GlobalDairyTrade auction

Dairy prices hold; IMF trims world growth guess; China slows; Germans less optimistic; Oil jump; UST 10yr yield 2.05%; oil and gold unchanged; NZ$1 = 64.9 US¢, TWI-5 = 70.6

20th Jan 16, 7:33am

17

Dairy prices hold; IMF trims world growth guess; China slows; Germans less optimistic; Oil jump; UST 10yr yield 2.05%; oil and gold unchanged; NZ$1 = 64.9 US¢, TWI-5 = 70.6

Oil dips; France declares 'social emergency'; more markets near bear territory; NAB talks up Clydesdale IPO; CDS spreads jump; gold marks time; NZ$1 = 64.4 US¢, TWI-5 = 70.2

19th Jan 16, 7:41am

5

Oil dips; France declares 'social emergency'; more markets near bear territory; NAB talks up Clydesdale IPO; CDS spreads jump; gold marks time; NZ$1 = 64.4 US¢, TWI-5 = 70.2

Oil under US$29/bbl; UST 10yr yield 2.04%; gold up; Wall Street takes big hit; China's 'National Team' can't halt slide; EMs look at money printing; NZ$1 = 64.7 US¢, TWI-5 = 70.4

18th Jan 16, 7:27am

37

Oil under US$29/bbl; UST 10yr yield 2.04%; gold up; Wall Street takes big hit; China's 'National Team' can't halt slide; EMs look at money printing; NZ$1 = 64.7 US¢, TWI-5 = 70.4

Indonesia, Korea and the UK all review rates; German growth rises; US prices fall; ANZ accused of dodgy behaviour by dealers; UST 10yr yield 2.07%; oil up, gold down; NZ$1 = 64.7 US¢, TWI-5 = 70.3

15th Jan 16, 7:24am

30

Indonesia, Korea and the UK all review rates; German growth rises; US prices fall; ANZ accused of dodgy behaviour by dealers; UST 10yr yield 2.07%; oil up, gold down; NZ$1 = 64.7 US¢, TWI-5 = 70.3

US mortgage applications jump; US targets cash laundering through property; China exports surprise; UST 10yr yield 2.13%; oil down, gold; NZ$1 = 65.6 US¢, TWI-5 = 71.2

14th Jan 16, 7:34am

16

US mortgage applications jump; US targets cash laundering through property; China exports surprise; UST 10yr yield 2.13%; oil down, gold; NZ$1 = 65.6 US¢, TWI-5 = 71.2

US Crude oil reaches new 12-year low; copper sinks to 6-year low; PBoC ups defence of yuan; UST 10yr yield 2.13%; oil and gold fall; NZ$1 = 65.4 US¢, TWI-5 = 70.9

13th Jan 16, 8:10am

28

US Crude oil reaches new 12-year low; copper sinks to 6-year low; PBoC ups defence of yuan; UST 10yr yield 2.13%; oil and gold fall; NZ$1 = 65.4 US¢, TWI-5 = 70.9

Oil price slumps on China share falls; air freight volumes rising; NZ winner in TPP; US Fed pays huge dividend; UST 10yr yield 2.18%; oil and gold fall; NZ$1 = 65.5 US¢, TWI-5 = 71

12th Jan 16, 7:34am

50

Oil price slumps on China share falls; air freight volumes rising; NZ winner in TPP; US Fed pays huge dividend; UST 10yr yield 2.18%; oil and gold fall; NZ$1 = 65.5 US¢, TWI-5 = 71

US non-farm payrolls rise almost +300,000; US inventories fall; SEC faults credit raters; China CPI rises; UST 10yr yield 2.12%; oil and gold fall; NZ$1 = 65.4 US¢, TWI-5 = 70.9

11th Jan 16, 7:13am

27

US non-farm payrolls rise almost +300,000; US inventories fall; SEC faults credit raters; China CPI rises; UST 10yr yield 2.12%; oil and gold fall; NZ$1 = 65.4 US¢, TWI-5 = 70.9

Brent crude falls to US$36/bbl, PwC warns banks may struggle to sustain record profits, European bankers in for more job losses ; UST 10yr yield 2.19%; oil hits rock bottom; NZ$1 = 67.7 US¢, TWI-5 = 73.1

22nd Dec 15, 8:09am

12

Brent crude falls to US$36/bbl, PwC warns banks may struggle to sustain record profits, European bankers in for more job losses ; UST 10yr yield 2.19%; oil hits rock bottom; NZ$1 = 67.7 US¢, TWI-5 = 73.1

WTO levels playing field in agri export sector; NZ-Korea FTA cuts tariffs on nearly half our exports; Emerging economies closer to getting more IMF power; UST 10yr yield 2.20%; oil down; NZ$1 = 67.4 US¢, TWI-5 = 72.9

21st Dec 15, 8:06am

1

WTO levels playing field in agri export sector; NZ-Korea FTA cuts tariffs on nearly half our exports; Emerging economies closer to getting more IMF power; UST 10yr yield 2.20%; oil down; NZ$1 = 67.4 US¢, TWI-5 = 72.9

US jobless claims fall; IMF boss to face trial; Aust. corporate tax details revealed; English says RBNZ partly to blame; UST 10yr yield 2.30%; oil and gold tumble; NZ$1 = 66.9 US¢, TWI-5 = 72.7

18th Dec 15, 7:25am

30

US jobless claims fall; IMF boss to face trial; Aust. corporate tax details revealed; English says RBNZ partly to blame; UST 10yr yield 2.30%; oil and gold tumble; NZ$1 = 66.9 US¢, TWI-5 = 72.7

US Fed lists rates first time in almost 10yrs; US housing surges; Eurozone economy improves; China expects +6.8% growth; oil prices still falling; UST 10yr yield 2.30%; NZ$1 = 67.7 US¢, TWI-5 = 73

17th Dec 15, 7:12am

27

US Fed lists rates first time in almost 10yrs; US housing surges; Eurozone economy improves; China expects +6.8% growth; oil prices still falling; UST 10yr yield 2.30%; NZ$1 = 67.7 US¢, TWI-5 = 73

Dairy prices hold; US inflation rises; Aussie deficits grow; markets awaiting Fed hike; oil steadies, gold slips; UST 10yr yield 2.27%; NZ$1 = 67.5 US¢, TWI-5 = 72.8

16th Dec 15, 7:22am

17

Dairy prices hold; US inflation rises; Aussie deficits grow; markets awaiting Fed hike; oil steadies, gold slips; UST 10yr yield 2.27%; NZ$1 = 67.5 US¢, TWI-5 = 72.8

Liquidity problems in junk bond markets; China fiscal revenues rise; China needs more mega cities; fear in oil markets; UST 10yr yield 2.18%; NZ$1 = 67.8 US¢, TWI-5 = 72.7

15th Dec 15, 7:20am

5

Liquidity problems in junk bond markets; China fiscal revenues rise; China needs more mega cities; fear in oil markets; UST 10yr yield 2.18%; NZ$1 = 67.8 US¢, TWI-5 = 72.7

Climate deal requires $20 tln; US data good; China data mixed; worries over derivative risk; China signals Yuan depreciation; UST 10yr yield 2.13%; NZ$1 = 67.2 US¢, TWI-5 = 72.3

14th Dec 15, 7:22am

18

Climate deal requires $20 tln; US data good; China data mixed; worries over derivative risk; China signals Yuan depreciation; UST 10yr yield 2.13%; NZ$1 = 67.2 US¢, TWI-5 = 72.3

American household wealth dips; China car sales surge; shipping industry downgraded; Woolworths in court over unconscionable behaviour; UST 10yr yield 2.22%; NZ$1 = 67.6 US¢, TWI-5 = 72.6

11th Dec 15, 7:25am

11

American household wealth dips; China car sales surge; shipping industry downgraded; Woolworths in court over unconscionable behaviour; UST 10yr yield 2.22%; NZ$1 = 67.6 US¢, TWI-5 = 72.6

Value of investor housing loans falls 6% in Australia; China inflation figures disappoint; US GDP hit by fall in wholesale inventories; UST 10yr yield 2.24%; oil & gold remain low; NZ$1 = 66.2 US¢, TWI-5 = 71.4

10th Dec 15, 7:29am

4

Value of investor housing loans falls 6% in Australia; China inflation figures disappoint; US GDP hit by fall in wholesale inventories; UST 10yr yield 2.24%; oil & gold remain low; NZ$1 = 66.2 US¢, TWI-5 = 71.4

Miners scramble to respond to changing China demand; China exports and imports tumble; Aussie business confidence rises; oil lower again; UST 10yr yield 2.22%; NZ$1 = 66.4 US¢, TWI-5 = 71.8

9th Dec 15, 7:30am

16

Miners scramble to respond to changing China demand; China exports and imports tumble; Aussie business confidence rises; oil lower again; UST 10yr yield 2.22%; NZ$1 = 66.4 US¢, TWI-5 = 71.8

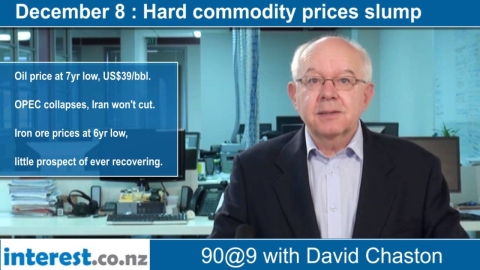

Oil prices hit 7yr low; iron ore prices hit 6yr low; Beijing on 'Red Alert'; China fx outflows quicken; UST 10yr yield 2.26%; NZ$1 = 66.5 US¢, TWI-5 = 71.8

8th Dec 15, 7:23am

12

Oil prices hit 7yr low; iron ore prices hit 6yr low; Beijing on 'Red Alert'; China fx outflows quicken; UST 10yr yield 2.26%; NZ$1 = 66.5 US¢, TWI-5 = 71.8

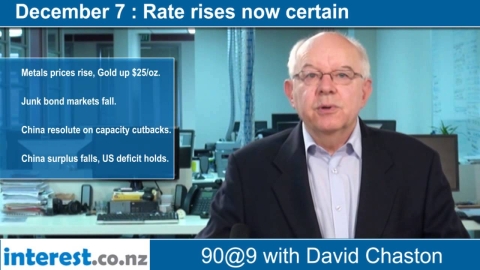

BIS supports rising rates; strong US non-farm payrolls report; many metals prices jump; low-rate companies and countries fall; oil under $40 on Iran position; UST 10yr yield 2.27%; NZ$1 = 67.5 US¢, TWI-5 = 72.6

7th Dec 15, 7:31am

14

BIS supports rising rates; strong US non-farm payrolls report; many metals prices jump; low-rate companies and countries fall; oil under $40 on Iran position; UST 10yr yield 2.27%; NZ$1 = 67.5 US¢, TWI-5 = 72.6

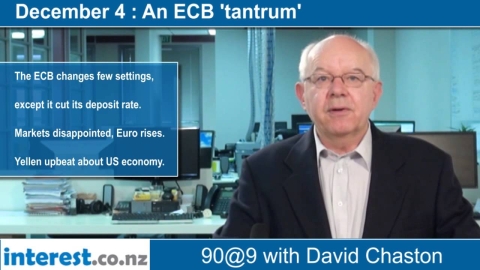

Draghi disappoints with minimum action; Yellen upbeat about US economy; air travel growing very strongly; UST 10yr yield 2.27%; oil and gold prices stable; NZ$1 = 66.4 US¢, TWI-5 = 71.4

4th Dec 15, 7:29am

12

Draghi disappoints with minimum action; Yellen upbeat about US economy; air travel growing very strongly; UST 10yr yield 2.27%; oil and gold prices stable; NZ$1 = 66.4 US¢, TWI-5 = 71.4

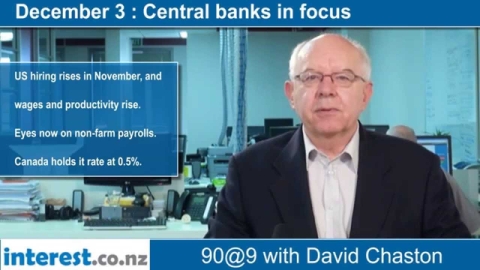

Hiring and wages up in the US; Canada holds its rate; banknote printer downsizes; China hacks Aussie supercomputer; oil production high; UST 10yr yield 2.19%; oil and gold prices lower; NZ$1 = 66.3 US¢, TWI-5 = 72.1

3rd Dec 15, 7:30am

2

Hiring and wages up in the US; Canada holds its rate; banknote printer downsizes; China hacks Aussie supercomputer; oil production high; UST 10yr yield 2.19%; oil and gold prices lower; NZ$1 = 66.3 US¢, TWI-5 = 72.1

Dairy prices rise 3.6% at GDT auction; US manufacturing contracts for first time in years; US car sales on track to reaching record highs; UST 10yr yield 2.18%; oil and gold stable; NZ$1 = 66.7 US¢, TWI-5 = 72.4

2nd Dec 15, 7:47am

10

Dairy prices rise 3.6% at GDT auction; US manufacturing contracts for first time in years; US car sales on track to reaching record highs; UST 10yr yield 2.18%; oil and gold stable; NZ$1 = 66.7 US¢, TWI-5 = 72.4

Dairy's down but don't panic... New Zealand's economy is still in the middle of the pack across the OECD, says HSBC's Paul Bloxham

6th Oct 15, 4:17pm

6

Dairy's down but don't panic... New Zealand's economy is still in the middle of the pack across the OECD, says HSBC's Paul Bloxham

Economists say further dairy supply cutbacks and increased demand from China are needed to pull prices out of the dumps; ASB calls for Fonterra to provide evidence it's cutting production

19th Aug 15, 10:32am

29

Economists say further dairy supply cutbacks and increased demand from China are needed to pull prices out of the dumps; ASB calls for Fonterra to provide evidence it's cutting production