Over the last 18 months, since US President Donald Trump instigated the trade war with China, the foreign exchange market’s response has generally been that a move to global tariffs and trade protectionism has been more negative for export dependent economies/currencies like Australia and New Zealand.

As a consequence, the Kiwi dollar has depreciated against the USD as the US dollar up until now has been viewed by the global financial markets as a one of the safe-haven currencies to have funds parked in a time of global trade disruption (along with the Japanese Yen and Swiss Franc).

During the course of the last 18 months the overall Kiwi dollar downtrend against the USD has been punctuated with two periods of NZD recovery and strength:-

- From lows of 0.6450 in October 2018, the Kiwi dollar appreciated up to the 0.6800/0.6900 area through until March 2019 on the back of stronger than expected NZ GDP growth data and rising commodity prices. The US Federal Reserve also stopped increasing their interest rates in January.

- The Kiwi also bounced up again from below 0.6500 to above 0.6750 in June when global economic risks subsided after President Trump and Premier Xi Jinping shook hands at the G20 Summit meeting in Osaka and a pathway to end the trade wars seemed possible.

However, more recent events of a surprise 0.50% OCR cut by the RBNZ earlier this month and the trade wars intensifying last week with tit-for-tat retaliation measures between China and the US have the Kiwi dollar back at 0.6400.

Significantly for the expected future direction of the NZ dollar, what is different today to any other time over the last 18 months is that the financial and investment markets are now seeing the trade wars directly damaging the US economy.

The Dow Jones share market index plummeted 623 points last Friday 23 August when Trump ordered US companies to pull out of China in response to China announcing increased tariffs on US imported goods.

The markets are no longer buying the US dollar in response to the trade wars escalating, they now see much greater risk of the US economy headed for recession, the Fed slashing interest rates in response and the US dollar weakening accordingly.

The EUR/USD exchange rate jumped up $1.1050 to $1.1150 on the Trump “tweetstorm” aimed at China and Fed Chair Jerome Powell last Friday. It is too early to tell whether this is a more permanent sea-change in sentiment and confidence towards the US dollar, however it does highlight that Trump’s trade wars are now sending the US economy downwards and defeating his whole misguided purpose of protectionist trade policies.

Further USD weakness to above $1.1200 against the Euro over this coming week should confirm that the FX markets now see the trade wars as USD negative. Therefore, continuing NZ dollar weakness is by no means assured in an environment of a weaker US dollar against the major currencies.

Federal Reserve now closer to more interest rate cuts

At the last US Federal Reserve FOMC meeting a few weeks back the committee was seemingly divided on whether interest rate cuts were justified.

Following Jerome Powell’s speech to the world’s central bankers at Jackson Hole last Friday, there is now no doubt that the Fed will see the global economic risks, as a result of the Trump trade wars, as increased and thus impose a much higher threat on the US economy.

Trump seeks to make Powell the scapegoat for the US economy faltering as he has ben too slow to reduce interest rates in Trump’s view.

Powell in return is now clearly painting Trump’s trade wars as the real reason for the US economy slowing.

Mr Powell also freely admitted that monetary policy has major new challenges in dealing with a global economic slide caused by the trade wars. It now requires weaker than expected US industrial, jobs and consumer economic data to convince the Fed to signal a series of interest rate reductions.

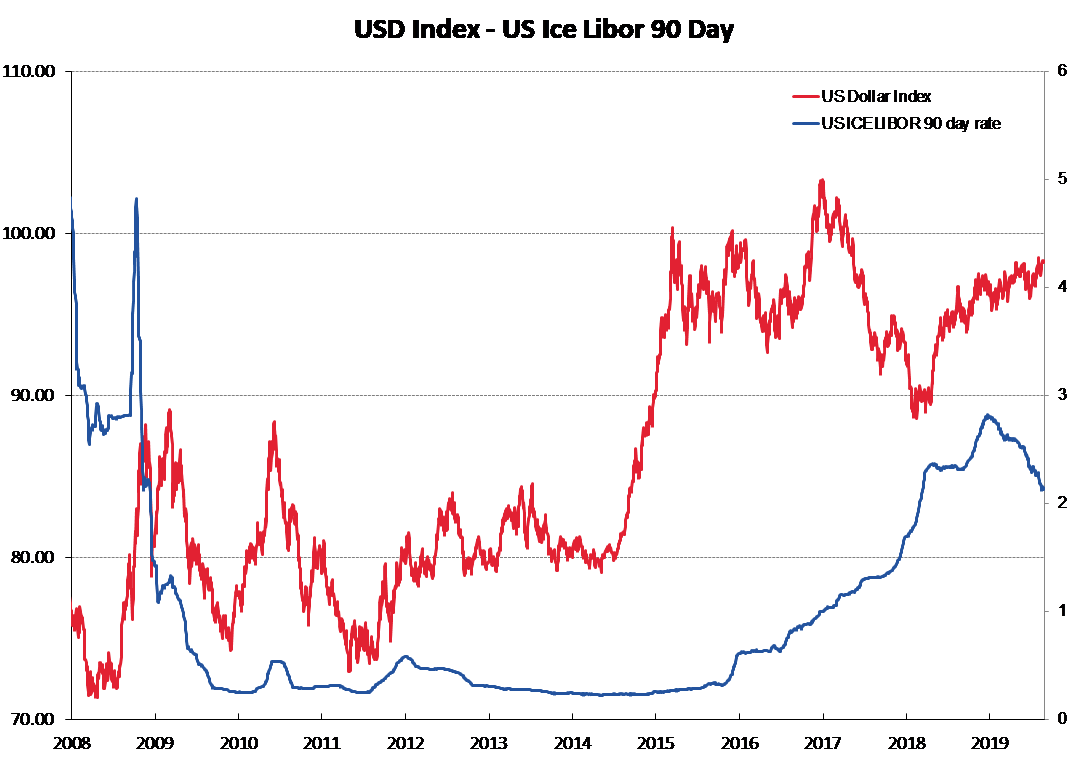

Luckily, the Fed increased their interest rates last year to above 2.00%, therefore (unlike other economies) they have the ammunition and fire-power to ease monetary policy to hopefully prevent the US economy sliding into recession.

The next US Non-farm Payrolls employment figures for the month of August on Friday 6 September will be keenly anticipated by the forex markets. A jobs increase well below 200,000 for the month will confirm that the manufacturing downturn (due to import tariffs) has spread into the wider services/retail economy. Lower US equity markets ahead of this date may well be signalling this slowdown in the US economy anyway.

A “weaponised” Yuan may no longer be needed if the USD falls by itself

Over recent weeks the Chinese authorities have deliberately weakened the Yuan exchange rate against the USD as a retaliatory measure against Trump‘s tariffs.

A weaker Yuan keeps Chinese exporters into the US competitive and negates the impact of the tariffs on their financial performance.

The US consumers are the ones paying the price for Trump’s trade war.

The USD/CNY exchange rate has devalued by 6% from 6.7000 to 7.0950 over the last six months.

The NZD and AUD do track the CNY due to the close economic ties, therefore it partially explains why the AUD has not been able to recover back upwards against the USD over recent times despite much improved Aussie economic data.

A weakening USD on the back of much more aggressive Fed interest rate cuts over coming weeks/months should weaken the USD naturally and take the pressure off the Chinese to adjust their currency value lower.

A trade war resolution does appear much further away now given recent events.

However, if and when Trump is convinced his tariff stance has back-fired on him, the Yuan can return to 6.7000 and lift the Kiwi and Aussie dollars upwards again.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

6 Comments

Hi Roger,

I think USD will continue to rise until Trump devalues it by fiat, just as Nixon did in February 1973.

That will probably be between Jan-March 2020.

USD rises in market panic because Trump or not, US is seen as THE safe haven.

NZD will continue to weaken due to over-dependence on China and continuing cuts in interest rates

1.15pm today will be very interesting - as it's when the Yuan is set by the Chinese authorities and given the news from Friday - don't be surprised to see some big movements either way basis where the Chinese set the rate.

Though interesting to note that the Yuan is trading in the off-shore movement at 7.19 - so a big drop and which if reflected today, will potentially set Trump off again.

If China/US don't come to some sort of agreement and we continue to spiral into trade war/recession - Kiwi will be low 60's or even sub 60 come Xmas.

In regards Roger's comment re: USD devaluing as Fed cuts - will pretty silly is all I can say. What are you going to buy - Euro's, JPY - ECB is about to re-introduce QE and Euro area is facing a potential crisis come Brexit.

USD will still be the go to currency - unless Trump does something silly and tries to devalue it - but what will everyone else do if he does that? Race to the bottom is all I can forsee and how NZ gets through this will be interesting...

Please beware if taking Rogers advice regarding the USD. Look what happened to the USD in August 2011 when US Sovereign debt was downgraded for the first time... The DXY jumped 6.5% in the aftermath and was around 13% stronger a year later. Look what happened when the US led the world into recession in '08, the USD EXPLODED 25% higher... If the US is in trouble then the world is in more trouble. It's not just the 'safe haven' effect, it's the reserve currency denomination. The worlds reserve currency is not the USD. It is in fact the Eurodollar which is a USD credit derivative created by banks outside the US. There is very little to no regulation on the Eurodollar system and is very susceptible to counter-party risk. When banks outside the US start to lose trust in each other the credit can vanish leaving a scramble for leftover Eurodollars or even better the real thing. There is no way that there are enough genuine USD to conduct global trade, this much should be obvious. If I have USD in a NZ foreign currency account, of course they are not real USD, it's just a bank created FX derivative. When the world goes to hell the USD is king of the world.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.