Summary of key points: -

- Kiwi dollar’s pandemic tailspin completely reverses

- Previous FX market themes examined

- Despite US jobs reversal, it is still a slow/hard grind to economic recovery

Kiwi dollar’s pandemic tailspin completely reverses

Throughout the pandemic crisis and subsequent economic adversity over the last three months, the central viewpoint themes of this column have remained consistent that the lower NZD/USD currency value below 0.6000 was not justified and several factors would lead to a recovery.

The mad scramble by fund managers, traders, USD borrowers and central banks around the world to buy US dollars that were in short supply in late March when the Covid-19 panic hit the markets, caused the plunge in the Kiwi dollar to a low 0.5500.

The US Federal Reserve rapidly rectified the USD supply problem, resulting in the Kiwi dollar’s dive being very short-lived and paved the way for the subsequent recovery.

In proffering currency predictions and weighing up the probabilities of the plus and minus variables for future exchange rate movements, one needs to be accountable for past forecasts and views.

This column was bullish on the Kiwi dollar in late 2019/early 2020 before the Covid-19 crisis hit, as the NZ economy was travelling better than most expected, the trade wars were over, inflation was increasing (the RBNZ not as bearish as they were for most of 2019) and the USD was expected to weaken. The pandemic panic that sent equity markets and currencies like the Kiwi dollar into a tailspin in March could not have been anticipated in advance.

However, it does demonstrate that global shocks and black swan events do occur, you just do not know when. Once the crisis reactions settle, the underlying economic fundamentals always come through and ultimately determine exchange rate value and direction.

Previous FX market themes examined

The spectacular recoveries in the AUD and NZD against the USD over recent weeks to levels above those prevailing in February, before the Covid-19 pandemic engulfed the world economy, does evidence that the forex markets have now also recognised the positive market and economic factors for the antipodean currencies.

A summary of the column’s FX themes, and recent outcomes are as follows: -

|

Theme |

Outcome |

|

The NZ and Aussie trade-based economies in being more linked to China would recover earlier and stronger from the pandemic economic shock than the US and Europe. |

Too early for economic data to prove that we are well ahead, however the signs are positive. The FX markets are telling us that we are ahead. |

|

The US dollar was set to weaken against all currencies due to massive US government deficits, debt and Fed money printing. |

The USD currency index finally weakening to below 97 after being above 100 for most of April and May. |

|

China would embark on large scale fiscal and monetary stimulus in response to the economic shock, resulting in infrastructure building which is always positive for hard commodity prices and the AUD. |

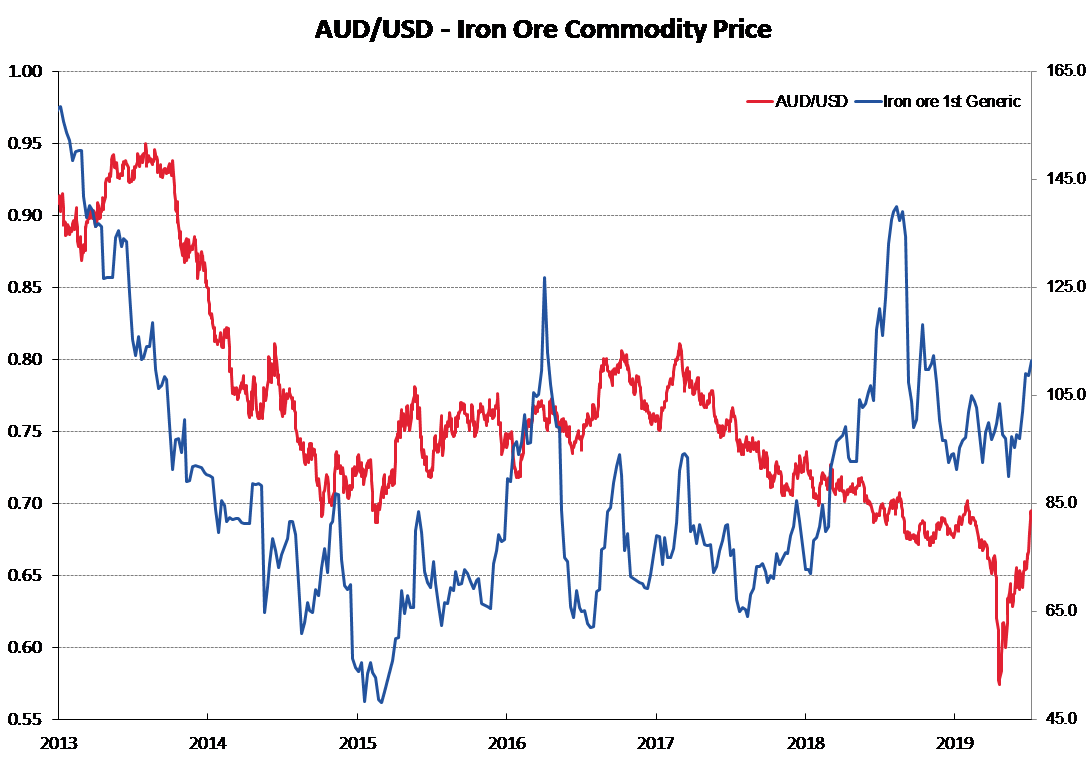

Over recent weeks prices for commodities such as copper and iron ore have moved higher, anticipating supply blockages and rebounding global industrial demand. The AUD closely tracks iron ore prices (refer chart below). |

|

The AUD would stand out as a favoured alternative investment currency destination as global funds cycled out of USD’s. The AUD was severely undervalued against the USD at the late-March levels below 0.6000. |

The RBA’s resistance to negative interest rates, Australia’s higher bond yields then elsewhere for a AAA sovereign credit and the Australian economy not as badly hit as first feared all adding to the AUD’s attraction. The AUD has appreciated 22% from its lows of 0.5700 against the USD in late March. Rising metal and mining commodity prices delivering the latest boost. |

|

The benefits of an always depreciating NZD currency value are illusory and the RBNZ’s continuing desire to talk it down were misplaced. Some commentators believe the RBNZ will be very unhappy with the NZD/USD returning to 0.6500. However, even the RBNZ know that it would be futile and unwise to try and stand in front of global FX market paradigm shifts. |

The RBNZ cannot and should not attempt to control a rising NZD/USD exchange rate when it is based on the other side of the currency pair – a weakening USD value on global FX markets. The RBNZ should not have a view on the exchange rate level, their job is to keep inflation between 1% and 3% and increase employment in the economy. |

|

Multi-year downtrend lines on the charts for the AUD, NZD and Euro against the USD were close to being breached to the upside as the USD weakens. |

The AUD/USD rate has appreciated up through the downtrend line (refer chart below). At $1.1300 the EUR/USD rate is not far away to its long-term downtrend line at $1.1600. |

|

As an exporter of food, the NZ economy was better placed than most others to recover earlier and faster from the Covid-19 economic shock. Food commodity prices were unlikely to fall. |

Export volumes through the last three months have been stronger than expected. RBNZ forecasts of lower export commodity prices appear to be off the mark. The economy will still take a hit from the foreign tourism downturn, therefore the sooner the trans-Tasman travel bubble is established the better. |

Despite US jobs reversal, it is still a slow/hard grind to economic recovery

US employment figures for the month of May completely defied previous forecasts of higher unemployment levels, jobs increasing by over two million as business firms re-hired staff.

President Trump was ecstatic with the numbers; however, it still looks like a slow/hard grind for the US economy to recover to some form of normality.

The equity markets also reacted positively to the surprise increase, but they are running on the candy of extraordinary monetary and fiscal stimulus.

Although the US economic data will show a rebound from the March/April trough over coming months, the Federal Reserve are expected to continue their stimulus programmes for some time yet. Therefore, a continuation of the fledgling US dollar downtrend seems more likely than not. In this changing global FX market environment, the NZD can record further appreciation against the weaker USD. However, perhaps not at the speed of the last two weeks!

The next major economic release in New Zealand that will impact on the NZD from a local perspective will be the Consumer Price Index for the June quarter on 16 July – inflation could surprise on the upside with food prices rising and a small minority of prices reducing.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

11 Comments

And the second question is .......... when the currency traders buy Kiwi$ do they get interest on the money ?

I assume they do

This may be similar to carry trade / hot money flows , where the currency is bought for a yield better than they can get in their home countries / currencies

Interesting argument/article. Personally think an appreciating currency is the last thing NZ currently needs -

1. Stronger Kiwi will simply reinforce deflationary forces coming through global economy. Very high chance (given Oil price) of negative read on next CPI stats.

2. Higher currency reduces export earnings and the idea that we can lift up the economy via export led rise is going to be hard to acheive if currency continues it's appreciation. Just have to note the last Dairy auction to see the effects of a stronger currency for our largest export earner.

Accordingly would note that RBNZ talked recently about buying off-shore assets to weaken the currency if required - If currency continues it's appreciation, then markets will be betting against the RBNZ and that's a dangerous position to take in the current world - where Central Banks are taking such a central role in directing economy etc.

Sarcasm on a Monday morning. Indeed, you are correct, Mr Kerr has posted innumerable articles on NZD bullishness over the past decade. Since peaking in August 2011, about the time Mr Kerr's articles first appeared the NZD/USD rate has fallen some 30 percent , a mere blip, remains in a downtrend, albeit at a channel top. The OCR has been adjusted moderately downwards by a kind RBNZ over 90 percent during his authorship and bond yields now offer little better in way of scraps than others, where growth may not be so reliant on maintaining and increasing housing wealth . Indeed, New Zealand has more recently commenced its own QE programme offering a buffet of financial hope when the reality is far more unsound.And the Warehouse has announced job cuts. ANZ forecast the NZD at 55 by year end. Only one can be right.

Lets be clear, the jobs rebound in the USA is fake news. Its "good news" to look at the people coming in the front door but overall there are still more people going out the back door. Like I said the other day, the same will happen here, politicians are all the same.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.