Oil

American household wealth dips; China car sales surge; shipping industry downgraded; Woolworths in court over unconscionable behaviour; UST 10yr yield 2.22%; NZ$1 = 67.6 US¢, TWI-5 = 72.6

11th Dec 15, 7:25am

11

American household wealth dips; China car sales surge; shipping industry downgraded; Woolworths in court over unconscionable behaviour; UST 10yr yield 2.22%; NZ$1 = 67.6 US¢, TWI-5 = 72.6

Value of investor housing loans falls 6% in Australia; China inflation figures disappoint; US GDP hit by fall in wholesale inventories; UST 10yr yield 2.24%; oil & gold remain low; NZ$1 = 66.2 US¢, TWI-5 = 71.4

10th Dec 15, 7:29am

4

Value of investor housing loans falls 6% in Australia; China inflation figures disappoint; US GDP hit by fall in wholesale inventories; UST 10yr yield 2.24%; oil & gold remain low; NZ$1 = 66.2 US¢, TWI-5 = 71.4

Miners scramble to respond to changing China demand; China exports and imports tumble; Aussie business confidence rises; oil lower again; UST 10yr yield 2.22%; NZ$1 = 66.4 US¢, TWI-5 = 71.8

9th Dec 15, 7:30am

16

Miners scramble to respond to changing China demand; China exports and imports tumble; Aussie business confidence rises; oil lower again; UST 10yr yield 2.22%; NZ$1 = 66.4 US¢, TWI-5 = 71.8

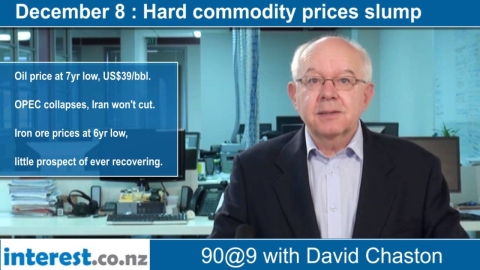

Oil prices hit 7yr low; iron ore prices hit 6yr low; Beijing on 'Red Alert'; China fx outflows quicken; UST 10yr yield 2.26%; NZ$1 = 66.5 US¢, TWI-5 = 71.8

8th Dec 15, 7:23am

12

Oil prices hit 7yr low; iron ore prices hit 6yr low; Beijing on 'Red Alert'; China fx outflows quicken; UST 10yr yield 2.26%; NZ$1 = 66.5 US¢, TWI-5 = 71.8

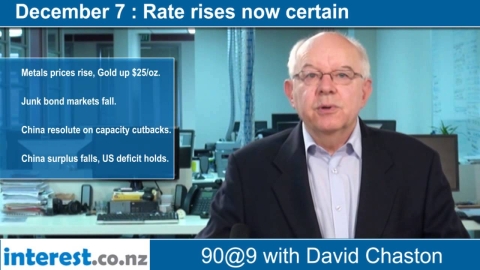

BIS supports rising rates; strong US non-farm payrolls report; many metals prices jump; low-rate companies and countries fall; oil under $40 on Iran position; UST 10yr yield 2.27%; NZ$1 = 67.5 US¢, TWI-5 = 72.6

7th Dec 15, 7:31am

14

BIS supports rising rates; strong US non-farm payrolls report; many metals prices jump; low-rate companies and countries fall; oil under $40 on Iran position; UST 10yr yield 2.27%; NZ$1 = 67.5 US¢, TWI-5 = 72.6

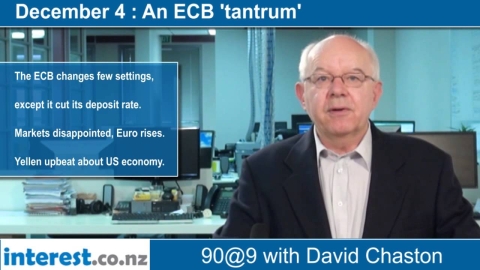

Draghi disappoints with minimum action; Yellen upbeat about US economy; air travel growing very strongly; UST 10yr yield 2.27%; oil and gold prices stable; NZ$1 = 66.4 US¢, TWI-5 = 71.4

4th Dec 15, 7:29am

12

Draghi disappoints with minimum action; Yellen upbeat about US economy; air travel growing very strongly; UST 10yr yield 2.27%; oil and gold prices stable; NZ$1 = 66.4 US¢, TWI-5 = 71.4

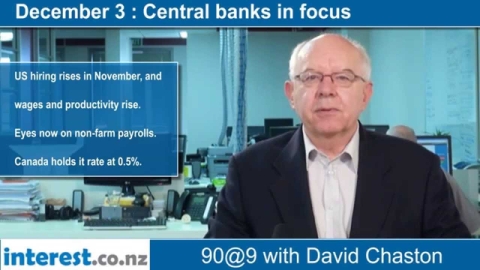

Hiring and wages up in the US; Canada holds its rate; banknote printer downsizes; China hacks Aussie supercomputer; oil production high; UST 10yr yield 2.19%; oil and gold prices lower; NZ$1 = 66.3 US¢, TWI-5 = 72.1

3rd Dec 15, 7:30am

2

Hiring and wages up in the US; Canada holds its rate; banknote printer downsizes; China hacks Aussie supercomputer; oil production high; UST 10yr yield 2.19%; oil and gold prices lower; NZ$1 = 66.3 US¢, TWI-5 = 72.1

Dairy prices rise 3.6% at GDT auction; US manufacturing contracts for first time in years; US car sales on track to reaching record highs; UST 10yr yield 2.18%; oil and gold stable; NZ$1 = 66.7 US¢, TWI-5 = 72.4

2nd Dec 15, 7:47am

10

Dairy prices rise 3.6% at GDT auction; US manufacturing contracts for first time in years; US car sales on track to reaching record highs; UST 10yr yield 2.18%; oil and gold stable; NZ$1 = 66.7 US¢, TWI-5 = 72.4

IMF adds yuan to SDR basket; Fed bows to Congress; US house sales underwhelms, retail impresses; Japan makes appeal; UST 10yr yield 2.22%; oil unchanged, gold rises; NZ$1 = 65.8 US¢, TWI-5 = 71.6

1st Dec 15, 7:24am

11

IMF adds yuan to SDR basket; Fed bows to Congress; US house sales underwhelms, retail impresses; Japan makes appeal; UST 10yr yield 2.22%; oil unchanged, gold rises; NZ$1 = 65.8 US¢, TWI-5 = 71.6

American retail strong; ECB preps easing; China profits drop; PBoC adds more QE; China bond concerns; AU to slash card merchant fees; UST 10yr yield 2.22%; oil lower, gold slumps; NZ$1 = 65.4 US¢, TWI-5 = 71.2

30th Nov 15, 7:22am

8

American retail strong; ECB preps easing; China profits drop; PBoC adds more QE; China bond concerns; AU to slash card merchant fees; UST 10yr yield 2.22%; oil lower, gold slumps; NZ$1 = 65.4 US¢, TWI-5 = 71.2

European markets rally, euro falls ahead of ECB meeting; New capex in Australia suffers record fall; iron ore prices to stay low for longer; Japan ups social spending; UST 10yr yield 2.23%; gold & oil stable; NZ$1 = 65.7 US¢, TWI-5 = 71.4

27th Nov 15, 7:54am

European markets rally, euro falls ahead of ECB meeting; New capex in Australia suffers record fall; iron ore prices to stay low for longer; Japan ups social spending; UST 10yr yield 2.23%; gold & oil stable; NZ$1 = 65.7 US¢, TWI-5 = 71.4

US households save, restrain spending but buy new houses; US businesses invest, labour markets tighten; huge China overstatement; UST 10yr yield 2.23%; gold and oil down; NZ$1 = 65.7 US¢, TWI-5 = 71.4

26th Nov 15, 7:25am

9

US households save, restrain spending but buy new houses; US businesses invest, labour markets tighten; huge China overstatement; UST 10yr yield 2.23%; gold and oil down; NZ$1 = 65.7 US¢, TWI-5 = 71.4

US growth higher; Renault next diesel cheat; China to expand high-speed rail; 3rd wave of globalisation coming; UST 10yr yield 2.2=4%; gold up, oil up; NZ$1 = 65.4 US¢, TWI-5 = 71

25th Nov 15, 7:12am

24

US growth higher; Renault next diesel cheat; China to expand high-speed rail; 3rd wave of globalisation coming; UST 10yr yield 2.2=4%; gold up, oil up; NZ$1 = 65.4 US¢, TWI-5 = 71

US house sales hesitate but prices higher; US factories slow, EU factories expand; VW cheating widens; a China corporate debt squeeze; UST 10yr yield 2.26%; gold lower, oil up; NZ$1 = 65.1 US¢, TWI-5 = 70.9

24th Nov 15, 7:26am

10

US house sales hesitate but prices higher; US factories slow, EU factories expand; VW cheating widens; a China corporate debt squeeze; UST 10yr yield 2.26%; gold lower, oil up; NZ$1 = 65.1 US¢, TWI-5 = 70.9

NZ gets sub 4% mortgage rate; China foils big underground bank; ECB targets inflation; India central bank employees strike; UST 10yr yield 2.26%; gold and oil hold; NZ$1 = 65.6 US¢, TWI-5 = 71.2

23rd Nov 15, 7:20am

25

NZ gets sub 4% mortgage rate; China foils big underground bank; ECB targets inflation; India central bank employees strike; UST 10yr yield 2.26%; gold and oil hold; NZ$1 = 65.6 US¢, TWI-5 = 71.2

China cuts wholesale gas price by 25%; US manufacturing perks up; labour market nears full employment; Republicans push for Fed to set rates using set formula; UST 10yr yield 2.25%; oil low; NZ$1 = 65.6 US¢, TWI-5 = 71.3

20th Nov 15, 8:02am

11

China cuts wholesale gas price by 25%; US manufacturing perks up; labour market nears full employment; Republicans push for Fed to set rates using set formula; UST 10yr yield 2.25%; oil low; NZ$1 = 65.6 US¢, TWI-5 = 71.3

US housing starts fall, consents rise sharply; China house price rises wane, shadow banking assets fall; iron ore price tanks; UST 10yr yield 2.29%; gold and oil fall; NZ$1 = 64.4 US¢, TWI-5 = 70.3

19th Nov 15, 7:23am

2

US housing starts fall, consents rise sharply; China house price rises wane, shadow banking assets fall; iron ore price tanks; UST 10yr yield 2.29%; gold and oil fall; NZ$1 = 64.4 US¢, TWI-5 = 70.3

Dairy prices drop again; US CPI rises again; China electricity use drops; RBA worried about China; UST 10yr yield 2.30%; gold and oil fall; NZ$1 = 64.6 US¢, TWI-5 = 70.4

18th Nov 15, 7:22am

18

Dairy prices drop again; US CPI rises again; China electricity use drops; RBA worried about China; UST 10yr yield 2.30%; gold and oil fall; NZ$1 = 64.6 US¢, TWI-5 = 70.4

Wall Street up; Japan in recession; China FDI growing; Brazil changes direction; EU inflation low, UST 10yr yield 2.26%; gold stable, copper falls; NZ$1 = 64.9 US¢, TWI-5 = 70.7

17th Nov 15, 7:25am

17

Wall Street up; Japan in recession; China FDI growing; Brazil changes direction; EU inflation low, UST 10yr yield 2.26%; gold stable, copper falls; NZ$1 = 64.9 US¢, TWI-5 = 70.7

G20 to tackle tax shifting; US retail sales disappoint; US consumer sentiment rises; China raises margin limits, UST 10yr yield 2.27%; oil price slips; NZ$1 = 65.4 US¢, TWI-5 = 71

16th Nov 15, 7:22am

13

G20 to tackle tax shifting; US retail sales disappoint; US consumer sentiment rises; China raises margin limits, UST 10yr yield 2.27%; oil price slips; NZ$1 = 65.4 US¢, TWI-5 = 71

Draghi hints at easing; US jobs data solid; AU jobs data very good; China in big spendup; UST 10yr yield 2.34%; oil falls on excess supply; NZ$1 = 65.3 US¢, TWI-5 = 70.9

13th Nov 15, 7:29am

4

Draghi hints at easing; US jobs data solid; AU jobs data very good; China in big spendup; UST 10yr yield 2.34%; oil falls on excess supply; NZ$1 = 65.3 US¢, TWI-5 = 70.9

China retail growth rises, factory and investment growth falls; Singles Day spectacular; Germany wary of ECB negative rates; UST 10yr yield 2.34%; oil and gold fall; NZ$1 = 65.6 US¢, TWI-5 = 71.4

12th Nov 15, 7:21am

21

China retail growth rises, factory and investment growth falls; Singles Day spectacular; Germany wary of ECB negative rates; UST 10yr yield 2.34%; oil and gold fall; NZ$1 = 65.6 US¢, TWI-5 = 71.4

Low China CPI inflation; producer price deflation, similar in US; American wholesale trade brightens; oil and gold up marginally; UST 10yr yield 2.35%; NZ$1 = 65.3 US¢, TWI-5 = 71.3

11th Nov 15, 7:29am

9

Low China CPI inflation; producer price deflation, similar in US; American wholesale trade brightens; oil and gold up marginally; UST 10yr yield 2.35%; NZ$1 = 65.3 US¢, TWI-5 = 71.3

OECD lowers global growth forecasts; TBTF banks face huge capital raising; ANZ bosses paid millions; US labour market improves; UST 10yr yield 2.37%; NZ$1 = 65.4 US¢, TWI-5 = 71.2

10th Nov 15, 7:29am

18

OECD lowers global growth forecasts; TBTF banks face huge capital raising; ANZ bosses paid millions; US labour market improves; UST 10yr yield 2.37%; NZ$1 = 65.4 US¢, TWI-5 = 71.2

US non-farm payrolls surge; markets expect liftoff; China trade shrinks, imports more than exports; Aust. looks at GST on financial services; UST 10yr yield 2.33%; NZ$1 = 65.2 US¢, TWI-5 = 71.1

9th Nov 15, 7:26am

6

US non-farm payrolls surge; markets expect liftoff; China trade shrinks, imports more than exports; Aust. looks at GST on financial services; UST 10yr yield 2.33%; NZ$1 = 65.2 US¢, TWI-5 = 71.1