RBNZ officials have gone out of their way in media briefings since the shock Monetary Policy Statement on 7th August to reassure all and sundry that they are not intentionally or deliberately seeking to wrong-foot the FX market and cause surprise reactions.

However, the evidence over the last 18 months since Governor Adrian Orr has been in the hot seat is that the RBNZ are causing extreme short-term exchange rate volatility after their statements.

They are consistently surprising the markets with statements at odds to the prior expectations.

The chart below highlights the NZD/USD movements subsequent to the various RBNZ statements.

What is obvious is that in their continuing desire to drive the NZ dollar lower, the RBNZ do cause a short-term deprecation of the currency, however the impact is not long-lasting or sustainable with other economic/market forces soon taking over. Often the Kiwi dollar is soon bouncing back upwards as the FX market day-traders who initially sell on the dovish words from the Governor, do not continue their short-sold NZD positions and rapidly buy the NZD’s back.

Why the RBNZ chose to go with a 0.50% OCR cut seems to be related to “getting ahead of the curve” in ensuring that interest rate decreases in New Zealand keep pace with further reductions offshore (particularly the US).

The RBNZ clearly believe that the NZ dollar will appreciate (and that somehow is a bad thing!) if our interest rates are left well above those prevailing elsewhere in the world.

Again, the evidence to support this stance is not strong.

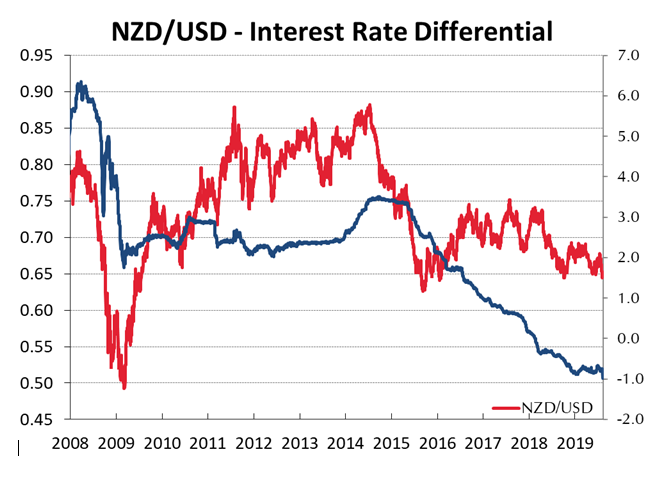

The second chart below confirms that interest rate differentials have not been driving the NZD/USD exchange rate value for more than 10 years now.

There are no longer carry-trade investors or hot-money punters holding NZ dollar deposits to receive a higher interest yield.

Those funds no longer come into New Zealand. So, when our interest rates are cut, there is no money to suddenly depart to send the Kiwi dollar permanently lower.

The Kiwi dollar dropped 1.5 cents to below 0.6400 on the “Shock & Orr” statement last week, however follow-though selling failed to materialise and the rate has already recovered to above 0.6470.

The pattern of the last 18 months seems likely to continue, with the RBNZ causing short-term market volatility but not a lot more.

The RBNZ Governor’s contract with the Minister of Finance states that monetary policy needs to be managed without causing undue volatility in interest rates and the exchange rate. The results of the last 18 months would suggest that this is not being achieved.

RBNZ provide impression that there is something seriously wrong in the economy

Business folk and household investors/borrowers could be excused for interpreting the RBNZ’s surprise 0.50% cut to the OCR as signalling that they know something about the economy that we do not know, and we are all headed into the abyss.

However, the RBNZ do not have any special insights about the economy that will unfold over coming months. Quite the opposite is the case.

Over last 12 months the New Zealand economy has performed quite well (2.5% GDP growth) despite the China/US trade wars and employment policy uncertainties.

The RBNZ and most bank economists have been universally pessimistic on the economic outlook for the last 18 months. Those gloomy forecasts have been proven to be wide of the mark as many parts of the economy remain robust. The very low level of business confidence has also been a totally false predictor of actual economic activity.

Business investment has been low, however that is due to the trade war uncertainties, not the cost of debt. The reduction in interest rates will make no difference to business investment at this point in time, not until the trade wars are resolved. Monetary policy as a tool to change behaviour (spending, saving and investment) in the economy has totally lost its potency and far too much fan-fare is made of changes to monetary policy that actually do not amount to anything.

Last week’s RBNZ prognosis on the economy was heavy on a weak global economy, low business investment, compressed profit margins, slowdown in housing, the lack of pricing power and what overseas central banks are doing.

No mention of the booming horticulture and software export sectors.

No mention of the dairy farming milk solids payout being nearer $7/kg than $6/kg for the next season.

No mention of 48kg lambs cracking $200 each at the Fielding saleyards last Friday and thus one of our largest export industries (sheep meat) riding high on record prices.

These positive factors in the economy answer the question as to why our overall economic growth is holding up much better than most have predicted. Our terms of trade remain at near record high levels, therefore it is not difficult to forecast a much more positive NZ economic outlook, if and when the trade war uncertainty reduces.

Has Trump over-played his hand?

It now becoming more evident that upcoming US economic data will print on the weaker side as Trump’s tariffs and trade war antics damage US business investment, jobs and agriculture prices.

Some time over the next several weeks/months ahead Donald Trump will wake up to the fact that a weaker US economy will not get him re-elected as President next year.

At that point he will be keen to do a deal with the Chinese on the trade front, the Chinese are well aware of this and are just waiting. In the meantime, both China and Australia have reported stronger export figures, underlying the fact that not everything depends on the US economy.

The US dollar is set to weaken further as the Federal Reserve are forced by the data to cut interest rates earlier than anticipated.

Economies that can expand from fiscal policy simulation should stand out

As central bankers around the world race each other to slash their interest rates to zero, monetary policy becomes a totally ineffective tool to stimulate economic activity.

Reserve Bank of Australia Governor, Philip Lowe stated last week, that the onus is now on Governments to use fiscal policy to save and grow their economies.

Monetary policy can do no more.

Currencies that will stand out to global investors will be the countries that have capacity to loosen fiscal policy to stimulate their economies.

The US and Europe have no fiscal capacity due to high Government debt levels, whereas China, Australia and New Zealand have capacity and are already acting on major infrastructure developments (albeit far too slow in New Zealand due to resource consents and bureaucracy).

NZD/USD Exchange Rate

RBNZ Statements Highlighted

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

23 Comments

It has always been the job of government fiscal policy to grow the real economy. Easing monetary policy only props up the fake economy - overcooking assets prices well beyond their true value and driving debt binge spending.

The NZ government now needs to get their asses into gear and increase debt ceiling to 30-40% of GDP and use the money to build infrastructure. The price of land in NZ is far too high, mainly because building new subdivision infrastructure is too costly which gets passed onto the land purchasers. Here is where the government should step in and start funding infrastructure costs and building new capacity (dams/sewage/piping/electricity supplies etc etc). Infrastructure bonds with a 5% payout, only accessible to NZ depositors would be a fantastic way to get the economy going again and solve housing issues while you are at it.

Is that you Phil? What infrastructure projects are you suggesting that will actually provide value?

More importantly, what incantation will you be using to conjure up the required builders to achieve this aim of spending tens of billions of dollars?

It's always easy to sit back in your armchair and allocate other people's money, especially with no evidence of benefit.

For the rural outlook perhaps, milk prices are heading in the wrong direction and now Fonterra cutting farm income further with no dividends. As another comment pointed out the bank considers shares as equity so dairy farmers will have less equity and income, banks don't usually respond well to that (eg tighter credit). Other commodity prices will be under continued pressure from the trade wars. Once we run out of interest rate cuts how are we to manipulate our currency lower?

I'm not convinced other sectors of the economy are going to pick up the slack of our exporters. Consumers pretty well maxed without wage increases, especially in AKL with house price growth. A government building and infrastructure program when construction falls over as credit tightens might help but this lots record of delivery isn't great so far.

We are already looking to be in a per capita recession like Aus has been.

Reality is that currently globally we are all in a race to the bottom and then when Trump comes out and threatens to weaken the US $, our currency will stregthens - as what occured last week.

Key point of the trading day currently is the CNY fix at 1.15 in the afternoon - if the Chinese keep on weakening the Yuan, so will the Kiwi. If CNY stays around the current level, then the Kiwi should rally - but for how long - trade war is if anything getting hotter and that can't be Kiwi positive given our reliance upon China.

Currency goes down, prices of imported goods increase, supermarkets increase the prices of goods on the shelves, petrol costs more, common man affected more.

Where will he get the courage to spend more to pull the economy out of the mess ?

Tax cut/payback is the only way.

Expecting the cheque in the mail soon, a la Aussies did a few years ago.

Law of diminishin return......At this level fall in OCR does not fully translate into lower interest Rate - as interest rates are already ver low UNLESS https://www.bloomberg.com/news/articles/2019-08-07/nordea-offers-20-yea…

Even that if happens will for brave heart as will indicate that the ecnomy is in for spinn for number of years to come just like 0.5% drop indicates that ecenomy is in a slippery slope

In the short term, USD will rise as a safe haven. Yuan will fall and NZD and Aus dollar with it.

Consumer is weak spot in your argument Roger, although I agree that monetary policy is less and less important or effective. Central banks were not prescribed (I thought) the task of devaluing currency. certainly they do not say that when they cut rates, but rather blaster about the economy and precautionary measures etc.

Trump will devalue USD sooner rather than later, just as Nixon did. Everyone under-estimates Trump. I do not like the man but I know he knows how to run USA financial policy. His ranting at Fed is having desired effect.

Longer term, the USD and Yuan are toast because of the 2 economies psychology which is becoming more insular and a new World currency will be needed as EURO goes down also. This is a 3-4 year perspective. meanwhile NZ has to carry on praying the CCP in China does manage to handle a financial crash because that is coming next year.

Yeah , so Orr drops interest rates , the Kiwi loses 2 cents vs the US$ and within a few short hours is back to where it started

Now that's a spectacular fail if ever we saw one , and can be likened to standing pissing into the wind storm on the South island over the weekend

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.