Oil

Fed takes cautious stand; China features in Panama Papers; China car buying sentiment improves, airfreight falls; UST 10yr yield 1.75%; oil up, gold down; NZ$1 = 68 US¢, TWI-5 = 71.1

7th Apr 16, 7:35am

20

Fed takes cautious stand; China features in Panama Papers; China car buying sentiment improves, airfreight falls; UST 10yr yield 1.75%; oil up, gold down; NZ$1 = 68 US¢, TWI-5 = 71.1

Panama Papers see Iceland's PM resign; GDT auction up in USD not NZD terms; India cuts rates; US services sector grows; UST 10yr yield 1.73%; oil stable, gold up; NZ$1 = 67.9US¢, TWI-5 = 71.2

6th Apr 16, 7:59am

2

Panama Papers see Iceland's PM resign; GDT auction up in USD not NZD terms; India cuts rates; US services sector grows; UST 10yr yield 1.73%; oil stable, gold up; NZ$1 = 67.9US¢, TWI-5 = 71.2

US durable goods orders fall; tax leak catches 100s; IMF warns on China; IMF forced to back down on Greece; UST 10yr yield 1.77%; oil and oil lower; NZ$1 = 68.4 US¢, TWI-5 = 71.5

5th Apr 16, 7:22am

15

US durable goods orders fall; tax leak catches 100s; IMF warns on China; IMF forced to back down on Greece; UST 10yr yield 1.77%; oil and oil lower; NZ$1 = 68.4 US¢, TWI-5 = 71.5

US jobs and wages grow; IMF tackles Germany over Greece; China facing floods; NZ outed as a tax haven, ANZ as a facilitator; UST 10yr yield 1.77%; oil and oil lower; NZ$1 = 69 US¢, TWI-5 = 72

4th Apr 16, 7:09am

11

US jobs and wages grow; IMF tackles Germany over Greece; China facing floods; NZ outed as a tax haven, ANZ as a facilitator; UST 10yr yield 1.77%; oil and oil lower; NZ$1 = 69 US¢, TWI-5 = 72

US layoffs drop, factories stirring; Korea rebounds; iron ore jumps +25%; downgrades for Singapore banks, China, Hong Kong; UST 10yr yield 1.81%; oil stable, gold up; NZ$1 = 69.1 US¢, TWI-5 = 72.2

1st Apr 16, 7:29am

10

US layoffs drop, factories stirring; Korea rebounds; iron ore jumps +25%; downgrades for Singapore banks, China, Hong Kong; UST 10yr yield 1.81%; oil stable, gold up; NZ$1 = 69.1 US¢, TWI-5 = 72.2

Bank profits slide and bad loans jump in China; China's economic growth forecast downgraded; More new jobs created in US than expected; UST 10yr yield 1.84%; oil stable, gold up; NZ$1 = 69.1 US¢, TWI-5 = 72.3

31st Mar 16, 7:52am

18

Bank profits slide and bad loans jump in China; China's economic growth forecast downgraded; More new jobs created in US than expected; UST 10yr yield 1.84%; oil stable, gold up; NZ$1 = 69.1 US¢, TWI-5 = 72.3

Yellen cautious; US confidence jumps; BofE raises bank capital buffer; 'alarm' over Australian deficits; Melbourne and Miami apartment prices slump; UST 10yr yield 1.86%; oil and gold lower; NZ$1 = 68.5 US¢, TWI-5 = 71.9

30th Mar 16, 7:30am

17

Yellen cautious; US confidence jumps; BofE raises bank capital buffer; 'alarm' over Australian deficits; Melbourne and Miami apartment prices slump; UST 10yr yield 1.86%; oil and gold lower; NZ$1 = 68.5 US¢, TWI-5 = 71.9

US housing up; US Q4-15 GDP revised higher on income gains; China profits jump; China retail still growing strongly; UST 10yr yield 1.88%; oil and gold lower; NZ$1 = 67.2 US¢, TWI-5 = 70.9

29th Mar 16, 7:26am

4

US housing up; US Q4-15 GDP revised higher on income gains; China profits jump; China retail still growing strongly; UST 10yr yield 1.88%; oil and gold lower; NZ$1 = 67.2 US¢, TWI-5 = 70.9

Another Fed president calls for rate hikes next month; P2P lenders risk going bust in China; ECB criticised for "going too far"; US housing market stalls; UST 10yr yield 1.91%; oil & gold down; NZ$1 = 67.2 US¢, TWI-5 = 70.8

24th Mar 16, 8:11am

21

Another Fed president calls for rate hikes next month; P2P lenders risk going bust in China; ECB criticised for "going too far"; US housing market stalls; UST 10yr yield 1.91%; oil & gold down; NZ$1 = 67.2 US¢, TWI-5 = 70.8

Terrorist attacks boost "safe havens"; RBA Governor's confidence in economy hikes AUD; US manufacturing down; US house prices up; UST 10yr yield 1.90%; oil & gold up; NZ$1 = 67.4 US¢, TWI-5 = 70.9

23rd Mar 16, 8:05am

46

Terrorist attacks boost "safe havens"; RBA Governor's confidence in economy hikes AUD; US manufacturing down; US house prices up; UST 10yr yield 1.90%; oil & gold up; NZ$1 = 67.4 US¢, TWI-5 = 70.9

Fed President talks up possibility of rate hike as soon as April; US housing market loses steam; Alibaba poised to dwarf Walmart; IMF calls for transparency from PBoC; UST 10yr yield 1.91%; oil up, gold down; NZ$1 = 67.6 US¢, TWI-5 = 71.0

22nd Mar 16, 7:47am

4

Fed President talks up possibility of rate hike as soon as April; US housing market loses steam; Alibaba poised to dwarf Walmart; IMF calls for transparency from PBoC; UST 10yr yield 1.91%; oil up, gold down; NZ$1 = 67.6 US¢, TWI-5 = 71.0

Rate cuts still on ECB's cards; PBoC red flags high corporate debt levels; US consumer sentiment slumps; Fonterra expected to report strong result; UST 10yr yield 1.88%; oil tracks up, gold down; NZ$1 = 67.9 US¢, TWI-5 = 71.2

21st Mar 16, 7:51am

11

Rate cuts still on ECB's cards; PBoC red flags high corporate debt levels; US consumer sentiment slumps; Fonterra expected to report strong result; UST 10yr yield 1.88%; oil tracks up, gold down; NZ$1 = 67.9 US¢, TWI-5 = 71.2

US C/A deficit falls; jobless claims fall; Hong Kong in sharp downturn; EM leverage keeps rising; AU banks world's top return; UST 10yr yield 1.90%; oil up, gold surges; NZ$1 = 68.5 US¢, TWI-5 = 71.6

18th Mar 16, 7:35am

5

US C/A deficit falls; jobless claims fall; Hong Kong in sharp downturn; EM leverage keeps rising; AU banks world's top return; UST 10yr yield 1.90%; oil up, gold surges; NZ$1 = 68.5 US¢, TWI-5 = 71.6

Yellen holds, optimistic; Wall Street jumps; US housing data strong, factory data weak; US core CPI rising; China power use rises; UK to tax sugar; UST 10yr yield 1.98%; oil up, gold down; NZ$1 = 66.8 US¢, TWI-5 = 70.6

17th Mar 16, 7:28am

3

Yellen holds, optimistic; Wall Street jumps; US housing data strong, factory data weak; US core CPI rising; China power use rises; UK to tax sugar; UST 10yr yield 1.98%; oil up, gold down; NZ$1 = 66.8 US¢, TWI-5 = 70.6

Dairy prices fall again; US retail sales drop; fraud issues in London, Nigeria, Bangladesh; China eyes Tobin Tax, iron ore price slides, UST 10yr yield 1.96%; oil down, gold down; NZ$1 = 65.9 US¢, TWI-5 = 69.9

16th Mar 16, 7:24am

16

Dairy prices fall again; US retail sales drop; fraud issues in London, Nigeria, Bangladesh; China eyes Tobin Tax, iron ore price slides, UST 10yr yield 1.96%; oil down, gold down; NZ$1 = 65.9 US¢, TWI-5 = 69.9

US inflation rising; US car loan defaults up; Moody's thinks China can't win; Eurozone factories buzzing; credit card benefits fade, UST 10yr yield 1.96%; oil down, gold down; NZ$1 = 66.8 US¢, TWI-5 = 70.7

15th Mar 16, 7:29am

22

US inflation rising; US car loan defaults up; Moody's thinks China can't win; Eurozone factories buzzing; credit card benefits fade, UST 10yr yield 1.96%; oil down, gold down; NZ$1 = 66.8 US¢, TWI-5 = 70.7

US eyes on Fed, services stronger; China factory growth slows, retail growth underperforms, UST 10yr yield 1.98%; oil unchanged, gold down; NZ$1 = 67.5 US¢, TWI-5 = 71.2

14th Mar 16, 7:21am

8

US eyes on Fed, services stronger; China factory growth slows, retail growth underperforms, UST 10yr yield 1.98%; oil unchanged, gold down; NZ$1 = 67.5 US¢, TWI-5 = 71.2

US jobless claims fall; US net worth rises; ECB cuts rates, hikes stimulus; world trade volumes high and stable, UST 10yr yield 1.90%; oil down, gold up; NZ$1 = 66.7 US¢, TWI-5 = 70.6

11th Mar 16, 7:21am

9

US jobless claims fall; US net worth rises; ECB cuts rates, hikes stimulus; world trade volumes high and stable, UST 10yr yield 1.90%; oil down, gold up; NZ$1 = 66.7 US¢, TWI-5 = 70.6

US inventories rise; Aussie home lending falls; China tightens currency trading; UST 10yr yield 1.87%; oil up, Saudis to borrow; gold down; NZ$1 = 68 US¢, TWI-5 = 72.1

10th Mar 16, 7:09am

2

US inventories rise; Aussie home lending falls; China tightens currency trading; UST 10yr yield 1.87%; oil up, Saudis to borrow; gold down; NZ$1 = 68 US¢, TWI-5 = 72.1

China exports fall sharply, trade surplus drops; Japan's economy shrinks; policy makers alarmed; air traffic up strongly; UST 10yr yield 1.81%; oil down, gold up; NZ$1 = 67.7 US¢, TWI-5 = 71.9

9th Mar 16, 7:30am

25

China exports fall sharply, trade surplus drops; Japan's economy shrinks; policy makers alarmed; air traffic up strongly; UST 10yr yield 1.81%; oil down, gold up; NZ$1 = 67.7 US¢, TWI-5 = 71.9

China forex reserves fall slower; China signals stimulus coming; iron ore prices 'go berserk'; Hong Kong housing slumps; airfreight shows good growth; UST 10yr yield 1.91%; oil up, gold down; NZ$1 = 68 US¢, TWI-5 = 72.2

8th Mar 16, 7:34am

4

China forex reserves fall slower; China signals stimulus coming; iron ore prices 'go berserk'; Hong Kong housing slumps; airfreight shows good growth; UST 10yr yield 1.91%; oil up, gold down; NZ$1 = 68 US¢, TWI-5 = 72.2

US jobs jump, boost rate hike prospects; BIS says markets losing faith; China sets growth and restructuring targets; UST 10yr yield 1.88%; oil up, gold down; NZ$1 = 68.2 US¢, TWI-5 = 72.5

7th Mar 16, 7:16am

7

US jobs jump, boost rate hike prospects; BIS says markets losing faith; China sets growth and restructuring targets; UST 10yr yield 1.88%; oil up, gold down; NZ$1 = 68.2 US¢, TWI-5 = 72.5

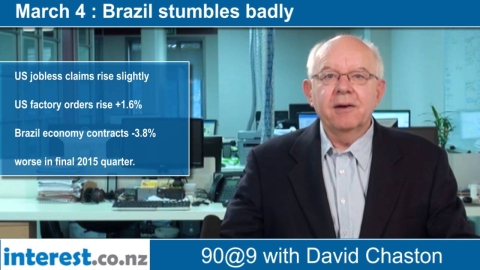

US jobless claims fall; US factory orders rise; Brazil on the skids; Macao slumps dramatically; iron ore price rise strongly; UST 10yr yield 1.82%; oil flat, gold rises; NZ$1 = 67.4 US¢, TWI-5 = 72

4th Mar 16, 7:34am

26

US jobless claims fall; US factory orders rise; Brazil on the skids; Macao slumps dramatically; iron ore price rise strongly; UST 10yr yield 1.82%; oil flat, gold rises; NZ$1 = 67.4 US¢, TWI-5 = 72

US job and wage growth looking good; Chinese officials call for calm as speculators rush into property market; Moody's lowers outlook on China's credit rating to negative; NZ$1 = 66.3 US¢, TWI-5 = 71.3

3rd Mar 16, 8:02am

7

US job and wage growth looking good; Chinese officials call for calm as speculators rush into property market; Moody's lowers outlook on China's credit rating to negative; NZ$1 = 66.3 US¢, TWI-5 = 71.3

Dairy prices inch up; US car sales power ahead; Japan paid to borrow; eurozone jobless rate falls; Wall Street rallies; UST 10yr yield 1.75%; oil rises, gold eases; NZ$1 = 66.2 US¢, TWI-5 = 71.4

2nd Mar 16, 7:23am

18

Dairy prices inch up; US car sales power ahead; Japan paid to borrow; eurozone jobless rate falls; Wall Street rallies; UST 10yr yield 1.75%; oil rises, gold eases; NZ$1 = 66.2 US¢, TWI-5 = 71.4