payments

Government to empower Commerce Commission to regulate fees charged by banks and card companies that are paid by retailers and other small businesses

12th May 21, 9:05am

16

Government to empower Commerce Commission to regulate fees charged by banks and card companies that are paid by retailers and other small businesses

Financial inclusion, payments stability, efficiency, and monetary policy implementation touted as benefits from central bank digital currencies

11th May 21, 10:00am

20

Financial inclusion, payments stability, efficiency, and monetary policy implementation touted as benefits from central bank digital currencies

Bank for International Settlements paper argues an approach combining financial regulation, competition policy and data privacy is required for regulating big tech's push into financial services

18th Mar 21, 10:08am

2

Bank for International Settlements paper argues an approach combining financial regulation, competition policy and data privacy is required for regulating big tech's push into financial services

Gareth Vaughan on whether COVID corporate winners should share their profits with COVID corporate losers, Dr Doom vs crypto-currency spruikers, central bank cryptos & Fed boss gets serious about unemployment

13th Feb 21, 9:31am

18

Gareth Vaughan on whether COVID corporate winners should share their profits with COVID corporate losers, Dr Doom vs crypto-currency spruikers, central bank cryptos & Fed boss gets serious about unemployment

Google Pay and banking-as-a-service business model seen making competitive landscape tougher for banks

28th Jan 21, 3:13pm

Google Pay and banking-as-a-service business model seen making competitive landscape tougher for banks

S&P expects central bank digital currencies to be developed in a way that enables financial institutions to continue to play a major role in the financial system

10th Dec 20, 4:37pm

2

S&P expects central bank digital currencies to be developed in a way that enables financial institutions to continue to play a major role in the financial system

Government outlines wide ranging merchant service fee regulation proposals including 'hard caps' on interchange fees

10th Dec 20, 12:08pm

2

Government outlines wide ranging merchant service fee regulation proposals including 'hard caps' on interchange fees

Macquarie analysts argue commercial banks and fintech will exist solely at the grace of central banks and their earnings will be determined by them

10th Dec 20, 6:11am

49

Macquarie analysts argue commercial banks and fintech will exist solely at the grace of central banks and their earnings will be determined by them

Discussion paper from Payments NZ details the 'building blocks' for a real-time payments system for the future

4th Nov 20, 9:34am

Discussion paper from Payments NZ details the 'building blocks' for a real-time payments system for the future

Reserve Bank's Geoff Bascand says the prudential regulator has seen 'instances and indicators of some vulnerability' in banks' payment systems

14th Oct 20, 9:48am

Reserve Bank's Geoff Bascand says the prudential regulator has seen 'instances and indicators of some vulnerability' in banks' payment systems

Labour pledges 'regulation of the price' as it eyes introduction of merchant service fee regulation in New Zealand, should it be returned to government in the October 17 election

9th Sep 20, 4:08pm

1

Labour pledges 'regulation of the price' as it eyes introduction of merchant service fee regulation in New Zealand, should it be returned to government in the October 17 election

Retail NZ and banks trumpet cuts in Visa & Mastercard interchange fees and merchants' contactless debit fees, but Commerce & Consumer Affairs Minister Kris Faafoi wants more competition

6th Aug 20, 9:34am

Retail NZ and banks trumpet cuts in Visa & Mastercard interchange fees and merchants' contactless debit fees, but Commerce & Consumer Affairs Minister Kris Faafoi wants more competition

Paymark increasing monthly Eftpos terminal fees by 28.6% from September to enable it to offer retailers 'the fastest, most secure mechanism for transferring funds'

1st Aug 20, 11:29am

15

Paymark increasing monthly Eftpos terminal fees by 28.6% from September to enable it to offer retailers 'the fastest, most secure mechanism for transferring funds'

Ian Woolford, who oversaw RBNZ's review of bank capital requirements, moves to new role as RBNZ's Head of Money and Cash

7th Jul 20, 11:17am

4

Ian Woolford, who oversaw RBNZ's review of bank capital requirements, moves to new role as RBNZ's Head of Money and Cash

Big banks starting to unwind COVID-19 inspired free contactless debit transactions for small business customers

26th Jun 20, 11:51am

23

Big banks starting to unwind COVID-19 inspired free contactless debit transactions for small business customers

The Bank for International Settlements reports that contactless payments have surged globally since the onset of Covid-19, but precautionary holdings of cash have risen as well

25th Jun 20, 9:37am

16

The Bank for International Settlements reports that contactless payments have surged globally since the onset of Covid-19, but precautionary holdings of cash have risen as well

Bernstein analysts look at why the pandemic inspired increases in non-cash payments and e-commerce are likely here to stay

11th Jun 20, 11:30am

Bernstein analysts look at why the pandemic inspired increases in non-cash payments and e-commerce are likely here to stay

Labour's government support partners would back regulation of retail payments as part of moves to stimulate the economy after the crushing impact of the COVID-19 pandemic

26th Apr 20, 7:31am

25

Labour's government support partners would back regulation of retail payments as part of moves to stimulate the economy after the crushing impact of the COVID-19 pandemic

In the fifth and final part of a series on New Zealand's retail payment systems Gareth Vaughan lays out a roadmap for regulating the retail payments sector and outlines why this should be done

16th Apr 20, 5:00am

8

In the fifth and final part of a series on New Zealand's retail payment systems Gareth Vaughan lays out a roadmap for regulating the retail payments sector and outlines why this should be done

In the fourth part of a series on NZ's retail payment systems, Gareth Vaughan looks at EFTPOS and COVID-19, and finds banks in charge of implementing some of the key technologies that could crimp their revenues

8th Apr 20, 10:00am

12

In the fourth part of a series on NZ's retail payment systems, Gareth Vaughan looks at EFTPOS and COVID-19, and finds banks in charge of implementing some of the key technologies that could crimp their revenues

In the third part of a series on NZ's retail payment systems, Gareth Vaughan looks at the complications of interchange & merchant service fees and finds a government minister still waving a regulatory stick

28th Mar 20, 10:32am

5

In the third part of a series on NZ's retail payment systems, Gareth Vaughan looks at the complications of interchange & merchant service fees and finds a government minister still waving a regulatory stick

In the second part of a series on NZ's retail payment systems, Gareth Vaughan looks at how New Zealand's regulatory oversight of retail payments is behind where Australia was at in 2001

22nd Mar 20, 8:40am

1

In the second part of a series on NZ's retail payment systems, Gareth Vaughan looks at how New Zealand's regulatory oversight of retail payments is behind where Australia was at in 2001

In the first part of a series on NZ's retail payment systems, Gareth Vaughan details the scale of key players Visa & Mastercard, looks at how & why they pay a miniscule amount of tax & how interchange works

21st Mar 20, 10:00am

6

In the first part of a series on NZ's retail payment systems, Gareth Vaughan details the scale of key players Visa & Mastercard, looks at how & why they pay a miniscule amount of tax & how interchange works

RBNZ says there's enough cash to 'meet demand under any circumstances' while banks and electronic payments systems are 'prepared, resilient, and will keep operating'

19th Mar 20, 3:50pm

9

RBNZ says there's enough cash to 'meet demand under any circumstances' while banks and electronic payments systems are 'prepared, resilient, and will keep operating'

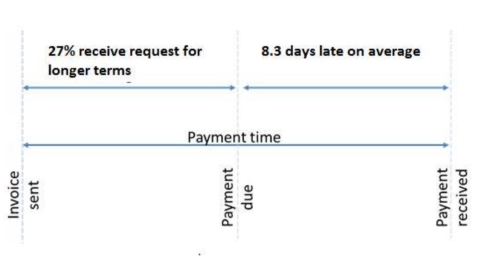

Minister for Small Business Stuart Nash 'prepared to legislate if necessary' to speed up late payments from large organisations to smaller suppliers

26th Feb 20, 10:11am

1

Minister for Small Business Stuart Nash 'prepared to legislate if necessary' to speed up late payments from large organisations to smaller suppliers