Summary of key points: -

- Significant inflation forecast miss by the RBNZ.

- Confident Aussies take a stance.

- Europeans becoming increasingly worried

Significant inflation forecast miss by the RBNZ

Last Friday’s inflation numbers for the December quarter highlighted the growing chasm between economic theory and the reality of the commercial marketplace.

RBNZ and consensus forecasts for the quarter were for a 0.20% increase and a further fall in the annual inflation rate to 1.10%. What we got was a 0.50% increase for the quarter, which maintained the annual inflation rate at 1.40%.

In all their inflation forecasts published last year (the latest being in November), the RBNZ were forecasting inflation to decrease to an annual rate of just 0.60% by March 2021 due to the Covid pandemic and its economic consequences causing deflation around the globe.

A fair part of that forecast was based on domestic (“non-tradable”) inflation decreasing as they saw the NZ economy faltering and unemployment increasing.

The evidence was clear by about September last year that the NZ economy was bouncing back on a V-shaped recovery as domestic spending ramped up and exports were largely unaffected by the Covid economic shock.

Domestic prices such as house rentals were on the increase and other household costs such as council rates and healthcare never fall.

As previously stated in this column, the shipping/supply chain disruptions causing shortage of imported consumer goods would rule out the normal price discounting by retailers at the end of last year.

The final telling result from the inflation figures was that for the first time in about a decade communication prices (mobile telephones and internet) increased (+0.40% for the quarter). Plummeting communications prices have swamped and disguised many other price increases that consumers have been paying for many years now.

To be so far away from actual inflation outcomes, proves the point that the RBNZ economic forecasting gurus need to spend more time talking to businesses at the coal-front of the economy and less time on the theory of calibrating their econometric models to what is happening in the rest of the world.

However, do not expect any change to the RBNZ’s stance on monetary policy as a result of actual inflation being much higher than they expected at this time.

They will correctly “look-through” the supply-chain problem impacting on inflation as it will eventually right itself.

The RBNZ have been wanting to increase inflation and the conclusion is that the starting point is higher than they forecast.

It has been clear for some time that the RBNZ have been prepared to accept the risk that all the monetary stimulus causes the annual inflation rate to burst out the top side of their 1% to 3% band.

They can justify that breach of their inflation target by stating that it was a consequence of them pursuing their other economic target of lower unemployment.

For these reasons, the next RBNZ Monetary Policy Statement on 24 February will be dovish in tone (Covid still a major economic risk factor) and they will not be changing their interest rate track and/or bond buying programme.

The implications for the NZD/USD exchange rate is that some market expectations of the RBNZ being more upbeat on the economy will be disappointed by their statement and that would cause NZD selling at the time.

With long-term interest rates now increasing (following the US bond yields) the RBNZ will also ignore the steepening yield curve as an indicator that they will have to lift short-term interest rates. They will not be “tapering-off” their monetary stimulus anytime soon. Employment figures for the December quarter being released on 3 February will show an increase in the unemployment rate and therefore will take some of the heat out of expectations that the RBNZ will start to change their policy stance.

An offshore economic forecasting house, Capital Economics received local media and financial market attention last week with a view that the RBNZ would be the first central bank in the world to increase interest rates later this year or next. It does pay to check the past track-record of such economic forecasters before putting too much credence on their predictions. In mid-2020, Capital Economics was forecasting the NZ economy to slide into a hole and the NZD/USD exchange rate to depreciate to 0.5000!

Confident Aussies take a stance

You just have to admire the sheer “chutzpah” (audacity) of the Australian Government to take a hard-line stand against the social media giants Google and Facebook in respect to paying for media content. The Aussie Government was also not afraid to directly criticise the Chinese on the Covid origination cover-up in Wuhan. They have suffered some economic consequences in doing so with Chinese retaliatory trade tariffs on selected Australian export goods into China. The Chinese/Aussie diplomatic/trade stoush relates back to Australia’s refusal to take Huawei communications systems. The stand-off, however, has not adversely impacted the value of the AUD exchange rate to date.

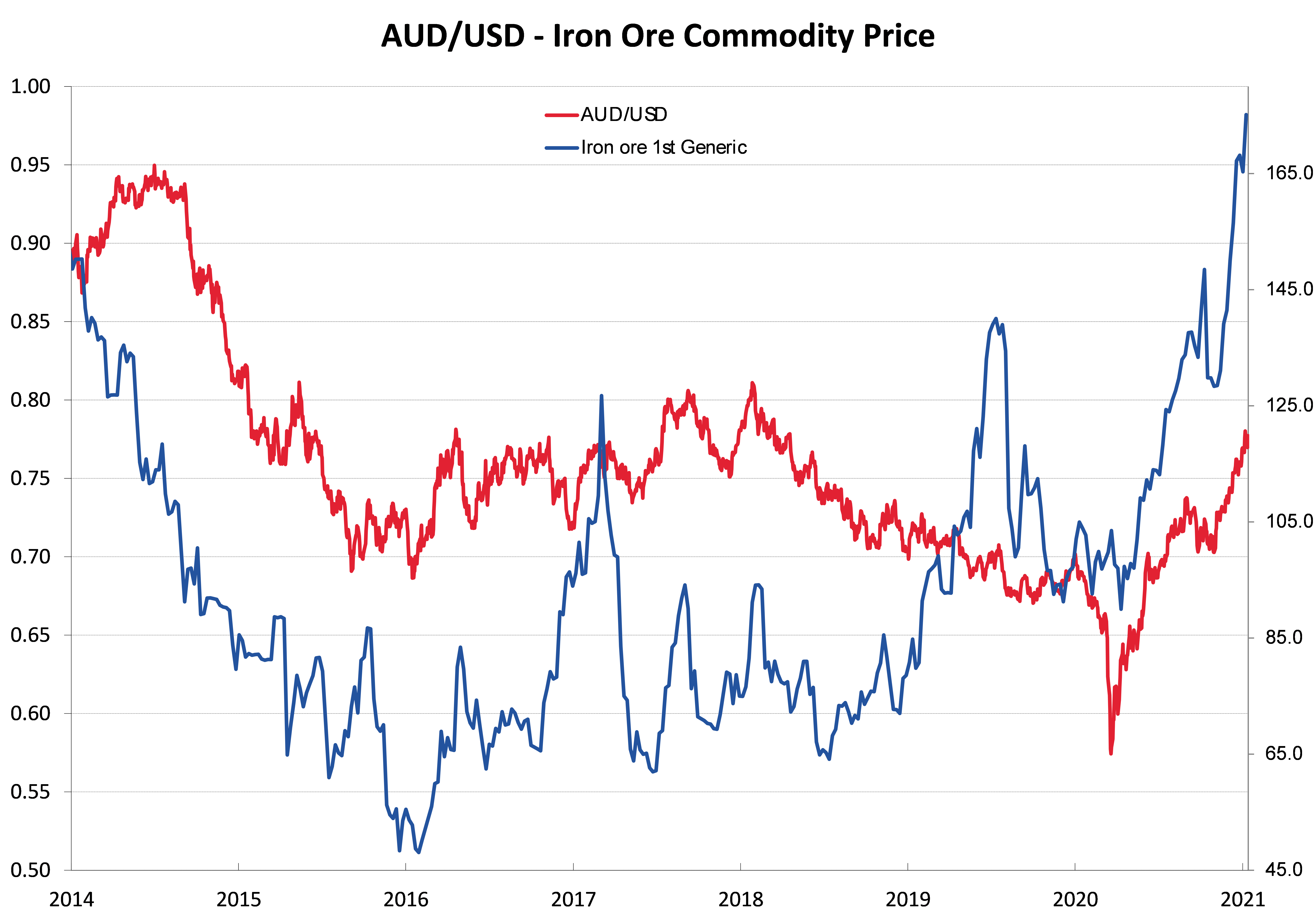

Tellingly, the Chinese have not touched Australian iron ore exports, as they need the ore for steel production to meet infrastructure build targets (the Government’s fiscal stimulus method). The sky-rocketing USD iron ore prices means that the big Australian mining exporters (Rio Tinto, BHP and Fortescue) are awash with cash and making mega profits. They are buying AUD, selling USD in very large amounts every week and thus contributing to the AUD appreciation against the USD. At some point (maybe not that far away) the iron ore price will correct downwards from its spectacular gains to US$170/MT and when that happens the AUD/USD rate will pullback from its sharp gains to 0.7700/0.7800. History has shown us that iron ore prices can fall as fast as they rise (refer chart below).

Europeans becoming increasingly worried.

Forecasts of an economic recovery in Euroland in 2021 are looking to be well wide of the mark as they suffer from another wave of Covid infection and lockdowns, problems with the vaccine distribution and bureaucratic inertia that slows everything down. ECB Chair, Christine Lagarde has warned of a double-dip economic recession this year and that they are watching the appreciating Euro exchange rate “closely”. The stronger Euro to $1.2300 against the USD makes imports into Europe cheaper which forces inflation downwards, the opposite of what the ECB want. The stronger Euro also hurts European exporters and further hinders their economic recovery.

The EUR/USD still appears to me to be on track for a sizable correction downwards to the $1.1600 area as US economic data (with the massive Biden fiscal stimulus) markedly out-performing Euro economic data over coming months. The widening differential in long-term interest rates is also a USD positive, EUR negative.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

9 Comments

Perhaps the reason we are heading for an epic fail in monetary policy is because they measure inflation all wrong. Maybe its time to include everything that you spend you money on with the appropriate percentages of each. Pretty obvious to me that the major ticket items are not even factored in.

"It has been clear for some time that the RBNZ have been prepared to accept the risk that all the monetary stimulus causes the annual inflation rate to burst out the top side of their 1% to 3% band."

Not much risk of that as last time CPI was above 3% was September 2011. Since that date we've spent around 3 years below 1% CPI.

No. OCR is set to achieve a 2% CPI. If OCR is at 0.25% and CPI is at 2% then arguably OCR should be left as is (unless there is some known change that will affect to CPI that needs to be countered).

Current OCR is 0.25% and CPI is 1.4% so arguably the OCR needs to be cut further to achieve 2% CPI.

Basically a simple computer program could be used "if CPI 2% raise OCR by 0.25%".

If you click on the news releases that accompany the RBNZ's OCR announcements there is an explanation of the bank's thinking.

https://www.rbnz.govt.nz/monetary-policy/official-cash-rate-decisions

Just watch keizer report and you know what's coming. https://www.rt.com/shows/keiser-report/513338-china-companies-trade-war…

Higher Interest Rates Are Coming - Steve Forbes | What's Ahead | Forbes - Inflation

Always very cynical of predictions however a point of view.

https://www.youtube.com/watch?v=cvIsIIS-s-A

I will repeat this again -

There is a very destructive flaw with the CPI/OCR model. That is, it totally prevents society from benefiting from increased productivity as follows

As productivity increases, relative prices of the effected products fall. This is not allowed by the inflation/interest rate model, so interest rates are dropped. This means money is channeled into fixed asset speculation so these assets rise in price. e.g. housing. There is also a rise in the price for goods that are not subject to strong competition and the forces that drive productivity (in NZ case building materials, food, petrol, power) The net effect is that the price falls due to rises in productivity are more than offset by the price rises from fixed asset speculation and price rises in low competition, low productivity sectors of our economy; so that inflation can remain positive. By this mechanism there has been a huge transfer of wealth from working people to some industrialists and the capital owning classes. How many times do we have to witness this part of the cycle before somebody with any clout wakes up.

I think that there is another aspect too. That of the savers. If you are a saver and interest rates drop, then you are less inclined to spend. So as I have been saying for years now; while the model that ties high inflation to raising interest rates makes sense, the converse does not. We have been laboring under this flawed model since the 2008 crash and really have not made any meaningful progress in addressing the problems. So now that we are facing even more problems we are "turning up" the knob further.

"The beatings will increase until the morale improves" Or as Einstein said - the definition of insanity is to keep doing the same thing and expect a different result.

As an addendum. The interest rates from 2008 fell dramatically initially, bounced around something under 3% until 2018 sometime then steadily fell until until practically nothing. Note it was falling significantly before the pandemic.

https://tradingeconomics.com/new-zealand/deposit-interest-rate

If low interest rates were effective at boosting the economy and raising the CPI, you would see evidence of that by way of a growing economy leading to a need to raise interest rates inside that 12 year period. There is no evidence of that in fact towards the end of that period they had to lower interest rates further. Therefore you can conclusively conclude that there is absolutely no linkage between lowering interest rates and raising economic performance.

Over the same period however we all know that house prices have galloped until we now face the ridiculous situation that we now have.

https://www.globalpropertyguide.com/Pacific/New-Zealand/Home-Price-Tren…

Thus we can categorically claim that lowering interest rates does absolutely nothing to help the productive economy, but is strongly linked to house price inflation. But we keep on doing the same thing and expect it to help.

As Einstein said - the definition of insanity is to keep doing the same thing and expect a different result.

Lets think about what might be going on in the real world to explain this.

CPI goes down so RB lowers the OCR.

Those on fixed incomes (16% of total population over 65) receive less so spend less, save harder and depress the economy further.

Property investors pile into the housing market with the cheaper capital so house prices rise. This becomes a positive feedback situation so they are rewarded and fuel the bubble mentality further. They probably spend a bit more as a result of their confidence and stimulate the economy. They are not a large percentage of the population so their stimulation contribution may not be that great.

Existing home owners benefit from the increased wealth effect, spend more and stimulate the economy. However recent first home buyers will have had to pay a high price for their home so will be paying a higher mortgage. They will not be spending much.

Next we come to the very large group of people (getting close to 40% of the population) who have to rent. Increasing house prices have a very depressing effect on their disposable income so this will tend to strongly depress the economy.

When you consider all that it is very hard to see how the net effect of lowering the CPI can stimulate the economy and it would not be surprising if it depressed it. Pretty much in line with the evidence set out above.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.