The international news and economic impact on the NZ dollar turned positive again over this last weekend, with US President Donald Trump and Chinese Premier Xi Jinping meeting and agreeing to re-start their trade negotiations.

The Kiwi was sold down to its lows of 0.6500 in May when the trade talks blew up in disagreements on how far the US pushed into Chinese domestic economic policies.

The prospect of the global economy weakening under acrimonious trade wars has significantly reduced after the Trump/Xi weekend meeting at the G20 in Osaka, Japan. Escalation in tariffs and restricted access into key export markets is always negative for the New Zealand economy and thus the NZ dollar.

Weaker global demand from a slower global economy is always unfavourable news for a commodity and growth currency like the Kiwi dollar.

That particular risk for the Kiwi dollar has not been totally removed, however, the news coming out of Osaka does pave the way for further gains as global financial and investment market breathe a sigh of relief and international trade faces less disruption.

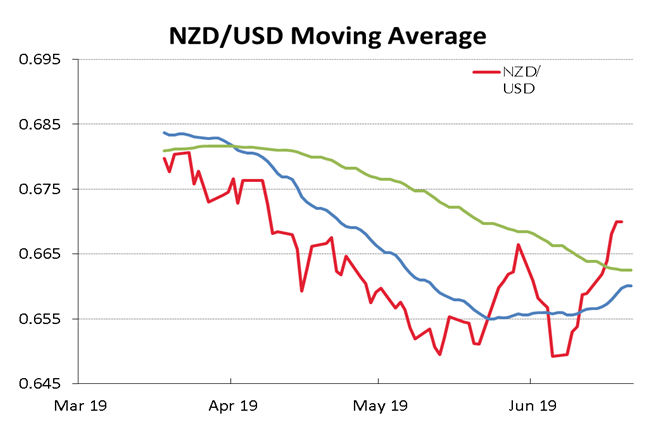

What is particularly encouraging for the outlook for the Kiwi is the fact that the NZD/USD exchange rate had already posted sharp gains from 0.6500 to above 0.6700 ahead of the G20 meeting.

Maybe there was a recognition by several players in the NZD forex market over the last two weeks that the Kiwi had been oversold at 0.6500.

That particular level was the point that it bounced back up from in September/October 2018 when the US dollar strengthened on the trade wars factor. On this occasion the US dollar itself has been under downward pressure from the Federal Reserve now more likely to cut their interest rates, as opposed to increasing them as they were doing in late 2018.

Trifecta of positive news comes in

The anticipated trifecta of positive news factors has now been delivered to the Kiwi dollar over recent weeks and it appears to have pulled the currency out of its previous downtrend.

- The US dollar has weakened on world currency markets from $1.11 to nearly $1.14 against the Euro as the Fed turns more dovish and the US short-term interest rate markets price-in four 0.25% rate cuts over the next 12 months. Interest rates are also priced to reduce in New Zealand and Australia as well, however be a smaller 0.50% over the next year.

- GDP growth in the NZ economy was a respectable +0.60% for the March quarter, well above the RBNZ’s official forecast of 0.40%. The positive aspect of the economic expansion over the first part of the year was that it came about when primary industry production (the dominant component in the economy) actually contracted due to climatic conditions. The figures confirmed that the NZ economy has not been spluttering and stalling in 2019 as many commentators have been confidently predicting.

- The global trade war risk has substantially reduced as the US and China get back on track with their talks following the May bust up.

International agencies’ view of NZ economy more downbeat

Both the IMF and OECD have recently released their report cards on the NZ economy.

The IMF believe that the economy has lost momentum and that future risks are tilted to the downside.

They cite high household debt levels and the increase in global trade protectionism as negatives.

On the other hand, they see loose monetary policy and a stimulatory fiscal impulse as positive factors for economic growth.

The OECD are just as miserable in their assessment of our performance and position.

They also focussed on the residential property market as being a risk to the economy and believe that the Kiwibuild policy would have a better chance of being effective if zoning changes freed up more land for affordable housing.

What is interesting against these downbeat assessments, is that our two key financial/capital markets, the NZ dollar FX market and the NZ share market are on the rise and are pricing a far more positive outlook.

The two markets are seeing more upbeat factors for the economy, and both will be buoyed by the global economic risks shifting down to a lower gear as the China/US trade negotiations resume.

Inflation and employment numbers the next focus

Outside the potential for further NZ dollar gains due to a continuation of the US dollar weakening trend against all currencies, the June quarter CPI inflation (16 July) and employment figures (31 July) will be the next pointers for the local currency market.

The inflation rate will be moving back up due the increase in oil/petrol prices in April and May.

Stronger than expected outcomes will throw some doubt as to the timing and extent of further interest rate cuts from the RBNZ.

The reversal in direction back upwards in the NZD/USD exchange rate to above 0.6700 has turned the technical chart picture to a more positive signal.

Further increases in the spot rate over the coming period will push the 30-day average rate (blue line in the chart below) up through the 90-day average (green line).

The negative forces on the NZ dollar have certainly reduced in intensity, the economy’s relative performance is still pretty good, therefore further gains to above 0.6800 seem likely.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

4 Comments

Its all going so well, yet Roger states the Federal Reserve, the RBA and RBNZ will cut rates , the US by 100 bps, the RBA and RBNZ by 50 bps. What is remarkable , the closer to the zero bound, both the US and Australia will in effect cut by the same percentage amount leaving the interest rate differentials positioned the same. At that time, in the year ahead Australia will have rates at 0.75 %, just astonishing .

The RBA is widely expected to cut tomorrow, risk/reward may be skewed on AUD/NZD given the weekends impasse .

So whilst our main export in dairy products is experiencing weaker prices, our main trading partner in China is having a marked slowdown, Central Banks around the world including NZ are all looking to reduce rates to avoid what appears to be a global slowdown and as an export driven country we are going to see the $ rise to .68 and beyond?

Could well be the case - but given it appears to be a race to the bottom in regards rate cuts globally and accordingly weaken currencies to retain competitiveness etc - As an export driven econmy - will 1. RBNZ be happy and accordingly look/be driven to cut rates further 2. If Kiwi $ has a sustained rise - what effect exactly on NZ inflation and our global competitiveness?

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.