The firm market resistance in the NZD/USD FX market at the rate of 0.6950 was again demonstrated and reinforced over this past week.

The Kiwi climbed to a high of 0.6935 following the better than expected GDP growth numbers for the December 2018 quarter on Thursday 21 March, however, tellingly follow-though buying was not forthcoming to break above the 0.6950 barrier.

The New Zealand centric factors for the NZ dollar continue to be very positive with dairy commodity prices continuing to increase and the NZ economy not slowing up as many of the doomsayer economic forecasters have been confidently predicting.

Whilst the 0.60% expansion in the economy in the final quarter of 2018 was less than the RBNZ’s official forecast of +0.80%, it was above the +0.30% to +0.40% expectation that the FX market and majority of forecasters had expected.

Hence the immediate currency market reaction to push the Kiwi higher. It does appear that all the positive local factors are now fully priced into the NZD/USD rate at 0.6900. The rebound upwards in the Kiwi dollar from the lows of 0.6500 last October to today’s levels reflecting the fact that the economy is performing better than most anticipated and our highly influential export commodity prices are still rising.

We should not expect further significant increases in commodity prices from here as they are already at record high levels. Therefore it will need to be some other extraordinarily positive for the Kiwi dollar to propel it through the 0.6950 barrier and up over 0.7000.

It is difficult to see that positive force being locally derived over coming months; therefore it will require a much weaker US dollar on the global stage and a stronger Aussie dollar to create the market environment for further Kiwi gains.

Divided economic outlook for Australia – what view will prevail?

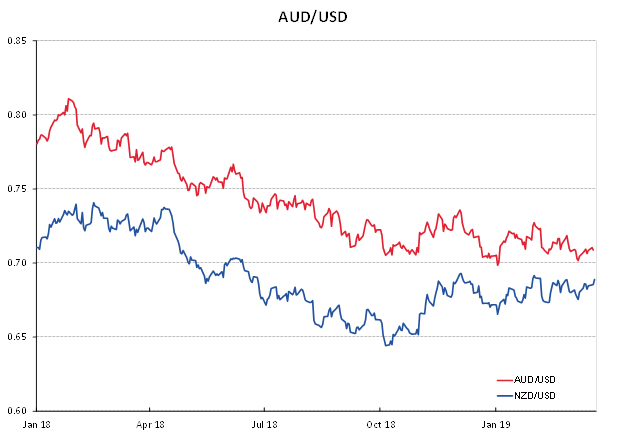

Whilst the AUD/USD exchange rate has bounced off the 0.7000 level three times over the last six months, we have yet to see a sustainable recovery upwards.

Australia looks increasingly like a two-speed economy in 2019 with domestic demand slowing (weaker house prices, consumer spending and construction activity), however the export mining/resources sector strengthening dramatically with substantially high commodity prices.

The stable AUD/USD exchange rate, that has not yet followed commodity prices higher, is delivering a massive boost to mining companies profitability, and investment and employment increases follow.

The strong Australian share market is reflecting the positive mining/resources side of the economy, however local and international economic forecasters remain uniformly negative on Australia’s outlook.

The Reserve Bank of Australia needs to balance the two-speed economy into what it means for future GDP growth and inflation.

The RBA has already stated that they will not be cutting interest rates unless the unemployment rates starts to increase.

That looks unlikely if we have a booming mining/resources sector. Therefore interest rate cuts in Australia seem unlikely, despite the moneymarkets pricing these in.

There is no Australian (or NZ) economic data of any significance being released this next week, however the week commencing 1 April has housing data, business confidence and a RBA OCR review.

In my view, a weaker US dollar value on global FX markets will eventually be the catalyst that causes the hedge fund speculators to realise that the AUD is undervalued vis-à-vis its commodity prices and they will rapidly buy back their short-sold AUD positions.

Sometime in April the US and China should announce their trade agreement, and that will also act as a positive catalyst to send the AUD higher.

The well-proven local FX market adage that as soon as local bank economists start mentioning parity parties for the NZD/AUD cross-rate, it will sure as eggs go in the opposite direction. The AUD/USD exchange rate has a lot of catching up to do on the NZD/USD gains of the last five months, we are becoming closer to that market adjustment in my view i.e. the NZD will not appreciate as far as the AUD against the USD and therefore the NZD/AUD cross-rate will reverse back to the 0.9300/0.9400 level.

It appears that many local AUD exporters failed to hedge sufficient amounts forward when the NZD/AUD cross-rate dipped to 0.9000 last August and they are now running out of hedging contracts. Converting AUD export proceeds at 0.9700 will now be really hurting their profitability and price competitiveness in the Aussie market.

The benefits of hedging larger amounts for longer terms (as this column advocated last August) when the exchange rate was attractive (i.e. 0.9000/0.9100) has proven its worth once again.

US dollar negatives continue to stack up

Three developments look likely to break the EUR/USD exchange rate out of its narrow sideways range between $1.1200 to $1.1500 over the last five months:-

- The US Federal Reserve’s U-turn (confirmed at the FOMC last week) to no interest rate increases this year – USD negative.

- The US internal budget deficit (which was 3.8% of GDP for 2018) is on track to be US$1.1 to US$1.2 trillion in 2019 and 2020 i.e. towards 6% of GDP. When the US budget deficits were last this high in 2010/2012 after the GFC, the US dollar weakened 25% from $1.2000 to $1.5000 against the Euro. Massive budget deficits need to be funded and a weaker USD will be required to attract foreign capital into the US to fund the deficit as domestic US savings are not enough – USD negative

- The US dollar strengthened when China and the US started their trade war last year. A truce and trade agreement next month will see the unwinding of those positions – USD negative.

The greater probability over coming months is that the USD weakens to above $1.1500 against the Euro.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.