QE

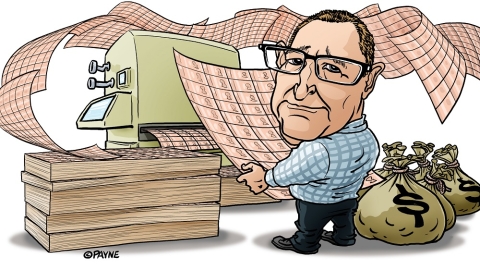

Rising interest rates could see government suffer a $5 billion loss from the Reserve Bank's QE programme

22nd Mar 22, 4:53pm

69

Rising interest rates could see government suffer a $5 billion loss from the Reserve Bank's QE programme

Chris Leitch argues the RBNZ's $53 billion government bond buying programme has proven to be nonsensical madness favouring commercial banks over taxpayers

8th Mar 22, 11:25am

20

Chris Leitch argues the RBNZ's $53 billion government bond buying programme has proven to be nonsensical madness favouring commercial banks over taxpayers

Harbour Asset Management's Mark Brown says some interesting interpretations can be inferred from the signals embedded in yield curves

16th Feb 22, 9:25am

6

Harbour Asset Management's Mark Brown says some interesting interpretations can be inferred from the signals embedded in yield curves

TOP's Raf Manji on UBI, land value tax, monetary financing and more

Government will probably have to issue more debt than planned to help the Reserve Bank downsize its $54 billion bond portfolio - BNZ strategist

7th Feb 22, 7:30am

41

Government will probably have to issue more debt than planned to help the Reserve Bank downsize its $54 billion bond portfolio - BNZ strategist

Central banks are carrying heavily loaded balance sheets after coming to the rescue in the GFC and now the pandemic. Now they want to end the piling-on. We assess how much they are carrying and how the loads compare

27th Jan 22, 10:18am

21

Central banks are carrying heavily loaded balance sheets after coming to the rescue in the GFC and now the pandemic. Now they want to end the piling-on. We assess how much they are carrying and how the loads compare

Harbour Asset Management's Hamish Pepper & Chris Di Leva look at the Top 10 risks and opportunities for 2022

19th Dec 21, 7:39am

79

Harbour Asset Management's Hamish Pepper & Chris Di Leva look at the Top 10 risks and opportunities for 2022

How Treasury and the Reserve Bank could work together to remove billions of dollars from the financial system

13th Dec 21, 3:05pm

53

How Treasury and the Reserve Bank could work together to remove billions of dollars from the financial system

RBNZ Chief Economist says Omicron hasn't changed the Bank's outlook; Points out that if the RBNZ decides to sell its NZ Government Bonds, the Government will need to be the buyer

29th Nov 21, 8:03pm

17

RBNZ Chief Economist says Omicron hasn't changed the Bank's outlook; Points out that if the RBNZ decides to sell its NZ Government Bonds, the Government will need to be the buyer

David Hargreaves crunches some facts and numbers and worries about what might be ahead in 2022

23rd Nov 21, 2:29pm

72

David Hargreaves crunches some facts and numbers and worries about what might be ahead in 2022

The RBNZ's own much-watched Survey of Expectations shows that inflation's expected to be around 3% in two years time; survey results may spark increased speculation of a 50 basis point lift to the Official Cash Rate next week

18th Nov 21, 3:24pm

23

The RBNZ's own much-watched Survey of Expectations shows that inflation's expected to be around 3% in two years time; survey results may spark increased speculation of a 50 basis point lift to the Official Cash Rate next week

Gareth Vaughan mulls whether our banks' strong profits in a time of Covid-19 induced upheaval warrant a one-off Covid tax

14th Nov 21, 6:00am

78

Gareth Vaughan mulls whether our banks' strong profits in a time of Covid-19 induced upheaval warrant a one-off Covid tax

Geoff Bascand says the health of business, household and bank balance sheets going into the pandemic played a very important role in the better than expected outcomes

14th Oct 21, 2:04pm

20

Geoff Bascand says the health of business, household and bank balance sheets going into the pandemic played a very important role in the better than expected outcomes

The RBNZ's own much-watched Survey of Expectations has revealed another lift in the anticipated level of inflation in two years' time from 2.05% to 2.27%

12th Aug 21, 3:10pm

25

The RBNZ's own much-watched Survey of Expectations has revealed another lift in the anticipated level of inflation in two years' time from 2.05% to 2.27%

Savings are stranded as inflation rises much faster than yields, and asset holders grab the benefits of low yields at the expense of savers. This type of financial repression is likely to persist for decades, possibly provoking anger for change

10th Aug 21, 11:25am

28

Savings are stranded as inflation rises much faster than yields, and asset holders grab the benefits of low yields at the expense of savers. This type of financial repression is likely to persist for decades, possibly provoking anger for change

Chris Leitch argues that returning to economic orthodoxy is like going back to the horse and cart

3rd Aug 21, 9:56am

14

Chris Leitch argues that returning to economic orthodoxy is like going back to the horse and cart

Inflation targeting architect Arthur Grimes says RBNZ should target lower inflation and house prices, as the status quo has caused a 'wellbeing disaster'

20th Jul 21, 10:40am

102

Inflation targeting architect Arthur Grimes says RBNZ should target lower inflation and house prices, as the status quo has caused a 'wellbeing disaster'

Reserve Bank to halt bond-buying using newly printed money by next week; OCR and Funding for Lending Programme unchanged

14th Jul 21, 2:13pm

48

Reserve Bank to halt bond-buying using newly printed money by next week; OCR and Funding for Lending Programme unchanged

Economists at the four biggest banks now all see the Reserve Bank starting to hike interest rates in November

7th Jul 21, 1:14pm

55

Economists at the four biggest banks now all see the Reserve Bank starting to hike interest rates in November

ANZ economists say the economy is running so hot the Reserve Bank's 'path of least regret' is morphing into tightening monetary policy sooner 'to head off excesses'

28th Jun 21, 3:28pm

26

ANZ economists say the economy is running so hot the Reserve Bank's 'path of least regret' is morphing into tightening monetary policy sooner 'to head off excesses'

BNZ economists now expect a 0.8% rise in GDP for the March quarter against the Reserve Bank's expectation of a -0.6% fall. They currently forecast inflation of 3% 'but evidence is gathering to move this higher'

10th Jun 21, 11:27am

13

BNZ economists now expect a 0.8% rise in GDP for the March quarter against the Reserve Bank's expectation of a -0.6% fall. They currently forecast inflation of 3% 'but evidence is gathering to move this higher'

Economists at the country's biggest mortgage lender suggest borrowers consider fixing 'at least a portion' of their mortgages for longer terms

9th Jun 21, 3:18pm

12

Economists at the country's biggest mortgage lender suggest borrowers consider fixing 'at least a portion' of their mortgages for longer terms

Deutsche Bank economists say policy makers could be facing their most challenging time in about 40 years

8th Jun 21, 12:41pm

43

Deutsche Bank economists say policy makers could be facing their most challenging time in about 40 years

Kiwibank economists, who are forecasting a first Official Cash Rate rise in May next year, now see a 'risk' of three rate hikes in 2022

1st Jun 21, 1:26pm

53

Kiwibank economists, who are forecasting a first Official Cash Rate rise in May next year, now see a 'risk' of three rate hikes in 2022

The Reserve Bank has provided the 'Go' signal for financial markets to start pushing up interest rates and the Kiwi dollar

27th May 21, 2:47pm

53

The Reserve Bank has provided the 'Go' signal for financial markets to start pushing up interest rates and the Kiwi dollar