Summary of key points: -

- NZ government’s calculated gamble still has a way to go

- No market “disconnect” between the NZD and the USD

NZ government’s calculated gamble still has a way to go

The constantly repeated tone in this column over many weeks has been the largest future risk facing NZ exporters in US dollars is the separate and independent depreciation of the US currency unit on the world stage.

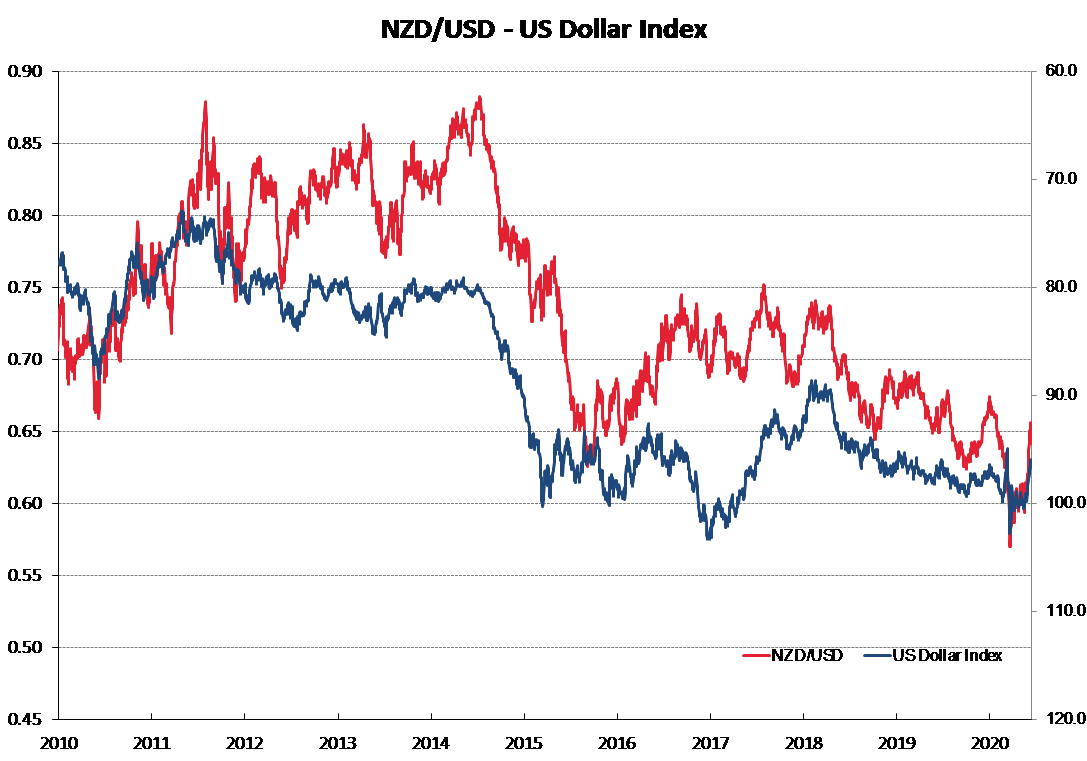

Recent evidence is that the expected weakening of the USD has commenced, and the NZD/USD rate is therefore trading in the 0.6400/0.6500 region and not below 0.6000. Further USD depreciation against all currencies seems likely as the US economy struggles to recover from the pandemic, thus massive deficits, debt and money printing continue.

However, what happens with the NZ economy over the next 12 months would stand as the second largest factor for the NZD/USD currency pair. Our economic direction and performance are less clear-cut.

Prime Minister Jacinda Ardern and Finance Minister Grant Robertson took a calculated gamble in March when they locked down hard, bringing the economy to a shuddering halt, on the premise that the earlier we eradicated the Covid-19 virus the earlier the economy could recover.

The plan was that economic damage would be limited by reducing the time period to return to normal economic activity.

The first part of the strategy has worked very well and Jacinda has received the plaudits from abroad and at home (judging by the political opinion polls).

Strong and decisive leadership, clear communication and unrelenting focus have been the successful hallmarks on addressing the health part of the crisis.

The nation is now crying out for the same leadership, decisiveness and focus from the Government to drive the economy to recovery.

However, the economic recovery is not just about returning activity levels to the previous norms.

We have a two-month hole to replace and that requires additional economic growth/activity in the future to the past norm.

To date, the Labour Coalition government shows absolutely no signs of understanding what is required to do this.

Distributing borrowed money around the economy was the relatively easy part, stimulating additional economic growth to generate additional tax revenue to the Government to repay that debt is more difficult. But it needs to be done.

Innovative economic policy prescriptions that allow New Zealand to advantage from our Covid-free status in the world would seem to be a very good place to generate that additional economic activity we require.

Entrepreneurial business folk have been promoting such initiatives as software/technology hubs, free trade zones, pharmaceutical research/drug trialling clusters, specialist education centres, global sporting events and movie industry opportunities.

Successive governments have recognised the benefits of hosting major sporting extravaganzas like the America’s Cup yachting in New Zealand, but only after they were prepared to listen to and be convinced by relentless lobbying from Grant Dalton and others.

Sadly, the current government, from the evidence so far, is not even prepared to listen, engage with and work with business to create the legislative/regulatory environment to bring these initiatives to fruition.

Anecdotes of business identities such as Rob Fyfe, Rod Drury and Fraser Whineray being totally frustrated with the inertia and lack of engagement from Wellington politicians and civil servants tells us that the Government has their ears and eyes shut to business.

The business/government dialogue that needs to occur is just not happening, with the PM being “angry” with a major retailer not helping the situation.

Fast-tracking identified “shovel ready” infrastructure projects has been promised for weeks and weeks now, however nothing happens.

Enormous opportunity exists to expand food production in New Zealand, therefore fast-tracking irrigation and aquaculture projects should be an imperative. But nothing happens.

If the government does not listen and engage with business in the design of the new economic policies, and instead attempt it on their own, you end up with expensive and disastrous failures such as Kiwibuild.

The post-war economic success of Japan and Germany was based on a unique partnership between the state and business. The successful partnerships were centred on mutual recognition and respect.

Unfortunately, political attitude and ideology from the current government prevents this happening in New Zealand today.

If the Government was to embrace the new initiatives and allow business to participate in the policy design with them we could have a chance at achieving the additional economic growth we need.

The “same old/same old” will not cut it for the New Zealand economy, the Government needs to create the policy environment so business risk takers can get on with what they do best.

No market “disconnect” between the NZD and the USD

The debate rages on that there is a total disconnect between Wall Street and Main Street, in that rising share market valuations bare no resemblance to what is happening in the real economy of lower activity, profit annihilation, worker layoffs and business failures.

The free cost of money (near zero interest rates) has a lot to do with the disconnect. Equities and property are the logical investment destinations when Mum and Pop investors receive less than 2% yield return from bank deposits and government bonds. The US Federal Reserve seem prepared to live with investment asset bubbles if that is what it takes to get the US economy on the recovery trail. The market disconnect seems likely to continue with only an escalation of second wave Covid-19 infections in the US causing equity market jitters (thus consequential NZD pullbacks).

However, there is no such disconnect for the NZ dollar’s future direction with the NZD/USD correlation to the overall US dollar currency index remaining strong. A weaker USD combined with a strongly recovering NZ economy (if the Government is listening to business!) suggests a higher NZD/USD exchange rate going forward. Otherwise, a weaker USD and a wobbly NZ economic recovery points to more time in the mid to low 0.6000’s.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

31 Comments

Good article and totally reflective of what businesses are saying in the real world. We had a few meetings last week and talking to counterparts, a large number are getting more and more nervous at the lack of detail from the government to back up the promises. Plans are being put in place to downsize fairly quickly if nothing materializes, and we are talking 1000's of jobs.

'IF nothing materialises' .. even tub thumping Shane Jones with a massive fund at his disposal has been unable to identify more than a handful of projects in his quest to buy NZF an electorate seat. The incompetent Twyford miserably fails at every large scale infrastructure project he is assigned and Davis in charge of NZ's largest export sector is out of his bewildered depth. Ardern hasn't a clue on corporate NZ and the rest of her cabinet is seriously deficient in real world business expertise. It's much more serious than 'lack of detail'.

FCM inhabits a similar world to me. Yes, it is a myth if you define that as a suspended animation state. But everyone knows it has to end soon and that we will have to face reality without hand outs. The COL is desperately trying to kick that day of reckoning down the road past September but as FCM alludes, the layoffs are already underway and the lists of who comes next are prepared. We are about to experience the consequences of putting in power a team 'kinder and fairer' but with little real world business experience.

no doubt

but the poly at the top is largely irrelevant now

if the real world were that street wise for opportunity they would be all over the problem

trouble is, there isnt a nice way out of the this particular cul de sac

business & degrowth are mutually exclusive

'business & degrowth are mutually exclusive' ... usually correct. But ideological purity is a peacetime luxury, swept away on the tide of war. The Oxford union society declared in 1933 that 'this House will under no circumstances fight for its King and country'. Spitfire cockpits were filled with Oxford grads a short time later.

This KiwiFail govt cannt think past all these small uneconomic projects - building cycle ways, clearing weeds, making footpaths wider, etc.

This is all 1930s chain gang work, we need big projects like Australia has just announced.

Where are all the so called "shovel ready" infrastructure projects - they were meant to be announced weeks ago!

I struggle to find fault with Roger's sentiments here. It is fairly typical of Governments to snatch at the easy wins, the 'low hanging fruit' if you will and then struggle to build something deeper and more meaningful. Roger pretty much sums up Labours failing, and Muller only seems to want to open the border to China. So not much really for a 'great reset'. No in depth policies, or even just noises, on building resilience and diversification. GR mentioned productivity in his article in the Sunday Star Times, but i also found that singularly lacking in real substance. Disappointing really.

Just a rant

That reads like advocacy for an OCR cut to negative -5% - lower NZD/USD

Anyone can sit on the sidelines and see all the mistakes made by the players.

What is required are serious ideas and suggestions.

What are your prescriptions for readymade instant businesses

Rod Oram over on Newsroom is inviting concrete suggestions

Go for it - don't be shy

Rod.Oram@NZ2050.com

i hope they do a trial importation of students for a university, as long as they pay for the 14 day isolation, tested before they board and when they land , i think we can import some rich kids here being covid safe and the freedom they would have here.

they could also look at other industries that want to do the same ie film, as long as they foot the bill let them come.

i think the problem is the short comings of the isolation at the border but if we can make that stronger and user pays i can not see why we can not let others in not just citizens and residents

You'd have to take away the right to work for international students, the last thing we need is more competition for existing jobs.

And without work rights and automatic post study visa leading to residency the demand would be right down. NZ's international education sector will be exposed for what it really is - a residency for sale program.

Yes, this will be interesting.

"Deputy leader Nikki Kaye this week international students shouldn't be allowed to work here however, to keep jobs open for Kiwis. " [sic]

https://www.newshub.co.nz/home/politics/2020/06/university-head-begs-fo…

I haven't heard Labours position on this yet.

"stimulating additional economic growth to generate additional tax revenue to the Government to repay that debt is more difficult."

Therein lies the problem, we have a structural issue in our economic system that demands incessant growth for no reason other than to prop flawed the system up. Then a underlying resource limits that challenge this growth also. It is set up for the perfect storm of hyperinflation as long as the dinosaurs keep wishing for the past.

"Successive governments have recognised the benefits of hosting major sporting extravaganzas.."

Which makes you wonder why we dont host an Olympics every second week

Its all a zero sum game ... An excuse to amp up consumption and load some more promises on the tab somewhere down the line ...

You can model all sorts of theoretical benefits for NZ Inc but underneath it all its just a resource waste fest

Roger theres arguably a lot of false economy in supporting extravagant events with tax payer money. Each time someone mentions paying for the next Americas cup with tax payer money it really annoys me because I know the health system is being underfunded by the same amount. Tell the yachties to shove it, they have tonnes of money anyhow....I'd rather have a properly funded state infrastructure!

the health system isnt underfunded ... its grossly overfunded based on unrealistic goalposts

its the assumption that we CAN & should provide " huge amounts of healthcare to all & sundry while poring billions into operations and life extension on the near dead " that is the problem

In a planet with huge overpopulation and resource scarcity issues?

Shear stupidity

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.