Summary of key points: -

- Delayed currency market reaction to sharply higher US inflation

- Past the “use-buy date” NZ GDP growth figures due out this week

- Aussie dollar continues to be unloved

Delayed currency market reaction to sharply higher US inflation

In a rather bizarrely delayed reaction to the higher than forecast US inflation rate last Thursday night, the US dollar has seemingly broken out of its shackles of recent weeks and strengthened to $1.2100 against the Euro.

The Kiwi dollar has consequently been sent lower to 0.7120 against the USD, moving below the previous strong support level at 0.7150. The initial FX market response to US inflation increasing by 0.6% over the month of May (consensus forecasts were +0.4%) was not to buy the US dollar. The reasons cited in analyst’s reports being that yet again it was all the goods and services that are only temporarily increasing in price that caused the above forecast increase e.g. used vehicles.

There, of course, always becomes a point when “temporary” price lifts actually become more permanent as the price never returns back down to the previous level.

The initial lack of US buying after the inflation number could have also been explained by the US Treasury Bond market doing the exact opposite to what you would expect on the annual inflation rate climbing to multi-year highs of +5.0%, 10-year yields rallying lower in yield from 1.60% to 1.45%. The US bond market movements over recent months are also somewhat bizarre, yields climbing from 1.00% to 1.75% in January/February/March on the expectation of a strong US economic recovery and the Fed being forced to taper their bond buying earlier. However, through April/May and into early June the bond market has decided that they were premature on the early tapering response and have since forced the yield back to 1.45%.

Whilst US monthly employment figures have turned out to be considerably below expectations over April and May, the evidence is very clear that job openings (vacancies) are growing rapidly to over 9 million and it is only a matter of time before workers currently sitting on the couch return to work. With the Covid-enhanced unemployment benefits now running out across the US, the job increases in June and July could be massive. The FX and bond markets will soon be realising that this scenario is building to be a lot more likely, therefore expect a continuation of the US dollar gains over coming weeks.

The delayed US dollar buying came the day after the CPI inflation release, and it was more a case of Euro weakness on the back of renewed commitment from the ECB to keep their money printing going at the same level for an extended period yet. Europe has not had the high level of fiscal stimulus that the USD has employed over the last 12 months, therefore there is more reliance on super loose monetary policy to pull their economy around.

Our view has always been that Europe is six to nine months behind the US in timing in respect to economic recovery, therefore do not expect a stronger Euro on the back of that until next year. The US economic rebound is in full flight now, it is just taking the jobs numbers a while to catch up.

The FX markets will be heavily focused on the Fed’s FOMC meeting this week on the 15th and 16th June, which will include updated economic projections.

Any miniscule changes in the rhetoric/wording to previous statements could be a sign that more voting members of the committee are starting to observe that actual inflation is higher than expected, high inflation could be more long-lasting and substantial jobs increases are around the corner. The evidence is mounting and a stronger USD on currency markets will be an early signal that the Fed could announce their plan to reduce monetary stimulus in August and commence implementing the tapering later in the year.

The majority of the US investment banks on Wall Street have been forecasting the USD to weaken in 2021 as they argue that the US money printing will stay in place for an extended period. Their conviction on those forecasts will now be wavering, potentially resulting in rapid USD gains to $1.1800 as they are “stopped-out” of their short-sold USD positions against the EUR i.e. they are forced to buy the USD to close their positions down.

Past the 'use-buy date' NZ GDP growth figures due out this week

New Zealand’s GDP growth figures for the March 2021 quarter are released this Thursday 17th June.

The RBNZ are forecasting a 0.6% contraction over the quarter, however market consensus forecasts are for a 0.30% increase.

An actual result anywhere close to the RBNZ forecast will be negative for the Kiwi dollar.

That seems unlikely as both retail sales and employment were stronger than expected in the quarter that ended 2½ months ago.

Looking ahead, the restraints on the economy that we have highlighted over recent times being; shortages of product, shortages of labour, shortages of export shipping space, no new business investment and uncertainties in the dominant agriculture industry due to Government policy intentions on regulation, employment, carbon and water, will all deliver to sub-optimal economic growth outcomes over the period ahead. Add on the uncertainty of supply and soaring cost of energy (gas) to some of our largest primary industry processing plants due to Government policy changes, the outlook is even bleaker.

Those that contend that the NZ economy is travelling along “just fine” are woefully out of touch with what is happening at the coalface of our largest industries. The high dairy and log prices at this time are arguably disguising several underlying negative issues.

The Labour Government is now displaying its “true colours” with trade unions driving employment law changes and favouritism to vested interest groups, such as their urban liberal elite supporters in central Auckland with the dedicated cycle harbour bridge. Similar to the Climate Change Commission report, there is a total absence of rigorous financial and economic cost/benefit analysis to support such policy decisions. Will New Zealanders accept lower standards of living to lead the world on climate change policies?

Given the combination of the aforementioned economic restraints and Government ideology driving policy, it is no great surprise that offshore investors have continued to absolutely ignore New Zealand and the Kiwi dollar in 2021. Foreign investor participation in our equity and bond markets continues to fall.

Aussie dollar continues to be unloved

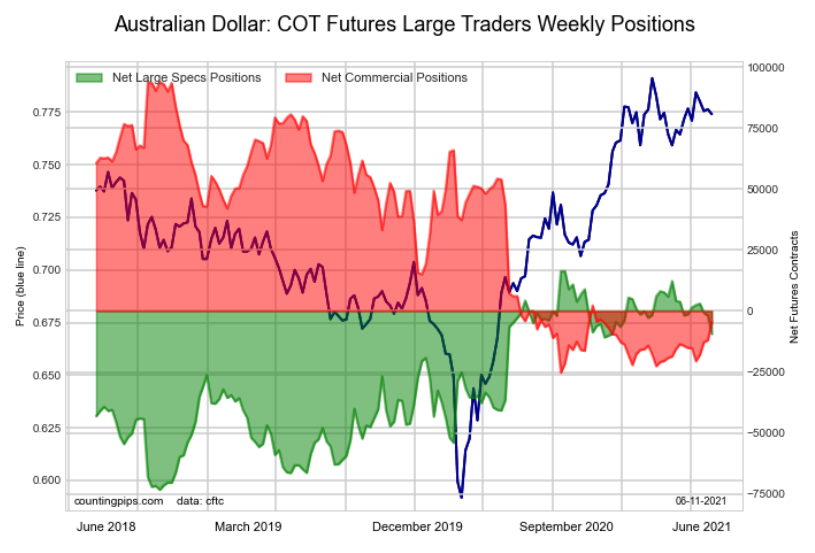

It is compellingly instructive to observe just how much the Australian dollar is out of favour with global investors in 2021. Despite copper and iron ore commodity prices racing to spectacular highs, the AUD/USD exchange rate has just not followed as it would typically do. The stringent commitment by the RBA to keep their interest rates at zero until 2024 is the counter-weight to the commodity price boom. For the RBA it is all about jobs and wages and they continue to forecast that these will be slow to increase over the next 24 months.

Currency speculators are now expecting a weaker AUD against the USD as net open AUD futures positions have moved to 9,400 short-sold contracts (refer green shading on the chart below). The largest influence on the NZD/USD exchange rate is the movement in the AUD/USD exchange, so watch this space.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

3 Comments

Excellent article Roger.

It amazes me how so many government decisions lack a rigorous cost/benefit analysis to justify policy changes. A classic example was the impact on renters with the rental property tax changes in March 2021. The changes will provide little benefit to first home buyers but a large disbenefit to renters.

The government’s incompetence will result in increased administrative costs & micro-management of the unintended consequences. Examples includes trying to define new builds & understanding whether restrictions on rent increases will be necessary.

Keeping interest rates artificially low in a high asset-inflation environment will also hurt NZD.

Paraphrasing...

- I don't know what is going on with the economy - people are making decisions that do not appear consistent with my neoliberal understanding of how things work

- This climate change nonsense has gone too far, why should my expensive pinot noir habit be compromised for my grandkids?

- We have enough stuff to live well, but we need that 'off-shore investment' to keep the super-rich in champers and yachts - and before you get uppity, don't forget the massive evidence base (i.e. zero) that tells us that wealth will trickle down

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.