The NZD/AUD cross-rate spiked up to a high of 0.9700 on the 6th of August, however it has all been one-way traffic for the NZ dollar against the Aussie dollar since that time.

In our market commentary column of August 18, it was highlighted that should the NZD/AUD cross-rate break below 0.9470 on the way down, a 12-month uptrend line would be broken and further NZD depreciation to the 0.9200/0.9300 area was likely.

The reasoning behind the view was that trans-Tasman currency speculators who had been long the NZD against the AUD for some time (and who had profited from the rise from 0.9000 to 0.9700) would reverse their positions once the uptrend was disrupted.

The NZD/AUD cross-rate fell away to 0.9270 on Friday 13th September as the AUD held firm against the USD at 0.6880, whereas the NZD/USD rate could not hold above 0.6400 and closed at 0.6380.

The rapid four cent decline in the NZD/AUD cross-rate is not an unusual pattern for this exchange rate pair, over the last five years the cross-rate has oscillated between 0.9000 and 0.9700, however it never stays too long at the top or bottom of the range. In the short-term, the sharp drop to 0.9270 appears to have been overdone and the Kiwi has some catching up to do on the AUD/USD rate.

Local AUD exporters who have held off from hedging whilst the cross-rate has been well above 0.9300 over the last 12 months now have an opportunity to re-build their currency hedge books at profitable levels.

After several years of New Zealand’s economic performance being superior to that of Australia (thus justifying a higher NZD/AUD cross-rate) the worm has now turned with recent Australian economic data being very positive indeed.

Up until recently, two economic fears kept the AUD/USD exchange rate well below its fair value vis-à-vis its commodity price correlation (somewhere in the mid 0.7000’s).

Scaremongering fears earlier this year about the imminent collapse of the Australian residential property market have proven to be inaccurate as property prices have recovered over the last few months.

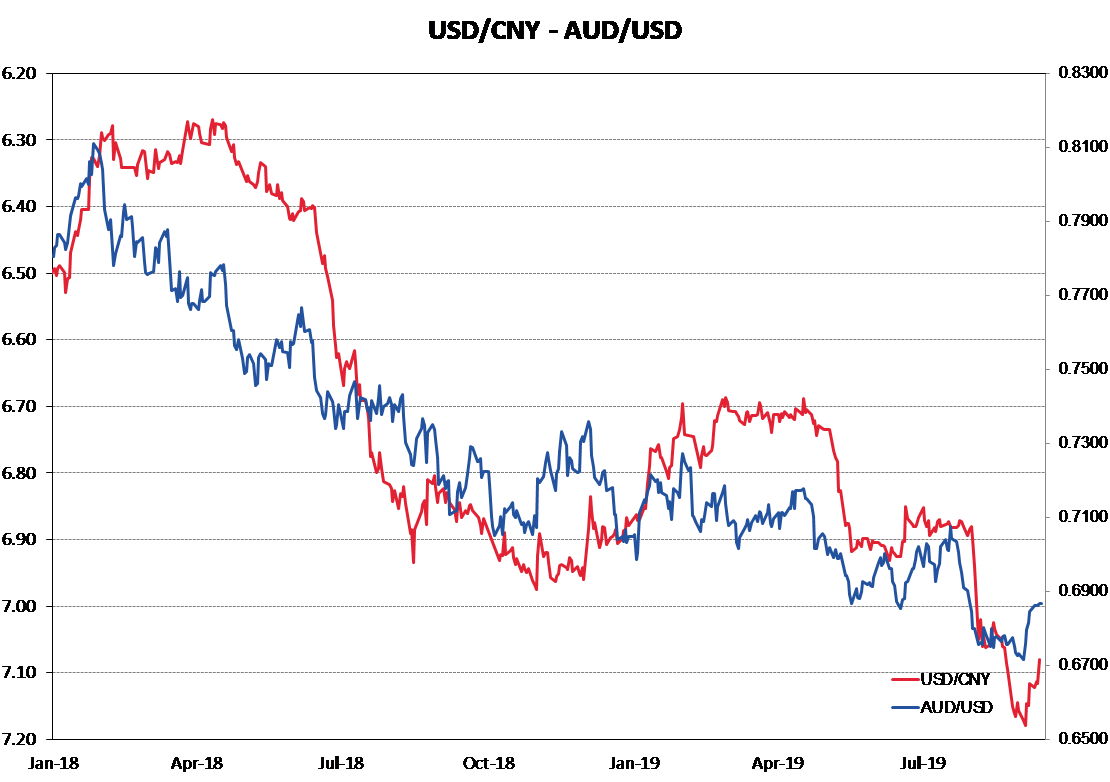

The second fear that has hung over the Aussie economy and currency over the last 12 months is the China/US trade wars as the Australian economy is highly dependent on China. The AUD/USD exchange rate is therefore reasonably correlated to the Yuan/USD movements. The AUD has not been able to recover losses against the USD below 0.7000 whilst the Chinese were deliberately devaluing the Yuan’s currency value as a countermeasure against US import tariffs on Chinese manufactured exports. Ahead of the next round of China/US trade talks scheduled for early October, the Chinese authorities now appear to be softening their stance and the Yuan has been strengthened from CNY7.17 to CNY7.07.

Will the AUD catch up to the soaring gold price?

Another interesting development in the world of investment and financial markets over recent months has been the rise in the price of gold.

Gold has always been regarded as a safe-haven investment asset to hold in times of global economic and geo-political turmoil.

The uncertainties from the China/US trade wars, Hong Kong riots and skirmishes with Iran in the Middle East have all contributed to the latest gold rush.

It has transpired that the Chinese and Russian Governments have been large buyers of gold this year as they diversify their foreign investment reserves away from the USD and Euro currencies.

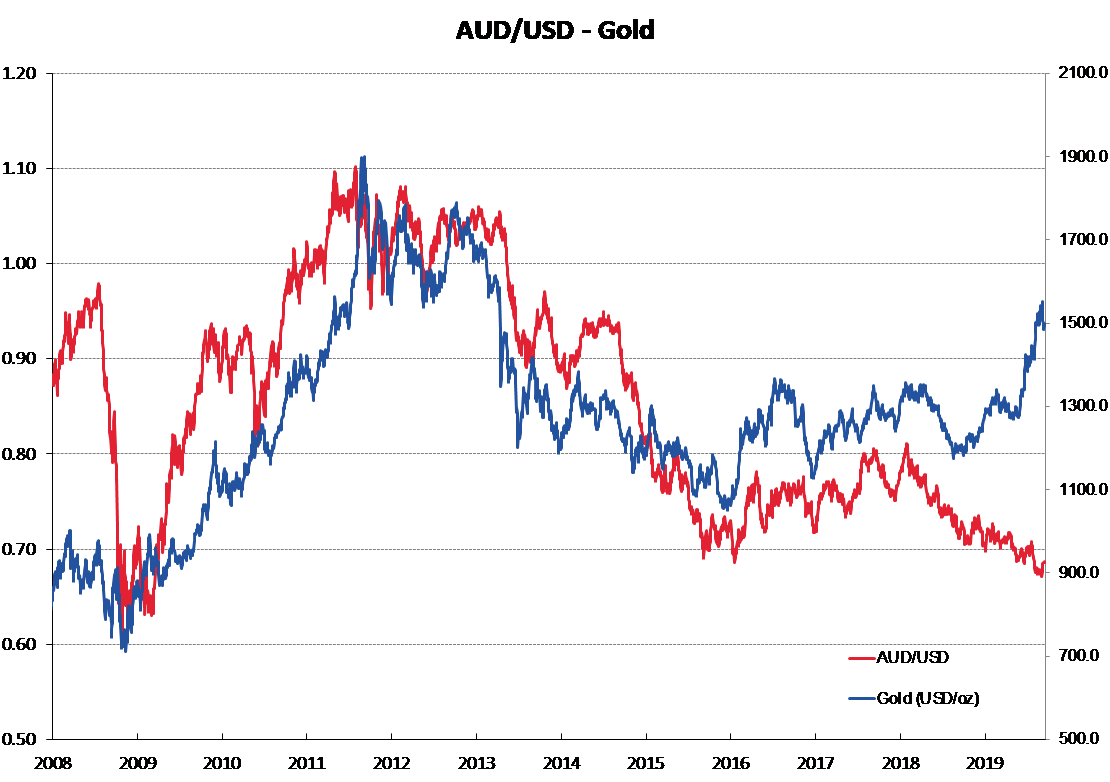

Australia is the second largest producer of gold in the world (300 tons per year, behind China at 440 tons), therefore Aussie gold mining companies are currently enjoying a bonanza of profits and cashflow as the AUD/USD exchange rate lags the increase in the gold price to USD1,488/oz. Once the second fear of the China/US trade wars (mentioned above) is removed from the Australian dollar’s outlook, the way seems clear for the AUD to catch up to its commodity price drivers like the gold price.

Weaker USD on interest rate cuts and higher oil prices?

The Australian dollar with its much-improved economic fundamentals now stands out as the currency of choice for global investors to move into as they reduce their USD holdings on lower US interest rates.

The US Federal Reserve will be cutting their official Fed Funds interest rate by 0.25% on September 18th, however the FX market focus will be on their accompanying rhetoric as to signs that they plan to cut interest rate further over coming months due to a slowing global economy, trade wars and weaker industrial/manufacturing data within the US economy.

Expect the USD to weaken further from its current level of $1.1075 against the Euro. A weaker USD from a ramp up in the oil price also must be anticipated following the Yemeni Houthi (backed by the Iranians) drone attack on Saudi oil production installations. The oil market will need to adjust to the temporary loss of 50% of Saudi production (Saudi Arabia produces 10% of the world’s oil). The USD oil price and the USD currency value are historically inversely correlated.

Likely Kiwi dollar responses to trade wars, GDP growth and political risks

After several months of some progress, punctuated by large setbacks, it appears the US and China may be back on track to reach some form of trade agreement. An interim agreement to delay tariffs may not be enough to placate the markets and restore business/investment confidence, however it is better than firing pot-shots at each other.

Whilst Australian and global influences are turning more positive for the Kiwi dollar, the local focus will be on our GDP growth numbers for the June quarter due to be released on Thursday 19th September. Consensus forecasts are for a 0.40% expansion in the economy over the quarter, reducing the annual growth rate to 2.00%. Dairy and meat production were lower in the June quarter following two strong prior quarters.

A result below +0.40% would be negative for the Kiwi dollar, however the impact may be muted as the US dollar itself is likely to losing ground at that time with the Fed interest rate cuts a few hours earlier.

Looking further ahead to this time next year, political developments with the US Presidential Elections and NZ General Election will add additional risk factors to the normal economic determinants of NZD and USD exchange rate values.

The current Labour Coalition government in New Zealand will be under pressure to deliver benefits of their policy changes to household living standards (not seen yet).

The breakdown in relationships between the Government and farming/business groups over water, carbon, employment and foreign investment policies is not a positive for the economy. Business confidence levels and maybe therefore the Kiwi dollar would likely do better on a change of government.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

12 Comments

The NZD/USD has declined for seven out of the last eight weeks. After several months of relentless positivity, Roger Kerr finally acknowledges that there are negative fundamentals in regards to the NZD.

This may be marking a turning point in the decline of the NZD... My reliable short indicator just flipped long. Frustrating as I had expected a 0.5X print before this happened.

Are you sure about Australia?

Well at least Australia has a pro-business Government rather than a Government with an openly hostile attitude to the people who pay their fancy salaries .

The Aussies have not done anything so utterly stupid as to BAN OIL AND GAS exploration and development , but we have , and are now facing the consequences of this folly .......... nay ..... utter stupidity .

They may have their problems over the ditch , but we are an inherently weak low-wage agro -based economy with a bit of tourism thrown in , whereas Aussie is well diversified broad based economy .

You got to mention Coal & Iron Ore...

Australia export earnings remain heavily reliant on these being maintained, so they have no choice to keep the pollution going.

If people hadn't worked it out, its manufacturing that creates wealth and US public company chief executives and boards working for themselves and margin share traders were stupid enough to export this to China; and as much as Trump has tried its not coming back anytime soon.. The UK use to be an economic powerhouse, but the exported their industry too.

The US & UK now rely on debt creation and money manipulation to keep themselves afloat, but this doesn't create any value other than market distortions.

NZ export trade has different strengths, and its not in commodity based trading. Rather naturally grown food, at least until we are capitalised enough to deliver value added to this and the other natural resources we have. Going down the clean green and electric transportation option supports this vision.

In the (recent) past, some have been in too much of a hurry to establish themselves overseas. Steady as she goes, so you don't expose yourself to predators. Commission agents should follow this model, so they have customers in the future; rather than leaving train wrecks behind like Jonkey and his bankster mates who represent failing US interests.

An anti-communist push in the 70s and 80s saw corporate interests becoming overrepresented in American politics with little concern about workers.

Policies are framed to protect profits rather than to promote broader socioeconomic agenda such as high-skilled job creation; much like the ongoing trade war that is aimed at forcing China to tighten its IP protection laws, not to repatriate manufacturing jobs.

I'm a national supporter and I would say the current coalition are just as hostile to business as the previous government, maybe even less so. There is billions sitting in the PGF plus a river of infrastructure renewal money tagged for release.. there was nothing remotely like that with Key and English and still isn't with Bridges. Goldsmith was a doubting thomas earlier in the week on the topic of stimulatory spending, seems he'd be happy we all lived on cold baked beans while his ministerial account buys him filet mignon...

Chinese company Mengiu have offered $ 1.5 billion for Aussie milk processor Bellamys ... A 59 % increase on the company's Friday closing share price ...

... buying hard assets in a strong currency ... these guys are protecting their money from the possibility of a complete crash at home ...

China's a bubble alright & they have finally woken up to the potential decoupling of their economy with the rest of the world, if they're not careful. It's one thing to make cheap stuff, it's another to play global games with hard arsed, one-sided trade relationships that we're (the weak west) is not only finally waking up to, but doing something about it. Thank God for that. For the past 30 years western leadership has been a mixed bag of the near useless to the down right dangerously ignorant socialist policies that seem to be standard fare within the state systems almost everywhere out west these days. IE: Look at ours today. F........g hopeless.

A$ with "much improved fundamentals"?

with:

a. recession this year in the GDP per capita;

b. GDP around the 1% mark;

c. unemployment trending up and now above 5.1%, with underemployment at 8%+

d. average individual debt-to-income high and only only second to the Swiss;

e. main source of the balance of payment surpluses due to high iron ore prices earlier this year but

have since come off to be below $90 per ton;

f. all 4 main Aussie banks have about 60% of their loan portfolio dedicated to property development,

mortgages and investment in real estate. High concentration of risk assets in an industry that had

to get lower interest rates to lessen financial stress and negative gearing.

g. growth in the domestic economy is unlikely to come from the highly geared consumer but from further

public sector spending in infrastructure that will have to be funded from external financiers because

the financial sector is already 20% dependent on foreign owned deposits. And at heightened costs

because of the weakening A$ exchange rates.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.