payments

New Zealand finally appears set for 24/7, 365 days a year retail payments

10th Feb 22, 7:14pm

New Zealand finally appears set for 24/7, 365 days a year retail payments

In a new consultation paper the Reserve Bank says that without a 'policy response' the cash system may be unable to meet its objectives

30th Nov 21, 2:00pm

24

In a new consultation paper the Reserve Bank says that without a 'policy response' the cash system may be unable to meet its objectives

Juniper Research details open banking use cases and challenges, sees turbo charged growth of payment transactions facilitated by open banking

12th Nov 21, 1:25pm

Juniper Research details open banking use cases and challenges, sees turbo charged growth of payment transactions facilitated by open banking

ANZ NZ chairman John Key says retail and central banks should use cryptocurrencies to improve the payments system in the face of competition from giant tech companies

7th Nov 21, 6:00am

56

ANZ NZ chairman John Key says retail and central banks should use cryptocurrencies to improve the payments system in the face of competition from giant tech companies

Having central bank digital currencies is a great idea. It's also fraught with difficulties including how to protect banks

7th Oct 21, 8:57am

54

Having central bank digital currencies is a great idea. It's also fraught with difficulties including how to protect banks

The Reserve Bank says, in the 'extreme' stablecoins could see the majority of transactions taking place in our economy occurring outside the domestic banking system

2nd Oct 21, 9:43am

5

The Reserve Bank says, in the 'extreme' stablecoins could see the majority of transactions taking place in our economy occurring outside the domestic banking system

RBNZ says a digital version of the Kiwi dollar would both support the value-anchor role of central bank money, and support its ability to act as a fair and equal way to pay and save

30th Sep 21, 9:00am

14

RBNZ says a digital version of the Kiwi dollar would both support the value-anchor role of central bank money, and support its ability to act as a fair and equal way to pay and save

Our central bank says emerging trends in the monetary system pose opportunities to stimulate innovation to enhance the prosperity and wellbeing of New Zealanders - but also pose credible threats to the stability and functioning of the monetary system

30th Sep 21, 9:00am

7

Our central bank says emerging trends in the monetary system pose opportunities to stimulate innovation to enhance the prosperity and wellbeing of New Zealanders - but also pose credible threats to the stability and functioning of the monetary system

Reserve Bank says it wants to ensure that our central bank money remains a stable value anchor for the monetary system and available as a fair and equal way to pay and save

30th Sep 21, 9:00am

51

Reserve Bank says it wants to ensure that our central bank money remains a stable value anchor for the monetary system and available as a fair and equal way to pay and save

Bank for International Settlements pushes central banks to get cracking with central bank digital currencies as Moody's warns they could be a credit negative for banks

13th Sep 21, 3:30pm

3

Bank for International Settlements pushes central banks to get cracking with central bank digital currencies as Moody's warns they could be a credit negative for banks

Government details more of its retail payments regulation plans including formal designation under law for Visa & Mastercard's networks, and regulating surcharging

10th Sep 21, 8:15am

6

Government details more of its retail payments regulation plans including formal designation under law for Visa & Mastercard's networks, and regulating surcharging

Westpac NZ subsidiary Red Bird Ventures prepares launch of open banking payments app 'Buck' which will be available to the customers of all NZ's major banks

19th Aug 21, 5:00am

30

Westpac NZ subsidiary Red Bird Ventures prepares launch of open banking payments app 'Buck' which will be available to the customers of all NZ's major banks

Buy now, pay later service providers tipped to replace banks as the dominant issuers of Visa and Mastercard cards

17th Aug 21, 10:08am

Buy now, pay later service providers tipped to replace banks as the dominant issuers of Visa and Mastercard cards

Square's swoop on Afterpay is a 'game-changing deal', addressing nearly all the issues Square faces as it strives to become 'a dominant payments ecosystem'

9th Aug 21, 12:14pm

1

Square's swoop on Afterpay is a 'game-changing deal', addressing nearly all the issues Square faces as it strives to become 'a dominant payments ecosystem'

Buy now, pay later service provider Afterpay set to be acquired by Jack Dorsey's Square in major payments sector acquisition

2nd Aug 21, 11:39am

10

Buy now, pay later service provider Afterpay set to be acquired by Jack Dorsey's Square in major payments sector acquisition

Time and again we've heard banks may be heading the way of the dinosaurs but they continue to thrive. Gareth Vaughan doesn't expect this to change anytime soon

20th Jul 21, 7:00am

19

Time and again we've heard banks may be heading the way of the dinosaurs but they continue to thrive. Gareth Vaughan doesn't expect this to change anytime soon

Westpac NZ set to launch regulation ready BNPL 'anywhere' service Bundll with Humm, and potentially buy up to 49% of the business

15th Jul 21, 10:04am

3

Westpac NZ set to launch regulation ready BNPL 'anywhere' service Bundll with Humm, and potentially buy up to 49% of the business

Economists with global researcher Capital Economics expect the first generation of Central Bank Digital Currencies will be designed to have as little impact on the existing financial system as possible

8th Jul 21, 10:49am

20

Economists with global researcher Capital Economics expect the first generation of Central Bank Digital Currencies will be designed to have as little impact on the existing financial system as possible

Andrew Haldane, the Bank of England's departing chief economist, argues central bank digital currencies could have both financial stability and monetary policy benefits

6th Jul 21, 6:14pm

22

Andrew Haldane, the Bank of England's departing chief economist, argues central bank digital currencies could have both financial stability and monetary policy benefits

Gareth Vaughan on the rise of contactless payments, the potential for IAG to be taken over, a long trip to nowhere, the great pandemic tipping boom & 'it's hard not to meme this stuff'

3rd Jul 21, 9:32am

8

Gareth Vaughan on the rise of contactless payments, the potential for IAG to be taken over, a long trip to nowhere, the great pandemic tipping boom & 'it's hard not to meme this stuff'

Reserve Bank to consult on, and test the perceived benefits and challenges of, a central bank digital currency

30th Jun 21, 10:48am

40

Reserve Bank to consult on, and test the perceived benefits and challenges of, a central bank digital currency

Bank for International Settlements teams with Swiss National Bank, Bank of France, Accenture and others in cross-border central bank digital currency experiment

11th Jun 21, 12:30pm

13

Bank for International Settlements teams with Swiss National Bank, Bank of France, Accenture and others in cross-border central bank digital currency experiment

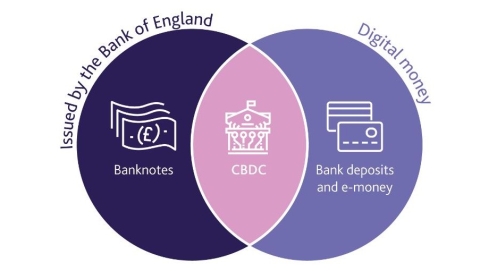

The nuts and bolts of how central bank digital currencies might operate and what they might mean

27th May 21, 6:27am

30

The nuts and bolts of how central bank digital currencies might operate and what they might mean

Gareth Vaughan looks at what merchant service fee regulation may mean for loyalty & rewards schemes, surcharging, and buy now pay later service providers, and why

16th May 21, 6:01am

22

Gareth Vaughan looks at what merchant service fee regulation may mean for loyalty & rewards schemes, surcharging, and buy now pay later service providers, and why

The Government details the Commerce Commission's proposed powers to regulate merchant service fees in a 'future-proofed' regulatory regime

13th May 21, 7:36am

The Government details the Commerce Commission's proposed powers to regulate merchant service fees in a 'future-proofed' regulatory regime