Oil

US jobs grow strongly; IMF sees little global growth; Australia loses coal exports, sees lower ore prices; McKinsey warns on bank profits; CDS spreads jump; gold falls; NZ$1 = 63.9 US¢, TWI-5 = 68.7

1st Oct 15, 7:39am

2

US jobs grow strongly; IMF sees little global growth; Australia loses coal exports, sees lower ore prices; McKinsey warns on bank profits; CDS spreads jump; gold falls; NZ$1 = 63.9 US¢, TWI-5 = 68.7

Cheap borrowing threatens emerging markets, India cuts rates, China limits overseas card withdrawals, Aus property market tempering, US confidence rises; UST 10yr yield 2.05%; NZ$1 = 63.4 US¢, TWI-5 = 68.2

30th Sep 15, 8:06am

1

Cheap borrowing threatens emerging markets, India cuts rates, China limits overseas card withdrawals, Aus property market tempering, US confidence rises; UST 10yr yield 2.05%; NZ$1 = 63.4 US¢, TWI-5 = 68.2

US consumer spending rises; Chinese factory profits fall; Chinese travel more; Swiss see more manipulation; UST 10yr yield 2.13%; NZ$1 = 63.5 US¢, TWI-5 = 68.2

29th Sep 15, 7:27am

25

US consumer spending rises; Chinese factory profits fall; Chinese travel more; Swiss see more manipulation; UST 10yr yield 2.13%; NZ$1 = 63.5 US¢, TWI-5 = 68.2

US growth surges +3.9% in Q2; Norway and Taiwan cut rates; F&P Finance to be sold; Sumatra fires; UST 10yr yield 2.17%; oil up, gold down; NZ$1 = 63.8 US¢, TWI-5 = 68.7

28th Sep 15, 7:25am

12

US growth surges +3.9% in Q2; Norway and Taiwan cut rates; F&P Finance to be sold; Sumatra fires; UST 10yr yield 2.17%; oil up, gold down; NZ$1 = 63.8 US¢, TWI-5 = 68.7

VW scandal threatens German economy more than Greek crisis; Fed set on rate hike; Chinese diesel exports hit record high; Caterpillar makes huge layoffs; US economy in growth mode; UST 10yr yield 2.09%; oil stable, gold up; NZ$1 = 63.5 US¢, TWI-5 = 68.2

25th Sep 15, 8:00am

8

VW scandal threatens German economy more than Greek crisis; Fed set on rate hike; Chinese diesel exports hit record high; Caterpillar makes huge layoffs; US economy in growth mode; UST 10yr yield 2.09%; oil stable, gold up; NZ$1 = 63.5 US¢, TWI-5 = 68.2

China's factories keep contracting; US and Europe factories still expanding; VW boss quits; UST 10yr yield 2.15%; oil down, gold up; NZ$1 = 62.5 US¢, TWI-5 = 67.2

24th Sep 15, 7:20am

11

China's factories keep contracting; US and Europe factories still expanding; VW boss quits; UST 10yr yield 2.15%; oil down, gold up; NZ$1 = 62.5 US¢, TWI-5 = 67.2

ADB lowers growth forecast; VW fraud extends, affects credit spreads; MasterCard outed in phoney campaign; UST 10yr yield 2.13%; NZ$1 = 62.9 US¢, TWI-5 = 67.6

23rd Sep 15, 7:27am

11

ADB lowers growth forecast; VW fraud extends, affects credit spreads; MasterCard outed in phoney campaign; UST 10yr yield 2.13%; NZ$1 = 62.9 US¢, TWI-5 = 67.6

US house sales stall; China economy 'transforming well'; Australia the big loser; UST 10yr yield 2.19%; oil higher, gold lower; NZ$1 = 63.1 US¢, TWI-5 = 67.6

22nd Sep 15, 7:23am

8

US house sales stall; China economy 'transforming well'; Australia the big loser; UST 10yr yield 2.19%; oil higher, gold lower; NZ$1 = 63.1 US¢, TWI-5 = 67.6

US net worth jumps; US home borrowing turns up Moody's downgrades France; VW caught in huge fraud; UST 10yr yield 2.13%; oil lower, gold higher; NZ$1 = 64 US¢, TWI-5 = 68.1

21st Sep 15, 7:30am

2

US net worth jumps; US home borrowing turns up Moody's downgrades France; VW caught in huge fraud; UST 10yr yield 2.13%; oil lower, gold higher; NZ$1 = 64 US¢, TWI-5 = 68.1

US central bank keeps rates near zero; forecasts a rise this year; USD plunges against NZD before creeping back to 63.8 US¢; UST 10yr yield 2.29%; oil unchanged, gold up; TWI-5 = 67.7

18th Sep 15, 6:49am

29

US central bank keeps rates near zero; forecasts a rise this year; USD plunges against NZD before creeping back to 63.8 US¢; UST 10yr yield 2.29%; oil unchanged, gold up; TWI-5 = 67.7

Fed meets, US CPI tame, OECD says 'hike', S&P downgrades Japan, Shanghai stocks jump; UST 10yr yield 2.27%; oil and gold higher; NZ$1 = 63.5 US¢, TWI-5 = 67.7

17th Sep 15, 7:22am

9

Fed meets, US CPI tame, OECD says 'hike', S&P downgrades Japan, Shanghai stocks jump; UST 10yr yield 2.27%; oil and gold higher; NZ$1 = 63.5 US¢, TWI-5 = 67.7

Dairy prices rise; US data disappoints; UPS prepares; World Bank warns; China stocks fall again; a Turnbull bounce; UST yield 2.23%; NZ$1 = 63.3 US¢, TWI-5 = 67.7

16th Sep 15, 7:23am

3

Dairy prices rise; US data disappoints; UPS prepares; World Bank warns; China stocks fall again; a Turnbull bounce; UST yield 2.23%; NZ$1 = 63.3 US¢, TWI-5 = 67.7

Turnbull ousts Abbott; China seizes funds; China markets fall; EU factory output jumps; US eyes retail report; US 10yr yield 2.18%; NZ$1 = 63.3 US¢, TWI-5 = 67.5

15th Sep 15, 7:24am

3

Turnbull ousts Abbott; China seizes funds; China markets fall; EU factory output jumps; US eyes retail report; US 10yr yield 2.18%; NZ$1 = 63.3 US¢, TWI-5 = 67.5

Waiting for the Fed; China data disappoints; BIS concerned; NZ data to fore; UST 10yr yield 2.19%; oil and gold lower; NZ$1 = 63.2 US¢, TWI-5 = 67.5

14th Sep 15, 7:26am

12

Waiting for the Fed; China data disappoints; BIS concerned; NZ data to fore; UST 10yr yield 2.19%; oil and gold lower; NZ$1 = 63.2 US¢, TWI-5 = 67.5

Brazil's credit rating downgraded, milk prices drop in China despite food prices increasing, improving employment and weak inflation complicate Fed rate decision; UST 10yr yield 2.22%, oil and gold up; NZ$1 = 63.1 US¢, TWI-5 = 67.5

11th Sep 15, 7:59am

11

Brazil's credit rating downgraded, milk prices drop in China despite food prices increasing, improving employment and weak inflation complicate Fed rate decision; UST 10yr yield 2.22%, oil and gold up; NZ$1 = 63.1 US¢, TWI-5 = 67.5

Canada hold, likes US gains; American job opening hit record high; markets surge except Wall Street; debt test coming; UST 10yr yield 2.23%, oil and gold lower; NZ$1 = 64 US¢, TWI-5 = 68.8

10th Sep 15, 7:14am

24

Canada hold, likes US gains; American job opening hit record high; markets surge except Wall Street; debt test coming; UST 10yr yield 2.23%, oil and gold lower; NZ$1 = 64 US¢, TWI-5 = 68.8

Wall Street up strongly; China scraps dividend tax; China's exports fall sharply; German exports rise; EU growth better; US labour market improves; bonds, oil and gold up; NZ$1 = 63.4 US¢, TWI-5 = 68.1

9th Sep 15, 7:27am

1

Wall Street up strongly; China scraps dividend tax; China's exports fall sharply; German exports rise; EU growth better; US labour market improves; bonds, oil and gold up; NZ$1 = 63.4 US¢, TWI-5 = 68.1

China's reserves fall, still huge; China pushes the stimulus button; EU caves in to dairy farmers; swaps rise; gold and oil fall; NZ$1 = 62.6 US¢, TWI-5 = 67.4

8th Sep 15, 7:27am

5

China's reserves fall, still huge; China pushes the stimulus button; EU caves in to dairy farmers; swaps rise; gold and oil fall; NZ$1 = 62.6 US¢, TWI-5 = 67.4

IMF tells Fed not to 'rush'; US jobs growth slows, wage hikes quicken; G20 pledge no currency wars; sovereign deadbeats; UST 10yr yield 2.13%; NZ$1 = 62.8 US¢, TWI-5 = 67.7

7th Sep 15, 7:19am

7

IMF tells Fed not to 'rush'; US jobs growth slows, wage hikes quicken; G20 pledge no currency wars; sovereign deadbeats; UST 10yr yield 2.13%; NZ$1 = 62.8 US¢, TWI-5 = 67.7

US trade gap narrows, ECB cuts growth and inflation forecasts, IMF worried about global economy, Aussie dollar on downhill slide; UST 10yr yield 2.16%; gold lower; NZ$1 = 64.0 US¢, TWI-5 = 68.8

4th Sep 15, 7:52am

US trade gap narrows, ECB cuts growth and inflation forecasts, IMF worried about global economy, Aussie dollar on downhill slide; UST 10yr yield 2.16%; gold lower; NZ$1 = 64.0 US¢, TWI-5 = 68.8

Fed sees relatively strong US economy, productivity jumps; Australia sees weak economy; Airfreight shipments fall from China; UST 10yr yield 2.17%; gold lower; NZ$1 = 63.6 US¢, TWI-5 = 68.2

3rd Sep 15, 7:28am

16

Fed sees relatively strong US economy, productivity jumps; Australia sees weak economy; Airfreight shipments fall from China; UST 10yr yield 2.17%; gold lower; NZ$1 = 63.6 US¢, TWI-5 = 68.2

WMP up strongly especially in NZD; US data positive; EU jobless high but less; China factories weak, more 'reform'; UST 10yr yield 2.17%; oil lower, gold higher; NZ$1 = 63.4 US¢, TWI-5 = 67.8

2nd Sep 15, 7:25am

5

WMP up strongly especially in NZD; US data positive; EU jobless high but less; China factories weak, more 'reform'; UST 10yr yield 2.17%; oil lower, gold higher; NZ$1 = 63.4 US¢, TWI-5 = 67.8

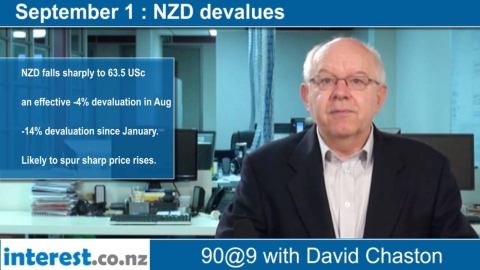

Oil prices jump; NZD slumps; Brazil in recession; Japan factory output falls; UST 10yr yield 2.18%; gold price unchanged; NZ$1 = 63.5 US¢, TWI-5 = 68

1st Sep 15, 7:22am

55

Oil prices jump; NZD slumps; Brazil in recession; Japan factory output falls; UST 10yr yield 2.18%; gold price unchanged; NZ$1 = 63.5 US¢, TWI-5 = 68

Fed claims rate hikes on track; US durables orders and confidence stay high; China defends crisis action; ACG gets high bid; UST 10yr yield 2.18%; oil and gold up; NZ$1 = 64.5 US¢, TWI-5 = 69.2

31st Aug 15, 7:00am

8

Fed claims rate hikes on track; US durables orders and confidence stay high; China defends crisis action; ACG gets high bid; UST 10yr yield 2.18%; oil and gold up; NZ$1 = 64.5 US¢, TWI-5 = 69.2

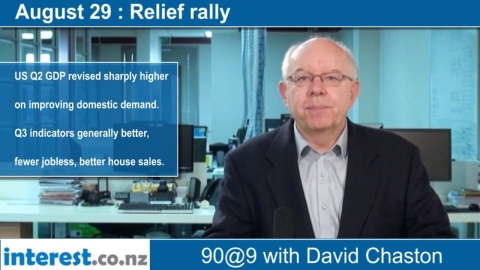

US Q2 growth surprises; Q3 indicators positive; But less drive for Sept rate hike; China blames US for share rout; UST 10yr yield 2.19%; oil higher, gold lower; NZ$1 = 64.7 US¢, TWI-5 = 69.1

28th Aug 15, 7:20am

15

US Q2 growth surprises; Q3 indicators positive; But less drive for Sept rate hike; China blames US for share rout; UST 10yr yield 2.19%; oil higher, gold lower; NZ$1 = 64.7 US¢, TWI-5 = 69.1