After breaking above a key resistance level at 0.6730 ten days ago against the USD, the Kiwi dollar was unable to sustain the gains and has since retreated to 0.6630.

From a high of 0.6785 on 23 July, the NZD/USD exchange rate has succumbed to a stronger USD on global FX markets and some renewed weakness in the Aussie dollar as Westpac bank predicted more interest rate cuts than the market has been pricing.

Despite impending US interest rate cuts commencing this week, the USD has strengthened from $1.1400 to $1.1130 against the Euro.

Two factors have been positive for the USD, negative for the EUR over this past week that have sent the EUR/USD rate lower: -

- The European Central Bank do not see their economy deteriorating into full recession, however also they see no inflation on the horizon, therefore they are signalling even further monetary loosening.

- US GDP growth for the June quarter at 2.1% (annualised growth) was stronger than expected. However, the figures revealed a serious split in the economy between consumer spending remaining robust, whilst business investment has fallen away under the tariff/trade wars uncertainty. Ultimately, the lower business investment (if it continues) will lead to fewer new jobs in the US economy and weaker consumer activity.

The marginally stronger economic expansion in the US should not deter the Federal Reserve from their first 0.25% preventative and pre-emptive interest rate cut this week.

The accompanying rhetoric from the Fed on economic risks and future rate cuts will determine whether the US dollar can hold onto its recent gains, or more likely recoil back towards $1.1300.

Foreign investment inflows behind Kiwi recovery from 0.6500

After the fact, there have been some plausible explanations for the impressive recovery in the Kiwi dollar from lows of 0.6485 on 15 June to above 0.6700 by the end of the month.

Two across-border investment transactions into New Zealand may well have been behind the substantial Kiwi dollar buying though the month of June.

The Canadian investment fund, Brookfield Asset Management teaming with local firm Infratil to buy Vodafone New Zealand for $3.4 billion may well have been large buyers of Kiwi dollars in order to settle the deal.

Likewise, Chinese dairy conglomerate Yili’s purchase of Westland Dairy has been approved and Kiwi dollars will be required for that deal settlement.

Permanent capital investment inflows are always positive for a currency, as there is no risk of the funds departing again after a short period as there is with speculative and macro-investment fund related flows in the currency markets.

In the mining boom in Australia in 2012 the Aussie dollar sky-rocketed in value as foreign capital inflows flooded into Australia to build new mines as the high commodity prices delivered very profitable investment opportunities.

It would have to be expected that the same could happen again in Australia over the next 12 months as the new mine investment propositions are once again very attractive.

However, it will need to China/US trade spat to be resolved with some form of agreement to provide the confidence to the Korean, Japanese and Chinese investment houses to pump their funds into new mining ventures in Australia again.

Will the NZD and AUD follow the Loonie against the USD?

The Aussie and New Zealand dollar are typically classified by all and sundry as “Commodity Currencies” alongside the Canadian dollar.

The Canadian economy is heavily dependent upon energy and mining commodity prices and volumes, very similar to the mining commodities for Australia and agriculture commodities for New Zealand.

Therefore, it is no great surprise that the AUD and NZD often track the direction of the Canadian dollar against the USD as all three currencies are broadly correlated to their commodity prices.

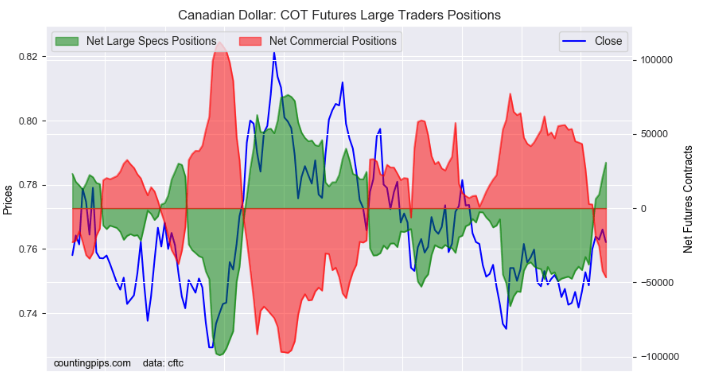

It is instructive to observe the recent change in sentiment towards the “Loonie” (the name of the bird on one side of the Canadian dollar coin). FX speculators have completely unwound previous “short-sold” CAD positions against the USD. The speculative FX market continues to be short sold the Aussie and Kiwi currencies, however indications are that the amount of positions is starting to reduce. Interest rate cuts in the US are certainly shifting speculative positioning away from the US dollar, therefore we should expect further reductions in the short-sold AUD and NZD positioning over coming weeks.

RBNZ should deliver a balanced outlook in monetary policy statement

The local interest rate market is fully pricing in a 0.25% cut in the OCR from the RBNZ on 7 August, therefore further Kiwi dollar selling is not expected when the announcement is made.

How the NZD forex market reacts on the day will be dependent on how dovish Governor Adrian Orr’s words are on the outlook for the economy.

Generally, the NZ economy is performing better in mid-2019 than the RBNZ have been forecasting, despite the uncertainty of the China/US trade wars.

Global risks for the NZ economy reduce when the US and China eventually reach a trade agreement (face-to-face talks resume this week).

Lower mortgage interest rates, Government fiscal stimulus and still high export commodity prices are all very positive forces for continued NZ economic expansion.

Therefore, the RBNZ would be misreading matters if they deliver an overly bearish economic outlook. A balanced statement would be justified.

A weaker US dollar on the global stage is still likely to be the dominant influence over the NZD/USD direction over coming weeks/months.

Chart: Speculators in the Canadian dollar have changed rapidly from “short-sold” CAD against the USD to “long” CAD: -

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

3 Comments

Following a week when both the AUD and NZD came under sustained pressure against the USD . Both currencies having one of the worst weeks of the year, its important to return to Mr Kerr's previous week's posting, when the following were used by Mr Kerr to highlight his opinion and outlook for the NZD and AUD . " spectacular, superior, gaining momentum, sharp , justifiably, dramatic increase , positive forces, massive positive cash inflows, stunning , outperformance." Sometimes using articles laden by adjectives leads to disappointment, particularly so if his clients had followed his expert opinion/advice. Having now turned to the CAD this week for solace, in a week when the United States will cut interest rates for the first time in a decade does not bode well.

Poor old Roger - he calls the currency up and it promptly slumps.

Personally think the RBNZ will cut 25 and indicate very much a willingness to cut further - Orr needs to because if Oz are going Sub 1% in rates,then so will NZ - would anyone really want to see NZ Dollar move through parity for out Biggest trading partner?

Whole world is now racing to the bottom and everyone wants to depreciate their currency to retain competitiveness - ECB, Fed, RBA, RBNZ - all pushing rates lower. Japan can't go any lower - BOJ is buying stock's to try and inflate Japan, China as well and still facing no resolution of a potential trade war.

Going to be an interesting couple of years and last thing NZ as an exporting country - is for our currency to stregthen.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.