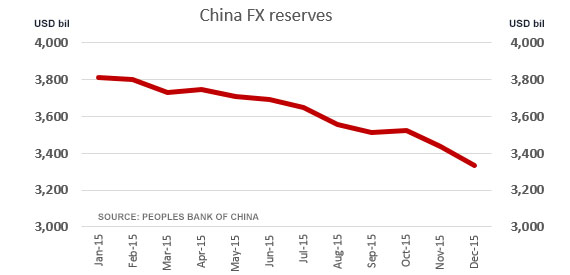

After starting the year at over US$3.8 tln, China's foreign currency reserves ended 2015 at at US$3.3 tln.

A reduction of half a trillion dollars in twelve months is not an insignificant thing.

And the rate of fall is picking up. For the first time ever, these FX reserves fell by more than US$100 bln in a month and that happened in December.

All this was a surprise to markets, and may help explain why we have seen extreme sentiment volatility in the past few days.

In August. the central bank eased its soft peg for their currency and that saw a sharp outflow at that time. But the December data eclipsed even that.

Capital flight is accelerating from the Middle Kingdom.

“It is a kind of vicious cycle – the weaker the yuan, the more capital flight,” Shen Jianguang, chief economist with Mizuho Securities Asia in Hong Kong was reported as saying. “The big fall in December foreign exchange reserves is another blow to market confidence in the yuan.”

It's not like at US$3.3 tln these reserves are 'too low'. They are far above any other country. The nation with the second-largest FX reserve level is Japan, who have about US$2 tln in reserve.

The issue that is spooking markets is how fast they are falling. A fall at the rate of US$100 bln per month, they could be down to US$2 tln by the end of 2016, and such a level would be very problematic for both China and the global economy.

Here is a good link to the Shanghai Stock Exchange 'live' index.

36 Comments

Never put your hard earned money into a big, big, ginormous hole in the Great Wall.!....it is wei too big. You will never see it again, if you do it will be devalued marketly....ie...markedly.

(That goes for the trucks too, but I digress as usual).

Why do you think that the stop is there. Too much debt. Too much flowing away overseas.

Cannot have that can XI. Has no control otherwise.

And no this is not xenophobic, I would not touch a Dairy Farm here either. No matter who owns it. Nor an Awkland House...no matter who owns it.

All out of Con troll. Cannot pump and dump, if the mugs have finally woken up.

is this US Government Debt they are shedding?

Logically, it may have been pledged elsewhere as private unreported ledger collateral to affect transformations.

The best way to describe the re-use of collateral is to visualize it in chains. Dealer banks

source collateral. They receive it from parties that require funding, or from agents that want

to enhance their return by “renting out” their assets as collateral (Singh and Aitken, 2010).

Then, collateral is pledged to other parties to obtain funding or support other contracts. Read more, page 14 (15 of 37)

Thereafter, these two articles my prove to be useful. Read more and more

You put me onto this excellent site.

And then the truth of it, which is much, much different:

Then there are other liabilities that China needs to cover, such as the nation’s foreign currency debt to finance and manage imports denominated in overseas currencies. When those factors are taken into account, some $2.8 trillion in reserves may already be spoken for just to cover its liabilities, according to Hao Hong, chief China strategist at Bocom International Holdings Co.

Yes indeed.The self liquidating nature of a reserve currency system built upon credit creation such as the eurodollar demands constant creation of said credit to replenish that which is extinguished due to redemption or a foreclosure by unwilling global bank participants - namely those registered as US primary dealers with previously overactive franchises in many jurisdictions.

Maybe China is in the process of developing it's own shadow bank dollar creation capacity network to replace that given up by significant others?

Shibor rules? A Chinese equivalent to Eurodollars that quietly sneaks up on us all, only evident to us in mysteriously rising house prices in Auckland. A replay of the Eurodollar glut that snook up on us during auntie Helen's era and caused house prices and household debt to double. It is an interesting possibility.

Maybe China is in the process of developing it's own shadow bank dollar creation capacity network to replace that given up by significant others?

In many ways that is what they have done with it too. Not just China.

When you add up all the figures, there is a lot of make believe in the Bankers and Countries portfolios.

Plus Derivatives and leverage and compounded stupidity, a huge game of pass the Parcel and a little Fractional Reserve x 14 and all competing for the next mans borrowings, to add to the confusion.

Ask Dick Smith...if he got out....just in time. IPO makes a mockery of many a Trader.

That is why Trillions of debt are now the true figures. I do believe it is called a Ponzi, but I think now it is called the Norm.

You could possibly have called it ROB after Muldoom, however, even he did not think this bleedin big, but Rob would be so more apt. Rob Peter, even more so.

An opposing analytical framework, one to which I subscribe, is focused foremost on finance – in particular the system of securities-based Credit and securities that over the past thirty years rose to world dominance. Regrettably, this “system” is deeply flawed and today acutely unstable. In short, global “money” and Credit are structurally unsound. In general, and especially late in this era, market-based finance drives economies. Unprecedented central bank monetization and market manipulation have inflated securities markets along with underlying fundamentals (corporate cash flows/profits, incomes, household perceived wealth and GDP).

Why is China today so critical to global markets – including those in the U.S.? The bulls argue that a Chinese slowdown will have minimal impact on U.S. corporate profits. The harsh reality is that Chinese financial and economic crisis has the potential to push an already fragile global financial “system” over the edge. From the perspective of my analytical framework, the historic “global government finance Bubble” is faltering and will not survive a China bust.

http://creditbubblebulletin.blogspot.com/2016/01/weekly-commentary-issu…

In raw terms, if Chinese firms and its economy can so struggle in this environment it stands to reason to at least contemplate why that might be – and how that might directly reflect on domestic considerations. Further, as noted earlier, risk perceptions have changed as the FOMC is no longer given blanket faith to declare whatever sky color they wish. Stocks really haven’t had much success, overall, in a year and a half; a pause that itself should register as complimentary to the Chinese struggles.

The S&P 500 is down just over 7 percent from its May high, but the average stock in the larger S&P 1500 was down 24 percent from its high as of yesterday’s close, according to new research from Bespoke Investment Group. A bear market is defined as a decline of 20 percent or more, meaning the average stock has already reached that threshold.

As Bespoke points out, the pain in stocks is not just energy-related shares. Small caps are among the hardest hit (the average stock** in the S&P 600 small cap is down an astounding 28% from its high!) as well as consumer discretionary stocks; the very sorts of economically-sensitive issues that should be leading the market if this was just China as China. Instead, they suggest China is, again, finding difficulty in no small part because of intensifying US struggles. That much has been obvious from trade figures which declare in no uncertain terms the great and ongoing lack of US “demand.” Read more

If there is a crisis in China, it is because of the level of private sector debt which has fueled overinvestment and speculation to bubble like levels...

http://democracyjournal.org/magazine/36/the-coming-china-crisis/

http://www.philly.com/philly/blogs/inq-phillydeals/Vague.html

Not sure why Changes in Foreign reserves held by the PBOC is a big deal..???

Its' not as if they are running trade deficits...or current acct deficits...

External debt is about 9-10% of GDP...

Having that much money held as foriegn currency reserves seems excessive in the ist instance..?/

AJ mentions that 2.8 trillion in reserves may already be spoken for, just to cover Chinas liabilities ....BUT most of those liabilities are in the form of FDI..(foreign direct investment)... which is probably "bricks and mortar" kinda investment..??

Compare this with NZ ... We have chronic Current acct deficits and an external debt of about 58% of GDP..

http://m.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=11468…

I'd be really surprised if China's Credit crisis causes a global financial meltdown..??

Commodity based countries have already felt the effect of Chinas collapse in demand...

I'm sure China will do whatever it has to.... no need for populism over there... they can be pragmatic and brutal if they want to or need to..... they can print money till the cows come home...

AND...with a trade surplus and $2.8 trillion in reserves....and a controlled exchange rate... maybe they are in a better place to manage a debt deleveraging..???

just my view....

Wishful thinking? Since 2008 the speculators and gamblers in the world's financial markets have turned to china to suppress their fear on a meltdown in "the west". However when you look at things like the BDI and oil demand you have to wonder just where is the "real" growth" when consumption of inputs is stagnant or dropping.

But the kicker is this, consider a simple piece of Math. China is supposed to grow at 10% per year "ideally" that means the doubling time for its economy is 7 years. So since 2008 we have had 7 years or so, just where then is the close to doubling of consumption of inputs and the outputs? Even if we said a more reasonable 7% that is still 10 years to double, but in the last 2 or 3 we have not seen that at all.

I think given my first paragraph yes China can cause a global meltdown because its the last thing not propping up the sentiment in the western gamblers / markets any more. One thing I feel pretty sure of with computers and the market interlinks when it does happen it will be extremely fast. Like 9/11 I suspect we will wake up one morning and look on with horror.

Since 2008 the speculators and gamblers in the world's financial markets have turned to china to suppress their fear on a meltdown in "the west".

Sovereign wealth funds spring to mind.

The Hedge Fund Known As The Swiss National Bank Posts A Record $23 Billion Loss, Down 4%, On EUR, AAPL, VRX Read more

Almost $200 million in taxpayers' money invested through the New Zealand Superannuation Fund has been lost after the collapse of a Portuguese bank where the money was invested - supposedly as a "risk-free" loan. Read more

I could go on citing more examples, but I guess the point is made.

Steven...

"China now has the most bad debt ever created -- more than $2 trillion. It's a little bigger than ours in 2008-09. Now, China can handle that. But Thailand, Australia and Brazil don't know how to handle that. They're going to have trouble. For Europe, for the U.S., it will be a softer impact."

http://www.philly.com/philly/blogs/inq-phillydeals/Vague.html

The article is worth a read ... very much so.

New Zealand and Austrailia.... ( as AJ shows with his stats.) are going to suffer from Chinas' over investment and Debt issues.... for years to come.

The reality is that there is not going to be any "real growth" anywhere.....for a while.

Deleveraging simply needs nominal interest rates to be less than nominal growth.... ( so... lots more money printing )

SO.... we can expect more Qe'ing and low interest rates .... for a while

In NZ.... expect continuing immigration and FDI... and more debt..... probably lots more Govt deficits.

Farmers are not going to be saved by booming prices.....????

As an aside... Richard Vague wrote a book called "the next economic disaster."

I highly recommend it.... http://www.amazon.com/Next-Economic-Disaster-Coming-Avoid-ebook/dp/B00L…

Having that much money held as foriegn currency reserves seems excessive in the ist instance..?/

The PBOC practice of running up assets by purchasing domestic manufacturing USD export receipts in exchange for domestic CNY liabilities created buoyant internal funding reserves. Many have witnessed the outpourings of over production/mal investment portrayed in photos of uninhabited towns etc.

Not much different than QE central balance sheet expansion, but nonetheless, a policy of picking winners via redistribution.

I hope you are right Roelof, the consequences of being wrong keep me up at night.

Without China we don't have an economy left.

China is Fonterra's big play ( Russia was number two importer in the world but no more.) over %50

China is %35 of our wine industry

China is %45 of our sheep meats

China is %45 of our beef exports

China is %90 of our wool exports

China is a big market for our apples and Kiwi fruit.

Without China we may as pack up and go home, thats as long as you can still pay the mortgage.

Even if China does survive we still will have to deal with the EU crisis.

Sorry but I call bullsh+t on at least some of those figures provided for the significance of China, as even a little bit of research shows - take the first item - wine. Thus the US is by far a bigger market in terms of export value ($328m in 2014). China was not at even 10% of that figure ($24m). Then there are the very large UK and Australian markets.

http://www.nzwine.com/assets/sm/upload/b5/2j/rr/2n/NZW%20AR%202014_web…

I haven't bothered to chase up the other claims but would just say:

In total value China comes in at just less than 20% of our total exports in goods (around $10B out of $51B).

https://www.nzte.govt.nz/en/invest/statistics/

Very significant - yes.

But to say that China is all the NZ economy has it quite simply ludicrous, and is not supported by the facts.

China is our largest export market for every agricultural commodity except beef (where it is our second largest market behind the United States). It purchases a third of New Zealand’s dairy exports (figure 6).

Although I admit the values into China may not be as high they are a large volume market for us.

http://www.rbnz.govt.nz/research_and_publications/speeches/2014/5721595…

China takes most of our Mutton, the lamb we cannot sell in Europe, the beef that doesn't fit into the US under the Quota, the WMP that has no market, it's a big deal for us.

Please provide evidence for your original claims ie that China takes 35% of our wine exports.

Ooops sorry you can't.

If you are going to make specific percentage claims you should at least be somewhere close. You were not even in the right ball park.

China is indeed a major market. But agricultural commodities are not everything - as I illustrated above they take 20% in total of all our goods exports (note - I have not included services in these totals). They are very important for sure. But China is not (yet) the NZ economy.

Yes I think you did - but just for the hell of it - you also claimed China takes 90% of our wool exports - that is b+llocks too -

http://www.beeflambnz.com/Documents/Information/Export%20clean%20wool%2…

Even if you include North Asia as all China then its 70% at best.

I take your point about China being important - but if you quote percentages then best to get them right....

The wool market is mostly China by Volume, other countries take more of the high value Merino like Italy.

China is the dominant buyer of our wool, as it is the dominant buyer of the worlds linen.

Looks like we send about 25,000 tonnes to Asia and about 10,000 tonnes to Europe. Next biggest market is Sth Asia. I'm not a happy wool grower prices have been too low for too long, I've given up on it.

China takes %70 of our Mutton and %30 of our lamb but with the very poor prices in Europe this year I would expect more Lamb to go to China. China has a Sheep flock of 130 -150 million. China import stats show it imported 31500, tons of wool from NZ. But low values $158.6 million. Maybe some of the foreign buyers are buying wool in NZ and getting it processed in China.

China imports %70 Korea %16 of our logs

And actions of China set or upset prices in other markets

China imported less dairy and less sheep meat last year. The impact and ass knock ons are front and centre.

http://dimsums.blogspot.com.au/2016/01/china-imports-ag-commodity-defla…

Meanwhile, the Chinese government is holding large stocks of most commodities. The government is unable to offload the inventories because market prices have fallen below the acquisition prices and authorities are not allowed to sell at a loss.

In summary, China is actually sopping up excess demand in most global commodity markets--with a few prominent exceptions--by importing while also holding massive inventories. Global prices would be even lower if China were to dump its inventories and stop importing. The drop in cotton and dairy imports reflects a draw-down of inventories for those commodities. However, China is still accumulating corn and rice inventories. Chinese authorities don't want to see lower ag prices because maintaining farmer income growth is a big priority.

We hit limits to the USA for beef in November, now the new year starts, don't tell me have stored two months beef? I expected it to go to China.

Beef prices have fallen in the UK and USA, if we have a backlog we could see significant schedule drops. The UK can hardly sell it's own lamb.

Had a read, they imported %48 more beef than last year, which is most likely where all our dairy cows went and why there are hopefully no big stockpiles, except in China.

Im not that worried about the Chinese stock market ,except that margin calls may require them to sell assets in places like AKL.

Currency crises worry me more.

Australia is our biggest market but they too have become dependent on China, although the Aussie Govt doesn't make much tax from mining, most of it's big mining companies like Rio Tinto who have a world of hurt coming their way. That big 40 billion sale of a gas field off the West Coast to the Japanese looks like a good move.

The crises is about high debt levels

Expect the FED to announce QE 4 this year to prop up equities, although I'm baffled why anyone would be in equities at the moment.

The EU is a mess, the UK will most likely leave, then some form of collapse, I don't know how that happens.

I do know that Erdogan doesn't just open the gates and let 1 million + refugees pour into Europe. Someone gave the OK. These refugees were all settled in Turkish camps and they are now unsettling Europe, and support is going to rightwing parties, doubt Merkel can survive.

So why did someone want all these refugees in Europe whats the hidden agenda? Great way to keep wages down.

Same in Libya, why attack a country with the highest living standards in Nth Africa, when it was obvious what would happen afterwards, I mean just look at Iraq and Afghanistan. The West is leaving Libyans to fend for themselves and there are 10,000 of them a week trying to get into Europe.

Then the mess in the Ukraine, why is an obvious question not getting a satisfactory answer.

The USA is going to have an electoral game changer now there is so much distrust of Congress, if %75 of the people think Congress is to in the pocket of big business , and nearly the same percentage think the Government is corrupt, there has to be change and it's going to happen at the ballot box.

The Neo con's who took over under G W Bush are creating a nightmare for the whole world.

http://www.washingtontimes.com/news/2015/aug/25/newt-gingrich-corruptio…

http://www.theguardian.com/world/2016/jan/08/cologne-violence-suspects-…

watching Saudi closely . Taking Aramco public is a sign of the distress

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.