Summary of key points: -

- Kiwi dollar climbs to 0.7000 target early

- What we have learnt about ourselves and about our economy from the Covid economic shock

Kiwi dollar climbs to 0.7000 target early

It is typical of always forward-looking currency markets that they price-in immediately what you expect to happen over several months.

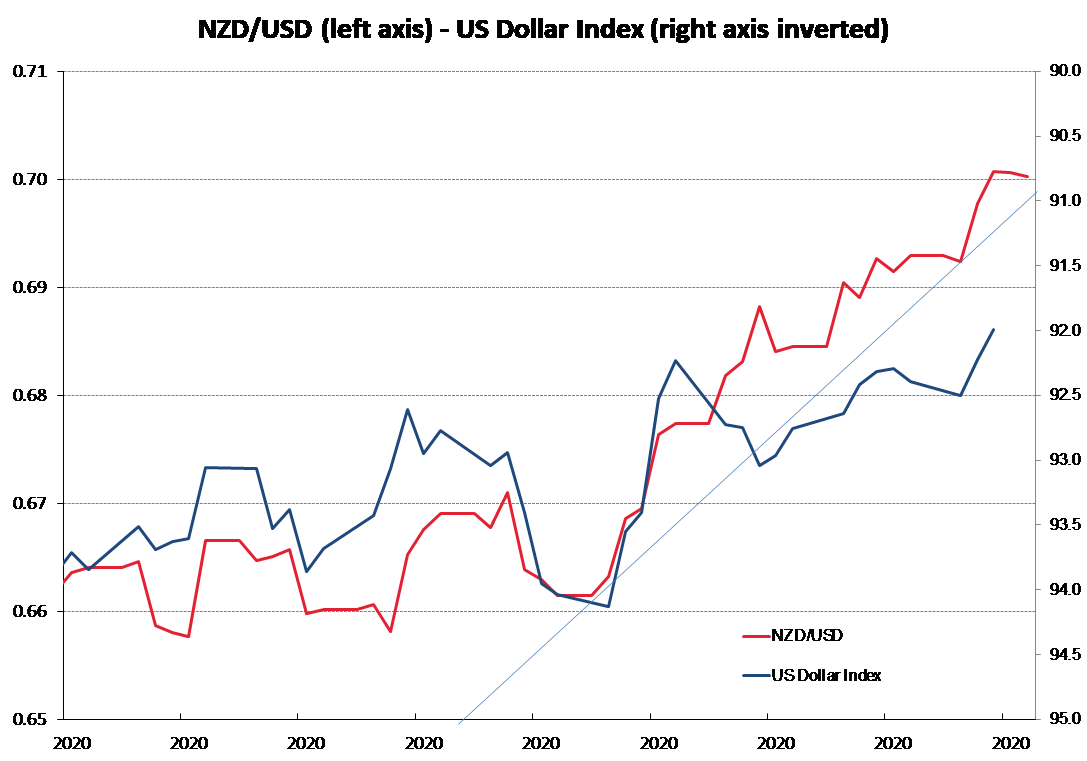

The theme of this column over the last eight months from when the NZD/USD exchange rate was below 0.6000 in April, has been that the we were more likely to nearer 0.7000 by the end of the year than at 0.6000. We did not expect to see rates above 0.7000 until the New Year.

Whilst the US dollar has weakened against all currencies on the global stage as forecast, we expected the RBNZ to hold the Kiwi lower by threatening additional monetary stimulus until the evidence on the economy was that further stimulus was not required.

Our previous viewpoint was that the overly-cautious RBNZ would not recognise that evidence until February/March time. By hinting that the new Funding for Lending Programme to the banks would effectively replace the need for negative interest rates two weeks ago, the RBNZ bought that timing forward to today.

Therefore, the Kiwi dollar has sailed higher to above 0.7000 as the interest rate market and bank economists all suddenly changed their forecasts on the future level of short-term interest rates.

The rest of the world automatically picked up on the RBNZ seemingly abandoning their previous policy of holding the Kiwi dollar down through super loose monetary policy and threats of more to come. The RBNZ has run out of runway and now have monetary conditions much tighter (through the higher exchange rate) than they desire. All a bit of a pickle really.

A number of corrective pullbacks in the NZD/USD rate have occurred over the last eight months, particularly into the low 0.6500’s on several occasions through the June to October period.

However, since the NZ election result in mid-October it has been a straight line up for the Kiwi dollar from 0.6600 to above 0.7000. The positive global news on Covid vaccines, resulting in further equity market gains has added to that upward momentum.

Given the speed and extent of that four cent appreciation, there has to be a better than even chance of a sizeable downward correction from here, as currency speculators inevitably take profits before the end of the year.

What we have learnt about ourselves and about our economy from the Covid economic shock

It is timely to reflect back on a tumultuous year and consider the positives and negatives for New Zealand, following the extraordinary events of the virus pandemic and the closing of our borders. Here are my 10 take-outs, all with implications for our future economic performance, thus ultimately the value for the NZ dollar: -

- Listen to the markets, don’t listen to economists – over the last six months the rise of the equity market and the appreciation of the NZ dollar have been signalling that our economic recovery was going to be the “V” shape. Economist’s dire forecast over that time for GDP growth, jobs, inflation, commodity prices and the dollar have all been proven to be hopelessly inaccurate. They even dismissed that the world would have a Covid vaccine by the end of 2020. The markets were telling us that our economy was hitched to China’s earlier recovery, as this column was as well.

- Critical importance of agriculture to the economy – Even the Prime Minister has belatedly recognised what really powers the NZ economy and pays for her Government’s social programmes. Export production has saved the economy from any extreme damage from Covid. Farmers will be looking for even greater Government understanding when it comes to such policies as water for irrigation. We produce food and we can produce more quality food with water harnessed to go on to the land.

- Reliance on immigrant and seasonal workers – The Government believes the theory that unemployed locals will re-locate if they are paid more to pick fruit and vegetables. The reality in the orchard is somewhat different. Our construction, agriculture, tourism and manufacturing industries rely heavily on seasonal and immigrant labour as the locals cannot/will not do the hard labour. The Government needs to urgently develop new policy to get an additional 11,000 RSE workers from the Pacific into New Zealand to pick the crops early next year, not just give special exemptions for a mere 2,000 workers.

- Don’t believe all of what politicians tell you! – No, not gullible Americans mesmerised by Donald Trump. We all came to understand rather quickly with the Covid border/quarantine controls and testing that our Government bureaucracy was as bad as we all suspected. The politicians stated that certain things were happening based on the reports they were receiving, unfortunately in many instances the reality on the ground was the opposite!

- We can improve our productivity – Lifting productivity is all about working smarter, not harder. Covid changed two important things in respect to improving our productivity in New Zealand that may not have changed as rapidly otherwise. Firstly, applying new technologies to business processes and ways of doing stuff. Secondly, local technology and other companies raising and applying new capital to grow their footprint globally. Local private and public capital is backing new initiatives in technology, food, bio-science and agriculture.

- Building infrastructure, not just talking about it! – “shovel-ready” projects would have to be the joke of 2020. They will not happen unless the Government moves at a much more rapid pace with RMA consenting timelines, external labour workforces and helping local government.

- Dislocated residential property market – Real wealth accumulation and living standards in New Zealand are not increased by trading existing property assets with each other. The house price “problem” can only be solved by the Government by changing local council zoning laws and limiting land-bankers to increase the supply of land for housing. Building the infrastructure to the new suburban sub-divisions goes hand-in-hand with such changes.

- Unintended consequences of zero interest rates – Investors previously relying on safe bond yields balanced alongside equity market risk are now lost and seeking alternatives. If the investor money is there, seeking a yield return, all sorts of offerings will suddenly appear. Remember the disasters of finance company debentures and CDO’s? Poorly managed and illiquid property syndicates are already appearing.

- Working from home, or living at work? – The lockdowns were a positive for many families in New Zealand as they restored parent/child family time that gets lost with modern living. Work/life balance has been reinvigorated for the better and that is actually a positive for the economy.

- Focused leadership kept NZ safe from Covid – PM Jacinda receives all the recognition; however, it is was the team of five million that did it. The challenge for the Labour Government ahead is whether they can display the same leadership with the economic policy changes we need to advantage from our favourable position?

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

3 Comments

Enjoyed your summary. My own thoughts are that the Prime Minister excelled at handling crisis events (e.g. Covid-19, the Christchurch terrorist shootings etc.) but the Government failed at leading change. For example the Prime Ministers enviable and urgent work in allocating more funding to families to lift children out of poverty failed because the cost of housing/rent has cancelled those benefits transferred. Today the Prime Minister was on telly blaming the public for the housing crisis.

The Reserve Bank look to the government to easy the housing situation through market reform. The government expect the public to endorse their policies before they've even implemented changes so shirking the responsibility of leadership. The public are frustrated at the Government and Reserve Bank for shirking responsibility to lead change. Everyone is looking at everyone else expecting leadership, none is forthcoming.

I think it's safe to assume that Roger hasn't read Limits to Growth. http://www.donellameadows.org/wp-content/userfiles/Limits-to-Growth-dig…

he Treasury is leading work across government on New Zealand's economic response to COVID-19, to:

cushion the financial blow to whānau and families, workers, businesses and communities from the impacts of COVID-19

position New Zealand for recovery, and

reset and rebuild our economy.

Our advice has supported the Government to put in place a broad range of initiatives. While it has been important to move quickly to limit the economic damage of COVID-19, we are also working to measure the effectiveness of this spending and inform decisions about any further measures that may be necessary.

- Treasury of the government of NZ

Jack | hamilton electrician | Regards from Hamilton NZ

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.