By Roger J Kerr*

The Kiwi dollar has recorded spectacular gains in the global foreign exchange markets for a second week in a row, spiralling up to US0.6890 at the time of publication.

From lows of 0.6520 at the start of November, the direction of the Kiwi has been all been one-way traffic.

The NZ dollar appreciated sharply to 0.6790 by 9th November, it subsequently retracted a little to 0.6720, however another strong surge has lifted the currency to five-month highs of 0.6890.

The appreciation has very little to do with the performance of the New Zealand economy or any depreciation of the US dollar.

The nature of the buying is from the source that this column has consistently highlighted as always likely to eventuate, the unwinding of speculative “short-sold NZD” positions established through the May, June July period when the RBNZ adopted a fresh dovish tone and the US/China trade wars hurt the Australian dollar in particular (and we followed the AUD down).

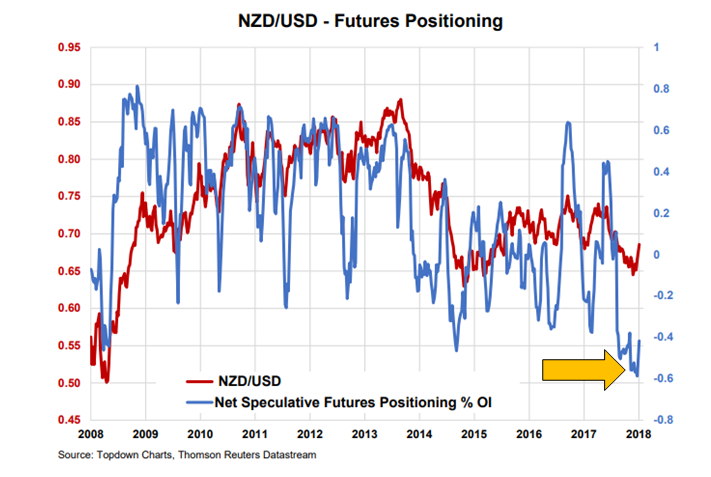

The chart below depicts the massive increase in volume of speculative positions added in US futures markets against the Kiwi dollar through that mid-year period.

The punters held on to their short-sold Kiwi positions for a much longer period on this occasion than is usually the case.

However inevitably, once the fall in the Kiwi has abated, it is only a matter of time before the speculators lose patience of making any further currency gains and buy-back the Kiwi dollars they had earlier sold.

The amount of outstanding “short-sold NZD” positions has finally started to reduce (refer to the yellow arrow on the chart).

As has happened many times in the past, once the unwinding of positions starts the NZD FX market liquidity is not enough to contain the volumes of NZD buying.

Swift Kiwi appreciation is the result of large volumes of NZD buying rushing the exit door at once and the door is just not wide enough.

The level of open NZD positions is still large against historical standards, therefore before the end of the year one would have to expect further massive volumes of NZ buying as stop-loss orders are triggered and the unwinding continues.

Appreciation to above 0.7000 does seem likely over coming weeks, particularly if the US dollar weakens back in international currency markets on more progress in the US/China trade negotiations.

Understanding speculative positioning in the market is an important component of interpreting the forces that cause the NZ dollar to rise and fall.

Many local commentators on the NZ dollar have been predicting continuing depreciation of the Kiwi to below 0.6000 due to NZ interest rates being substantially below those of the US and investment funds exiting new Zealand.

Predictably, that has not happened, as in recent years there has not been any “carry-trade” hot money coming into the NZ dollar to cause Kiwi depreciation when it subsequently departs.

The Kiwi dollar appreciation has been largely made on its own over recent weeks.

The Australian dollar has rebounded up three cents off its August lows of 0.7050 to 0.7350 against the USD, however the Kiwi has sky-rocketed up nearly five cents.

The Kiwi was more heavily over-sold against the USD compared to the AUD back in the May, June, July period.

As a result of this recent NZD out-performance, the NZD/AUD cross-rate has lifted from 0.9100 to 0.9380. Local AUD exporting companies following a disciplined hedging programme of always increasing hedging percentages in the 0.9100 region have again been rewarded and protected business profit margins.

Looking ahead over coming months into 2019, it is difficult to locate factors that would cause stand-alone selling of the Kiwi dollar.

Local economic performance and commodity prices are expected to be relatively stable.

The worst appears to be over for the AUD in terms of the trade wars damaging the Chinese economy and in turn this being negative for Australia.

Global equity markets have settled following the October correction.

The US Federal Reserve will continue their well-defined path of increasing interest rates; however, this is all well anticipated, and surprises are not anticipated.

Should the talks between President Trump and Chinese Premier Xi Jinping in Buenos Aires at the G20 meeting at the end of November make progress on resolving the trade war, the US dollar can be expected to retreat to $1.16/$1.17 against the Euro (currently $1.14).

Therefore, no strong reasons to suggest that the Kiwi gains will not be sustained and even added to.

Daily exchange rates

Select chart tabs

*Roger J Kerr is an independent treasury Management advisor. He has written commentaries on the NZ Dollar since 1981.

7 Comments

Roger J Kerr

Your much earlier assessment is proving correct

I’m amazed how some of pseudo intellectual types seem to lambaste the kiwi$ without appreciating it is a respected currency / country

Now if the government could introduce some bank deposit guarantees please ?

It is fun to read the various views in regards to currency movements. I am reminded about the quote about how the market can remain irrational longer than one can remain solvent. If one went long on the kiwi when Mr Kerr first advocated that the kiwi would rise, one would almost certainly would have become insolvent prior to the point where the kiwi stopped decreasing and started increasing. The broken clock has made it to one of the twice a day points now. We shall see as to whether the prognosication about further strong kiwi increases eventuate.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.