slaves of defunct economists. Economist Brian Easton says the comment is particularly relevant as we try to understand the prospects for inflation

The next major challenge the Reserve Bank faces is convincing everyone that once interest rates hit peak highs they won't start falling rapidly again

12th Feb 23, 6:00am

128

The next major challenge the Reserve Bank faces is convincing everyone that once interest rates hit peak highs they won't start falling rapidly again

Only a decade ago more than half the country's mortgages were on floating rates, now the amounts on floating rates has dwindled to record lows

9th Feb 23, 12:38pm

7

Only a decade ago more than half the country's mortgages were on floating rates, now the amounts on floating rates has dwindled to record lows

David Hargreaves has a trawl through some of the RBNZ's mortgage data to see how homeowners are reacting to rising rates a year and a half into a rising mortgage rate environment

9th Feb 23, 9:33am

37

David Hargreaves has a trawl through some of the RBNZ's mortgage data to see how homeowners are reacting to rising rates a year and a half into a rising mortgage rate environment

[updated]

Westpac the latest big bank to cut fixed home loan rates as wholesale rates turn back up. In this confusing mortgage market haggle with your bank

8th Feb 23, 10:41am

7

Westpac the latest big bank to cut fixed home loan rates as wholesale rates turn back up. In this confusing mortgage market haggle with your bank

[updated]

Path to achieving a soft landing for the economy remains narrow, Reserve Bank of Australia says as it lifts cash rate again

7th Feb 23, 4:43pm

21

Path to achieving a soft landing for the economy remains narrow, Reserve Bank of Australia says as it lifts cash rate again

BNZ returns with more home loan rate reductions, a day after their first set of changes. These come as wholesale markets shift their bets to lower levels, mainly on international influences

3rd Feb 23, 9:43am

28

BNZ returns with more home loan rate reductions, a day after their first set of changes. These come as wholesale markets shift their bets to lower levels, mainly on international influences

ANZ and BNZ both change fixed mortgage rates, embedding inverted offerings into their rate cards as wholesale rates shift lower

2nd Feb 23, 8:02am

44

ANZ and BNZ both change fixed mortgage rates, embedding inverted offerings into their rate cards as wholesale rates shift lower

RBNZ figures show first home buyers might possibly be hitting the limits of their seemingly boundless enthusiasm, while investors may have just stirred slightly

31st Jan 23, 10:50am

35

RBNZ figures show first home buyers might possibly be hitting the limits of their seemingly boundless enthusiasm, while investors may have just stirred slightly

New Zealand's largest bank 'moves early' on interest rates for its business clients, raising them by 40 basis points

31st Jan 23, 9:16am

21

New Zealand's largest bank 'moves early' on interest rates for its business clients, raising them by 40 basis points

Westpac has reacted to ASB's shift to an inverted mortgage rate card. They too have inverted, and matched ASB at the long end

26th Jan 23, 5:51pm

21

Westpac has reacted to ASB's shift to an inverted mortgage rate card. They too have inverted, and matched ASB at the long end

Big price falls in Auckland, BoP, Taranaki, Manawatu, Wellington, and Nelson/Marlborough a boon for first home buyers last month

26th Jan 23, 9:59am

172

Big price falls in Auckland, BoP, Taranaki, Manawatu, Wellington, and Nelson/Marlborough a boon for first home buyers last month