QE

Opposition leader and potential Finance Minister say they're 'shocked and appalled' Orr was reappointed Governor

8th Nov 22, 12:23pm

115

Opposition leader and potential Finance Minister say they're 'shocked and appalled' Orr was reappointed Governor

ASB economists say there is likely 'more upside' to wholesale interest rates, while the odds of an economic 'soft landing' are shrinking

17th Oct 22, 2:23pm

110

ASB economists say there is likely 'more upside' to wholesale interest rates, while the odds of an economic 'soft landing' are shrinking

David Hargreaves sees increasing signs the Reserve Bank will have to either raise the Official Cash Rate by more than it wants to - or concede some ground to inflation

13th Oct 22, 7:48am

65

David Hargreaves sees increasing signs the Reserve Bank will have to either raise the Official Cash Rate by more than it wants to - or concede some ground to inflation

David Hargreaves tries to get a sense of where we are in the battle with inflation - and how much more the Reserve Bank might need to do

6th Oct 22, 1:12pm

70

David Hargreaves tries to get a sense of where we are in the battle with inflation - and how much more the Reserve Bank might need to do

Reserve Bank has raised the Official Cash Rate to 3.5% - but gave serious consideration to a bigger hike

5th Oct 22, 2:03pm

122

Reserve Bank has raised the Official Cash Rate to 3.5% - but gave serious consideration to a bigger hike

National Leader rejects Reserve Bank suggestion that review of its performance by overseas independent experts is enough; says proper review needed before Orr gets second term

24th Aug 22, 10:27am

32

National Leader rejects Reserve Bank suggestion that review of its performance by overseas independent experts is enough; says proper review needed before Orr gets second term

Reserve Bank Assistant Governor Karen Silk says decisions on the desired 'neutral' level for interest rates aren't likely to be made till next year

24th Aug 22, 9:14am

31

Reserve Bank Assistant Governor Karen Silk says decisions on the desired 'neutral' level for interest rates aren't likely to be made till next year

Reserve Bank says there's no sign that higher servicing costs are as yet translating into substantive increases in the level of arrears or stress in commercial bank home lending portfolios

23rd Aug 22, 8:11am

24

Reserve Bank says there's no sign that higher servicing costs are as yet translating into substantive increases in the level of arrears or stress in commercial bank home lending portfolios

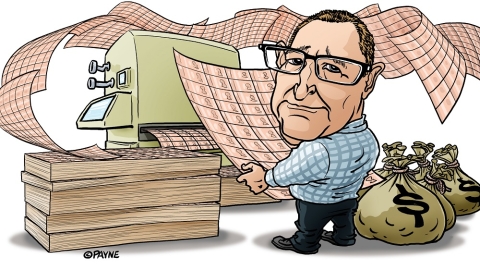

Reserve Bank defends use of quantitative easing, saying it did so because it was 'constrained' from taking the Official Cash Rate into the negatives

18th Aug 22, 9:19am

65

Reserve Bank defends use of quantitative easing, saying it did so because it was 'constrained' from taking the Official Cash Rate into the negatives

David Hargreaves has a crunch of inflation expectations in which he points out that getting people to predict what they think inflation will be in future is not about whether they can pick a correct number or not

10th Aug 22, 8:30am

61

David Hargreaves has a crunch of inflation expectations in which he points out that getting people to predict what they think inflation will be in future is not about whether they can pick a correct number or not

BNZ economists say one of the tricky aspects facing the RBNZ is the 'market' desire to price in interest rate cuts next year

9th Aug 22, 9:17am

67

BNZ economists say one of the tricky aspects facing the RBNZ is the 'market' desire to price in interest rate cuts next year

Influential RBNZ survey shows significant fall in expectations of inflation in two years time - but the fall is unlikely to deter the central bank from another 50 point OCR hike next week

8th Aug 22, 3:33pm

31

Influential RBNZ survey shows significant fall in expectations of inflation in two years time - but the fall is unlikely to deter the central bank from another 50 point OCR hike next week

TOP Leader Raf Manji says an inquiry into the RBNZ's Covid-19 response could help establish a blueprint for managing future crises

7th Aug 22, 6:00am

21

TOP Leader Raf Manji says an inquiry into the RBNZ's Covid-19 response could help establish a blueprint for managing future crises

BNZ Interest Rate Strategist Nick Smyth explains how financial markets are behaving in a recessionary manner

31st Jul 22, 11:10am

59

BNZ Interest Rate Strategist Nick Smyth explains how financial markets are behaving in a recessionary manner

Gareth Vaughan argues politics isn't the reason we should have a review, or inquiry, into the RBNZ's monetary policy response to the Covid-19 pandemic

29th Jul 22, 11:32am

74

Gareth Vaughan argues politics isn't the reason we should have a review, or inquiry, into the RBNZ's monetary policy response to the Covid-19 pandemic

Bernard Hickey suggests some terms of reference for a truly independent inquiry into the Reserve Bank's 'tidal wave of cash' unleashed in 2020 and 2021

28th Jul 22, 1:07pm

34

Bernard Hickey suggests some terms of reference for a truly independent inquiry into the Reserve Bank's 'tidal wave of cash' unleashed in 2020 and 2021

[updated]

National wants review of Reserve Bank's 'inflationary money printing' before decision on Governor's second term; Robertson rejects call from 'Captain Hindsight'

26th Jul 22, 3:56pm

86

National wants review of Reserve Bank's 'inflationary money printing' before decision on Governor's second term; Robertson rejects call from 'Captain Hindsight'

Gareth Vaughan on the missing profits of nations, the last taboo in central banking, the CBDC threat to ticket clippers, China's 'mountain of non-performing loans,' & the multi-billion dollar global illegal mining industry

26th Jul 22, 10:34am

46

Gareth Vaughan on the missing profits of nations, the last taboo in central banking, the CBDC threat to ticket clippers, China's 'mountain of non-performing loans,' & the multi-billion dollar global illegal mining industry

Reserve Bank may have lots of good company in the money-printing dog box, but that doesn't let it or the Government off the hook on inflation

21st Jul 22, 1:37pm

44

Reserve Bank may have lots of good company in the money-printing dog box, but that doesn't let it or the Government off the hook on inflation

As our Official Cash Rate is being increased at never-before-seen speed, David Hargreaves tries to make sense of it all and the potential repercussions

21st Jul 22, 1:24pm

65

As our Official Cash Rate is being increased at never-before-seen speed, David Hargreaves tries to make sense of it all and the potential repercussions

The Bank for International Settlements, the central banks' bank, says governments are more to blame for high inflation than central banks

12th Jul 22, 3:37pm

The Bank for International Settlements, the central banks' bank, says governments are more to blame for high inflation than central banks

Ex-RBNZ Deputy Governor and Acting Governor Grant Spencer says the RBNZ should've started increasing the OCR sooner to combat inflation, gives his outlook for inflation

17th Jun 22, 12:57pm

54

Ex-RBNZ Deputy Governor and Acting Governor Grant Spencer says the RBNZ should've started increasing the OCR sooner to combat inflation, gives his outlook for inflation

Gareth Vaughan on container shipping topping FANG profits, Argentina's lithium, the Brazilianization of the world & a special case of helicopter money

28th May 22, 9:59am

26

Gareth Vaughan on container shipping topping FANG profits, Argentina's lithium, the Brazilianization of the world & a special case of helicopter money

Influential RBNZ survey shows that even though the central bank has already hiked interest rates to fight inflation, people believe that high inflation is going to be with us for quite some time

12th May 22, 3:21pm

34

Influential RBNZ survey shows that even though the central bank has already hiked interest rates to fight inflation, people believe that high inflation is going to be with us for quite some time

Rising interest rates could see government suffer a $5 billion loss from the Reserve Bank's QE programme

22nd Mar 22, 4:53pm

69

Rising interest rates could see government suffer a $5 billion loss from the Reserve Bank's QE programme