JPY

Steven Dooley doesn't see much lingering impact on the NZD from the Government's housing moves. But he does see it turning and supported by global growth and rising commodity prices

29th Mar 21, 4:33pm

Steven Dooley doesn't see much lingering impact on the NZD from the Government's housing moves. But he does see it turning and supported by global growth and rising commodity prices

Alex Ross sees disorderly yield spikes as suddenly the largest short-term risk, and they traditionally hit commodities and commodity linked currencies (such as NZD and AUD) the hardest

22nd Mar 21, 8:21am

Alex Ross sees disorderly yield spikes as suddenly the largest short-term risk, and they traditionally hit commodities and commodity linked currencies (such as NZD and AUD) the hardest

Alex Ross will be watching the US Fed for signs of yield curve controls because a successful restraining of bond yield rises could create a Goldilocks moment for the NZD

15th Mar 21, 8:38am

Alex Ross will be watching the US Fed for signs of yield curve controls because a successful restraining of bond yield rises could create a Goldilocks moment for the NZD

Alex Ross says central banks are now playing game theory with markets thinking they can win, when ultimately markets will be ready to have that head on collision if needed

8th Mar 21, 8:06am

15

Alex Ross says central banks are now playing game theory with markets thinking they can win, when ultimately markets will be ready to have that head on collision if needed

Producing less for more cost. Alex Ross says central bank policies no longer determine inflation and their delusion is worrying bond markets. The currency consequences when the inflation river crests will produce another taper tantrum

1st Mar 21, 8:57am

1

Producing less for more cost. Alex Ross says central bank policies no longer determine inflation and their delusion is worrying bond markets. The currency consequences when the inflation river crests will produce another taper tantrum

Alex Ross says we are in the midst of a Dollar Smile. Meanwhile the Chinese yuan is getting a hawkish push while the Japanese yen is getting the opposite. And is the RBNZ snookered?

22nd Feb 21, 8:08am

1

Alex Ross says we are in the midst of a Dollar Smile. Meanwhile the Chinese yuan is getting a hawkish push while the Japanese yen is getting the opposite. And is the RBNZ snookered?

Alex Ross points out that distortions tend to end badly and to avoid it we may need a carrot to encourage productive investment and a stick to reduce the non-productive type

15th Feb 21, 8:31am

7

Alex Ross points out that distortions tend to end badly and to avoid it we may need a carrot to encourage productive investment and a stick to reduce the non-productive type

Alex Ross points out the RBNZ may end up in a tight place as the major central banks move to average inflation targeting, oil prices rise, and overshoot is at risk especially for the NZD

8th Feb 21, 9:28am

13

Alex Ross points out the RBNZ may end up in a tight place as the major central banks move to average inflation targeting, oil prices rise, and overshoot is at risk especially for the NZD

Alex Ross says things have gotten really crazy in financial markets with excesses everywhere you look. He suggests how importers and exporters should protect themselves while participating in fx markets

25th Jan 21, 8:32am

13

Alex Ross says things have gotten really crazy in financial markets with excesses everywhere you look. He suggests how importers and exporters should protect themselves while participating in fx markets

Alex Ross points out that the US dollar generally strengthens when Democrats control Congress although it may take most of 2021 for that to work through

18th Jan 21, 8:49am

Alex Ross points out that the US dollar generally strengthens when Democrats control Congress although it may take most of 2021 for that to work through

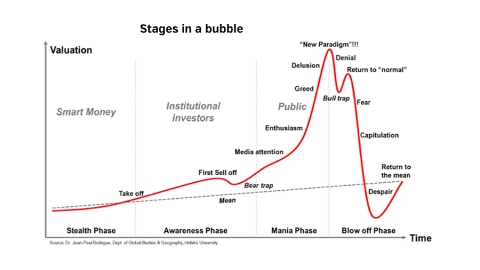

As the Kiwi dollar rides the speculative bubble, Alex Ross sees markets at the delusional stage, a stage set for a major bubble bursting in 2021 as everyone else enters the year thinking the current exuberance is the new normal

11th Jan 21, 8:50am

30

As the Kiwi dollar rides the speculative bubble, Alex Ross sees markets at the delusional stage, a stage set for a major bubble bursting in 2021 as everyone else enters the year thinking the current exuberance is the new normal

Alex Ross says excess liquidity is the Kiwi’s best friend right now but sometime in 2021 it’s likely to become its biggest risk

21st Dec 20, 8:30am

2

Alex Ross says excess liquidity is the Kiwi’s best friend right now but sometime in 2021 it’s likely to become its biggest risk

Alex Ross says as global growth picks up, most Asian economies look set to boom, powered by central bank punchbowls. More Chinese alcohol may be about to be added to the mixture

14th Dec 20, 8:20am

3

Alex Ross says as global growth picks up, most Asian economies look set to boom, powered by central bank punchbowls. More Chinese alcohol may be about to be added to the mixture

Alex Ross sees APAC currencies benefiting as 2021 arrives. But prepare for volatility as some central banks try to counter the falling USD. And longer term, the EUR isn't looking good

7th Dec 20, 8:12am

1

Alex Ross sees APAC currencies benefiting as 2021 arrives. But prepare for volatility as some central banks try to counter the falling USD. And longer term, the EUR isn't looking good

Alex Ross sees the reflation trade alive and well. But if a return to normality means a withdrawal of artificially suppressed rates and stimulus, will this be positive for the Kiwi in the medium term? Perhaps not

30th Nov 20, 7:58am

Alex Ross sees the reflation trade alive and well. But if a return to normality means a withdrawal of artificially suppressed rates and stimulus, will this be positive for the Kiwi in the medium term? Perhaps not

Many central banks are looking nervously at the demise of the US dollar, and that probably includes the RBNZ. It is instability unwelcomed in the middle of the pandemic stresses

23rd Nov 20, 7:59am

5

Many central banks are looking nervously at the demise of the US dollar, and that probably includes the RBNZ. It is instability unwelcomed in the middle of the pandemic stresses

Although the present currency and economic situation looks very challenging, markets are looking forward with bullish optimism in the face of the second wave COVID risk, says Alex Ross

16th Nov 20, 8:01am

Although the present currency and economic situation looks very challenging, markets are looking forward with bullish optimism in the face of the second wave COVID risk, says Alex Ross

A mix of black and blue skies lie ahead for the FX market after Biden takes the White House, and rising COVID-19 cases in Europe

9th Nov 20, 6:23am

3

A mix of black and blue skies lie ahead for the FX market after Biden takes the White House, and rising COVID-19 cases in Europe

US election headlines a massive week that also features plenty of central bank action as well as jobs data and pandemic influences. Few positives are expected

2nd Nov 20, 7:45am

US election headlines a massive week that also features plenty of central bank action as well as jobs data and pandemic influences. Few positives are expected

The impending US election casts a fog over Asian currency movements. Overall markets have become complacent and vulnerable to an economic surprise. The pandemic resurgence is under-priced

27th Oct 20, 8:00am

3

The impending US election casts a fog over Asian currency movements. Overall markets have become complacent and vulnerable to an economic surprise. The pandemic resurgence is under-priced

China leads a recovery in export trade by Asian nations which is keeping some currencies elevated. Alex Ross expects our new government to prioritise exports and want to keep the NZD lower

19th Oct 20, 8:29am

China leads a recovery in export trade by Asian nations which is keeping some currencies elevated. Alex Ross expects our new government to prioritise exports and want to keep the NZD lower

Asian currencies double down on a Democrat clean sweep in the US. Alex Ross is also watching how central banks react to a slowing velocity of money, and whether a reflation is really coming

12th Oct 20, 8:07am

6

Asian currencies double down on a Democrat clean sweep in the US. Alex Ross is also watching how central banks react to a slowing velocity of money, and whether a reflation is really coming

Alex Ross finds that a rising Chinese yuan is keeping the NZD competitive in the China trade. But can it last? One big bank is now shorting the NZD

5th Oct 20, 8:14am

6

Alex Ross finds that a rising Chinese yuan is keeping the NZD competitive in the China trade. But can it last? One big bank is now shorting the NZD

New contributor Alex Ross assesses the currency pressures on the NZD and looks how the majors will move over the coming week, from the USD, CNY, INR, and other Asian influences

28th Sep 20, 7:55am

New contributor Alex Ross assesses the currency pressures on the NZD and looks how the majors will move over the coming week, from the USD, CNY, INR, and other Asian influences

Opinion: Only lower milk powder prices and an OCR pause can drive the Kiwi lower

26th Jul 10, 12:22pm

1

Opinion: Only lower milk powder prices and an OCR pause can drive the Kiwi lower