A showdown is looming ahead for the Kiwi dollar exchange rate as it continues to stay within its relatively tight trading range between 0.6250 and 0.6450 over the last two months.

The NZD/USD rate has been pushed higher to test the market resistance at 0.6450 on three occasions over this period and each time the Kiwi has failed to break through and has rebounded back down.

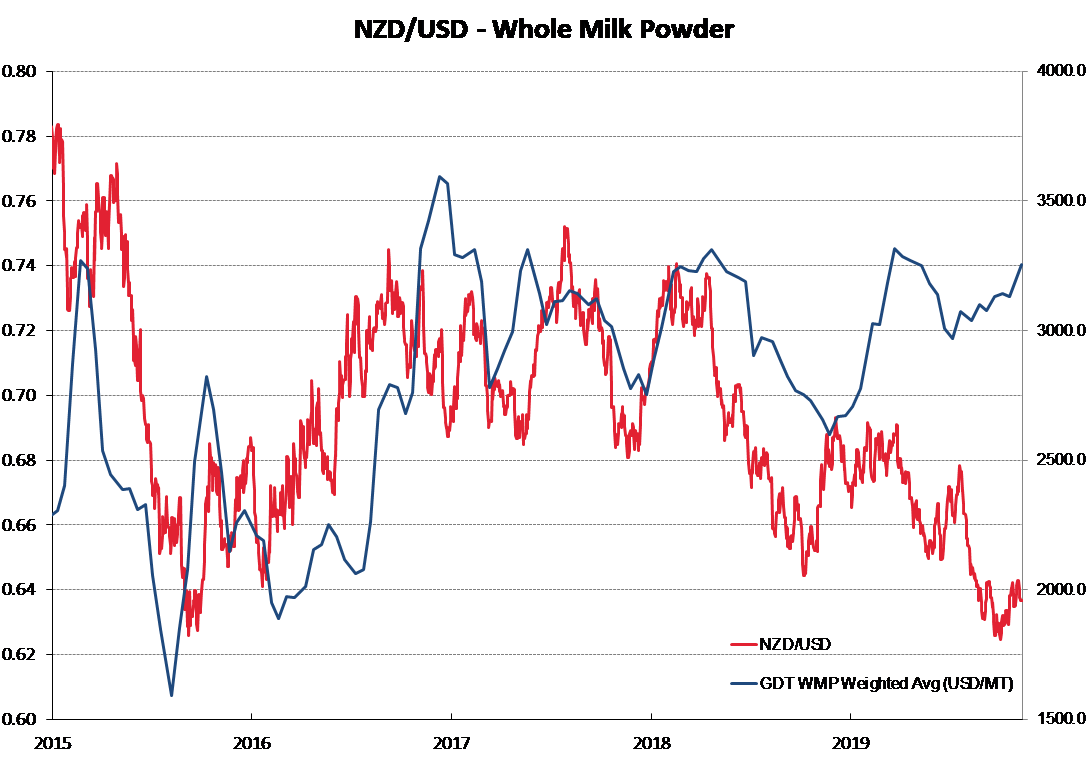

New Zealand’s own economic conditions and performance has not really changed over this time; therefore, it is largely external forces that are preventing the Kiwi recovering to above 0.6450. However, there is also the observation that the economy has not slowed up to the extent that most economists predicted for 2019 and thus there is no justification to sell the Kiwi dollar further down than its already 9.5% depreciation from 0.6900 this year.

Over the next month in the run-up to the Christmas holiday period, three factors will determine whether the NZ dollar can break its shackles and appreciate up to 0.6500/0.6600 and thus confirm a cyclical low-point in the 0.6200/0.6300 region, or whether the range trade continues: -

Speculative marketing positioning:

The number of outstanding/open interest “short-sold” NZ dollar speculative positions in the US futures market remains at record high levels of 40,000 contracts.

For the meantime, the punters are maintaining their bets that the NZD/USD rate will be moving lower over the next few months.

The speculator’s expectations must be that the RBNZ will cut interest rates again this week and thus make the Kiwi dollar less attractive to own/hold vis-à-vis the US dollar which has higher interest rates.

Over recent years such high levels of short-sold NZD positions have not lasted too long as the punters lose patience if the currency is not falling and unwind their positions.

It will need a catalyst, some fresh event or development, it seems, to cause these currency traders to change their view on the Kiwi dollar. What we do know is that the speculators generally close-down their open FX positions before the end of the year and especially before US Thanksgiving holidays at the end of November.

Therefore, something must give on these speculative positions over the next few weeks. Given the record short-sold NZD levels, the smart money must be on large NZD buying volumes being traded as they buy back the NZD’s and square up. The book squaring is likely to be the NZD buying demand that finally forces the Kiwi up through the 0.6450 resistance point.

RBNZ OCR interest rate decision:

Over recent weeks the local interest rate market has shifted their forward pricing on whether the RBNZ will cut the OCR by another 0.25% to 0.75% on 13 November from a 90% probability to just over 50% probability.

There are a number of reasons behind the change in sentiment and expectation, ranging from our Australian neighbours moving to an “on hold” monetary policy stance, to inflation and GDP growth outcomes being stronger than RBNZ forecasts, to global economic risk factors on the NZ economy reducing in intensity.

A 0.25% cut in the rate cannot be ruled out as RBNZ Governor Adrian Orr has created an aura around himself that he likes to surprise the markets and attempt to catch them off-guard.

As the Aussie are finding out, even lower interest rates at these already very low levels can be counter-productive in terms of stimulating economic growth through increased consumer spending and business investment.

It could be argued that even if the RBNZ do cut the OCR this week, the Kiwi dollar will not be sold, but will rally higher as the FX markets react to the fact that this is probably the last cut.

If they decide to leave the OCR at the current 1.00%, at least half of the financial markets will be surprised at that decision and the likely result is a higher Kiwi dollar.

Therefore, it will come down to the tone and rhetoric of the RBNZ’s statement and whether they see downside risks to the economy reducing and positives like stellar increases in export commodity prices lifting economic growth going forward.

The justification for loosening monetary policy further at this time to increase inflation would seem at odds with rising wages in the economy and rising expectations from businesses to increase prices over coming month (from the business confidence surveys) due to higher costs (lower NZD being one cause) and compressed profit margins.

The RBNZ must be struggling to maintain and justify their overtly past dovish outlook on the economy, such a stance would be contrary to the economic evidence in front of them.

Trade deal negotiations continue via Trump tweets:

The Kiwi dollar was sold down to 0.6330 late last week following the inevitable tweet from President Trump that he was not going to roll back existing tariffs as a condition of the “Phase1” trade agreement with China.

Earlier news reports were that the Chinese were insisting that this be the case.

In some ways it has been surprising that there has not been more back-tracking on the Phase 1 agreement. The financial and investment markets will remain sceptical about this part resolution to the China/US trade war until the leaders meet and put pen to paper on the deal.

That meeting between President Trump and Premier Xi Jinping was going to happen next week in Chile. However, that has been cancelled for other reasons and we still have no confirmation of where and when Trump and Xi will meet.

Trump will be keen to seal the deal as he rates his performance as the leader of the free world on whether the US share market goes up or down on what he says! A failure to deliver on the Phase 1 would send Wall Street down and not be a good look for Donald Trump.

The conclusion on the trade war front must be that the news, from where we sit today, is more likely to be positive for the Kiwi dollar as the US and Chinese will soon announce a date and venue to sign the agreement.

Another breakdown in negotiations similar to what happened in June/July would send the Kiwi dollar lower.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

5 Comments

Best thing about this article, it's a long justification for why the Kiwi will rally from the current level - basically justification for the advice given to his treasury clients re: hedging, which thus far has being horribly wrong.

But the icing - after long justifications on why Kiwi will/should rally/RBNZ should not cut etc- one sentence on the downside risk:

"Another breakdown in negotiations similar to what happened in June/July would send the Kiwi dollar lower."

Priceless!

All of Wall Street are hanging their hats on a trade deal. The problem with that is that they don't understand how Trump makes decisions. In the trade deal he's overridden the negotiators, and he's doing it again. It seems like everyone has forgotten that Trump is the only one that can roll back the tariffs and he will want to take credit for it.

Wall Street is going to freak out when the bad figures come in next year. Then stock prices will increase unjustifiably as they have since 2008. Whatever is happening in the US market is always the opposite of what should be happening.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.