Oil

US Q2 growth surprises; Q3 indicators positive; But less drive for Sept rate hike; China blames US for share rout; UST 10yr yield 2.19%; oil higher, gold lower; NZ$1 = 64.7 US¢, TWI-5 = 69.1

28th Aug 15, 7:20am

15

US Q2 growth surprises; Q3 indicators positive; But less drive for Sept rate hike; China blames US for share rout; UST 10yr yield 2.19%; oil higher, gold lower; NZ$1 = 64.7 US¢, TWI-5 = 69.1

Shanghai Composite down, PBoC intervenes, US stocks rebound with solid data, Fed hike still "less compelling"; UST 10yr yield 2.13%; oil = US$39; NZ$1 = 64.3 US¢, TWI-5 = 68.9

27th Aug 15, 7:48am

4

Shanghai Composite down, PBoC intervenes, US stocks rebound with solid data, Fed hike still "less compelling"; UST 10yr yield 2.13%; oil = US$39; NZ$1 = 64.3 US¢, TWI-5 = 68.9

Chinese stocks plunge, PBoC cuts rates, US markets fail to rebound, NZ's TWI hits low; UST 10yr yield 2.10%; oil US$39/bbl; NZ$1 = 65.0 US¢, TWI-5 = 68.7

26th Aug 15, 8:17am

2

Chinese stocks plunge, PBoC cuts rates, US markets fail to rebound, NZ's TWI hits low; UST 10yr yield 2.10%; oil US$39/bbl; NZ$1 = 65.0 US¢, TWI-5 = 68.7

Global equity markets nosedive; China support measures fail; UST 10yr yield 2.01%; oil falls under US$38/bbl; NZ$1 = 65.2 US¢, TWI-5 = 68.9

25th Aug 15, 7:17am

46

Global equity markets nosedive; China support measures fail; UST 10yr yield 2.01%; oil falls under US$38/bbl; NZ$1 = 65.2 US¢, TWI-5 = 68.9

Volatility at 4 year high; factories slower; PBoC about to cut reserve ratio; China state pension funds released; UST 10yr yield 2.05%; commodity prices fall; gold rises; NZ$1 = 66.8 US¢, TWI-5 = 70.9

24th Aug 15, 7:10am

16

Volatility at 4 year high; factories slower; PBoC about to cut reserve ratio; China state pension funds released; UST 10yr yield 2.05%; commodity prices fall; gold rises; NZ$1 = 66.8 US¢, TWI-5 = 70.9

US house sales rise to 8-yr high, Tsipras calls snap election, wait for yuan to become a reserve currency extended; NZD = 66.3 US¢, TWI-5 = 70.7

21st Aug 15, 7:50am

26

US house sales rise to 8-yr high, Tsipras calls snap election, wait for yuan to become a reserve currency extended; NZD = 66.3 US¢, TWI-5 = 70.7

US Fed commits to rate hike; US CPI and wage data supportive; China stocks gyrate; Japan improves; RBA accuses banks of credit card gouging; oil sinks; NZ$1 = 66.2 US¢, TWI-5 = 70.7

20th Aug 15, 7:29am

25

US Fed commits to rate hike; US CPI and wage data supportive; China stocks gyrate; Japan improves; RBA accuses banks of credit card gouging; oil sinks; NZ$1 = 66.2 US¢, TWI-5 = 70.7

Dairy price rise beats expectations; US housing starts impress; Shanghai stocks slump again, EMs face huge capital outflow; Merkel faces rebellion; NZ$1 = 65.8 US¢, TWI-5 = 70.6

19th Aug 15, 7:13am

37

Dairy price rise beats expectations; US housing starts impress; Shanghai stocks slump again, EMs face huge capital outflow; Merkel faces rebellion; NZ$1 = 65.8 US¢, TWI-5 = 70.6

US housing stronger; Japan's economy contracts; EU posts modest growth; China ends devaluation; UST 10yr yield 2.16%; oil down; NZ$1 = 65.8 US¢, TWI-5 = 70.4

18th Aug 15, 7:27am

41

US housing stronger; Japan's economy contracts; EU posts modest growth; China ends devaluation; UST 10yr yield 2.16%; oil down; NZ$1 = 65.8 US¢, TWI-5 = 70.4

US factories growing; consumers hesitate; big forex civil claim settled; Pepsi launches China milk drink; UST 10yr yield up; oil down; NZ$1 = 65.3 US¢, TWI-5 = 69.9

17th Aug 15, 7:39am

21

US factories growing; consumers hesitate; big forex civil claim settled; Pepsi launches China milk drink; UST 10yr yield up; oil down; NZ$1 = 65.3 US¢, TWI-5 = 69.9

PBOC pledges yuan won't devalue more, AUS housing market expected to cool, US retail sales up, oil prices plummet; UST 10yr yield 2.16%; oil below US$42/barrel; NZ$1 = 65.7 US¢, TWI-5 = 70.2

14th Aug 15, 7:46am

9

PBOC pledges yuan won't devalue more, AUS housing market expected to cool, US retail sales up, oil prices plummet; UST 10yr yield 2.16%; oil below US$42/barrel; NZ$1 = 65.7 US¢, TWI-5 = 70.2

China adjusts yuan down again; US suspicious of 'currency war'; US labour market strong; RBA warns on house prices; UST 10yr yield 2.09%; oil and gold higher; NZ$1 = 66.1 US¢, TWI-5 = 70.6

13th Aug 15, 7:29am

18

China adjusts yuan down again; US suspicious of 'currency war'; US labour market strong; RBA warns on house prices; UST 10yr yield 2.09%; oil and gold higher; NZ$1 = 66.1 US¢, TWI-5 = 70.6

US productivity rises; China devalues; EU and Greece cement deal; AU confidence falls; Singapore growth sags; UST 10yr yield 2.13%; oil lower; NZ$1 = 65.3 US¢, TWI-5 = 70.1

12th Aug 15, 7:18am

20

US productivity rises; China devalues; EU and Greece cement deal; AU confidence falls; Singapore growth sags; UST 10yr yield 2.13%; oil lower; NZ$1 = 65.3 US¢, TWI-5 = 70.1

Key Fed members talk up rate rises; China shakes up their SOEs, using reserves to cover slowdown; Russia shrinks faster; UST 10yr yield 2.22%, oil and gold higher; NZ$1 = 66.2 US¢, TWI-5 = 70.8

11th Aug 15, 7:27am

3

Key Fed members talk up rate rises; China shakes up their SOEs, using reserves to cover slowdown; Russia shrinks faster; UST 10yr yield 2.22%, oil and gold higher; NZ$1 = 66.2 US¢, TWI-5 = 70.8

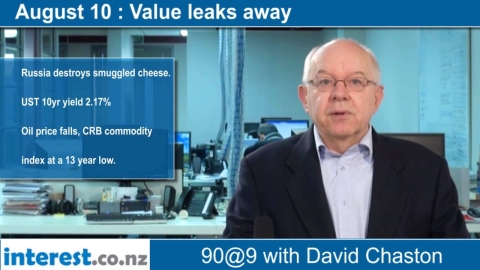

US jobs grow as expected; China exports tumble, producer prices sink further; Russia destroys food; UST 10yr yield 2.17%; AU banks shares shed value; NZ$1 = 66.2 US¢, TWI-5 = 71

10th Aug 15, 7:23am

26

US jobs grow as expected; China exports tumble, producer prices sink further; Russia destroys food; UST 10yr yield 2.17%; AU banks shares shed value; NZ$1 = 66.2 US¢, TWI-5 = 71

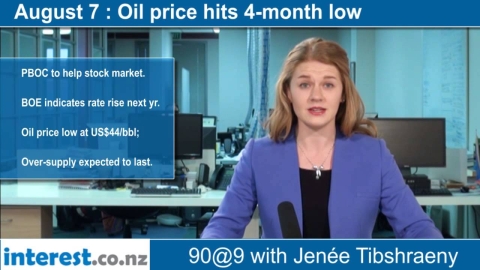

Jitters ahead of Fonterra's milk price forecast and US jobs report, oil price woes, PBOC helps stock market, Bank of England surprises markets; UST 10yr yield 2.23%; NZ$1 = 65.5 US¢, TWI-5 = 70.2

7th Aug 15, 7:56am

11

Jitters ahead of Fonterra's milk price forecast and US jobs report, oil price woes, PBOC helps stock market, Bank of England surprises markets; UST 10yr yield 2.23%; NZ$1 = 65.5 US¢, TWI-5 = 70.2

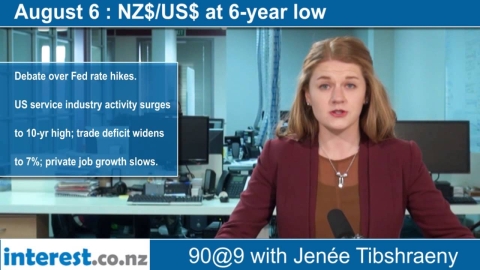

NZ$ low against US; US service industry activity surges, imports rise and private jobs growth slows; Greece upbeat on loan progress; UST 10yr yield 2.28%; NZ$1 = 65.2 US¢, TWI-5 = 70.3

6th Aug 15, 8:02am

3

NZ$ low against US; US service industry activity surges, imports rise and private jobs growth slows; Greece upbeat on loan progress; UST 10yr yield 2.28%; NZ$1 = 65.2 US¢, TWI-5 = 70.3

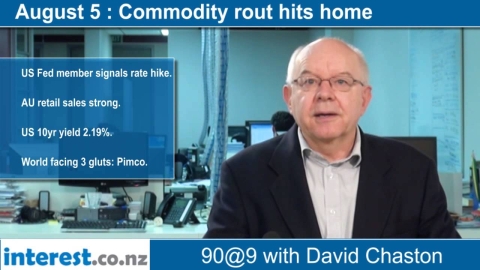

Dairy prices caving in; US factory orders rebound; Fed sends rate hike signal; Aussie retail sales surge; UST 10yr yield 2.19%; NZ$1 = 65.4 US¢, TWI-5 = 70.2

5th Aug 15, 7:32am

4

Dairy prices caving in; US factory orders rebound; Fed sends rate hike signal; Aussie retail sales surge; UST 10yr yield 2.19%; NZ$1 = 65.4 US¢, TWI-5 = 70.2

US savings rate rises, consumer spending grows; weak China data; UST 10yr yields down to 2.16%; oil and gold fall; NZ$1 = 65.9 US¢, TWI-5 = 70.9

4th Aug 15, 7:30am

3

US savings rate rises, consumer spending grows; weak China data; UST 10yr yields down to 2.16%; oil and gold fall; NZ$1 = 65.9 US¢, TWI-5 = 70.9

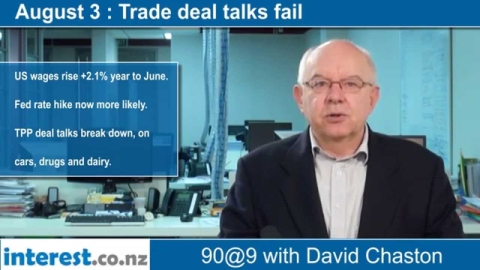

US wages rise, bolsters rate hike case; TPP talks break down; Russia cuts rates; iron ore price falls; UST 10yr yield down to 2.19%; oil lower, gold higher; NZ$1 = 65.9 US¢, TWI-5 = 70.8

3rd Aug 15, 7:26am

47

US wages rise, bolsters rate hike case; TPP talks break down; Russia cuts rates; iron ore price falls; UST 10yr yield down to 2.19%; oil lower, gold higher; NZ$1 = 65.9 US¢, TWI-5 = 70.8

US growth rises, jobless claims low; IMF wants haircut; TPP talks get hard; Aussie banking regulators warn; UST 10yr yield 2.27%; gold lower; NZ$1 = 65.9 US¢, TWI-5 = 71

31st Jul 15, 7:30am

12

US growth rises, jobless claims low; IMF wants haircut; TPP talks get hard; Aussie banking regulators warn; UST 10yr yield 2.27%; gold lower; NZ$1 = 65.9 US¢, TWI-5 = 71

Russian currency in turmoil, US economy overcomes first-quarter slowdown, IMF commends Chinese govt efforts to calm markets; UST 10yr yield increases, oil and gold prices in a slump; NZ$1 = 66.7 US¢, TWI-5 = 71.7

30th Jul 15, 7:45am

37

Russian currency in turmoil, US economy overcomes first-quarter slowdown, IMF commends Chinese govt efforts to calm markets; UST 10yr yield increases, oil and gold prices in a slump; NZ$1 = 66.7 US¢, TWI-5 = 71.7

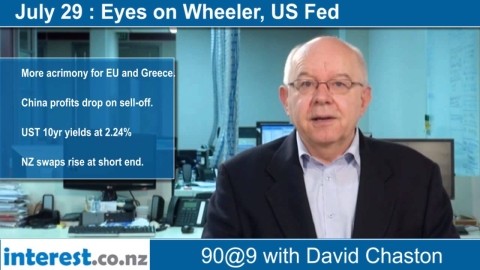

US confidence dented, but stocks higher; more Greek wrangling; China stocks stabilise; UST 10yr yield holds, as does oil and gold; copper falls; NZ$1 = 66.8 US¢, TWI-5 = 71.6

29th Jul 15, 7:36am

11

US confidence dented, but stocks higher; more Greek wrangling; China stocks stabilise; UST 10yr yield holds, as does oil and gold; copper falls; NZ$1 = 66.8 US¢, TWI-5 = 71.6

US durable goods orders jump; China shares tumble; China demographic crisis; older Aussies need to work; swap curves flatten; oil and gold down; NZ$1 = 66.1 US¢, TWI-5 = 70.8

28th Jul 15, 7:25am

17

US durable goods orders jump; China shares tumble; China demographic crisis; older Aussies need to work; swap curves flatten; oil and gold down; NZ$1 = 66.1 US¢, TWI-5 = 70.8

US new house building slows, factories busy; China PMI surprisingly weak; Singapore stutters; Australian AAA under threat; final TPP push; NZ$1 = 66.3 US¢, TWI-5 = 70.7

27th Jul 15, 7:00am

17

US new house building slows, factories busy; China PMI surprisingly weak; Singapore stutters; Australian AAA under threat; final TPP push; NZ$1 = 66.3 US¢, TWI-5 = 70.7