Savings

Government review of KiwiSaver default provider arrangements probes potential support for New Zealand capital markets development, fee reductions and more

14th Aug 19, 5:09pm

7

Government review of KiwiSaver default provider arrangements probes potential support for New Zealand capital markets development, fee reductions and more

With interest rates down and seemingly heading ever lower, David Hargreaves ponders how long the remarkable restraint being shown by the New Zealand public will last for

2nd Aug 19, 10:00am

35

With interest rates down and seemingly heading ever lower, David Hargreaves ponders how long the remarkable restraint being shown by the New Zealand public will last for

Latest Reserve Bank figures show that annual mortgage growth has slowed for the first time since last November

31st Jul 19, 3:44pm

33

Latest Reserve Bank figures show that annual mortgage growth has slowed for the first time since last November

IRD now says over half a million kiwis in schemes such as Kiwisaver were on the wrong tax rate and will collectively be billed a total of between $45-50 million

19th Jun 19, 12:54pm

8

IRD now says over half a million kiwis in schemes such as Kiwisaver were on the wrong tax rate and will collectively be billed a total of between $45-50 million

New Reserve Bank lending by borrower type figures show lowest March borrowing total since at least 2015, but the First Home Buyers are still out and about

29th Apr 19, 3:34pm

15

New Reserve Bank lending by borrower type figures show lowest March borrowing total since at least 2015, but the First Home Buyers are still out and about

Home Funding Group faces Commerce Commission action for allegedly claiming it was offering a savings scheme when clients were instead paying for mortgage brokering and financial coaching

10th Apr 19, 11:44am

Home Funding Group faces Commerce Commission action for allegedly claiming it was offering a savings scheme when clients were instead paying for mortgage brokering and financial coaching

While wannabe first home buyers face borrowing eye watering amounts of money just to get into a home, the money they borrow IS at least getting cheaper, thanks to falling interest rates. Is this a trap or an opportunity?

2nd Apr 19, 11:23am

60

While wannabe first home buyers face borrowing eye watering amounts of money just to get into a home, the money they borrow IS at least getting cheaper, thanks to falling interest rates. Is this a trap or an opportunity?

Two months after the Reserve Bank relaxed lending rules for banks there's no sign of a rush for high loan to value ratio loans - meaning the RBNZ may be encouraged to relax the rules again

27th Mar 19, 11:37am

6

Two months after the Reserve Bank relaxed lending rules for banks there's no sign of a rush for high loan to value ratio loans - meaning the RBNZ may be encouraged to relax the rules again

Latest Reserve Bank monthly figures show mortgage credit growth remains above 6%, while agricultural and business credit are rising again but consumer credit is falling

28th Feb 19, 3:29pm

7

Latest Reserve Bank monthly figures show mortgage credit growth remains above 6%, while agricultural and business credit are rising again but consumer credit is falling

Latest Reserve Bank figures show first home buyers getting a record high share of new mortgage money for the second consecutive month

27th Feb 19, 3:47pm

63

Latest Reserve Bank figures show first home buyers getting a record high share of new mortgage money for the second consecutive month

FMA plans more work on KiwiSaver fees, says eye will be on the conduct of default providers ahead of the next round of default appointments

13th Feb 19, 4:16pm

2

FMA plans more work on KiwiSaver fees, says eye will be on the conduct of default providers ahead of the next round of default appointments

David Hargreaves ponders the unanswerable question of how much money is desirable for a comfortable retirement

11th Feb 19, 1:54pm

68

David Hargreaves ponders the unanswerable question of how much money is desirable for a comfortable retirement

Latest Reserve Bank monthly figures show mortgage credit growth remains above 6%, while non-bank lending has surged in the past month

31st Jan 19, 3:43pm

7

Latest Reserve Bank monthly figures show mortgage credit growth remains above 6%, while non-bank lending has surged in the past month

Latest Reserve Bank monthly figures show first home buyers getting a record high share of new mortgage money last month

29th Jan 19, 3:50pm

79

Latest Reserve Bank monthly figures show first home buyers getting a record high share of new mortgage money last month

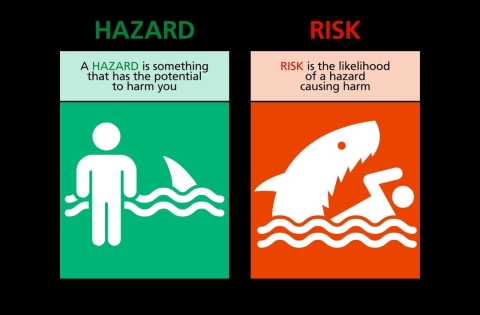

We look at some key data available from the RBNZ Dashboard to help investors and depositors in our banks understand where some important hazards lie

9th Jan 19, 12:00pm

79

We look at some key data available from the RBNZ Dashboard to help investors and depositors in our banks understand where some important hazards lie

Latest Reserve Bank monthly figures show the share of borrowing by the housing investor is continuing to drop sharply to new lows

20th Dec 18, 3:30pm

47

Latest Reserve Bank monthly figures show the share of borrowing by the housing investor is continuing to drop sharply to new lows

The NZX warns against the introduction of a capital gains tax on NZ shares, saying it could uneven the playing field between those who invest in the market directly and indirectly through the likes of KiwiSaver

19th Nov 18, 4:58pm

23

The NZX warns against the introduction of a capital gains tax on NZ shares, saying it could uneven the playing field between those who invest in the market directly and indirectly through the likes of KiwiSaver

Latest Reserve Bank monthly figures show declines in the rate of annual borrowing growth across the personal, housing, business and agricultural sectors

31st Oct 18, 3:32pm

30

Latest Reserve Bank monthly figures show declines in the rate of annual borrowing growth across the personal, housing, business and agricultural sectors

Michael Littlewood argues Tax Working Group members must ask themselves whether KiwiSaver has lifted NZ's overall savings & if its tax subsidies are worth it

25th Oct 18, 10:42am

41

Michael Littlewood argues Tax Working Group members must ask themselves whether KiwiSaver has lifted NZ's overall savings & if its tax subsidies are worth it

Ratings agency Moody's says the financial performance of our banks will continue to compare favourably with peers in other countries over the next 12-18 months despite slower credit growth and rising wholesale funding costs

4th Oct 18, 3:49pm

11

Ratings agency Moody's says the financial performance of our banks will continue to compare favourably with peers in other countries over the next 12-18 months despite slower credit growth and rising wholesale funding costs

Chairman Michael Cullen says the Tax Working Group will be as detailed as possible to combat political attacks through 'mischief by misrepresentation'

24th Sep 18, 2:22pm

42

Chairman Michael Cullen says the Tax Working Group will be as detailed as possible to combat political attacks through 'mischief by misrepresentation'

Although intertwined with the issue of capital gains, finding a fairer treatment for retirement savings is arguably the most important objective for the TWG, says Terry Baucher

24th Sep 18, 9:39am

46

Although intertwined with the issue of capital gains, finding a fairer treatment for retirement savings is arguably the most important objective for the TWG, says Terry Baucher

Tax Working Group Chairman Michael Cullen on taxing capital gains, environmental taxes, incentives for retirement savings & applying GST to financial services

22nd Sep 18, 5:00am

15

Tax Working Group Chairman Michael Cullen on taxing capital gains, environmental taxes, incentives for retirement savings & applying GST to financial services

Crikey! Falling business investment is a serious threat to term deposit savers. The last time business loan demand slumped, TD returns fell -0.5%. If that happens this time, we would be at record lows

3rd Sep 18, 11:57am

64

Crikey! Falling business investment is a serious threat to term deposit savers. The last time business loan demand slumped, TD returns fell -0.5%. If that happens this time, we would be at record lows

Liz Kendall and Miles Workman look at the Top 10 things keeping ANZ economists up at night, which include expensive houses, underwhelming productivity, the cost of an ageing population, anxious businesses and more

20th Jul 18, 10:00am

6

Liz Kendall and Miles Workman look at the Top 10 things keeping ANZ economists up at night, which include expensive houses, underwhelming productivity, the cost of an ageing population, anxious businesses and more