Summary of key points: -

- Signs of a correction in equities looms for the Kiwi dollar

- New Zealand’s economy: The good, the bad and the ugly…

Signs of a correction in equities loom for the Kiwi dollar

How two global prices play out over coming weeks will determine whether the NZD/USD exchange rate has a chance of pulling back to the 0.6400 region this column has been calling for over recent times.

The near-term NZ dollar direction will be driven by the risk-on/risk-off investor sentiment in US share markets and also by US dollar currency shifts against the Euro.

- The last two trading days on Wall Street have produced the first signs of equity investors finally taking their profits on the high-flying technology stocks. There has not been a specific trigger such as a negative piece of economic data to encourage the selling, however, it would be totally understandable that both large and small investors would want to convert impressive paper-profits into real cash ahead of the early November Presidential election. The NZD/USD rate has already corrected back from a high from 0.6785 last Wednesday 2nd September to trade at 0.6720 at the time of writing. The correlation between US equities and the Kiwi dollar can be expected to hold firm and thus a lower NZD/USD rate will result from the “fear” index overtaking the “greed” index in equity markets.

- The EUR/USD exchange rate peaked-out at $1.2010 on the 1st of September and has also corrected back sharply to $1.1840. It was inevitable that currency speculators who sold the USD at $1.1000 several weeks ago and rode the USD sell-off all the way to $1.2000 would also take profits by buying the USD’s back. The downward correction in the EUR/USD rate may well have further to go in the short-term as the European authorities’ express displeasure at the recent strengthening of the Euro. The European Central Bank’s Chief Economist, Phillip Lane stated that the Euro exchange rate “does matter” for their monetary policy. The stronger Euro value will weigh on Euroland’s exports, pull domestic prices downwards and intensify pressure for more monetary stimulus. Adrian Orr is not the only central banker “jawboning” down its currency value!

Should the above two market prices move lower over the coming days/weeks, the NZD/USD rate will be testing the technical/chart support levels at 0.6600 and 0.6400 respectively that it has held above since the lows of 0.5700 in late March (refer chart below).

New Zealand economy: The good, the bad and the ugly…

Given that the recovery of the NZ economy and the recovery of the NZ dollar, since the depths of Covid despair back in March, have both exceeded all economic and currency forecasters predictions, it is now timely to take stock of our current situation: -

What is good about the NZ economy

- The historical “brain drain” that saw most of our brightest human talent disappear overseas to never return, is dramatically reversing to a “brain gain” as the diaspora come home. The Covid pandemic and associated lockdowns has convinced these Kiwis that they are now better off working and living in New Zealand. As the numbers returning increases over coming months it is a potential game-changer for our economy. Additionally, our poor taxpayers will no longer by short-changed by paying for their education just to see them leave NZ and our country receiving no benefit. As they bring their wealth back they have to buy Kiwi dollars.

- The Terms of Trade Index released last week increased to yet another record high. The economy’s ability to pay its way in the world from increased export prices and generally lower import prices has never been so good. In the medium to long term, higher export production/output coupled with high export commodity prices results in a stronger currency value as the economy outperforms others.

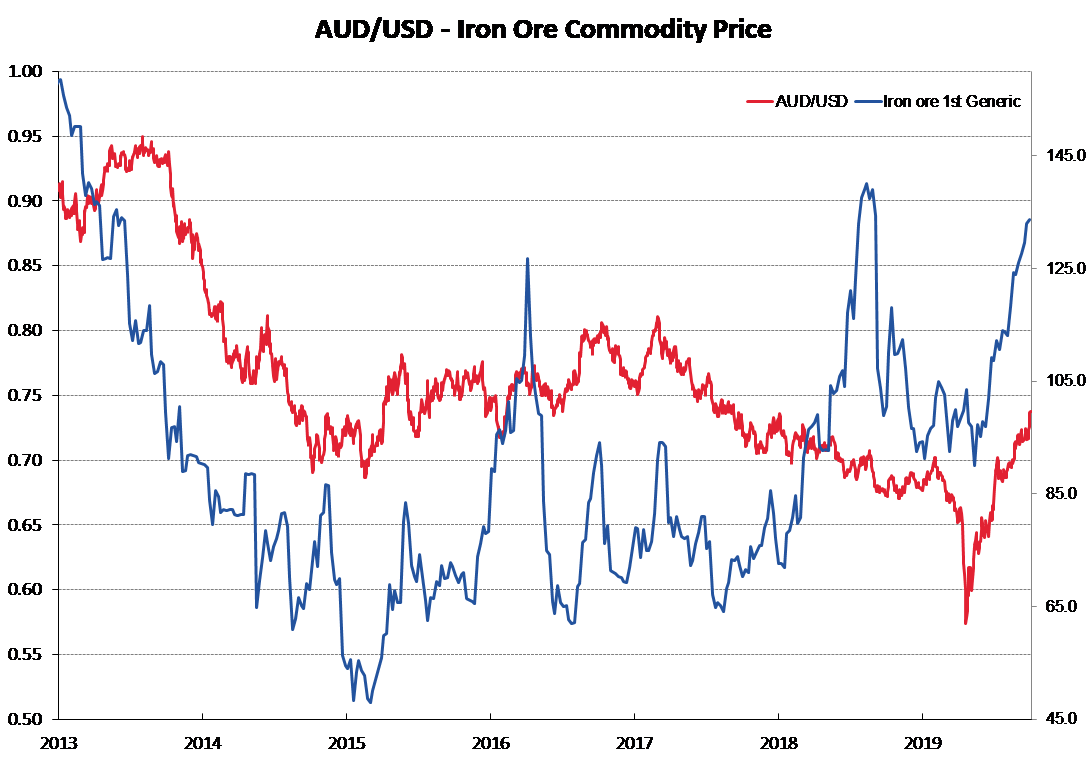

- As highlighted by this column on several occasions, the NZ economy would recover earlier and faster than the US and Europe from the pandemic economic shock, as we were hitched to the Chinese economic train and they were always going to be well ahead in terms of timing. On top of that, the Chinese are executing their fiscal stimulus/infrastructure build which is driving up the demand for steel, therefore iron ore prices, Australian mining profitability and the Aussie dollar. Twenty Chinese cities are building new underground train networks.

- New Zealand businesses of all shapes and sizes (outside of international tourism) have rapidly adapted, improvised and innovated to the new world order and are just getting on with it.

What is bad about the NZ economy…

- Despite New Zealand’s successes with the Covid health emergency and the rescue money thrown at the economy, business remains very cautious about future investment and expansion as there is no plan of economic policy reforms from the current Government to provide that trust and confidence. The Government’s focus is entirely short-term (i.e. getting re-elected), and this is holding back our economic opportunities and advancement as business sees no economic plan to work to.

- The cost of the Government’s fiscal rescue package is of course the mountain of extra debt that has to be repaid somehow so that we have fiscal flexibility should another disaster strike our economy at some future date. Higher GDP growth that produces more tax revenue coming into the Government is the only solution to repaying the debt. Hiking tax rates is not the answer as that will restrict GDP growth. Tellingly, the Australian Federal Treasurer is talking about cutting tax rates whilst the UK Chancellor of the Exchequer wants to increase tax rates. Who we should follow is obvious.

…and what is potentially ugly about the economy

- One of the unintended consequences of super low mortgage interest rates (from the extraordinary RBNZ monetary stimulus) and returning Kiwis from offshore buying houses is rising residential property prices. Sadly, the affordability for first home buyers is slipping away again. Our economy never really benefits from buying and selling existing properties with one another. New tenancy laws are also having unintended consequences with rentals rising.

- Forget about the V, U or L shaped economic recovery patterns, the latest theory from the US is the “K” shaped economic outcome from the Covid economic shock. The booming sharemarket values and white-collar workers largely unaffected as they work from home being the up-slanting part of the K. Contrasting to the job losses for blue-collar workers and thus poorer outcomes for the lower socio-economic groups (down sloping part of the K). The gap between rich and poor is widening in the US and also in New Zealand.

The Australian economy contracted 7% in the June quarter, so there will be a lot of interest in the size of our contraction when the GDP figures are released on 17 September. Whilst all economies are in the same boat with the plunge in GDP in the June quarter, it is hard to see this data release being positive for the Kiwi dollar.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

9 Comments

Exactly GV 27 ...... doesn't matter about the John and Jan Doe's ......as long as the Corporates, Bankers, Wall St and all their hangers on are doing well....... the rest can eat cake !!

Also heard a very interesting comment about Wall St and when the issue an IPO .....they buy the shares themselves @ 0.11cents and put them on the market for $45 - so when your average schmuck is celebrating making 30% their shares with a bottle of Champagne, the Wall St crowd are off to the Caribbean in their $100 mil yacht with cases of the stuff !!

As usual in any turbulence and transformation of this size, the inequalities will increase and it will take another genenration to fight it out. Hope this crisis engenders a group of smart, honest politicians and more efficient adminstrators to take advantage of the expected recovery to work for the betterment of the disadvantaged.

House prices are set to rise and the follow on effect is bound to be good, with a feel good factor pushing up consumption, which helps business and the employed.

We have all of the usual orthodox economic jargon in this article.

"The cost of the Government’s fiscal rescue package is of course the mountain of extra debt that has to be repaid somehow so that we have fiscal flexibility should another disaster strike our economy at some future date. Higher GDP growth that produces more tax revenue coming into the Government is the only solution to repaying the debt"

As the government has now demonstrated it can use QE to repay its debt at any time that it chooses and borrowing by the government is something that it chooses to do, it is not mandatory as it does not finance the government.

We had economist Steven Hail on this site only a few weeks ago giving us a completely different point of view.

https://www.interest.co.nz/news/106341/steven-hail

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.